SFDR implementation: More answers. More questions?

By Paul Ellison; Maren Stadler-Tjan; Lily Marcel; Charlotte Chopping; Jacqueline Jones, Clifford Chance LLP

Published: 18 September 2023

Implementing the EU’s Sustainable Finance Disclosure Regulation (SFDR) has been a challenge for industry and regulators alike. One of the reasons for this has been a lack of clarity over the definition of ‘sustainable investment’ and other fundamental concepts underpinning the SFDR framework. Numerous questions have also been raised on how to apply the requirements in practice, especially as many of the rules are not fully compatible with alternatives investment strategies.

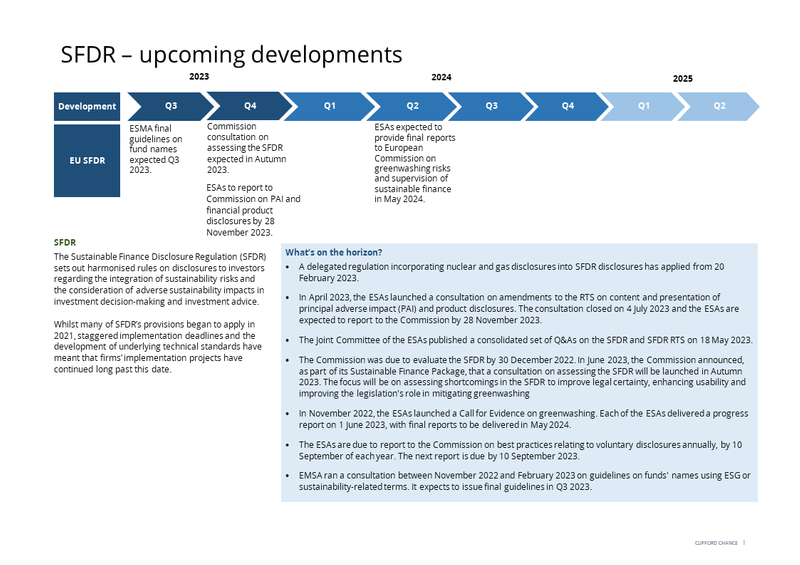

This has led to the publication by the European Commission (Commission) and the European Supervisory Authorities (ESAs) of several sets of Q&A, covering both interpretational questions, as well as answers to a whole host of questions on the practical implementation of SFDR, culminating in the publication of a consolidated set of Q&A in May 2023. However, as we highlight in this article, SFDR is still very much a moving target. Recent developments on SFDR, such as the ESAs’ consultation on the SFDR Delegated Act and the upcoming evaluation of the SFDR framework, alongside developments affecting other EU sustainable finance regulations that interrelate with SFDR, particularly the Taxonomy Regulation and the Corporate Sustainability Reporting Directive, are likely to raise further important questions. The end outcome of these questions is important, as it will shape the future direction of the SFDR framework and how firms are expected to reflect these outcomes in their implementation processes.

More answers

The SFDR began to apply in March 2021. Since that date, firms’ implementation projects have caused a series of interpretational questions to surface. This led to the publication of Commission Q&As on the SFDR in July 2021 and May 2022 (see our earlier briefing).

In September 2022, the ESAs submitted a further set of eight interpretational questions to the Commission. These related to:

- How to interpret the phrase ‘sustainable investment’;

- Products that have the objective of reducing carbon emissions;

- The nature of product-level principal adverse impacts (PAI) disclosures;

- How to interpret the 500 employee threshold that triggers mandatory PAI disclosures; and

- The frequency with which firms providing portfolio management services should publish their periodic SFDR reports.

On 14 April 2023, the Commission’s responses to these questions were published. The responses emphasise the status of the SFDR as a disclosure regulation, leaving firms to determine their underlying approach to sustainability rather than mandating that approach centrally. In particular, the Commission confirms that it is for firms to determine whether investments are ‘sustainable investments’. This flexibility is likely to be welcomed by firms, although leaves scope for divergence over firms’ resultant approaches. The Commission therefore provides a corollary warning: firms must exercise caution when determining whether an investment is sustainable. In other words, freedom should not mean a race to the bottom in terms of determining the threshold at which an investment may be deemed sustainable.

This question, together with the Commission’s responses to the remaining questions in the Q&A, are summarised in our earlier briefing.

