Dissecting ESG: ethics and profitability

By Rosie Guest, Apex Fund Services Holdings Ltd.

Published: 12 October 2018

There is a wide spectrum of ethically focused investment strategies around, various ways of referring to them and a lot of acronyms.

Divesting, ESG, Negative Screening, Shareholder Activism, Shareholder Engagement, Positive Investing, Impact Investing, SRI, Ethical Investing, Faith based Investing, Norms-based Investing, Values-based Investing, Thematic investing, Philanthropic investing… the list goes on.

Environmental, Social and Governance (ESG) are the three core factors for measuring the sustainability, responsibility and ethical impact of an investment. To understand the importance of the ESG strategy, where it sits on the spectrum and the reasons for its rise to the top of the strategy popularity contest, we must first differentiate it from other similar types of ‘ethical’ investment strategy.

The overarching category under which each of these sits is Sustainable Investing (SI).

SI is Not a New Phenomenon

Faith based investing (aligning investments with faith-based values) has been around since the 1800's. At that time religious communities such as the Methodists, quickly followed by the Quakers, implemented socially responsible investing guidelines for their congregations. The Vietnam War signalled another boost for ethical investment vehicles in the 1970’s, when investors started to question how their money was being used.

Fast-forward to today and the world we now live in sees the merging of finance and ethics becoming a mainstream expectation, a requirement even. The societal milieu has ultimately led to an explosion of ethics based and morally driven investment strategies in the financial services segment and in turn to the growth of the ESG investment space.

Where does ESG fit in?

ESG takes into consideration the social, environmental and governance impacts of investments, yet it is still focused on financial performance and generating positive returns. As a values-based approach to investing, ESG prioritises ethical types of investment whilst seeking to maintain investor returns. It is often referred to as “norms-based” investing/screening. Norms-based screening ensures that investors can scrutinise a firm’s ethical and responsibility policies and procedures. The European Sustainable Investment Forum (Eurosif) describes norms-based screening as the “screening of investment according to compliance with international standards and norms”.

ESG investments are different from other SI strategies such as ‘impact investments’ and ‘philanthropic investments’, in which the key difference lies in a reversal of priorities. Unlike ESG, an impact strategy ranks the result of a positive influence on society and/or the environment higher than the need for financial gain, yet still sees any profit as positive.

Its evenly weighted focus on ethics and profitability means that ESG slots well into the asset management space in the age of the millennial. It provides an ethical and responsible way of investing whilst generating returns, yielding dual satisfaction for investors.

The Facts and Growth Stats

In 2016 the Global Sustainable Investment Alliance suggested in its report that there were $22.89 trillion of assets being professionally managed under “responsible investment strategies”, adding that there had been a 25% growth in the area since 2014. It was ten years prior to this report that the United Nations introduced a set of six investment principles, namely the UN Principles of Responsible Investment (UNPRI). UNPRI was created by investors for investors and was put in place to guide the investment community toward a more sustainable and ethical approach to investing.

More recently the UNPRI published a report (November 2017) stating that impact investing is forecast to grow by $250 billion annually. Based on this, we can safely assume that ESG is also here to stay. Diversification and the growth of the hybrid fund also bolsters the need for ESG on a global basis. Hybrid funds are increasingly including environmental, social and governance outcome-based strategies to fulfil investor requirements and mitigate risk.

The PwC report ‘Asset & Wealth Management Revolution: Embracing Exponential Change’ states, “Whether millennials, HNWIs or institutional investors, there is a rapidly rising demand for forms of ESG investing evident in thematic and ESG-integrated styles across mutual funds, impacting investing private equity and bespoke institutional mandates”. Full Report

The trend is more developed in Europe, but the APAC and Americas regions are now tuning-in to asset managers with ESG competencies. As the need for transparency increases from allocators and regulators across the globe, the focus is not only on fees but also operations and governance. Naturally, CSR activity, or lack thereof, from managers and their service providers is further exposed. As younger investors become increasingly active and influential, ESG certainly fills a requirement.

As a result, many firms are now improving their ability to disclose ESG indicators which often positively impacts long-term profitability. ESG‘s proliferation is being driven by a combination of genuine investment rationale, alongside the need to demonstrate a responsible investment methodology in an increasingly socially and environmentally aware world.

