How the hedge fund industry has evolved over the last 25 years

By By Neil Wilson, Wilson Willis

Published: 14 September 2015

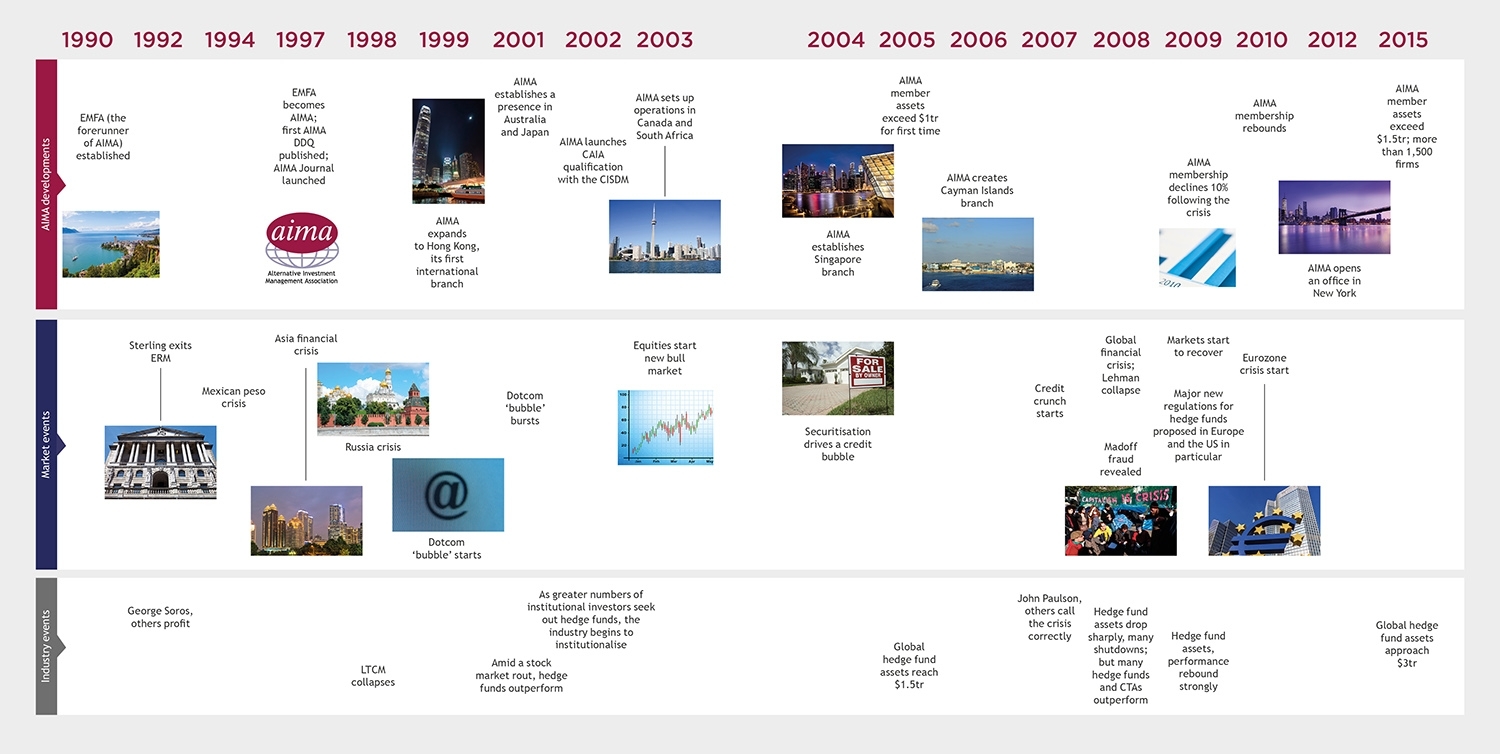

Back in 1990, the year of AIMA’s founding, it would be safe to say that both managed futures and hedge funds — indeed, alternative investments in general — were regarded as somewhat peripheral to the financial markets, very much on the outer fringes of the mainstream financial world.

