The impact of volatile markets on PB margining: Understanding margin model changes and the impacts on your portfolio

By Vardaan Kohli, Cassini Systems

Published: 28 November 2022

In times of market uncertainty, risk functions at prime brokers (PBs) manage their client risk exposures more dynamically. Their role is to ensure enough margin is charged and collateral is held in a variety of ‘risk-off’ scenarios across the spectrum of hedge fund trading strategies.

How do prime brokers manage market volatility?

PB margin frameworks utilise parametrised rules and market stress shocks meant to provide stable margin for clients whilst also covering their lending risk in adverse scenarios. These models, at times, may be outdated for the adverse market conditions they were developed for, or may not account for extreme tail risk. As such, in times of turmoil, PBs will alter the parameters for client margin agreements or house stress policies to cover any potential gaps in margin charged.

The practice of benchmarking the frameworks used to margin a PB’s clients to the PB’s own internal stress models is commonplace across all major banks.

This means that dynamically changing margin parameters to ensure the margin charged stays within the stressed risk or backtesting metrics become more frequent in choppy markets.

These margin methodologies are often opaque to the end client when initially implemented as they are defined in complex model documentation. This, coupled with parameter and threshold changes that become more frequent during volatile markets, makes it challenging for hedge funds to have full transparency over their margin calculations on a daily basis.

How are hedge funds looking at this?

Prolonged and heightened market volatility has renewed the focus on margin costs across the hedge fund industry. At times when market factors lead to sudden deleveraging and reallocation of risk; Treasury and COO functions need to ensure margin jumps don’t generate additional drags on P&L.

A recent market study commissioned by Cassini, in partnership with Acuiti, on Margin Management for Hedge Funds, found some impactful themes supporting this:

- 50% of hedge funds surveyed had been forced to take negative steps, reducing fund performance when meeting margin calls in volatile markets. In parallel, 38% had to close out high-margin strategies.

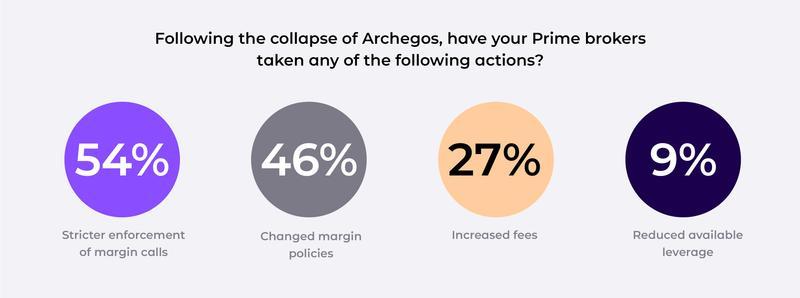

- In the aftermath of Archegos, 46% of funds saw their PB’s change margin policies and 54% have stricter enforcement of margin calls.

- In contrast, aspects such as pricing were found to be much stickier in volatile markets, with only 27% of funds reporting fee increases.

From the view of their margin relationships with PB’s; Hedge fund personnel are most focused on the following:

- How they can validate complex margin policies, assess the impact of new trades prior to receiving T+1 margin calls and ensure transparency on daily margin vs term lending limits.

- Having transparency for day-to-day reconciliation. Validating large moves in the margin or changes to parameters.

- Attributing margin costs against different strategies and to different portfolios for optimal operational performance. Examining exposure and margin at intermediate margin rules assesses which strategies are margin-reducing.

- The front office wants to reduce performance drag from margin inefficiencies and have a pre-trade view of the impact of give-ups, closeouts, executions, or clearing activity across Prime clearing counterparties.

There are 4 ways hedge funds can address margin strategies

1. Evaluating the impact of a rules-based vs stress-based margin policy.

Stress-based margin policies have comprehensive market scenario shocks, for bespoke strategies such as an equity fund with mergers or pairs arbitrage this type of policy won’t be the most efficient.

2. Assess how altering parameters can impact the portfolio whilst cognizant of parameter changes' trickle-down effect.

A PB may change policy thresholds in light of market volatility, which doesn’t lead to a significant change in day 1 margin, though over time can creep to have a much higher margin percentage charged.

3. Testing the impact of increased mandates or hypothetical portfolios across PB relationships.

Where funds anticipate a new trading mandate or higher allocation to a PM in a multi-manager strategy, they should run what-if scenarios across their PB relationships to estimate if the increase in margin is linear or it has an asymmetric impact to margin increase.

4. Overlaying impact of margin when negotiating the allocation of balances across PBs based on wallet share.

PBs offer lower financing rates when they can negotiate a higher share of balances from hedge funds. Though, a mismatch in exposure where hedge funds have directional portfolios at PBs can lead to overall higher margin rates and subsequently lower leverage. As much as lower financing rates will have a direct impact to the bottom line; the ability to have higher leverage will allow trading strategies to achieve higher efficiency. At times when without a certain amount of leverage, the strategy may be ineffective, it is imperative to overlay margin rates in wallet share negotiations.

Conclusion

As we have seen, there are several reasons why prime brokers alter and adapt their margin rules. It is imperative for them to keep their models current with market conditions to manage their counterparty risk.

Last year’s events from the fall of Archegos are a prime justification for prime brokers to ensure their margin policies are not outdated. This event shed light on the equities and synthetic PB business lines and was a driver in a re-evaluation of the client risk PBs are taking.

Similarly, the events we are seeing this year with the war in Ukraine and post COVID-driven market demand/supply imbalances are causing prolonged high inflation rates which in turn are leading to strong macro-economic policy responses. This has brought market shocks to all areas of investing such as interest rates, inflation, and corporate debt driven strategies.

There have been outsized losses and some contrarian winners as a result. Volatility levels across the asset classes remain elevated. This has enhanced the need for banks to have comprehensive stress-based policies that cover all asset classes and market scenarios.

Given the current volatility in the market, changes in margin models are going to be more common, rather than the alternative. PB internal stress testing policies are more robust and are reflected in client policies. After Archegos, there has been a big push to review PB policies more frequently and update risk parameters to reflect current market risks.

This is a prompt to hedge funds to be more proactive in their assessment of PB margin requirements rather than reactive to changes driven by the primes.

Hedge funds should have the tools and resources at hand that allow them to transparently view complex PB Policies.

They need to use these tools to discuss their margin requirements openly with their prime brokers so they don’t block an unnecessarily higher amount of liquidity and collateral, which would ordinarily be deployed towards revenue-generating avenues.