Executive Summary

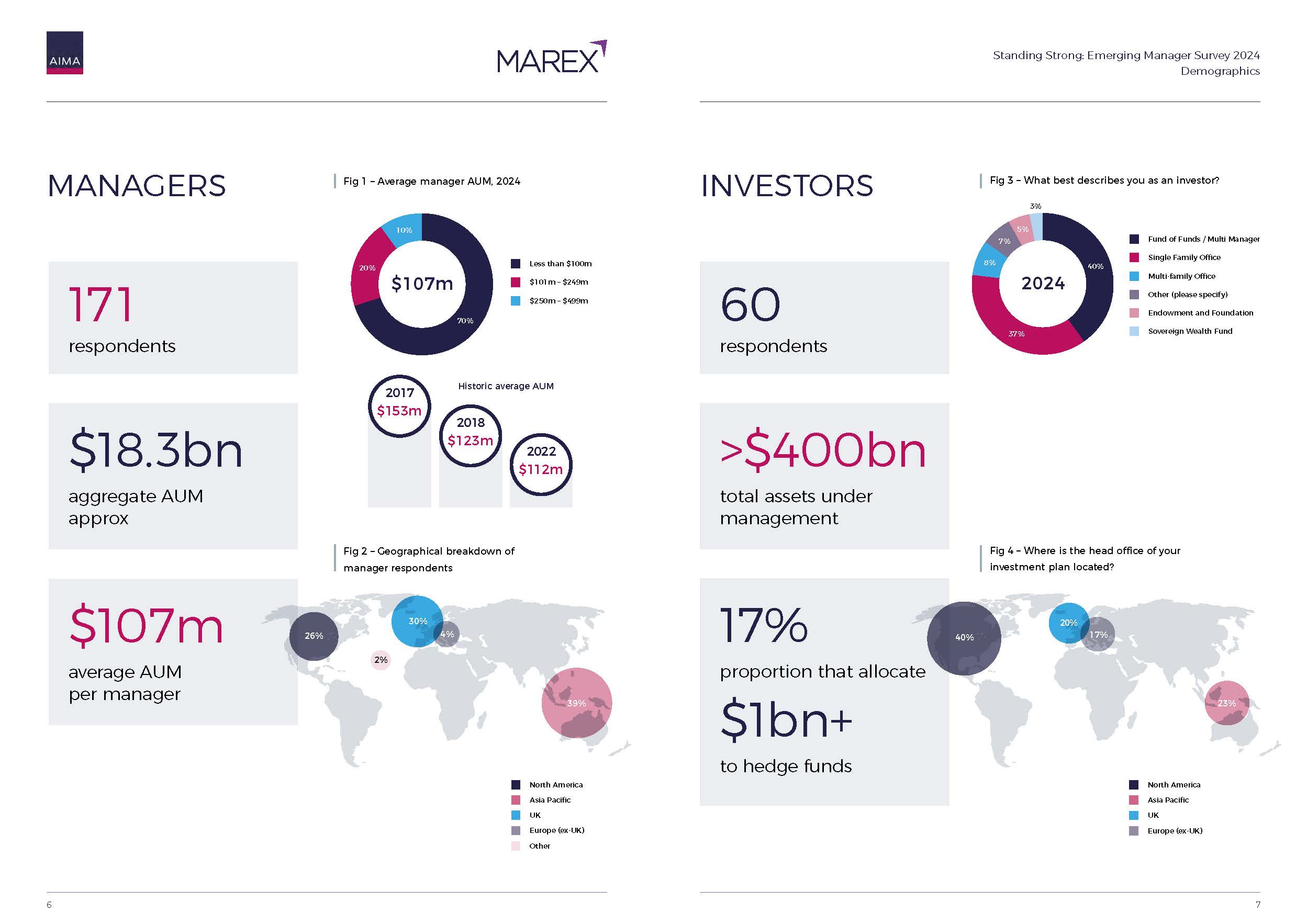

In the first half of this year, AIMA, in collaboration with Marex Prime Services, conducted a brief survey of next-generation hedge fund managers and their investors. Previously, we categorised this group as firms managing up to $500 million in assets under management (AUM). Recognising that some industry commentators consider this group to be larger, we also surveyed firms managing up to $1 billion and included that data for relevant comparison.

This report focuses on several key areas: fund fees, average headcount, operational costs (including estimated breakeven costs), and the average time to secure a new investment. The report is divided into two main sections: Part one will highlight the key findings that we extrapolated as it relates to all the flagship funds of the fund managers who responded to this survey, while part two discusses the key findings of their firms. Where relevant, we offer a time series analysis of how the responses have changed.

-

Tom Kehoe

Managing Director, Global Head of Research and Communications

-

Lawrence Obertelli

Head of EMEA Prime Service Sales, Marex

Demographics

The Long-Short

The Long-Short is a podcast by the Alternative Investment Management Association, focusing on the very latest insights on the alternative investment industry.

Each episode will examine topical areas of interest from across the alternative investment universe with news, views and analysis delivered by AIMA’s global team, as well as a host of industry experts.

In this episode of The Long-Short, we dive into the often-overlooked world of smaller and emerging hedge funds. While 75% of global hedge funds manage less than $500m in assets, these entrepreneurial managers are rarely highlighted in mainstream media, which tends to focus on multi-billion-dollar firms.

For nearly a decade, AIMA has tracked the growth and challenges of this sector, and our latest report, Standing Strong: The 2024 Emerging Manager Survey, offers fresh insights into everything from the costs of running a hedge fund to the milestones firms must hit on their way to becoming billion-dollar managers. Joining us to discuss these key findings is Lawrence Obertelli, Head of EMEA Prime Services Sales at Marex Prime Solutions, and a long-time contributor to AIMA’s research on start-up hedge funds.

Listen to this episode and subscribe on Spotify

Listen to this episode and subscribe on Apple Podcasts

Listen to this episode and subscribe on Amazon Music

Watch the video on YouTube

Disclaimer

This podcast is the sole property of the Alternative Investment Management Association (AIMA). This audio production and content are intended as indicative guidance only and are not to be taken or treated as a substitute for specific advice, whether legal advice or otherwise. AIMA permits use or sharing of the content in media or as an educational resource, provided always that proper attribution is made. The rights in the content and production, including copyright and database rights, belong to AIMA.

Download the report

Members with a log-in should log-in here to be provided with a download link to the report

Standing Strong is available to members and non-members of AIMA.

Non-members can recieve the report by submitting their name and email below. The report will then be sent directly to you.

For more information about the report, please contact AIMA’s Global Head of Research and Communications, Tom Kehoe ([email protected])