AIMA Global Investor Board Perspectives: Alignment of Interests and Fee Preferences

Published: 07 October 2022

Ahead of new AIMA research to be published later this year which explores the alignment of interests’ dynamic between fund managers and investors, our Global Investor Board met over the summer to discuss some key trends addressing fund performance incentives, paying for expenses, and aligning interests through fee structures. The below snapshot includes their observations:

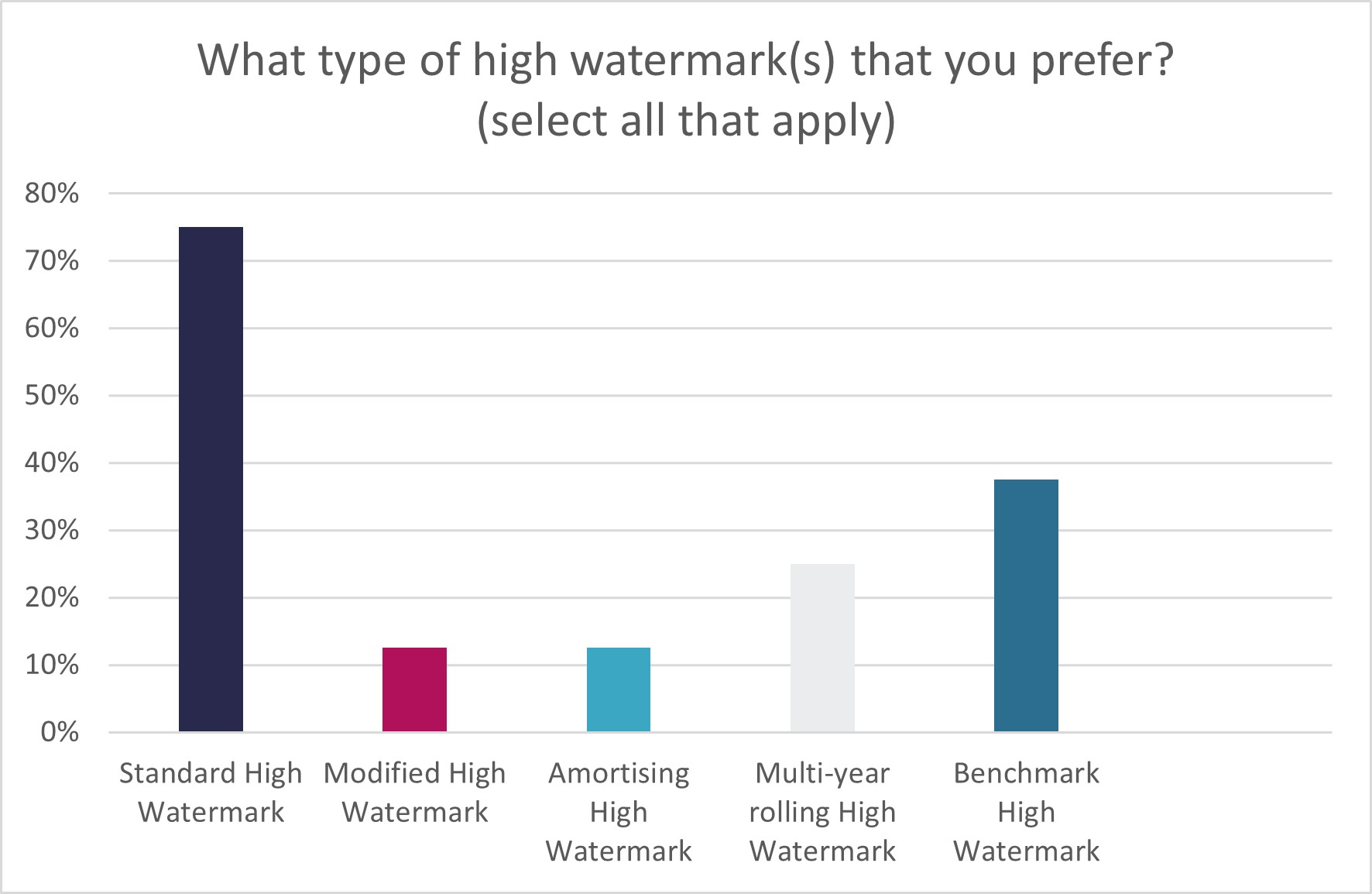

High Watermark:

A high watermark can be applied to the calculation of the fund’s performance fee so that the fee is only paid on net new increases in the fund’s asset value (NAV). Through using the high-water mark, when the net asset value of the fund drops below its peak, no performance fee can be charged on any subsequent profit until the NAV reaches its previous high. The high watermark is a similar concept to a clawback provision.

- The standard high watermark (HWM) is the most used mechanism. Some of the investors polled expressed a preference for a modified version of this arrangement. Having this type of arrangement can help spread out any fund losses incurred by the fund over a longer term, enabling them to earn at least some of the performance fee in more challenging conditions. Notably, this arrangement is still very much the exception.

