ESG Integration on the Rise: And how to implement it in your portfolio

By George Sullivan, Executive Vice President, Global Head of Alternative Investment Solutions, State Street

Published: 23 April 2018

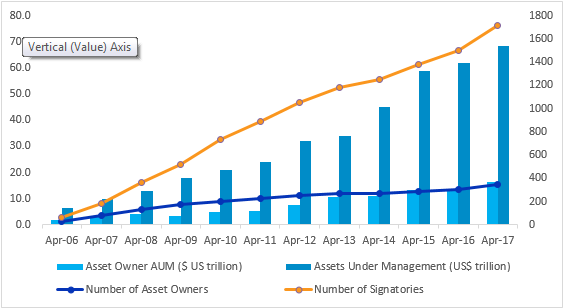

Over the past 12 years the United Nations’ Principles for Responsible Investment (UNPRI) – a set of six responsible investing concepts and a network of investors who have committed to implementing them – has reached 1,700 signatories representing $68 trillion in assets under management[i]. This growth suggests that investors are embracing sustainable investment practices and are increasingly considering environmental, social, and governance (ESG) factors in their investment strategies.

Figure 1. [ii]

However, the true degree of ESG implementation does not match those figures. According to US SIF, a forum for sustainable and responsible investment, only about one-third of the signatories’ assets – $21 trillion – are actually invested in an ESG strategy.[i] Those who do invest in ESG primarily employ negative screening, which excludes certain types of investments (e.g. alcohol, tobacco, and firearms stocks) and is also the simplest approach. ESG integration, on the other hand, is the most sophisticated ESG strategy, in which investors consider material nonfinancial risk factors throughout the investment process. Our survey of 582 institutional investors worldwide shows that 47% of institutional investors use exclusionary strategies, while only 21% practice full integration of ESG risk factors.

Moving in the right direction

In our 2017 study The Investing Enlightenment: How Principal and Pragmatism Can Create Sustainable Value through ESG, we sought to determine how to close the gap between investors’ aspirations and actions in ESG integration by examining the best practices of ESG investors worldwide.

In our study, we identified three major shifts that have set the stage for ESG integration to become mainstream, and therefore showing promise to improve risk-adjusted returns and society as a whole.

The first of these shifts is in policy. Regulatory changes have reduced the limitations of public pension funds to incorporate ESG issues into their investment process, opening the door for increased ESG investment opportunities.[ii] Two examples are the Department of Labor ruling on ERISA in the US, and the EU Non-Financial Reporting Directive; the latter of which requires 6,000 companies to report ESG information annually, making more data available to potential investors.[iii]

The second shift is in academia. A growing number of empirical studies show a positive relationship between ESG factors and corporate financial performance, which supports the premise that managing ESG risk factors improves financial returns for companies.[iv]

The third shift is the formation of industry groups such as the Sustainability Accounting Standards Board (SASB). Founded in 2011, SASB has led efforts to develop standards for companies to measure and report material non-financial sustainability information. Other organizations such as Ceres, Global Sustainable Investment Alliance, and The Investment Integration Project (TIIP) are advocating sustainability and systems-level thinking in asset management.

Removing outdated barriers

Additionally, we discovered that some of the traditional perceived barriers to ESG implementation are now receding. First is the perception that ESG strategies will negatively impact performance. In fact, almost half of institutional investors in our survey (48%) don’t believe ESG means missing out on returns, and only a third (35%) believe ESG means sacrificing returns.

Second is the perception that fiduciary duty prevents ESG integration. Actually, only 10% of our respondents see fiduciary duty as a barrier and furthermore, 40% of asset owners and 51% of asset managers worldwide see fiduciary duty shifting in the direction of supporting ESG integration. These numbers reflect a broader change in perception of ESG investing, from activism or negative screening to accounting for a complex set of non-financial risks.

Third is the perception that investors’ performance expectations are too short-term for ESG investing. We found that only 8% of institutional investors believe ESG strategies would outperform in less than a year, but 75% expect outperformance after three years. This suggests that investors are willing to soften their focus on annual or short-term returns when it comes to ESG strategies.

