Coronavirus Crash: Fund-flow lessons from the financial crisis

By Eric Bernstein & Chris Chancellor, Broadridge

Published: 01 June 2020

As we approach what is likely to be one of the steepest recessions and economic contractions in living memory, it is inevitable that some asset managers will start panicking. The volatility has sapped performance across many asset classes, heightening fears about the likelihood of mass client redemptions at traditional and alternative asset managers. However, it is crucial that investment firms reflect on previous crises as these can shed light on how things might play out for global fund demand. Admittedly, past market performance is not a guide to future returns, but fund sales are also driven by emotion. While each crisis has its own nuances, there is often a degree of similarity in investor behavior.

Take the 2008 financial crisis, for example. From its zenith in 2007 to its nadir in 2009, the S&P 500 fell 50%. For many managers of alternative and traditional funds, that was an extraordinarily painful period. Revenues dissipated while clients withdrew vast sums of capital, causing overall assets under management (AuM) to drop precariously. For some managers, this was fatal. But the 2008 crisis was also notable for the speed at which the asset management industry recovered itself. With investors desperate for returns, they put their money into funds, especially those with diversified return streams.

As we approach what is likely to be one of the steepest recessions and economic contractions in living memory, it is inevitable that some asset managers will start panicking. The volatility has sapped performance across many asset classes, heightening fears about the likelihood of mass client redemptions at traditional and alternative asset managers. However, it is crucial that investment firms reflect on previous crises as these can shed light on how things might play out for global fund demand. Admittedly, past market performance is not a guide to future returns, but fund sales are also driven by emotion. While each crisis has its own nuances, there is often a degree of similarity in investor behavior.

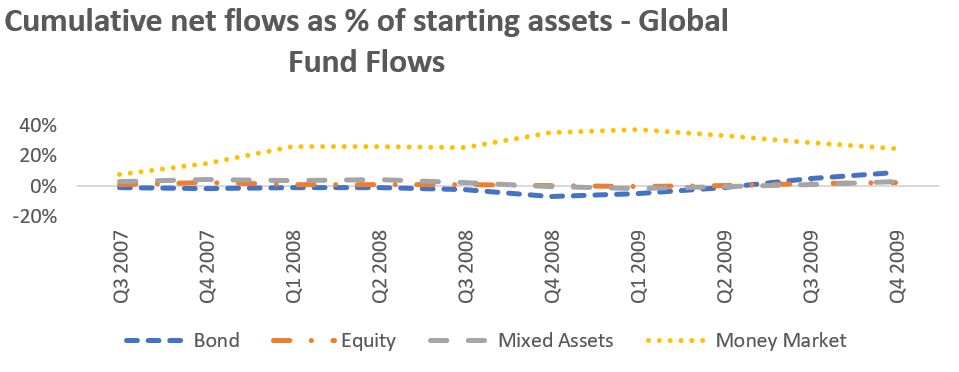

The above chart is indicative of the pace of this resurgence. Of the four asset classes identified, bond funds suffered the most in terms of declining sales and withdrawals, incurring a 7% loss of assets. However, bond funds were back in positive net sales territory (on a cumulative basis) within two years, illustrating the brevity of the disruption. In the case of money market funds, these actually continued to attract capital throughout the crisis as they were viewed as being a safe haven. It was only after the crisis receded that the cash in money market funds was reallocated into more rewarding asset classes.

Hedge funds are facing short-term challenges too as a result of Covid-19, but institutional investor appetite will eventually recover. Covid-19 wrong-footed a number of hedge funds to begin with, and performance initially suffered. As a result, hedge fund AuM dropped by $366 billion at the end of Q1 to $2.96 trillion, a steep decline from its record $3.32 trillion.1 It also prompted investors to pull $33 billion from hedge funds in Q1, making it the biggest quarterly outflow since the financial crisis when $42 billion was withdrawn. Despite the gloomy projections, there is reason for optimism, especially if we benchmark current events against 2008. In 2008, hedge funds went on to beat the market, and investors returned in even greater numbers. Hedge fund performance in April 2020 was at levels unseen in more than a decade, and this achievement will have been noted by return-hungry institutional investors.

Why the future is bright for hedge funds

So who will be the managers that thrive in this adversity? In 2008, the firms that enjoyed success were the ones who had the foresight to diversify their businesses. An over-reliance on a single strategy proved detrimental for many managers during the last crisis, but things have improved markedly since. Nowadays, hedge funds are more diversified with managers pivoting towards multi-asset class strategies, including infrastructure, private debt and private equity. Such diversification not only helps hedge funds attract a wider spectrum of investors, but it can protect their businesses during sharp downturns.

Simultaneously, the hedge funds in 2008 that paid diligent attention to operational risk management also fared well when markets normalised. Fortunately, most hedge funds now take operational risk very seriously, evidenced by the ease in which the industry adjusted to working from home without much disruption. Those hedge funds whose business continuity plans (BCPs) are found wanting are expected to see withdrawals. Conversely, managers - who prior to Covid-19 - invested time and effort into their operational resiliency and risk management programmes are likely to be rewarded with further inflows.

Additionally, the hedge funds which have been open and maintained regular dialogues with clients will be the primary beneficiaries when Covid-19 subsides. Pre-2008, the industry was criticised for being opaque with investors, many of whom would receive performance updates on a quarterly basis, if that often. Post-crisis, the hedge fund model institutionalised itself partly as a result of the huge inflows that came from major pension funds, sovereigns and insurance companies. With that, hedge funds were forced to become more transparent and communicative with clients. These much-improved transparency standards will serve hedge funds well when institutional investors start allocating capital once again.

If hedge funds are to win mandates, they need to evolve with the times. This latest crisis is a stark reminder of the importance of digitalisation. Fortunately, a number of hedge funds have transitioned away from manual processing towards something more automated, which has had a positive impact on client reporting. As investors increasingly embrace technology, it is critical their fund managers do so too. If hedge funds are to accumulate more assets in the future, they need to digitalise the investment experience by ensuring performance and operational reports are available in real-time or near real-time in a compatible, user-friendly format that can be accessed via a mobile phone or smart tablet device.

Lessons learned

Covid-19 will lead to short-term pain in the funds industry, but there is reason for optimism. Past crises have shown that flows bounce back relatively quickly. Moreover, the hedge fund industry has made some impressive strides since 2008 by becoming more diversified; communicative; digitalised and better risk-managed. If performance is robust and superior to that of public markets, then investors will return.

[1] Hedge Fund Research (April 22, 2020) Hedge fund assets fall as market volatility surges on pandemic uncertainty