Stronger, smarter, faster: Investor relations moving forward

By Andre Boreas, VP - Marketing, DiligenceVault

Published: 28 June 2021

“We have a 22% annualised three-year return and 2.1 Sharpe Ratio. I don’t understand why we can’t win mandates from larger institutional investors.”

This is not an uncommon statement from many hedge fund managers. As recently as a few years ago, a compelling risk/return profile was enough to capture an institutional mandate, but those days are long gone as the investor community have raised the bar significantly in terms of what the criteria is to make an allocation. Asset growth in the industry over the past five years has been steady, but certainly not as explosive as it was from 2010-2015. You can thank the equity bull market and surging interest in private capital for that.

What’s it going to take, then, to become the next name-brand hedge fund? And, more importantly, do you even want to? Because servicing $3 billion of institutional assets is quickly becoming very different from even just three years ago. Investor engagement,both in fundraising and servicing,will be as much of a driver of a firm’s success as its risk/return profile. Investor relations will need to be a key advocate for that, and therefore a driver of change and adoption to a new world, as limited partners (LPs) become more sophisticated. Investor relations (IR) will need to adapt to a new operating model as many of the larger managers have already done. It’s worth noting that raising assets is, of course, only part of the story — keeping those investors and having them allocate additional capital is also a huge undertaking, particularly in having to address the reporting and information needs of investors. You can always hire more IR people, but that becomes quite expensive, and with the fee pressure managers are facing, hiring more people isn’t going to help margins. Technology, though, can be an extremely useful tool for fund managers to scale their business, including the investor relations function. While most attention for new technology normally goes to the investment team and back office, there are evolving solutions to help IR meet the information needs of institutional investors.

The phenomenon where the bulk of allocator capital going to the largest managers is not a new trend. This has been going on for years and almost becomes a self-fulfilling prophecy as the larger get larger, with the vast majority of managers fighting over what’s left. The good news for the hedge fund industry is that early 2021 has seen a renewed interest from investors as managers have been able to take advantage of market dislocations from 2020 along with concerns from sky-high valuations in both the public and private equity markets. For many managers not in the multi-billion dollar club, though, the question becomes — do you even want to try to attract institutional assets? Some managers might not want to, given the effort, time, and investment it takes to compete effectively in the institutional space. For those that do, the question is 1) what’s it going to take to get there, and 2) how do you communicate to the market that you are ‘institutional ready’ once you’ve made the necessary investments in the firm? Third-party marketers and prime brokers can certainly help in capital raising (marketing material, introductions,) but after you’ve posted the top quartile risk-adjusted returns to get you a meeting, do you have the right people, processes and systems in place for an investment consultant, sovereign wealth fund or public pension plan to feel comfortable in making an allocation?

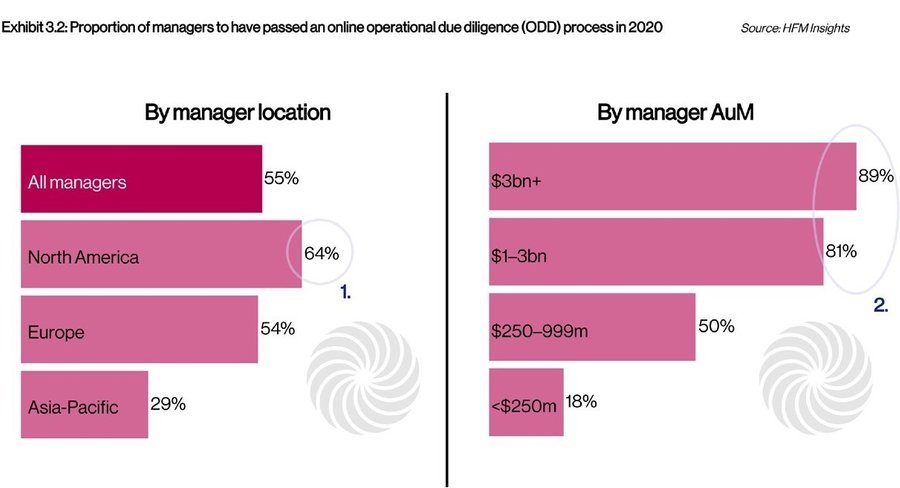

It should also be noted that larger managers that already have institutional capital and have passed an operational due diligence (DD) cannot rest on their heels. The bar for what constitutes best practices across a manager’s operations is always being raised. Disruptions last year from the pandemic proved to be an important litmus test for the industry. Allocators took notice as operational DD processes went virtual. The challenge for smaller and mid-sized managers is the larger set of operational unknowns that are perceived by investors (rightly or wrongly) and the drag that had last year on raising capital.

Ultimately, the criteria for winning mandates is always changing. Managers would do well to think about how they want to be perceived in the market, how they build investor affinity, and their points of differentiation versus peers and competitors. Are you known for your risk management? Environmental, social and governance (ESG) capabilities? Diverse team? Are you transparent and communication friendly? Do you have a niche investment strategy that can act as a diversifier to an investor’s existing alternative investment programme? How the IR team is positioned to effectively engage in the investment community with the right message, knowledge and tools behind them can make-or-break the capital raising path forward.