Optimising Returns:

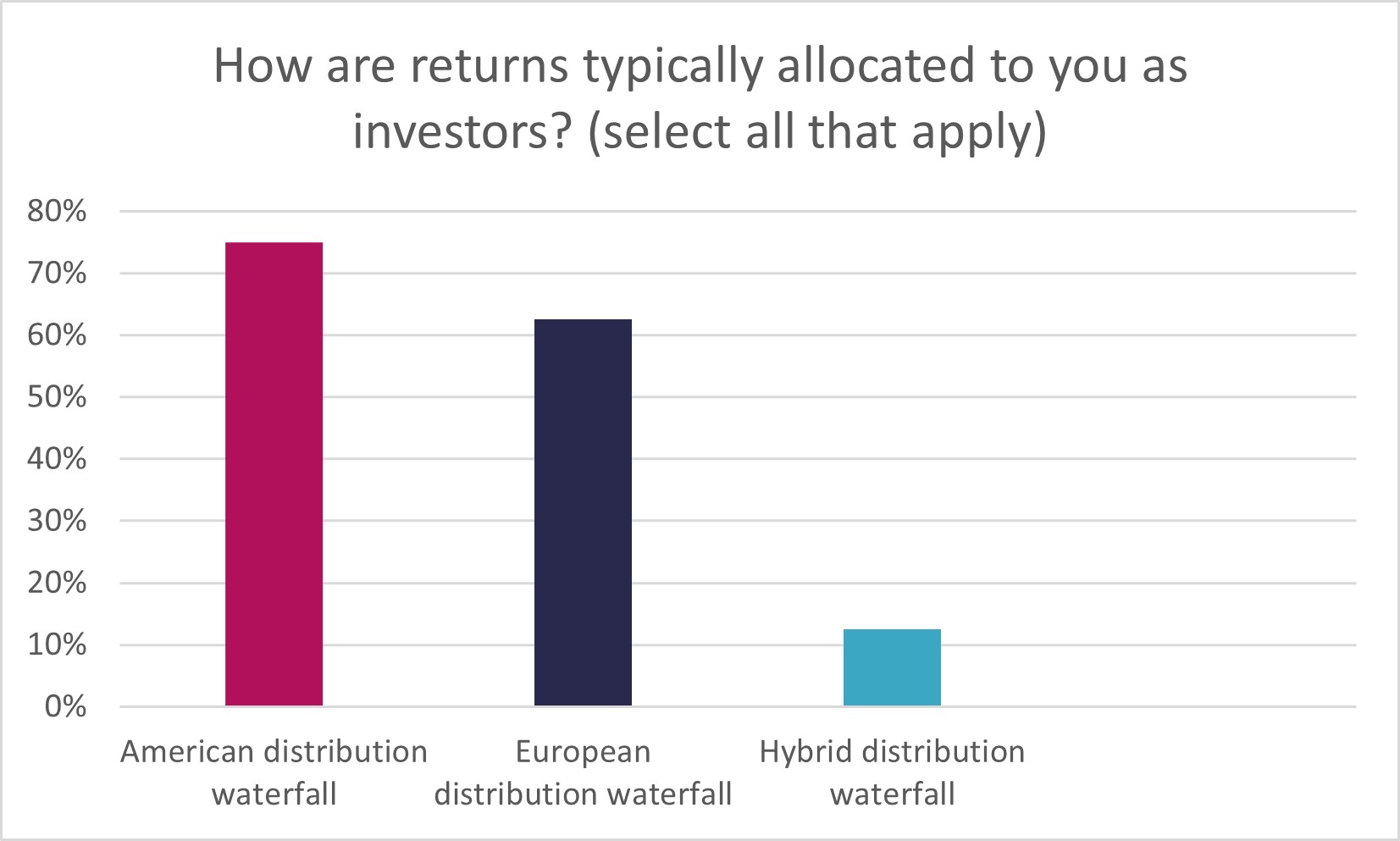

A distribution waterfall is a structure designed to ensure that the interests of fund managers and investors align in a way that properly compensates everyone involved in an investment. These structures tend to be mostly found in private equity arrangements. The two most common forms of distribution waterfalls are the American waterfall and the European waterfall.

An American distribution is applied on a deal-by-deal basis, spreading the risk over all the deals and is more beneficial to the fund managers of the fund. Under this structure, fund managers get paid prior to investors receiving all their invested capital and preferred return.

By comparison, a European distribution (also called a 'global’ distribution) is applied at the aggregate fund level. Under this structure, fund managers do not receive any profits earned until all investors make back their initial investment and the amount owed in the preferred return.

- Despite the American distribution waterfall being the most used, this group would prefer to have their returns distributed via the European option. The latter can be hard to negotiate if the former is already included in the LP agreement.

- As per the responses of this group, the location of the fund manager (with most operating out of the US) resulted in the American waterfall being the default option.

