The Luxembourg Reserved Alternative Investment Fund - A change-maker for AIFs

By Johan Terblanche, Partner, Marc Seimetz, Partner, Patrick Goebel, Partner, and Jean-Louis Frognet, Dechert LLP

Published: 14 October 2016

Introduction – Background

The entry into force of AIFMD1 resulted in a double layer of regulation, as there was regulation and supervision at the level of the product (regulated investment funds) and supervision at the level of the manager (AIFM)2.

There are currently three types of investment funds in the alternative asset management industry in Luxembourg which are subject to the supervision of the Luxembourg supervisory authority, the Commission de Surveillance du Secteur Financier (CSSF):

- Undertakings for collective investment3 (“Part II UCIs”) under part II of the law of 17 December 2010 on undertakings for collective investment, as amended (the "UCI Law"), which do not qualify as UCITS and whose units can be offered to any type of investor including retail investors ;

- Investment companies in risk capital4 (SICARs) under the law of 15 June 2004 on investment companies in risk capital, as amended (the SICAR Law) which are reserved to well-informed investors and whose investment policy is restricted to investments in securities representing risk capital; and

- Specialized investment funds5 (SIFs) under the law of 13 February 2007 on specialized investment funds, as amended (the SIF Law) which are reserved to well-informed investors and can invest in virtually any type of asset.

Largely inspired by the SIF Law and the SICAR Law, the reserved alternative investment fund (RAIF) was enacted by the law of 23 July 2016 on RAIFs (the RAIF Law) which became effective on 1 August 2016 offering greater flexibility on the product side by avoiding the double layer of regulation as the RAIF will not be authorized by the CSSF.

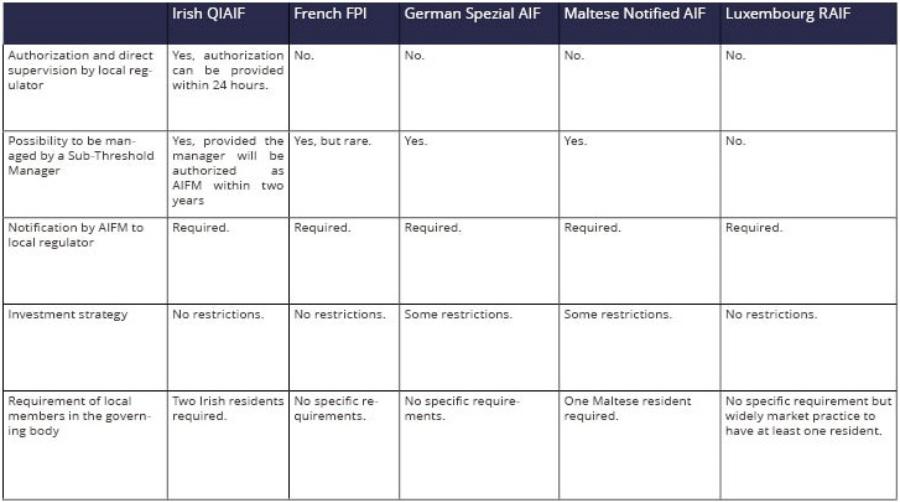

A comparison with a selection of other European regimes can be seen at the end of this article. The RAIF is available in a variety of legal forms.

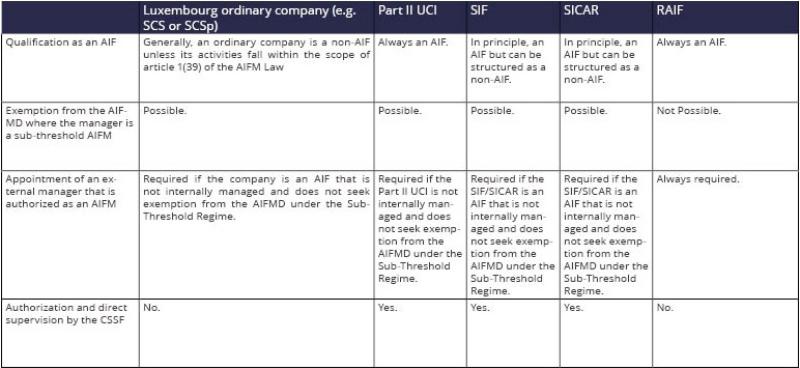

Qualification as an AIF – Appointment of an external authorized AIFM

The RAIF is an undertaking for collective investment and must be an alternative investment fund (AIF)6. Unlike the SIF or the SICAR, the RAIF cannot be structured as a non-AIF7.

