Why cash management should be central to alternatives funds’ plans

By Ryan Fitzgerald, Citco Fund Services (USA) Inc.

Published: 18 March 2024

Interest rates will once again be a key factor in firms’ cash management strategies as we move through 2024.

With markets pricing in rate cuts in both the US and UK this year, alternatives funds could be missing out on a performance boost from cash positions if they are not making the most of multi-year high interest rates.

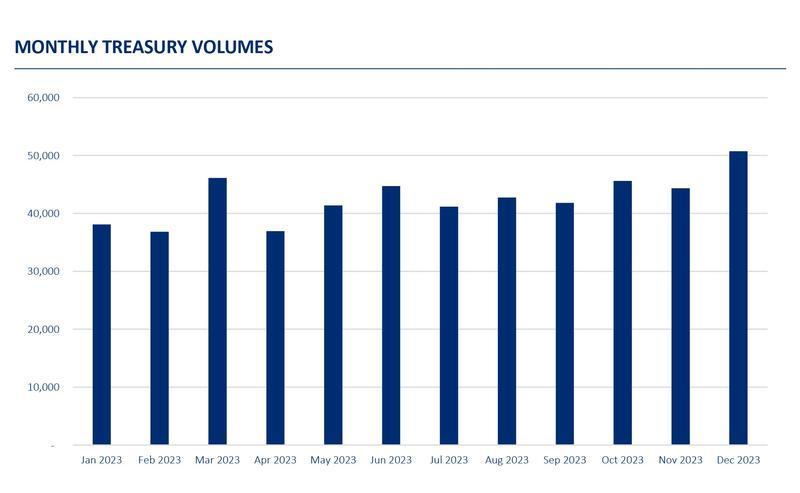

Cash management has become an increasingly important focus for managers in recent years, with Citco’s 2023 Middle Office Solutions Report showing the value of treasury transactions set a new record among its client-base last year, up 14% to US$1.55tn.

Whether running fledgling funds or multi-billion dollar strategies, interest rates have clear implications for all alternative investment managers, so a forward-thinking cash management approach is key.

To make the most of cash management, there are a number of operational considerations to take into account.

The changing face of global cash management

In 2009 when interest rates were cut sharply, managing multiple currencies was low on a manager’s list of priorities as differences in spreads were small. However, now interest rates across the globe are significantly higher, cash can have a material impact on a strategy’s performance.

This is especially true for some asset classes, such as infrastructure, where cash may be sitting in accounts for some time. Simply put, managers cannot afford to accept lower rates on cash than competitor funds given the drag it can have on performance.

Indeed, for large hedge, private equity and real assets managers, cash may well be in different tranches spread out across the US, Europe, Asia and the Middle East – and so having to manage this in-house, after over two decades of low interest, is far from straightforward and requires expertise that firms may have not previously had.

If a firm holds its cash in multiple bank accounts, in different currencies, they may be earning different returns, have different fixed terms, and new opportunities may be emerging in different jurisdictions.

So again, staying on top of this is a growing and unprecedented challenge for many in-house teams, especially as end investors are demanding greater transparency and more information about all aspects of funds they own.

A tale as old as time

The principles around cash management have fundamentally remained the same as time has passed – firms need to manage their cash efficiently and effectively to keep the wheels of their business turning. However, due to low interest rates dominating for the last two decades many have turned their attention away from strategies to maximize the returns it can generate.

By having full oversight of cash positions – whereby managers have a platform where they can see all their cash in one place – it means they can make timely decisions to move excess cash. But the development of such a platform in-house can prove expensive and time-consuming.

This is where partnering with an external provider that can deliver a highly customisable, end-to-end treasury application that provides managers with the immediate ability to review cash across all its bank accounts, putting any idle cash to work in higher interest accounts, or to deploy to another strategy, will ensure that firms are not missing out on opportunities.

Rather than do this manually as some managers do when they handle this in-house, a cash management solution deployed by a specialist provider – that uses a systemic, cloud-based application which gathers the data and provides a clear view as to the state of affairs with all of a manager’s cash positions – will free up capacity and allow teams to concentrate on what they do best, generate growth.