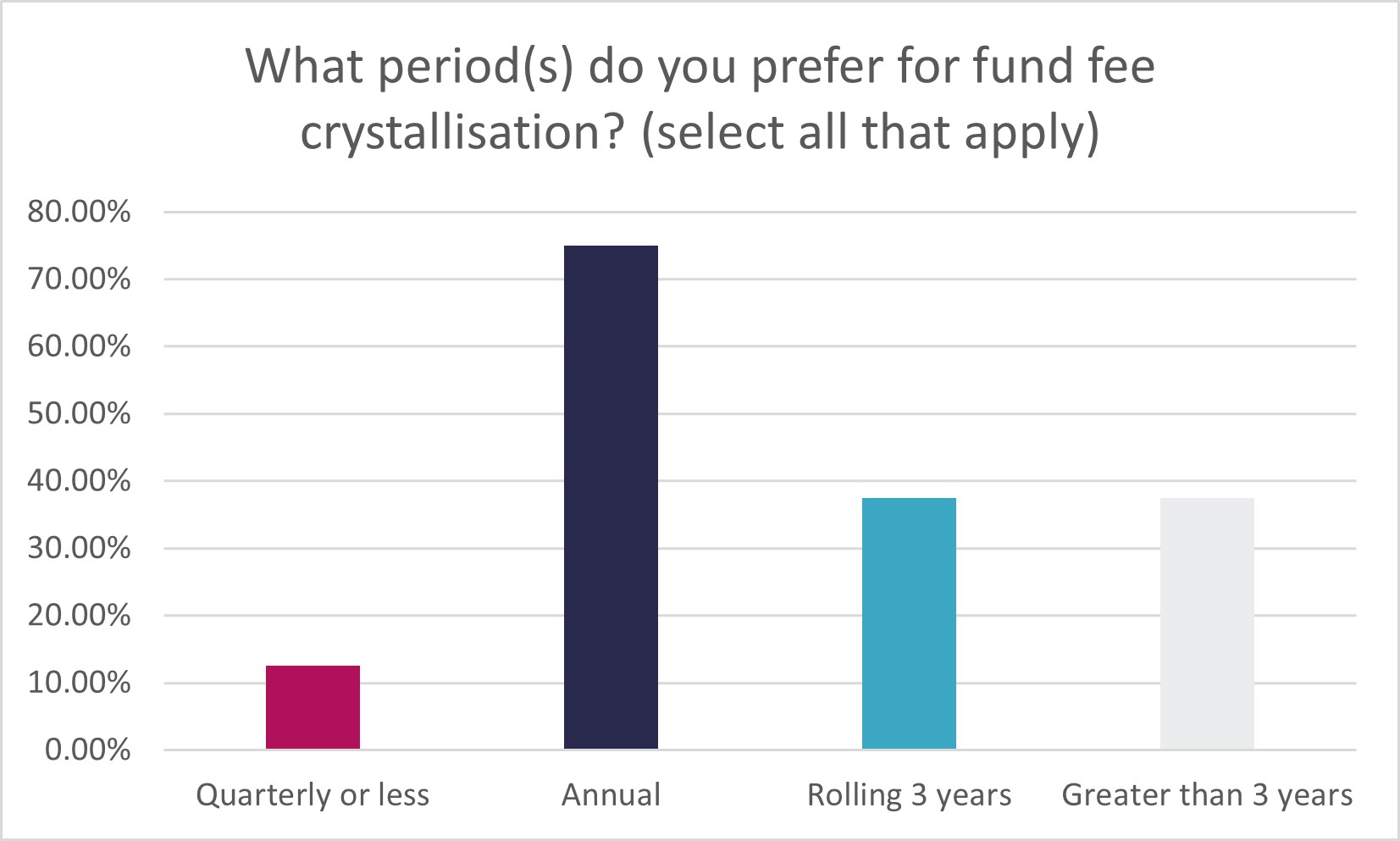

Paying for Performance:

Often referred to as fee crystallisation, this term describes how often fund managers get paid when delivering performance to their investors. This can be very often (daily, monthly, or quarterly) or less so (annual or multi-year). The preferred structure for the crystallisation of a hedge fund’s fees is for the fund’s underlying investment to match its time horizon. The payment for performance should be consistent with the realisation of the fund’s returns.

-

As per below, most investors polled prefer for performance fees to be paid out no more than annually. At the same time, investors acknowledge that there can be considerable differences in the crystallisation frequencies applied by different hedge fund strategies – mainly due to the variety of fund liquidity terms used across the universe of hedge fund strategies. Some hedge fund strategies can have a high portfolio turnover (liquidate the underlying positions in their fund more often) while others, illiquid strategies, can have a low portfolio turnover.