The RAIF must always be managed by an external manager that is an authorized AIFM and cannot be managed by a manager that seeks exemption from the AIFMD under the sub-threshold regime of article 3(2) of the AIFMD8 (the Sub-Threshold Regime).

Although the RAIF will not be authorized by the CSSF, the AIFM must ensure that the RAIF complies with the terms of the AIFMD. The RAIF is therefore indirectly regulated, as it is managed by an external AIFM that in turn must be authorized and ensure compliance by the RAIF with AIFMD requirements.

Comparison of the RAIF’s main features to other Luxembourg fund vehicles

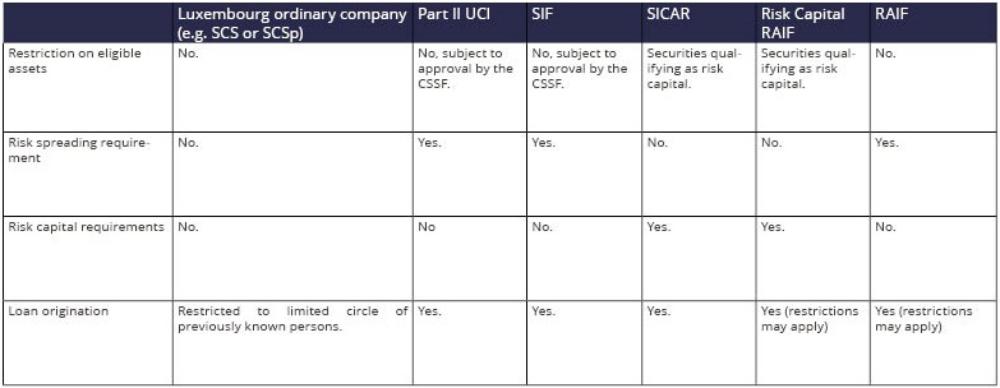

Investment strategies – Dual regime

Under the general regime inspired from the SIF Law, the RAIF can, in principle, invest in any type of assets and follow any type of investment strategy. However, the portfolio of the RAIF must be managed in compliance with the principle of risk spreading. The RAIF Law simply refers to the requirement of risk spreading (as is the case with the SIF Law), but does not provide further guidance. A RAIF that exclusively invests in securities representing risk capital (the Risk Capital RAIF) is not subject to any risk spreading requirements. The concept of risk capital in the RAIF Law is taken from the SICAR Law and provides that investment in risk capital means the direct or indirect contribution of assets to entities in expectation of their launch, development or listing on a stock exchange. The Risk Capital RAIF must limit in its constitutional documents its investments exclusively in securities representing risk capital.

The governing body of the RAIF and the AIFM have the responsibility to assess the level of risk spreading deemed appropriate for the RAIF’s portfolio. The AIFM and the RAIF's governing body (where applicable) may look for guidance to a certain extent to CSSF circular 07/309 on the concept of risk spreading for SIFs and, with respect to Risk Capital RAIFs, to CSSF circular 06/241 on the concept of risk capital for SICARs for guidance on the concept of risk capital.

The constitutional documents of the RAIF must determine whether the RAIF is subject to the general regime or whether the RAIF qualifies as a Risk Capital RAIF. The selected regime applies to the RAIF as a whole and cannot be selected on a compartment basis. It is debatable whether a RAIF may have lending activities as its main objective without falling within the scope of article 28-410 of the law of 5 April 1993 on the financial sector, the (the Financial Sector Law). Unlike Part II UCIs, SICARs or SIFs, RAIFs have not been expressly excluded from the scope of the Financial Sector Act11. However, it must be underlined that there was no intention of the Luxembourg legislator to make a difference between Part II UCIs, SICARs or SIFs on the one hand and the RAIF on the other hand.

