Overview

6th edition - Updated as of March 2025

AIMA and CAIA are thrilled to release this updated risk rating system as a guideline for better alignment of internal risk ratings at investment dealer firms with the historical risk-adjusted returns of funds within indices.

This sixth edition features the addition of other alternative asset classes, including strategies across private equity and real assets, and the use of data from PivotalPath.

In past editions, risk category recommendations for hedge fund and private credit strategies have remained largely consistent, with the exception of convertible arbitrage moving down one risk category and distressed hedge funds moving up one risk category in this current edition.

The AIMA and CAIA risk rating guideline remains an important reference as investment dealers in Canada often automatically rate non-prospectus public and private alternative funds as high risk, regardless of the risk/return metrics of a particular strategy or fund. Having a high risk rating limits the number of retail investors who can allocate to these products, and how much they can allocate.

To facilitate Canadian retail investors’ fair access to strategies that can provide diversification, non-correlated returns and risk reduction through a variety of market conditions, the Associations advocate that internal dealer risk ratings systems should better align with historical risk-adjusted data from funds within indices, per this guideline.

-

Claire Van Wyk-Allan

Managing Director, Head of Canada and Investor Engagement

-

Steven Novakovic

Managing Director, CAIA Association

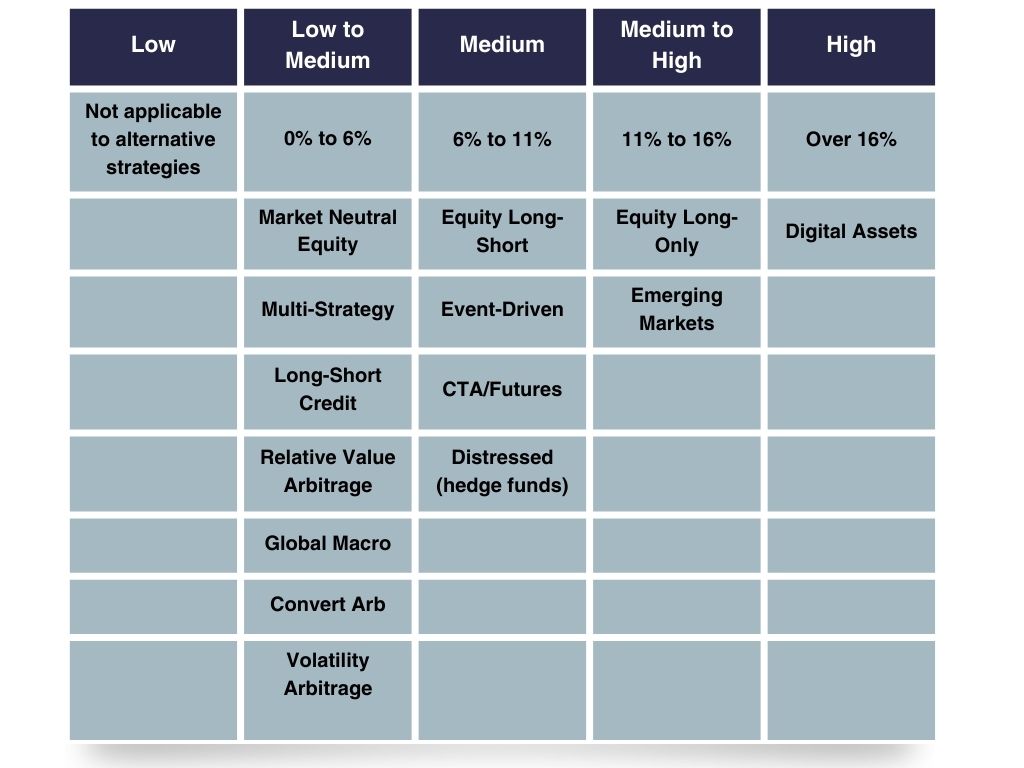

Table 1

Table 1: Proposed risk rating for hedge funds and alternative mutual funds based on the median trailing standard deviation of funds within PivotalPath indices

Source: CAIA Association, AIMA, PivotalPath. Data as of 12/31/2024.

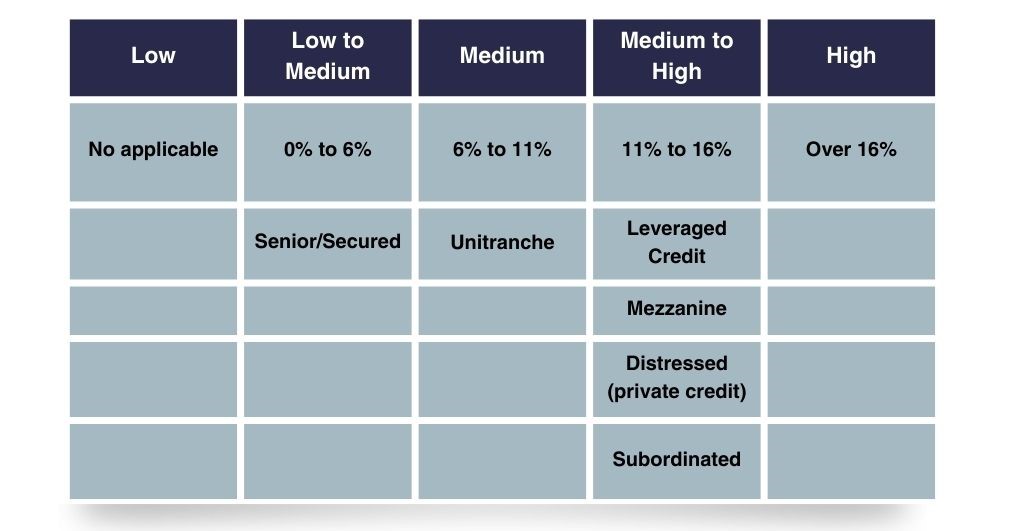

Table 2

Table 2: Proposed risk rating for private credit funds based on S&P & Cliffwater indices

Source: CAIA Association, AIMA/ACC, 2024.

Table 3

Table 3: Proposed risk rating for private equity funds

Source: CAIA Association, 2024.

Table 4

Table 4: Proposed Risk rating for real estate funds

Source: CAIA Association, 2024.