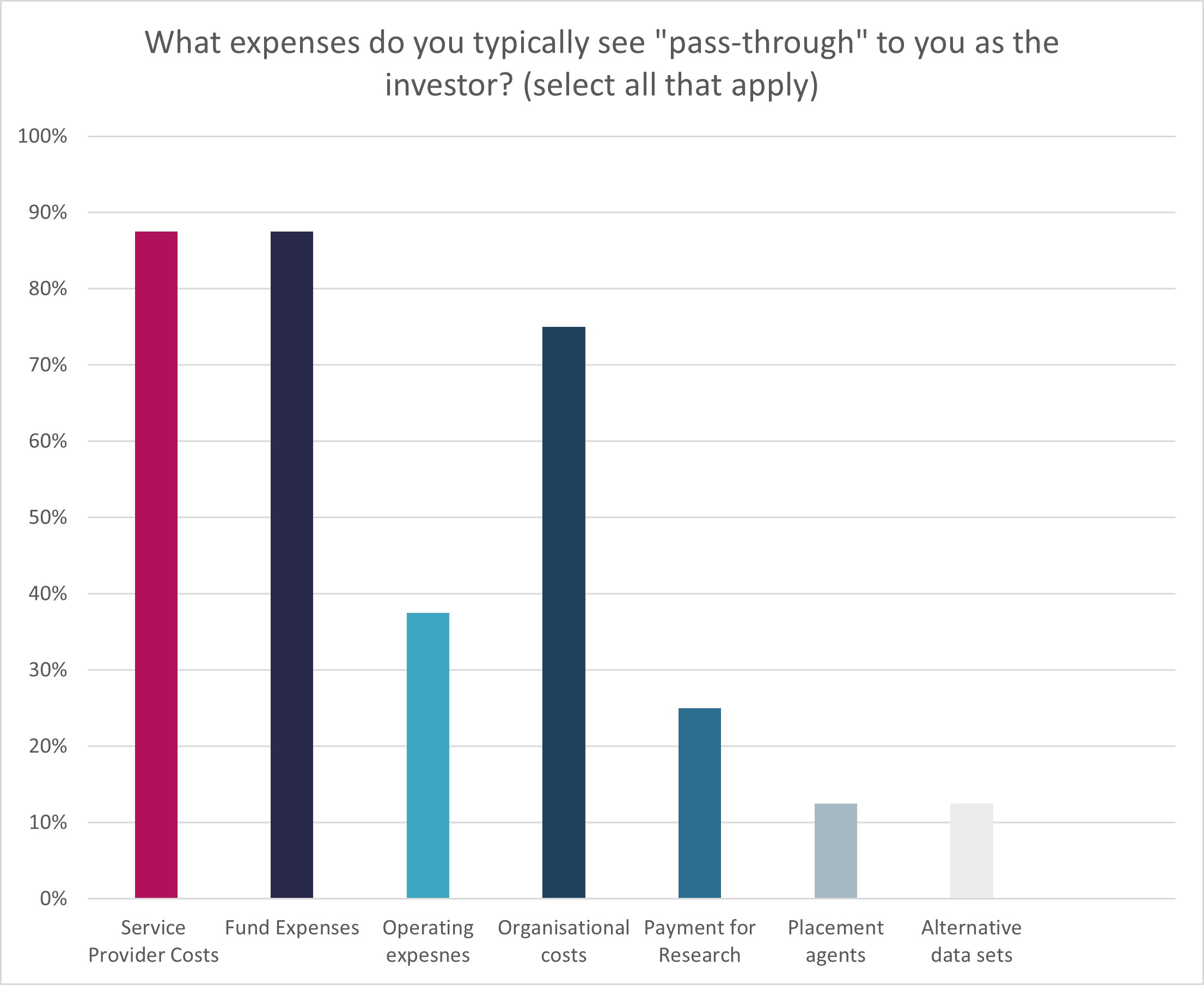

Paying for Fund Expenses:

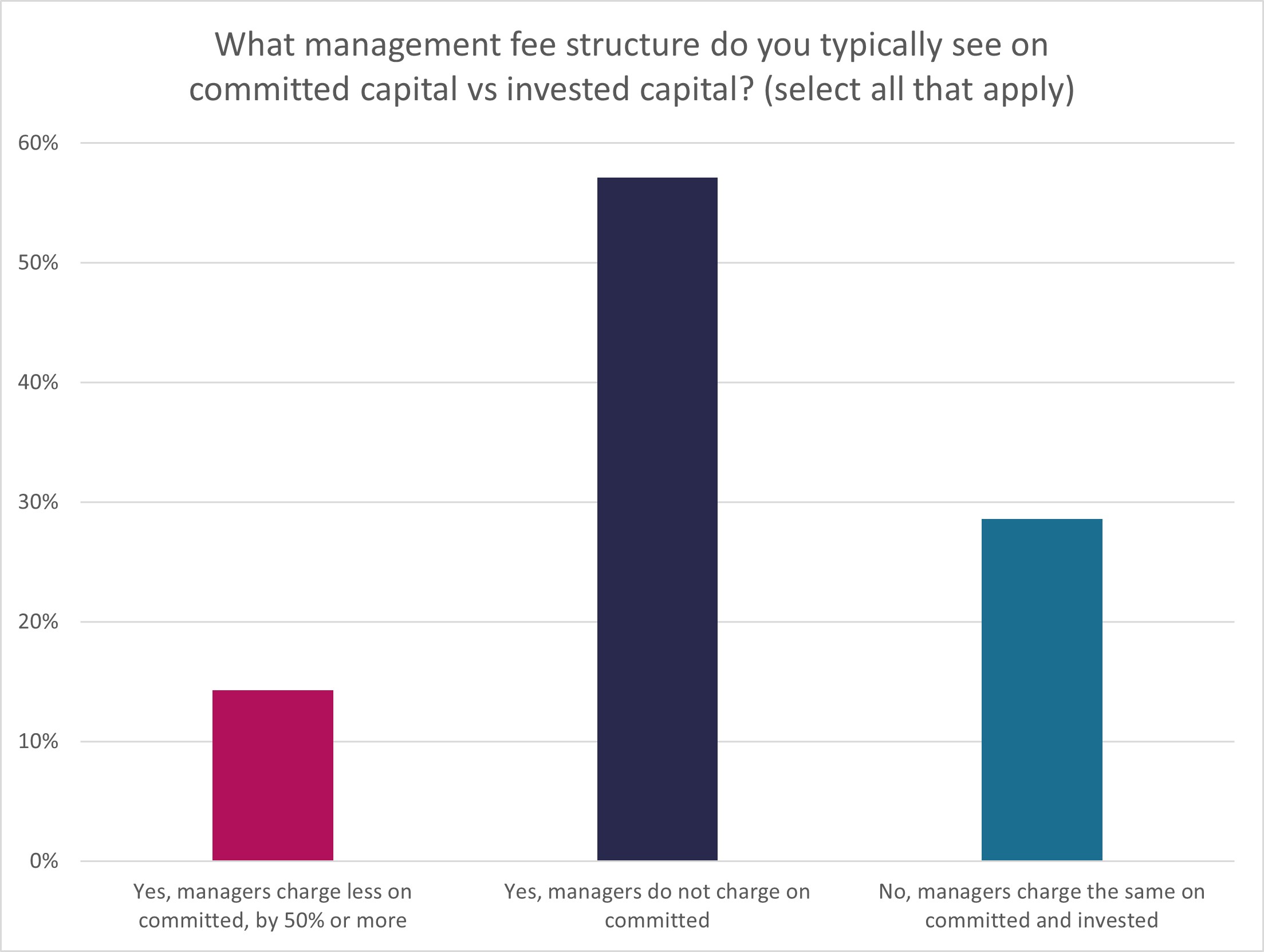

Investing in a hedge fund comes at a cost, and investors are aware that certain expenses of the fund will be “passed through” to them. Some funds have implemented arrangements that allow the fund manager to pass certain expenses through to the fund (and to its investors) as add-ons to the management fee.

- While there are no set guidelines for what expenses can be passed through, in general, anything that is providing a direct service to the fund tends to be charged as an expense.

- As per the chart below, service provider costs, fund expenses and organisational costs are generally accepted while there is less of an acceptance regarding costs for placement agents and alternative data.

- Allocators feel that if they pay for the fund’s operating expenses and help the fund in other funds or business lines, then a further negotiation of fees is justified, including in some cases demanding an equity stake in the fund manager.

- Investors would like to see fund managers report gross and net performance in any marketing materials. Included in the marketing should be a full breakdown of any expenses passed through to the fund. For example, a smaller LP might not have the staff, expertise, or due diligence resources to uncover all pass-through expenses, and therefore an expense ratio should be automatically and transparently shared.