Sustainability is Key

Risk factors increase as complexities in regulation, pollution, political unrest, migration, weather disruption etc. combine. This perfect storm of global change is forcing the investment management space to be fluid and respond accordingly to mitigate those risks. The increasing global nature of asset management only serves to increase the influence of these factors and the subsequent risks. What might have been previously localised issues are becoming globally significant as the use of multi-jurisdiction investing and multi-asset strategies increase.

In 2016, JP Morgan produced a report title ‘ESG – Environmental, Social & Governance Investing – A Quantitative Perspective of how ESG can Enhance your Portfolio’. The report states that “not having ESG factors in your portfolio significantly increases volatility, lowers potential Sharpe ratios and leads to a higher probability of suffering larger drawdowns during times of market stress”. In addition to this, long-term financial performance is evidenced as being impacted in a positive way by identifying “better-managed” companies to invest in, which ultimately acts to moderate risk and enhance long-term sustainability in financial performance. Full Report

The CFA Institute conducted a survey of over 1,300 financial advisors and research analysts in 2017 which unequivocally demonstrates the importance of ESG as a mainstream strategy in today’s world. The survey found that 73% of respondents take ESG issues into account in their investment analysis and decisions. Full Report

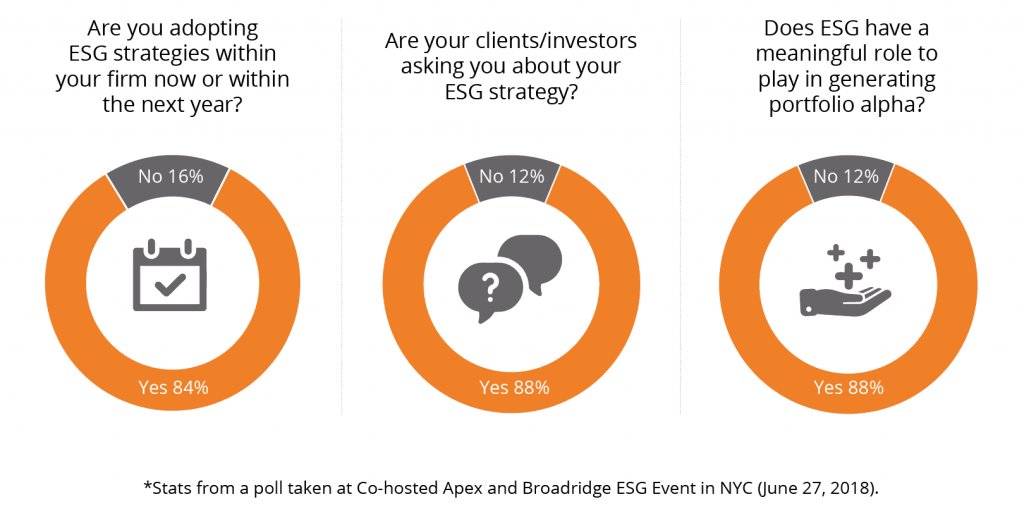

In our own informal poll taken at a recent Apex ESG event held in New York (June 2018), over 80% of respondents stated the same. The CFA survey strongly demonstrated that the main reason for consideration for integrating ESG into investment analysis and decisions came from investor and client demand, with 66% stating that as the core driver.

Interestingly, the asset class leading the pack with ESG is Listed Equity, with 76% of CFA survey respondents noting it as being the predominantly appropriate asset class. It was followed by Fixed Income at 45% and right at the bottom were hedge funds at only 8% considering ESG analysis in that space.

It is perhaps not a coincidence then that as the private equity space continues to grow, so too does ESG. Tim Hames, Director General of the British Private Equity and Venture Capital Association said, “The integration of ESG into a GP’s operations has been high on the industry’s agenda for some years now. Many firms have demonstrated that ESG integration can add value to a portfolio and there is growing support for adopting the Principles of Responsible Investment”. Source

We know that the current disruptive nature of the asset management space suits private equity managers. It makes sense then that this is the asset class embracing ESG. The long-term view private equity managers take means that through ESG integration they can capitalise on the opportunity to create social value, improve the environment and in doing so, increase their financial returns.