More questions?

More questions on SFDR implementation are likely to arise in the future, as publication of the Commission’s Q&A has occurred against a backdrop of continuing SFDR developments, the consequences of which are still playing out.

The first of these developments was the ESAs’ public consultation on potential changes to the SFDR Delegated Regulation. Published two days prior to the publication of the Commission’s Q&A, the ESAs’ proposals aim to broaden the disclosure framework and address the main technical issues that have emerged in implementing SFDR. They include:

- Extending and enhancing the list of social indicators for PAIs;

- Refining the content of some of the other indicators for adverse impacts and their respective definitions, applicable methodologies, metrics and presentation;

- Making amendments regarding GHG emissions reduction targets;

- The potential introduction of more specific disclosure requirements regarding DNSH under PAIs for sustainable investments, to increase transparency and support some degree of comparability;

- Extensive changes to the recently finalised reporting templates; and

- Making other technical adjustments to the RTS as regards the treatment of derivatives.

The proposed changes to the RTS raise several important issues for the industry, particularly those relating to social PAI indicators, treatment of derivatives, DNSH, GHG emission reduction targets and simplification of the templates. Firms will be watching closely the approach ultimately taken by the ESAs in these areas. Many of the questions have arisen because of ongoing developments in other EU workstreams that impact the SFDR framework. Notable among these is the phased implementation of the Corporate Sustainability Reporting Directive (EU) 2022/2464) (CSRD) and finalisation of the European Sustainability Reporting Standards (ESRS) upon which the Commission issued a Consultation Paper in June 2023. These affect the availability of data that is needed for SFDR reporting.

In particular, the introduction of ‘materiality assessments’ in the ESRS for data needed for mandatory SFDR PAI disclosures adds to the ‘data challenge’ already faced by the industry, where data quality and availability is an important issue, particularly for non-equity asset classes.

This problem extends beyond the EU, where different reporting standards would apply and where data on investments is not necessarily collected or comparable, as is the case for some of the data needed for the new social indicators, for example. The ESAs will deliver their final report on the draft RTS to the Commission by the end of October 2023, so at the moment it is not clear what changes to the RTS will be made.

A further complication is that the Commission and ESAs’ Q&A are not necessarily the only sets of guidance that firms need to be aware of. Some national regulators, including the CSSF, have issued their own guidance and on 10 July 2023, the German financial services regulator, BaFin, announced a supplement to its own Q&A on SFDR and issued detailed guidance on the related RTS.

BaFin supplementary Q&A on SFDR and guidance on the SFDR RTS

BaFin has announced a supplement to its Q&A on SFDR and issued detailed guidance on the related regulatory technical standards.

BaFin notes that the SFDR contains certain undefined legal terms that financial market participants and financial advisors have found difficult to interpret in practice. In its Q&A, BaFin addresses questions on the practical implementation with respect to the SFDR and RTS that are not covered in the SFDR questions answered by the EU Commission, or in the RTS questions answered by the ESAs. BaFin has now supplemented the existing five Q&A by clarifying issues on product related templates in Annex II and III of the RTS. Together with the Q&A supplement, BaFin has published detailed guidance on these templates.

Unless a dissenting assessment on these questions is published by either the Commission or the ESAs, BaFin will base its administrative practice on the legal interpretations set out in its updated Q&A.

The second significant development which has raised many questions in the industry is the upcoming evaluation of the wider SFDR framework, due to commence in the Autumn of 2023. This will focus on assessing shortcomings in the SFDR framework to improve legal certainty, enhance usability, and improve effectiveness in tackling ‘greenwashing’. The review may lead to a legislative proposal, something the industry will be watching closely, given that they will be formalising their SFDR implementation with the prospect of changing regulatory expectations on the horizon.

As well as questions concerning the future direction of the SFDR framework, whether it moves towards a labelling regime for example, many concerns have been raised about the prospect of further wide-ranging changes. These are due to the compliance costs involved and a desire to avoid a series of ongoing changes over the next few years, given the SFDR review is coming so soon after the ESAs’ consultation.

With so many concurrent developments, SFDR is still very much a moving target, and there remains uncertainty in many important areas. What is certain, however, is that firms are likely to have many more questions in the coming months, as they continue to grapple with their SFDR implementation projects and the challenges of implementing sustainable finance regulations more broadly.