Comparison of the RAIF’s investment strategies to other Luxembourg fund vehicles

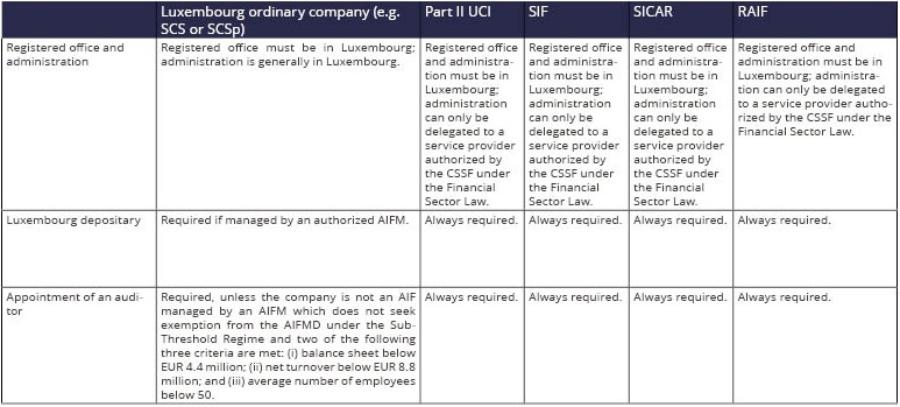

Management – Depositary – Administration – Reporting

Any authorized AIFM established in Luxembourg or another EEA Member State can manage any type of RAIF. A non-EEA AIFM will be permitted to manage a RAIF, if, in the future, non-EEA AIFMs are authorized under the passport regime to manage and/or market AIFs in the EEA. A Luxembourg depositary must be appointed for cash monitoring, safe-keeping of assets and oversight duties as required under AIFMD. The depositary can either be a Luxembourg credit institution or the Luxembourg branch of a credit institution established in another EEA Member State. If the RAIF invests mainly in non-financial instruments, is not leveraged and does not grant any redemption rights to its investors during a period of five years after the first investment has been made, the depositary can also be a depositary of assets other than financial instruments in accordance with article 26-1 of the Financial Sector Law.

The administration of the RAIF must be conducted in Luxembourg. As an undertaking for collective investment, the administration and register-keeping of a RAIF can only be entrusted to an administrative agent and registrar authorized by the CSSF under the Financial Sector Law. The RAIF must produce an annual report, which must be made available to investors within six months of the end of the accounting year. The annual report must be reviewed by a Luxembourg statutory auditor (réviseur d'entreprises agréé). Separate annual reports may be drawn up on a compartment basis, provided consolidated information on all compartments is also contained in these annual reports. As any AIF managed by an authorized AIFM, the RAIF must comply with transparency requirements under the AIFMD and be subject to reporting to the AIFM's home regulator on the basis of the template of Annex IV of Commission Delegated Regulation12.

Comparison of RAIF’s management and administration to other Luxembourg fund vehicles

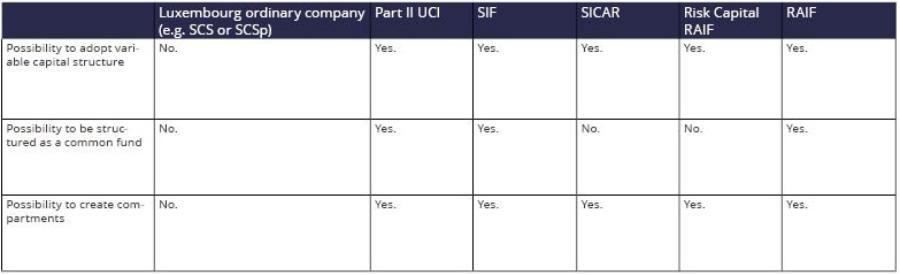

Legal form – Creation of the RAIF

A RAIF can be structured as an umbrella fund with one or more compartments, where the assets and liabilities of each compartment can be segregated from the assets and liabilities of other compartments. The RAIF Law also permits cross-investment between compartments.

A RAIF subject to the general regime can be structured as a common fund (FCP)13 which is a contractual co-ownership scheme without legal personality. A RAIF in the form of an FCP must always be managed by a Luxembourg management company. This management company can be a Luxembourg AIFM14. If the Luxembourg management company is not authorized as a Luxembourg AIFM15, it must appoint an AIFM either in Luxembourg or in another EEA Member State.

