Are you leaving money on the table? A cross-border tax recovery guide for hedge funds

By Brian Sapadin, Executive Director of Hedge Fund Service, GlobeTax

Published: 21 January 2018

Why are my international dividends being over-withheld and what remedies do I have to secure my entitlements?

Funds receiving dividends from international investments are often subject to withholding by the government of the issuer's jurisdiction. The same income may also be subject to home country tax. To mitigate this double taxation, pairs of countries have entered into double taxation treaties or enacted laws providing investors the opportunity to recover all or part of the foreign tax withheld.

Some markets offer a relief at source process (where treaty rates can be obtained on pay-date). This is the best situation for investors. However, participation in relief at source is dependent on several factors including market availability and custodial support. While global custodians support a relief at source process to varying degrees, prime brokers, for the most part, do not. When relief at source is unavailable, investors seeking entitlements must rely on standard long-form procedures. Since standard refund filing requirements are increasingly complex, funds should be aware of a number of factors. The following is meant to educate hedge funds about the tax recovery process, guiding an informed course of action.

What is involved in lodging a standard (long-form) reclaim?

You must first determine how the process works in a particular market. Each jurisdiction operates with its own unique processes and requirements. Do forms need to be completed in native language, or is English an option? Does a claim go directly to a tax authority? Which counterparties need to be involved? Do you have to navigate through the web of custodians, withholding agents, depositaries, and depositories to lodge a claim? Once these questions are answered, error-free claim applications must be accompanied by all required documents and lodged within the statute of limitations. Entitlements must be precisely calculated, taking into account prevailing statutory rates, treaty rates, and beneficial owner types for each income event.

In the event of an audit, claimants must be ready to support information requests from tax authorities. Most are routine and can be easily managed, if you are prepared. The importance of audit support can’t be overstated.

How much am I entitled to recover?

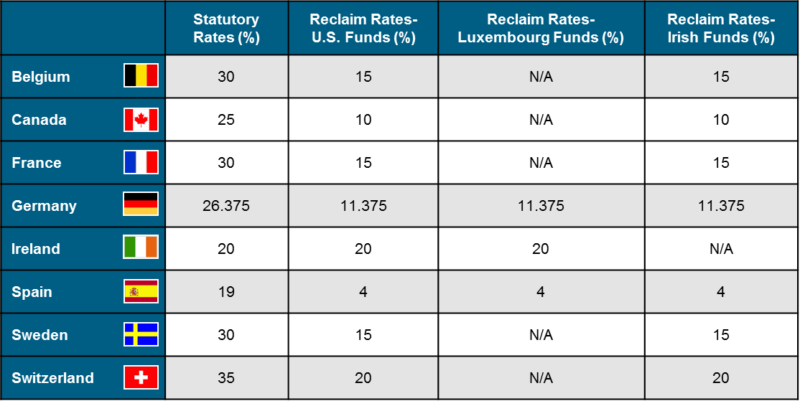

For taxable entities, recoveries range from 4% of the gross dividend (e.g. Poland, Spain) to 20% of the gross dividend (e.g. Ireland, Switzerland). Tax-exempt entities can often reclaim the entire withholding (e.g. 35% in Switzerland, 30% in Belgium, Finland, and Sweden, 26.375% in Germany, and 25% in Canada). Transparent funds (such as partnerships) can often reclaim at a “blended” rate based on the tax-status of the underlying investors.

Potential Recoveries: Sample Markets

* All rates subject to change

* Reclaim rates above are based on taxable entities

How long does the recovery process take?

The average recovery time for most markets is around 12 months, though the range varies from as short as 3 months to as long as 24 months.

How quickly must I act?

Claims must be lodged within the published statute of limitations or the investor forfeits the entitlement. Statutes of limitations vary by market, but range from 2 years to 7 years. As a result of the statutes, investors engaging in tax reclamation for the first time often receive a windfall for the initial filing based on prior years’ excess withholdings that are still available for recovery.

What are the disclosure requirements?

While each market has its own rules and nuances, most jurisdictions now require disclosure of investors within transparent entities to ensure treaty benefits are being granted appropriately. Tax authorities often require funds to submit lists of their underlying investors or certificates of residency for those investors. While the latter requirement is more onerous, funds can usually reclaim the pro rata portion of the entitlements for investors for whom they can produce proper documentation, so it is typically not an all-or-nothing scenario.

In certain markets, a greater portion of the withholding can be recovered if investors are pensions or other tax-exempt entities. ‘Funds of one’ for large tax-exempt investors have a distinct advantage in this context.

Are Depositary Receipts and Global Shares also eligible for reclamation?

Yes. Depositary Receipts (DRs) and Global Shares also present a reclaim opportunity for investors. Some investors are unaware that they have an entitlement because they did not buy the shares in their home market. However, investors who hold these securities have the same issue of withholding at source and the same burden to file a tax reclaim application to recover the excess withholding. To recover these funds, investors must file reclaims through the institution that issued the DRs, who then files a claim with the foreign tax authority.

Are there reclaim opportunities for offshore funds (Cayman, BVI, Bermuda, etc.)?

While it is easier for fund managers to access treaty benefits for onshore funds and feeders, there are opportunities for offshore vehicles as well.

1. Control Provision Claims for Offshore Corporations:

In certain markets, opportunities exist to lodge claims based on specific control provisions within the treaty or local law in the jurisdiction of investment. Disclosure and documentation requirements vary by jurisdiction.

2. Accessing Treaty Benefits through Cayman LLCs:

Traditionally, many U.S. tax-exempt entities invest through an offshore feeder-- most commonly a Cayman limited company. While providing protection from unrelated business taxable income (UBTI), these vehicles subject investors to 30% back-up withholding on all U.S.-sourced income, as well as full withholding rates on dividend payments from other markets.

Last year, the Cayman Islands introduced a new vehicle: the Cayman Limited Liability Company. Although US withholding tax still applies, the structure allows for fund managers to reclaim over-withheld foreign tax on behalf of U.S. tax exempts and other eligible investors (in certain markets), while allowing U.S. tax exempts to remain shielded from UBTI.

3. Accessing Legal Entitlements through EU Discrimination Claims:

Eligible fund structures can explore new opportunities in Europe thanks to decisions by the European Court of Justice (ECJ). Cases like FIM Santander and DFA Emerging Markets, among others, have paved the way for non-EU funds to qualify for more favorable tax rates in European Union member countries. In these rulings, the court has found that the ‘free-movement of capital’ provisions in the Treaty on the Functioning of the European Union entitles foreign funds to the same treatment as similarly-structured resident funds; to suffer worse outcomes would constitute discrimination.

While ultimate results are still uncertain, U.S. RICs and Cayman/BVI-domiciled corporations can take advantage of the new legal landscape by filing discrimination-based claims with foreign tax authorities. Fund structures must be compared, evidence gathered, and legal briefs presented to local authorities. Upon receiving the evidence, the applicable authority will determine whether the fund in question is sufficiently similar to those granted refunds in prior ECJ rulings.

How can I develop a tax recovery strategy?

Tax reclamation is a powerful tool for enhancing portfolio performance and meeting industry best practices. Because most funds do not have the in-house capabilities to successfully reclaim over-withheld tax on their own, those seeking to pursue entitlements should consider a specialized tax recovery firm.

To contact the author:

Brian Sapadin, Executive Director of Hedge Fund Services at GlobeTax: [email protected]