Building the case for ESG integration

Based on our study, we expect that ESG implementation is here to stay for three reasons. First, 48% of institutional investors believe ESG integration is associated with better investment practices, and two-thirds say it is associated with a longer-term investment mindset. Second, only 18% say that their interest in ESG integration is driven by regulatory requirements, so it is largely not compulsory. Finally, only 10% of institutional investors say that peer pressure is a driver behind ESG integration, which suggests that it is not simply a fad.

So what’s holding investors back from ESG integration? Unsurprisingly it comes down to data. The most frequent barrier, reported by 60% institutional investors, is the lack of standards for measuring performance of ESG strategies. The second most common barrier is a lack of ESG performance data reported by companies, cited by 53%. About two-thirds (67%) of institutional investors say that greater transparency in ESG reporting from companies would be the most useful thing towards improving ESG integration.

Five actions on the path to success

To help keep the dialogue going we developed a framework for ESG integration that is based on five actions.

First, take ownership – meaning to obtain decisive support from the C-suite and board on implementing ESG strategies. Second, conduct education and training on ESG across the investment organization. ESG integration cannot be done effectively when there’s a dividing line between the sector analysts and a (usually small) group of ESG analysts who handle proxy voting and attempt to influence the decisions of the sector specialists. The most common practice for reducing barriers to ESG integration is providing training on ESG to sector portfolio managers and analysts. This makes ESG factors a part of the investment organization’s DNA, so to speak.

Third, ask for the necessary data. This primarily occurs through engagement with portfolio companies. Corporations often complain that investors neither give them credit for sustainability efforts nor ask about their ESG performance; but instead focus on short-term financial performance. In turn, investors complain that companies don’t report useful ESG data and never talk about it on investor calls. Indeed, 92% of our respondents said that they want companies to explicitly identify what they regard as material ESG factors affecting financial performance. The only way to accomplish that is through engagement. Less directly, supporting industry efforts for increased standardization of ESG data and reporting requirements goes a long way toward better access to data.

Fourth, incorporate a materiality filter. Effective ESG integration does not require all the data at all times, but rather the necessary, materially important data. Information can be considered material if “there is a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investors as having significantly altered the ‘total mix’ of information made available.”[v] More simply, material information is anything that impacts your investment decisions. We found that two-thirds of institutional investors now believe it’s possible to build models that show the relationship between material ESG factors and financial performance.

The fifth and final step is aligning time horizons. This means adjusting performance metrics and incentives structure to reflect the long-term nature of ESG investing. While our survey results suggest that ESG investors are comfortable with a longer time horizon, most investment organizations are still evaluating and compensating managers on short-term performance regardless of their stated investment horizon.

We believe that this framework will allow investors to effectively integrate ESG risk factors into their investment decisions and achieve sustainable value creation.[vi]

Footnotes

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

State Street Corporation, One Lincoln Street, Boston, MA 02110-2900, Adtrax #: 2038048.1.1.NA.RTL, Exp 2/28/2019

[i] PRI Homepage – Principles for Responsible Investment. (2017, April). Retrieved February 1, 2018.

[ii] ibid

[iii] US SIF: The Forum of Sustainable Investment and the US SIF Foundation, “Report on US Sustainable, Responsible, and Impact Investing Trends 2016”. (2016) US SIF refers to ESG investing as “sustainable and impact investing.”

[iiv] “An important purpose of this Interpretive Bulleting is to clarify that plan fiduciaries should appropriately consider fa ctors that potentially influence risk and return. Environmental, social, and governance issues may have a direct relationship to the economic value of the plan’s investment. In these instances, such issues are not merely collateral considerations or tie-breakers, but rather are proper components of the fiduciary’s primary analysis of the economic merits of competing investment choices.” Department of Labor Employee Benefits Security Administration, 29 CFR Part 2509. October (2015).

[v] The Climate Disclosure Standards Board, “EU Non-Financial Reporting directive – how companies make the most out of it,” Climate Disclosure Standards Board News, CBDB.net (2016). Accessed March 2017.

[vi] Subramanian et al, “Equity Strategy Focus Point ESG: good companies can make good stocks,” Bank of America Merrill Lynch (2016).

[vii] Sustainability Accounting Standards Board: Why is it important? About Materiality. (n.d.). Retrieved February 1, 2018.