A RAIF can also be structured as an investment company with variable capital (SICAV)16 whose capital is automatically adjusted to its net asset value. In this case, the RAIF can be an opaque joint-stock company under the form of a public limited liability company (SA)17, a corporate partnership limited by shares (SCA)18, a private limited liability company (Sàrl)19 or a cooperative company formed as a public limited liability company (SCoSA)20. The RAIF can be a transparent limited partnership under the form of a common limited partnership (SCS)21 or special limited partnership (SCSp)22.

Finally, the RAIF can adopt any legal form available under Luxembourg law when it is neither formed as an FCP, nor as a SICAV. The RAIF can also be structured as a joint-stock company with fixed capital where shares are issued at a nominal value or as a mere SCS or SCSp.

The RAIF (or any of its compartments) can be structured as an open-ended fund where units can be redeemed upon request of the investor or as a closed-ended fund where no redemption right is granted to the investors.

The creation of a RAIF must be acknowledged by notarial deed within five business days following its creation. Within 15 days thereafter, a confirmation (which must name the AIFM of the RAIF) must be deposited with the Luxembourg electronic gazette (Recueil Electronique des Sociétés et Associations - RESA).

RAIFs must be registered on a publicly available list maintained by the Luxembourg trade and companies' register.

Eligible Investors – Marketing of the RAIF

RAIFs are reserved to well-informed investors which are any of the following type of investors:

- Professional Investor23;

- Institutional Investors as defined by the administrative practice of the CSSF; and

- Any other investor who is neither a Professional Investor, nor an institutional investor, and who, subject to the following, invests or commits to invest at least EUR 125,000 (or equivalent in another currency) in the RAIF and confirms in writing that it will maintain the status of a well-informed investor. Where such an investor wishes to invest less than EUR 125,000 (or equivalent in another currency), such investor’s experience and knowledge adequately to appraise the investment in the RAIF must be certified pursuant to an assessment by: a credit institution (within the meaning of Regulation (EU) No 575/2013); an investment firm (within the meaning of Directive 2004/39/EC); a management company (within the meaning of Directive 2009/65/EC); or an authorized AIFM.

A RAIF can be marketed to Professional Investors throughout the EEA under the passport regime, in accordance with the notification process established under the AIFMD. Marketing to well-informed investors who do not qualify as Professional Investors must comply with national rules and can only benefit from the passport if national rules permitted an extension of the use of passport under article 46 of the AIFMD.

A RAIF must have an offering document that contains all information necessary for investors to assess their participation in the RAIF. To avoid confusion with a Part II UCI, a SIF or a SICAR (whose offering documents are approved by the CSSF), the cover page of the RAIF’s offering document must clearly indicate that the RAIF is not subject to the supervision of the CSSF. Important information in the offering document must be kept up-to-date before new investors are admitted to the RAIF. Separate offering documents may be established on a compartment basis, provided that the issuing document of a relevant compartment discloses that there are other compartments.

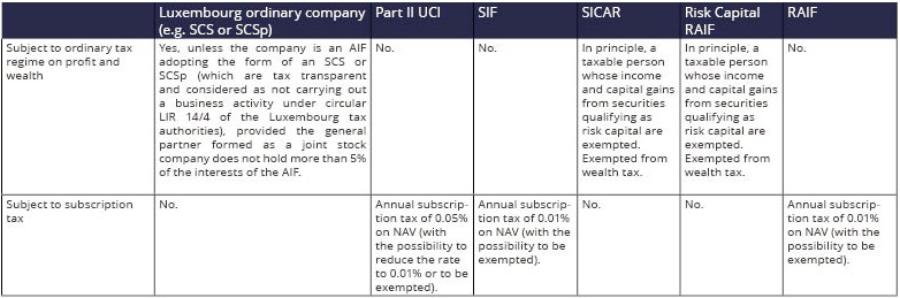

Dual tax regimes

The RAIF other than a Risk Capital RAIF is subject to an annual subscription tax (taxe d’abonnement) of 0.01%. The RAIF is exempt from the subscription tax on, among other items, investments in other Luxembourg undertakings for collective investment subject to the subscription tax. A RAIF whose investment objective is to invest in money market instruments and bank deposits or microfinance, or whose units or interests are held by institutions for occupational retirement or by similar institutions, is also exempt from the subscription tax.