At the same time, hedge fund managers will need to look to offer new vehicles and products that will have the ability to address specific gaps in investor goals (ESG, liquidity, risk/return, diversification, yield, etc). As investors look for more specialised outcomes from certain mandates, managers will need to respond to request for proposals (RFPs) and DD questionnaires (DDQs) that are outside of what they typically are prepared for. Two specific examples of this that have been gaining significant traction in the hedge fund industry include private capital and ESG-specific offerings. For managers that are diversifying their product offerings, private equity or private debt funds are a compelling way to diversify the asset base while capturing potentially higher fee revenue streams. ESG, for its part, can no longer be ignored as a criteria from institutions, particularly European investors. There is no getting around the fact that what initially took root in the long-only and private markets is finding its way to the hedge fund industry. LPs are expanding their definition of fiduciary beyond risk/return to societal/impact. Managers will need to respond.

In either case, investors are sure to change how they perform due diligence (both investment-wise and operationally) to take into account any specialised mandates that extend from a managers’ core offering. Managers will need to be prepared to address the diligence requirements of investors should these (or other) types of strategies be offered.

Investor experience

The model for how IR teams of all sizes interact, communicate and service their investors is quickly moving beyond the monthly one-pager and quarterly phone call. One thing IR teams can rely on, is the fact that any increase in volatility or a downturn in the markets will inevitably lead to an increase in information requests from investors. COVID-19 is, of course, the most recent example of this. How hedge fund managers respond during periods of stress can be a watershed moment in their relationship with their investors. Proactive versus reactive investor communications is of paramount importance in maintaining goodwill with investors.

Performance will always be the driving factor for investors to redeem (outside of running afoul of regulators, of course). However, how the firm’s operations evolve over time will always be a continual point of evaluation to institutional investors. The evolution of ODD means fund managers, regardless of performance, will always be under scrutiny. How a manager responds to such scrutiny and how changes in the operational performance of the firm, both positive and negative, evolve can carry significant consequences in the manager-investor relationship.

The fund managers who win the communication game will have a leg up on competitors. The IR team’s ‘tech stack’ will be a key contributor to said wins. In fact, technology can be a great equaliser when competing against larger firms when utilised correctly.

Technology

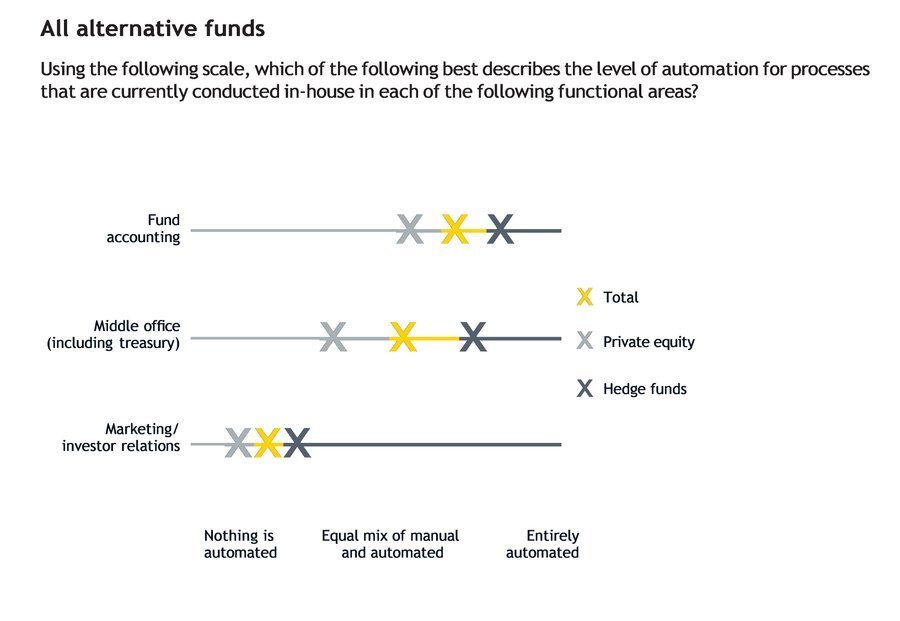

The data management, reporting and communication technology needs of the IR team are often an afterthought in relation to a manager’s firm-wide tech stack. While the software and systems used can be broad (email, video conferencing, spreadsheets, presentations, databases, workflow tools, onboarding platforms, diligence platforms, shared drives or intranets), it is often the challenges around information management and collaboration that creates the biggest obstacles in communicating to both prospective and current investors. Developing a ‘single source of truth’ between your marketing materials, third-party databases, DDQs and RFPs and regulatory filings can go a long way to offering your prospects and investors a modern, timely and goodwill-friendly experience.

The hedge fund/investor communication dynamic is changing constantly. LPs are upping their own tech game, particularly around how they consume data and information from their managers, service providers and other data sources. The PDF as the primary tool to pass both quantitative and qualitative information from manager to investor is quickly becoming outdated. The next generation of brand-name hedge funds will emphasise a hyper-focus on delivering solutions, interactions and experiences to the institutional investor community, and will look to scale their firms by leveraging the right technology in doing so.