A lot has changed in the past 25 years. Both hedge funds and managed futures have grown enormously over the intervening years. And AIMA has played an increasingly central role in championing the cause of the industry, developing sound practices and providing a forum for industry practitioners.

Of course, hedge funds and alternative investments were not completely new in 1990. Alfred Jones invented what was generally regarded as the first modern hedge fund — a fund with the ability to use leverage and to go short as well as long — way back in 1949. And the first notable boom in hedge funds had occurred in the US back in the early 1970s.

That first wave of funds was largely snuffed out by the rampant inflation and fierce bear market in equities that followed the oil price shocks of that decade. But by 1990, there were still a few hardy survivors of the early period left — including legendary ‘global macro’ players like George Soros, who had survived by making the right macro calls over the years across multiple asset classes; and Julian Robertson’s Tiger group, which had done so too though with a greater focus on equities in particular.

It was no accident, however, that the first group of players who decided to form a trade association were focused on the managed futures space. By the early 1990s, many of the biggest players in alternatives globally were either macro managers like Paul Tudor Jones and Louis Bacon, who had strong roots in commodity futures, or pure commodity trading advisors (CTAs) — operating primarily in the futures markets, often with systematic trend-following strategies.

When EMFA, the forerunner to AIMA, first appeared, it was not clear yet that Europe — and London in particular — would become such a major centre of the nascent industry. But even at that time, there were London-based firms like ED&F Man group that were already thinking a lot bigger. In the early 1990s, seeing a need to source new capacity, Man had the foresight to acquire the UK-based managed futures firm AHL and also spawned a range of further top rank CTAs including Winton Capital and Aspect Capital.

Today, the US remains by far the biggest region for hedge funds by assets under management — with New York by a long way the top single centre, alongside significant clusters in other regions around the country in Connecticut, Massachusetts, Illinois, Texas, California and elsewhere. London has for many years been the second biggest centre globally. And in the managed futures space, in particular, many of the world’s operators are now based in Europe — and all around the Continent too, including the likes of Transtrend in Rotterdam, Lynx in Stockholm and Capital Fund Management in Paris.

Sterling crisis

Arguably, the first time that hedge funds reached the public consciousness, at least in Europe, was in 1992 — when the Bank of England was forced to give up its policy of trying to keep sterling within the European exchange rate mechanism (ERM), the forerunner of the euro. That was not until after the Bank of England had suffered major losses in a failed attempt to keep sterling inside the ERM — and various hedge fund managers, led by Soros, famously made massive profits by betting successfully against it.

While there was much hot air expended by critics at the time — venting about these ‘buccaneering’, ‘upstart’ hedge funds being allowed to humble the stately Bank of England — the resulting exit of sterling from the ERM proved a boon for the UK economy.

During the 1990s, while many CTAs continued to thrive and generally make good returns (not without some volatility), they were gradually over-shadowed by managers investing instead in a long-running bull market in equities. TT International had launched what was widely regarded as the first hedge fund managed in Europe in the late 1980s. And notable early long/short equity managers who emerged in Europe during the early 1990s included Crispin Odey, who launched his first hedge fund in 1992, and John Armitage, who went live with Egerton Capital in 1994.

The pace of development, however, was quite slow in Europe in those early days. In the US, by contrast, the industry was already growing rapidly — and not just in equity-related strategies, but into other areas such as convertible arbitrage, distressed debt and fixed income relative value. It was in the latter strategy area that hedge funds next made big headlines — after the Asia and Russia crises of 1997 and 1998 was followed by the sudden and shocking implosion of Long Term Capital Management.

The huge scale of the leverage deployed by LTCM caused what looked like a potential systemic problem — raising serious questions for the first time that hedge funds were perhaps becoming so big that they could constitute a danger to the whole market.