-

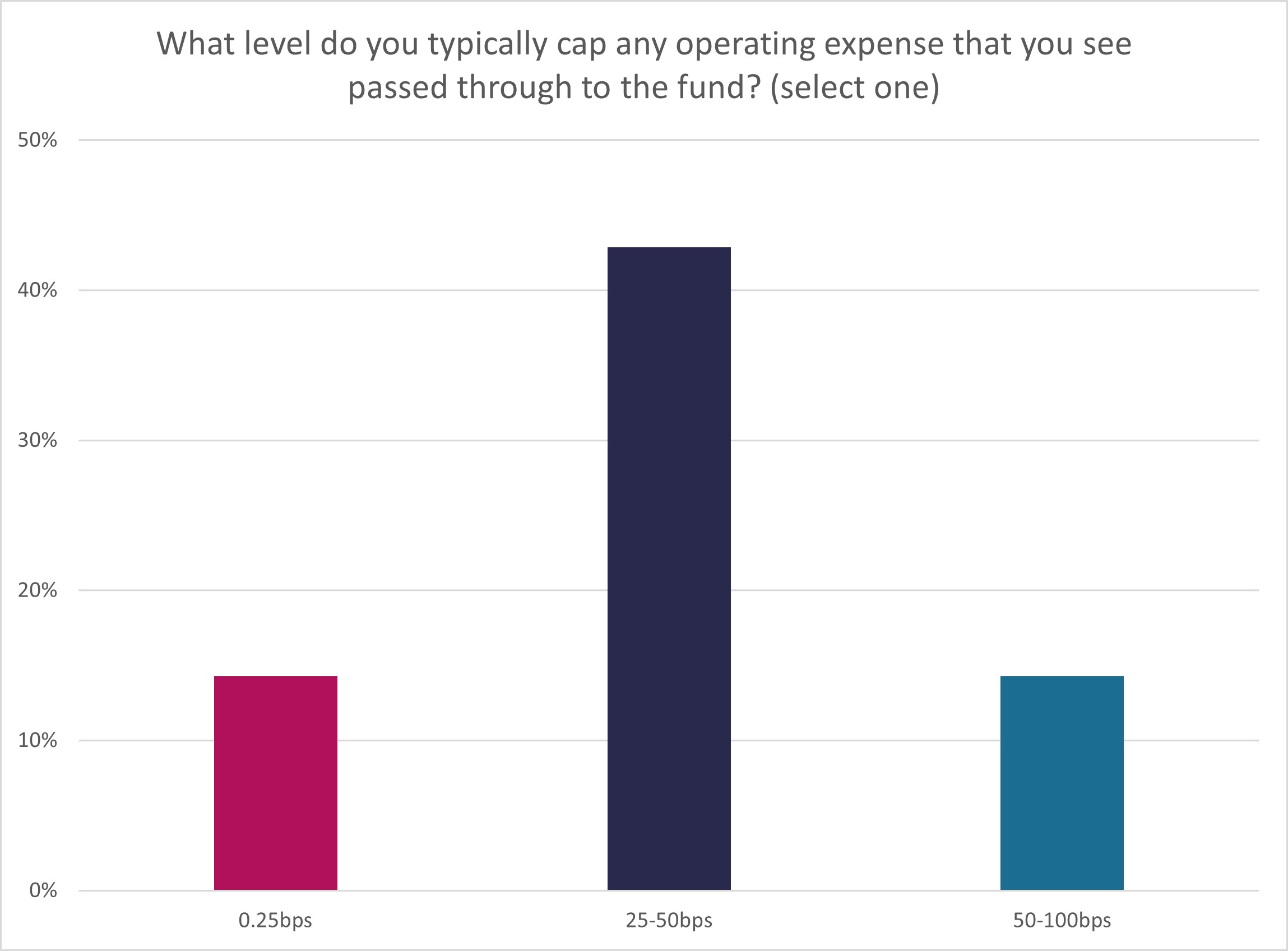

While 25-50bps was most cited as a typical cap level for operating expenses passed that are passed through to the fund, investors recognise that it’s heavily dependent on the fund’s underlying strategy (for example, quant and systematic managers may apply a different cap). Where investors believe the pass-through expense is higher than their tolerance, they will seek further clarification from the fund manager.

Fee Arrangements for Co-Investments:

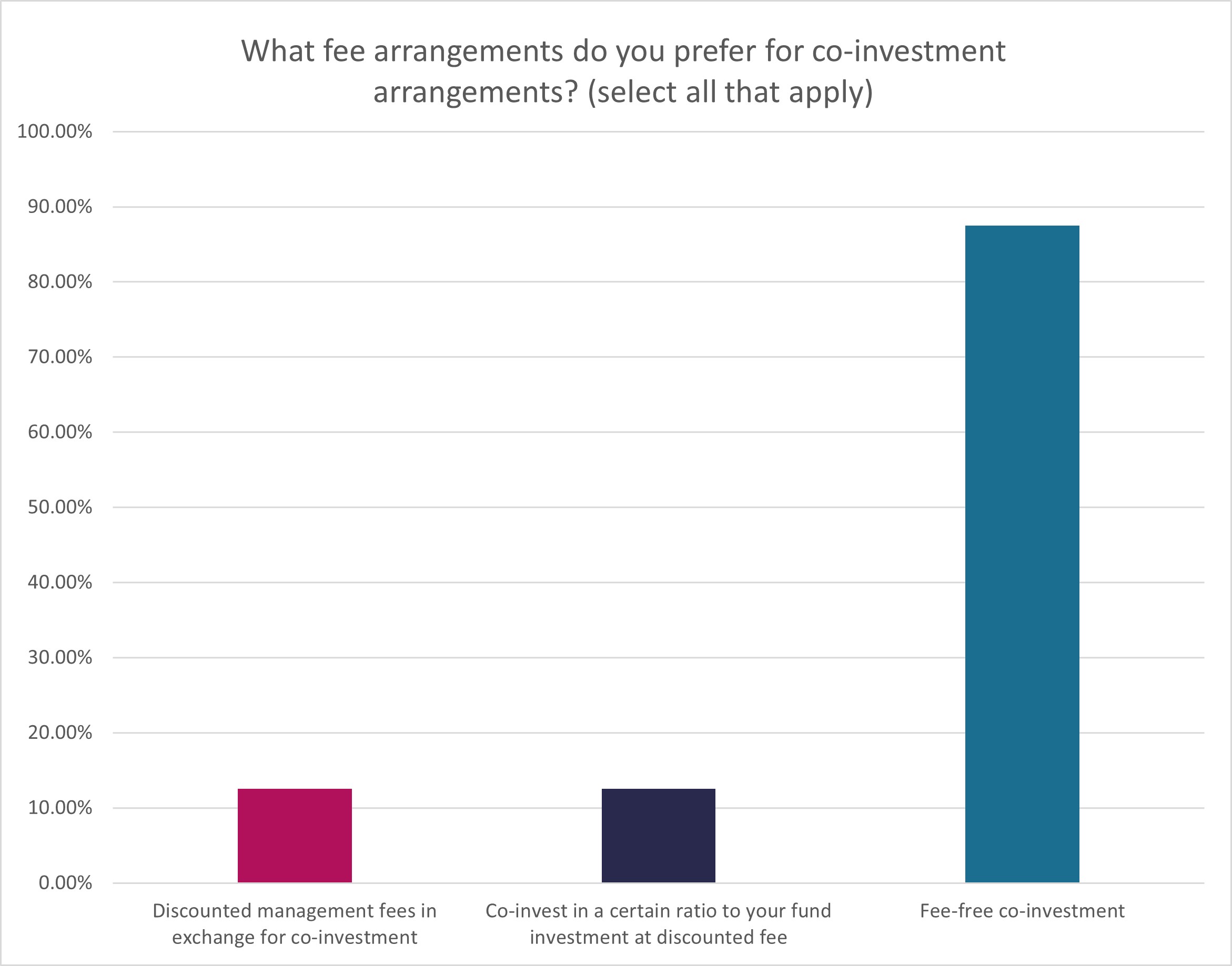

Co-investments are already a popular form of alignment between private market fund managers and investors. Hedge funds are establishing similar arrangements with their investors recognising the mutual benefits of a co-investment.

Fee-free co-investments which enable some of the fund’s investors to participate in a venture are the most preferred option. These tend to be mostly a syndicated co-investments alongside a private equity or venture capital firm.

If the co-investment opportunity comes in another way, an origination fee makes sense to be shared by others in the deal.

Strategic Relationships:

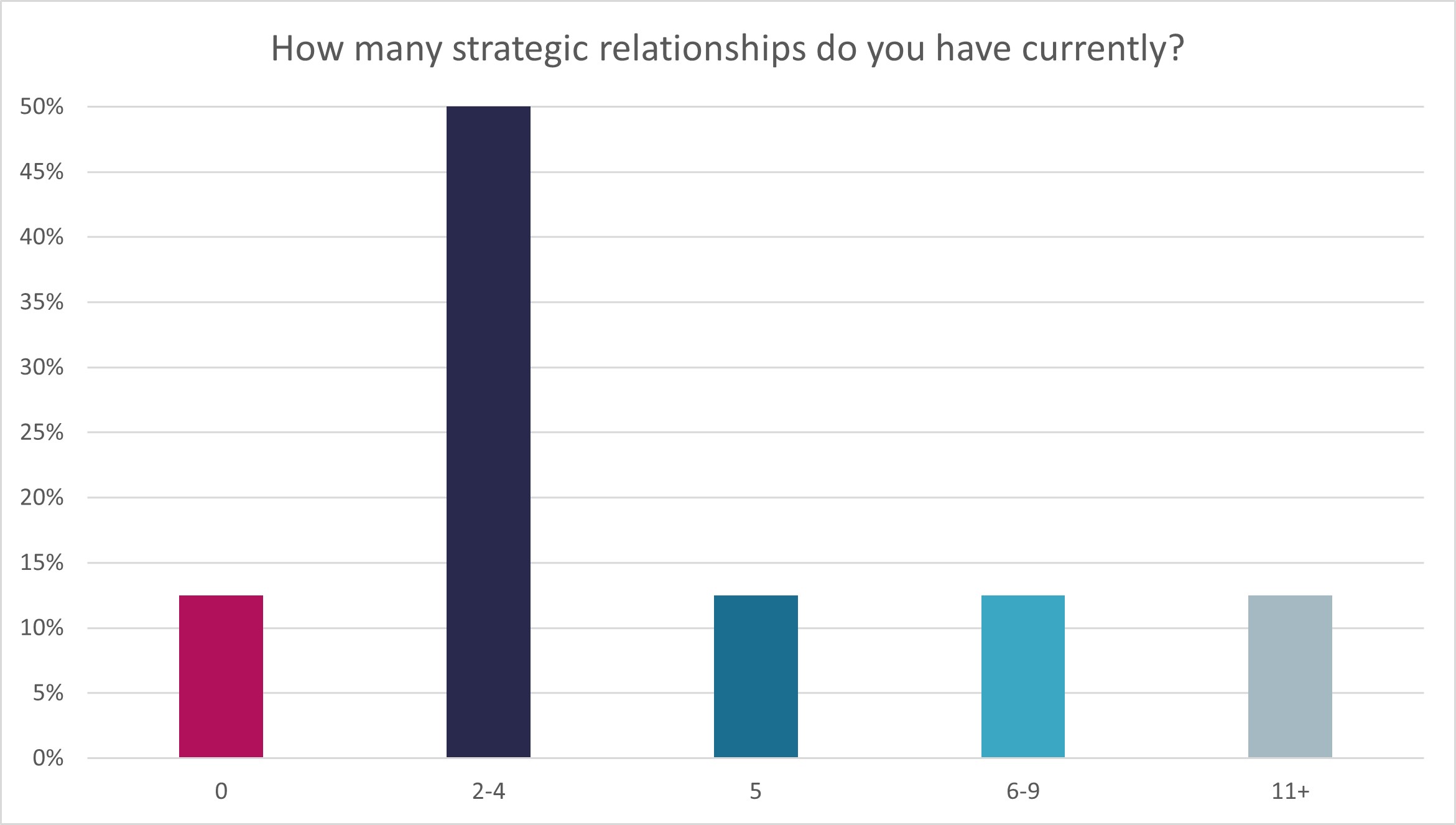

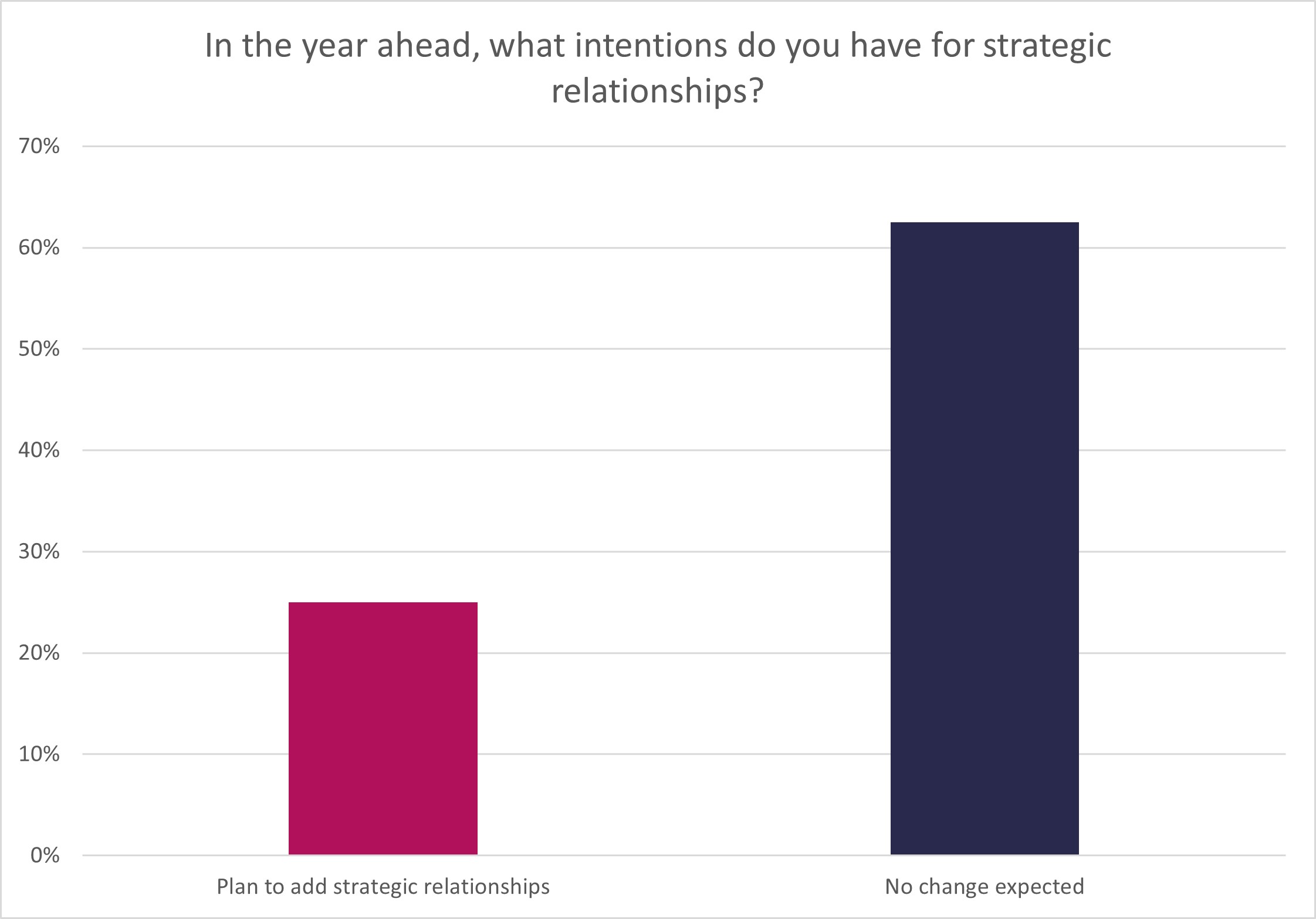

An average of two to four truly strategic relationships primarily on the private market side were cited by this group as being the optimum. Most are planning to maintain, if not increase, this number over the coming year. Most felt that more than five strategic relationships could not be properly managed or executed, though some allocators philosophically consider every relationship as “a strategic one”.

***********************************************************************************

If you wish to learn more about how fund managers and investors are aligning interests? AIMA will be publishing a comprehensive fund manager/investor study which goes into all these trends and more over the coming months. Visit aima.org for more information.