As ESG investing grows, how can investors measure success?

By Anthony Decandido, RSM US LLP

Published: 31 January 2020

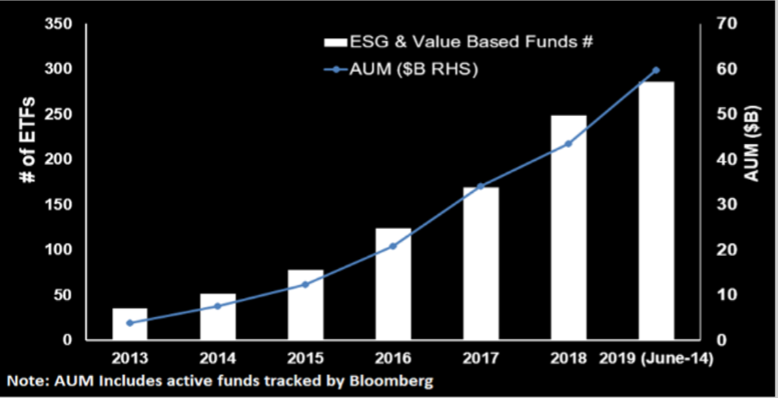

As trends in investing go, there is perhaps no sector gaining more interest than ESG (Environmental Social Governance). The trend is a reflection of broader concerns in society, whether it is climate change, how companies are run or who is affected by a company’s actions. And the money is following. According to Morningstar, inflows into ESG-related investments over the first three quarters of 2019 exceeded $4 billion in each quarter, far surpassing previous highs of $2 billion or less in previous quarters.

Yet, as more and more money flows into the sector, investment managers are facing increasing scrutiny over how they pursue returns while still adhering to the societal goals of ESG investments. For many managers, it has created a quandary- where do they draw the line between driving financial returns and seeking socially beneficial outcomes?

It’s a question that has no clear answer and only highlights the need for an accreditation that would provide an important benchmark the industry so clearly needs.

Investment managers are no strangers to scrutiny. They have endured widespread regulatory changes during the Dodd-Frank era, which aimed to improve market stability and consumer protection. They have been the target of proposed sweeping policy reforms by presidential candidates and they now are being asked to demonstrate strong ESG missions and values.

But at what cost should investment managers proceed?

There is often an inherent tension between the actual benefits of applying ESG strategies and the financial cost needed to execute such strategies. Would a manager be willing to forfeit a few points of financial returns for the sake of doing good for society?

Many proponents of ESG investing argue that this trade-off is a false choice. They may argue that an investor can continue to earn a healthy return while still benefiting society, pointing to wind power investments as just one example.

However, the challenge remains on how to measure this benefit to society? There has yet to be a consensus on how this could or should be done.

This leads to other questions, including what exactly ESG represents? Is it the same as responsible investing, impact investing or sustainability? Even top industry professionals are split in their responses.

What is clear is that investors are pouring money into the sector. Many managers can point to successes and demonstrate the positive impact their investments are having – and that only attracts more investment. But industry professionals all have a different sense of ESG’s stated objectives and outcomes. While some are interested in honest change, others may use it more as a marketing technique to raise their public profile.

In the end, the lack of consensus leaves a need in the market for an ESG accreditation to determine, beyond hesitation, that a manager’s intentions and behaviors fit a more sustainable outcome. Morningstar has made a significant effort toward this goal. Unfortunately, with good data still scarce and definitions still grey, it may be some time before managers earn a vote of confidence from investors, and more time before managers devote substantial resources to ESG.