For the first time in 1998, hearings were held in Washington to investigate this notion — with Congress even summoning George Soros to answer for the industry. At the time, industry representatives were able to argue successfully that LTCM was very much a one-off case — and that hedge funds in general were just too small and too modestly leveraged to pose a genuine systemic risk. But, over the years since, regulators and legislators have continued to be pressed by sceptical or hostile public opinion — re-ignited whenever there has been any significant hedge fund-related ‘blow-up’ or scandal. So 1998 turned out to be just the first in a series of debates about potentially damaging new regulations that have continued all the way through to the present day.

Global reach

It was very timely, therefore, that in 1997 the managed futures-focused and still largely European EMFA evolved to become the broader, and globally-aspiring, AIMA — seeking to represent the increasing community of hedge funds as well as CTAs. The importance of this development was again probably not widely appreciated at the time — given what was still a nascent industry driven by fiercely competitive and independent-minded individuals.

As a breed, hedge fund managers and CTAs have of course always been entrepreneurial, and fiercely competitive among themselves — and hence by nature very hard to rally together behind the same banner. Yet the new AIMA was not slow to take up the task with enthusiasm. As early as 1997, AIMA was issuing its first due diligence questionnaire. In 2000, AIMA’s first Regulatory Forum was held. And by September 2002, AIMA’s first Guide to Sound Practices had been published. The association was also beginning to expand globally — first into Hong Kong in 1999, and then into Australia and Japan in 2001. Canada, Cayman, Singapore and other locations would gradually follow.

AIMA was early to establish a presence on the ground in Asia — starting at a time when feelings were still running high about hedge funds in many parts of the region following their perceived role in ‘shorting’ various markets during the Asia crisis. In the late 1990s, there were very few funds managed from within the region itself and they were mostly focused on Japan. Over the years since, while assets have waxed and waned in what have often been volatile markets, the ex-Japan markets have grown dramatically — with Hong Kong and Singapore emerging as the leading centres for managers to be based in the region.

Meanwhile, by the late 1990s the industry in Europe was also taking off in a very significant way, with a whole new generation of managers being inspired to leave the institutions where they worked, set up on their own and deploy the most sophisticated asset management techniques to deliver the best risk-adjusted returns.

"AIMA was early to establish a presence on the ground in Asia — at a time when feelings were still running high about hedge funds' perceived role in the Asian financial crisis."

The LTCM affair — given not least the pedigree of a management team including Nobel laureates — had certainly been a shock when it happened. But in retrospect it looks more like a mere blip — with funds launching at the time finding it more difficult than they had expected to raise capital, but most of them going ahead anyway.

Those launching their first funds during that period — including AQR, Marshall Wace, Viking Global and Lansdowne Partners, and firms like BlueCrest that were leading a new wave of fixed income and macro focused players — have gone on to become some of the biggest names in the global hedge fund industry of today.

This was despite the fact that markets at the time continued to be volatile and challenging. By 1999, the ‘dotcom bubble’ was in full swing — making it hard for hedge funds, including the growing community of long/short equity managers, to stand out from traditional long-only funds that were riding a raging bull market.

But hedge funds began to look increasingly compelling after the dotcom bubble burst — during the subsequently sharp bear market of 2001 − 2003. While equity markets were plunging 30% and more, hedge funds on average were generally retaining their value — and many individual managers, even in equity strategies, were continuing to produce gains.

The process of institutionalisation

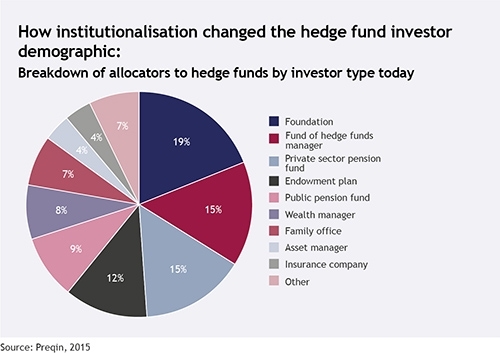

In the early years of the industry, hedge funds and CTAs had attracted money mainly from wealthy individuals and clients of private banks (which formed many of the early funds of hedge funds), plus like-minded family offices. Over time, more money had also started to come in from investors with tax-exempt status like endowments and foundations, and corporate sources like insurance companies.