If the Risk Capital RAIF only derives income and capital gains from transferable securities representing risk capital, the Risk Capital RAIF is in practice not liable to any taxes in Luxembourg, except for the minimum tax of EUR 3,000 (EUR 3,210 when the solidarity surcharge is included).

Tax regime comparison of the RAIF to other Luxembourg fund vehicles

Conversion of an Existing Entity into a RAIF

A SIF or SICAR can be converted into a RAIF in accordance with applicable laws and the provisions of its constitutional documents. The conversion is subject to the prior approval of the CSSF with respect to the amendments of the entity’s constitutional documents. A free redemption period may have to be granted to investors who are opposed to the conversion of the SIF or the SICAR into a RAIF.

A non-regulated Luxembourg AIF as well as, in principle, non-Luxembourg AIFs can also be converted into a RAIF. In addition to applicable laws and the provisions governing the constitutional documents of the relevant AIF, the RAIF Law requires the conversion be approved by a majority of two-thirds of the votes cast. The RAIF Law does not require a minimum quorum for the conversion vote.

RAIF – Comparison with similar EU regimes

Footnotes

1 Directive 2011/61/EU on Alternative Investment Fund Managers.

2 An alternative investment fund manager, as defined under chapter 2 of the AIFMD.

3 Organisme de placement collectif (OPC).

4 Société d'investissement en capital à risque (SICAR).

5 Fonds d'investissement spécialisés (FIS).

6 AIFs are collective investment undertakings, including any sub-funds thereof, that: (a) raise capital from a number of investors, with a view to investment in accordance with a defined investment policy for the benefit of those investors; and (b) do not require authorization pursuant to article 5 of Directive 2009/65/EC on undertakings for collective investment funds in transferable securities.

7 SIFs or SICARs that do not raise any capital from investors do not fall within the scope of the definition of an AIF under article 1(39) of the AIFM Law. Examples of such SIFs or SICARs are entities whose access is limited to a predefined group of investors or which have only one investor within the meaning of the ESMA/2013/600, Final Report, and Guidelines on key concepts of the AIFMD.

8 The sub-threshold exemption applies to AIFMs managing assets below EUR 100 million or AIFMs managing assets below EUR 500 million provided no redemption rights are granted to investors during a minimum period of five years after the first investment was made and no leverage is undertaken. AIFMs qualifying for this exemption must only register with their home supervisory authority for the purpose of reporting.

9 Law of 12 July 2013 on AIFMs, as amended.

10 Professionals performing lending operations under article 28-4 of the Financial Sector Law are professionals engaging for their own account in the business of granting loans to the public.

11 Article 1-1 (2) of the Financial Sector Law determining those entities which do not fall within the scope of the Financial Sector Law (including its article 24-8) was not amended when the RAIF Law was adopted with a view to exclude the RAIF as it was previously made for Part II UCIs, SIFs and SICARs. This being said, article 1-1 (2) (r) excludes from the scope of the Financial Sector Law any persons carrying on any activity the taking up and pursuit of which are governed by special laws. The RAIF is governed by a special law, namely the RAIF Law.

12 Commission Delegated Regulation n°231/2012 of 19 December 2012 supplementing the AIFMD with regard to exemptions, general operating conditions, depositaries, leverage, transparency and supervision.

13 Fonds commun de placement (FCP).

14 Such a management company is authorized as an AIFM under article 125(2) of the UCI Law.

15 A management company that is not an AIFM is subject to article 125(1) of the UCI Law.

16 Société d’investissement à capital variable (SICAV).

17 Société anonyme (SA).

18 Société en commandite par actions (SCA).

19 Société à responsabilité limitée (Sàrl).

20 Société cooperative sous forme de société anonyme (SCoSA).

21 Société en commandite simple (SCS).

22 Société d'investissement spéciale (SCSp).

23 The term “Professional Investor” is defined under Directive 2015/65/EU on markets for financial instruments (as amended).