Shifting Risk Management Priorities

By Ken Owens, Partner, and Sean Herlihy, Director, PwC

Published: 27 January 2017

While risk management remains a primary area of focus for Hedge Funds Advisors, priorities have shifted over the past year. Favorable credit conditions with low default rates, strong market prices and a changing regulator landscape are just some of the reasons firms might be turning their attention to other looming formidable risks.

PwC’s Asset Management practice is delighted to publish the results of our European Alternative Asset Management Benchmarking study. This study was designed to gather, analyse, and share information about key industry trends and metrics. The study covered

19 European focused alternative asset management firms representing $427 billion of assets under management across various product types and strategies. The study replicated a similar study performed in the US where participant advisors provided data covering industry practices related to their organizational structure, boards and governance, products and strategies, operations, service providers, regulatory, valuation, financial reporting and of particular interest, Risk Management Priorities.

In order to comply with enhanced governance and regulatory requirements, alternative advisors are focusing on risk more than ever before. 59% of participating advisors say they have a dedicated risk management function. The remaining 41% of the participant pool indicate that the greater part of their risk personnel sit in the front office. In total 44% of participants have created a dedicated role equivalent to Chief Risk Officer. This demonstrates how integrated risk management needs to be within the investment process.

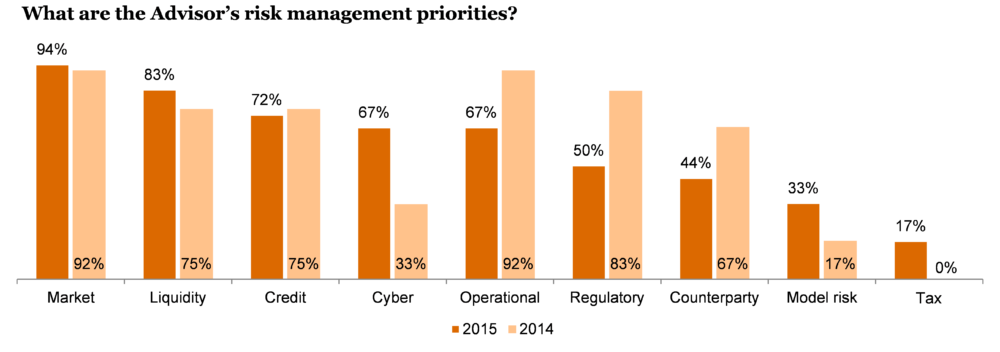

When it comes to risk priorities, market risk continued to top the list of priorities for Advisors, hardly surprising given Hedge Fund performance over the past year and the continued outflows from the sector. Interestingly we noted increased concern around tax possibly coming from the increased uncertainly around the possible outcome of the OECD's work on base erosion and profit shifting (BEPS). Liquidity and credit risk have remained broadly static year on year, what is slightly more of a surprise is shifting priorities around cyber, regulatory and operational risk.

We can quite clearly see that one of the significantly increased areas of concern is cyber risk. 67% of Advisors cite cyber risk as a priority for 2015, this risk has more than doubled when compared with last year. Based on PwC’s Asset Management 2020 report, technology will become paramount and mission critical in five years, while cyber risk will increasingly become one of the key risks for the industry. We can already see the impact of this on the ground with both fund advisors and fund boards looking to ensure that they are ready for ‘when’, not ‘if’, the cyber-attack happens. Regulators are also waking up to the issue with a number of European regulators, such as the Central Bank of Ireland, recently issuing circulars citing the growing threat to the industry. While we believe the industry is becoming more aware of the risks and better able to manage the threat we feel that it will continue to stay near the top of the list of risk management priorities for the foreseeable future.

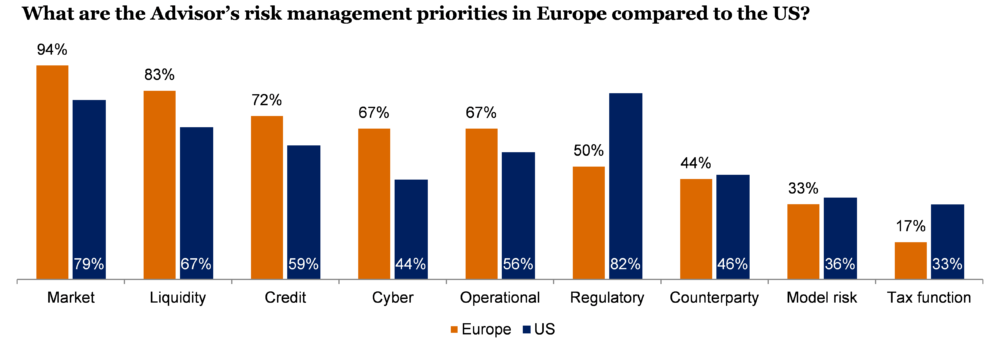

One of the more dramatic shifts is regulator risk. Falling from third on the list of risk management priorities in 2014 to sixth on the list for 2015, a drop of 23%. In Europe AIFMD was a huge challenge for the industry, with the regulation now well established and advisors having found their solutions, regulation is for the moment at least, falling back down the list of priorities. We would think however that this will be short lived as the ever increasing regulatory burden will begin to bring the risks of non-compliance back up the agenda. Interestingly regulatory concerns have stayed high on the agenda for US firms reflecting US regulators continued focus on the alternatives sector. Looking to other elements of our benchmarking we can see 43% of managers surveyed, either already operate or are planning to launch a liquid version of their existing alternative product. In this context we would expect regulatory concerns to come back to the fore. In parallel to this we have seen a notable fall in counterparty risk as a concern, which is perhaps an indication that element of regulation such as ESMA’s work on the European Market Infrastructure Regulation (EMIR) is restoring some confidence. Perhaps as an indication of how views are developing in the space we have seen a rise in advisors setting up committees tasked specifically with regulatory oversight. While still only present in a minority of participating advisors (26%), we expect to see such committees become a more common feature of Advisors oversight framework.

As an interesting aside we have seen a marked increase in the level of outsourcing across both participants and the wider industry. Given this backdrop its worth noting that we did not find any notable increase in the level of outsourcing of risk and compliance functions, with 68% of participating advisors choosing to retain 100% of their risk and compliance functions in house.

The shift in focus on operational risk is of particular interest. Counterintuitively we have seen the focus reduce from the previous study. We believe this is not necessarily becoming less of an area of focus but more that it is returning to a more normalized level of risk. In 2014 operational concerns were, along with market risk, joint top of the listings. In contrast for US Advisors it was far less of an area of focus, ranking fifth on their list of risk management priorities. However this was with the backdrop of the European Industry grappling with the implementation of AIFMD and with both the clearing and reporting obligations coming from EMIR. With Advisors now having weathered the regulatory storm and many service providers having developed enhanced offering in this space we see operational concerns of European Advisors moving to a more normalized level and more aligned with their US counterparts.

While you can draw varying conclusions from the interplay of certain risk priorities, it is quite apparent that Advisors areas of focus are ever changing. Each advisor has their unique perspective on risk, but understanding the areas of focus of both their peers and the wider industry is of paramount importance.

To contact the authors:

Ken Owens, Partner, PWC: [email protected]

Sean Herlihy, Director, PwC: [email protected]