After hedge funds outperformed so clearly during the dotcom era, the investor base started to become increasingly institutional, with corporate and public pension funds and sovereign wealth funds becoming more and more significant allocators. Hence a more ‘institutional’ sort of hedge fund industry started to emerge — one that needed to cater to the ‘institutional standards’ in money management required by those investors.

This process of institutionalisation was to continue over a number of years and did not really reach its zenith until after the financial crisis of 2008 — with the assets managed for institutional allocators like pension funds eventually coming to exceed the amount hedge funds managed for their traditional private bank, high net worth and family office type of clientele.

Over the five years just before the crisis, from 2003 − 2007, there was largely a slow and steady rising market in equities, plus a major boom in credit markets — where an increasing number of hedge funds also began to focus. These were conditions in which numbers of players and assets could grow robustly — as indeed they did. In that period, HFI was routinely recording well over 1,000 new hedge fund launches a year.

The combined assets of AIMA’s global membership had reached the $1 trillion mark as early as 2005. And the long-running Hedge Fund Research database put aggregate global assets at a peak of almost $1.9 trillion by 2007, though some other data providers put the number even higher. HedgeFund Intelligence reported assets breaching the $2 trillion level that year — and (albeit very briefly) even exceeding $2.5 trillion just before the financial crisis hit.

As the industry became more institutional during this period, there was an accompanying trend towards more consolidation too — with an increasing number of managers monetising the value of their firms through selling stakes, such as to Petershill, a private equity vehicle managed by Goldman Sachs, or by creating listed vehicles all the way through to full-scale IPOs.

The impact of the financial crisis

With assets growing so robustly, there were however mutterings among investors that overall performance — which had been strong historically — had become increasingly tepid or lacklustre, which was indeed being reflected in the indexes of composite performance as that period wore on. But few investors seemed to be prepared for the sort of aggregate performance that came through after the ‘credit crunch’ of 2007 gave way to the collapse of Lehman Brothers and the full-blown financial crisis of 2008.

Many of the newer investors, in particular, had been sold on the notion that hedge funds were ‘absolute return’ products. And so, somewhat naively perhaps, they were simply not prepared for the eventuality that hedge fund performance in aggregate could be significantly negative — even if there was a complete meltdown of the whole financial system.

In the febrile, panicky conditions of late 2008, the situation was made significantly worse by a virtual tidal wave of redemption requests hitting the industry. This led some hedge funds to suspend redemptions or ‘gate’ investors — in order to avoid realising massive losses in a collapsing market. At the same time, many other managers were criticised for realising major losses — precisely because they were obliging investors by liquidating assets in a market with no buyers. For many hedge fund managers, it was an invidious position to be in.

In the circumstances, it should have been no surprise that the databases were showing average losses of 15 − 20% for hedge funds in 2008 — although that was of course nothing like as bad as equity market returns at the time. Alongside the simultaneous flood of redemptions, asset levels overall suddenly dropped by 30%.

The Madoff affair

There were further aggravating factors. At the depth of the crisis in December 2008, the wave of redemptions finally caught out Bernie Madoff — who was revealed after many years to have been running a fraudulent ‘Ponzi scheme’. The smattering of fraud cases involving (supposed) hedge funds which had occurred intermittently over the years before were mostly small and obscure cases with minimal impact. But Madoff was truly shocking in its scale — and for the fact that, although Madoff was not strictly a hedge fund manager himself, he had been acting as a sub-adviser running feeder funds or accounts for many investors in the industry.

