Bermuda: A regulatory update and fund structure primer

By Elizabeth Cava, Sarah Demerling & David E Bule, Deloitte, Walkers (Bermuda) Limited & HSBC Bermuda

Published: 01 June 2020

Bermuda has a long and rich history as a financial center, supporting both the asset management and insurance industries. With recent regulatory milestones achieved, now is a good time to review the investment management and fund framework supported locally.

Bermuda’s Position as a Global Financial Center

Bermuda's key strengths, as detailed below, include (i) its position as an experienced global financial center; (ii) the quality of its service providers; and (iii) a solid well-respected regulatory environment that adheres to international requirements.

Bermuda is a strategic global financial center with sophisticated infrastructure and human capital to support various types of professionals in the financial sector, from managers of traditional hedge funds to private equity, venture capital, collateral managers and insurance managers. This marketplace was developed, and is continually refined, by talented professionals who are experts in their respective fields. There are long-established business partners on the island including globally recognized banks, lawyers, accountants, corporate service providers and administrators working together with the investment manager community to drive world class innovation in the local industry, including fintech innovation.

Recent changes in legislation have affirmed Bermuda’s commitment to responsiveness and quality. The Economic Substance Act 2018 and the Economic Substance Regulations 2018 were enacted in response to a scoping paper issued by the European Union’s Code of Conduct Group (Business Taxation) in June 2018. Further, effective December 2019, Bermuda enhanced its regulatory framework, including amendments to the Investment Funds Act 2006 (IFA). The EU's Economic and Financial Affairs Council (ECOFIN) confirmed in February 2020 that Bermuda had met its commitments given to the EU to implement legislative changes that comply with the EU’s tax governance principles ahead of the deadline, and had accordingly been discharged from the review process.

Bermuda is globally respected for its leadership and proven record on compliance and transparency. In January this year, Bermuda’s regulatory regime has been assessed by the Caribbean Financial Action Task Force (CFATF) and the global inter-governmental Financial Action Task Force (FATF). The results of these assessments continue to confirm Bermuda as having some of the highest international standards when it comes to combatting money laundering and the financing of terrorism and proliferation.

Bermuda Funds Landscape

The Bermuda legislation provides flexibility and options for global asset managers to meet their offshore investment business objectives. Investment funds may be structured and organized under Bermuda law in the following ways:

- Company limited by shares

- Limited partnership

- Limited liability company (LLC)

- Segregated accounts company

- Incorporated segregated accounts company (ISAC)

- Unit trust scheme

Companies, partnerships, LLCs and unit trusts that meet the definition of an investment fund as stated in the IFA are either Authorised (further classified as Institutional, Administered, Specified Jurisdiction Funds or Standard Funds (for retail investors)) or Registered (further classified as Private, Professional Class A, Professional Class B Funds or Professional Closed Fund) and thus regulated by the Bermuda Monetary Authority (BMA).

Authorised funds are classified based on criteria such as minimum investment and/or sophistication of the investor base. Investors seeking enhanced, yet efficient, supervision tend or prefer to invest into an authorised fund.

Professional funds are either Class A or Class B. In both cases, reporting requirements are met by filing an annual certification with the BMA. The qualification criteria differs between the two classes as it relates to the appointment of the investment manager. Professional Class A funds must appoint an investment manager for the fund who is either:

- licensed under the Investment Business Act 2003;

- authorized or licensed by a foreign regulator recognized by the BMA; or

- carrying on business in or from Bermuda or in a jurisdiction recognized by the BMA, being a person who has gross assets under management of an amount that is not less than $100 million; or is a member of an investment management group that has consolidated gross assets under management of an amount that is not less than $100 million.

Closed ended funds (private equity) can be established as either private (less than 20 investors) or professional closed funds and audit waivers are available where the BMA considers it appropriate to do so.

The new Incorporated Segregated Accounts Companies Act 2019 allows for the creation of segregated accounts with separate legal status. This allows both open and closed-ended strategies to be housed in the same vehicle, benefiting from synergies and cost and operational efficiencies while enjoying statutory ring fencing (assets of individual segregated accounts, or cells, are not available to the creditors of any other cell). Given the separate legal personality, separate accounts may appoint different boards of directors. ISAC structures can be useful for master/feeder structures (one account can invest into another account within the same structure) and for family office structures.

It is not a requirement for investment funds to either have economic substance in Bermuda or to have a local audit or a local director. Officers and service providers must be fit and proper persons. That being said, the Big Four accounting firms have a large presence on the island and the Institute of Directors continues to broaden and strengthen the independent director talent pool in Bermuda.

As managers look to implement ESG initiatives and consider "green" valuations, the Bermuda Stock Exchange (BSX), a fully electronic offshore securities market, has launched an Environmental, Social and Governance initiative that aims to empower sustainable and responsible growth for its member companies, listings and the wider community. The BSX is the world's leading exchange for the listing of Insurance-Linked Securities (ILS) which are acknowledged as sustainable development investments.

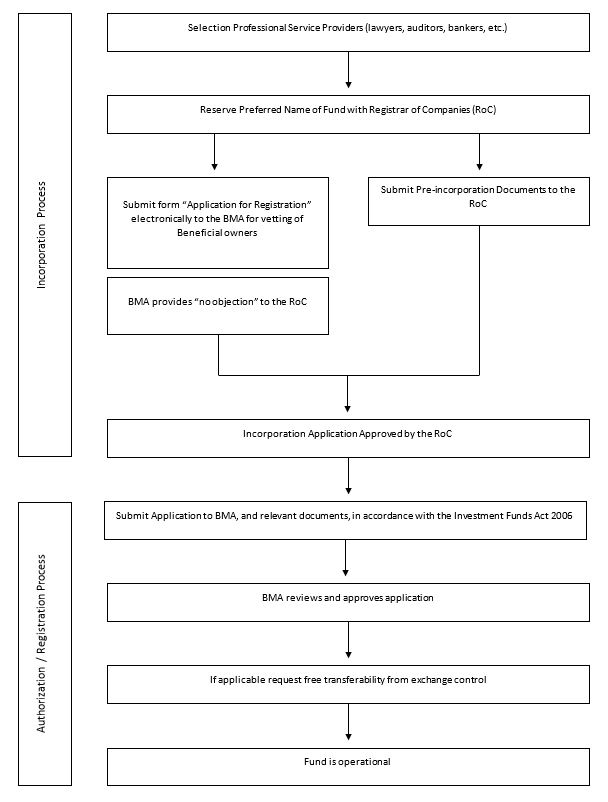

How to set up a Bermuda fund structure.

The following chart is reproduced courtesy of the BMA, the Bermuda Monetary Authority.