The Madoff affair took a heavy toll on the fund of hedge funds (FoHF) sector, despite the fact that most FoHF groups had no exposure to him. Research published by InvestHedge showed that only 22 of the top 150 FoHF groups were known to have exposures to Madoff, and the vast majority of the money Madoff had raised had not come via FoHFs but from direct investors, sometimes via feeder funds or managed accounts and even some in onshore structures — on all of which he was reporting bogus returns.

Nevertheless, following the crisis and the Madoff affair, the proportion of assets allocated to the industry via the FoHF sector began to drop — from over 50% before 2008 to around 20% — 25% today.

The recovery

Assets started to recover quite quickly after the crisis — within a year or so after the equity market bottom in March 2009. That was after it became apparent that aggregate hedge fund performance had not in fact been all that bad during the crisis — not when you considered that global equity markets had plummeted 30 − 40%, more than twice as much as hedge funds on average had fallen. Moreover, while the dispersion in returns across the industry had been enormous during the crisis, many individual funds had indeed continued to deliver positive returns in 2008 — on some measures up to around 20% — 25% of those trading at the time.

Those who made profits during the period included some huge gains from managers who had called the credit crunch correctly; from some big macro funds; and across the board from CTAs — who once again reaffirmed their non-correlation with average gains of 15 — 20% in 2008, with many of them up considerably more. As the dust settled on the crisis, and investors began to take these sorts of facts on board, asset levels began to recover — as they continued to do steadily year after year since 2010. Both the HFR and HFI databases now show global assets surpassing previous peaks and reaching record highs around the $3 trillion level, including a rising proportion in onshore structures like UCITS and 40 Act funds.

Increased regulation

Yet the image of the industry — as indeed of the whole financial sector — took a battering during the crisis. With governments (and their taxpayers) in the major economies being asked to borrow hundreds of billions to bail out the banks, it provoked widespread hostility to the financial sector as a whole. If anything, the fact that some hedge funds had correctly diagnosed the mounting problems in the financial sector only seemed to attract greater opprobrium.

Other key facts — such as the reality that hedge funds had not caused the crisis, or that many of them were badly impacted by it — and had never received a penny of bail-out money — were very difficult to get across to the press, the public and the politicians. In such a hostile atmosphere, it was inevitable that pressure would mount on politicians for ‘something to be done’ to address what had caused the crisis — and prevent it from happening again.

Thus, it was critically important that AIMA was there — with a long record of encouraging good standards in the industry — to fight the industry’s corner, and to prevent the results from being too negative, and perhaps even destroying the industry. Extremely effective campaigns were waged on a variety of fronts particularly in Europe and the US. The world changed in 2008/9, and with it, AIMA changed too. Following the crisis, the Association built new structures and brought in new people to address the challenges posed by the crisis and the regulatory reforms that followed. Amid a spirit of constructive and proactive engagement, AIMA and the industry achieved significant amendments to proposals that could have threatened the industry’s very existence.

Instead, we have an industry that has been growing again at a good pace of around 10% a year or more since 2009 — though one that looks very different from before. While assets under management have been growing, the numbers of players trading has not — with higher barriers to entry reflected in a falling number of new funds coming through, especially in Europe, and the big getting bigger, with an increasing concentration of assets among the biggest firms of the Billion Dollar Club. According to HFI figures, these top 400+ firms globally now account for close to $2.5 trillion of the industry’s assets — well over 85% of the total.

Challenges, and risks, remain. The industry today is more global, more institutionalised, and more diverse in terms of investment strategies than it has ever been, even allowing for the consolidation that inevitably has occurred. It remains a source of innovation and entrepreneurialism. It is playing an ever increasing role in the ‘real economy’. Its investors continue to earn significant sums and allocate ever greater shares of that portfolio.

The past 25 years have been instructive, they have been incredibly difficult at times, but ultimately it has been a rewarding period. For the new generation of hedge fund managers, the next 25 years could be yet more exciting.