How hedge funds and their investors can manage increased reporting demand in the digital age

By Neil Giavara; Michael R. Dittenhoefer; Ram Chandrasekar, Intertrust Group

Published: 20 September 2021

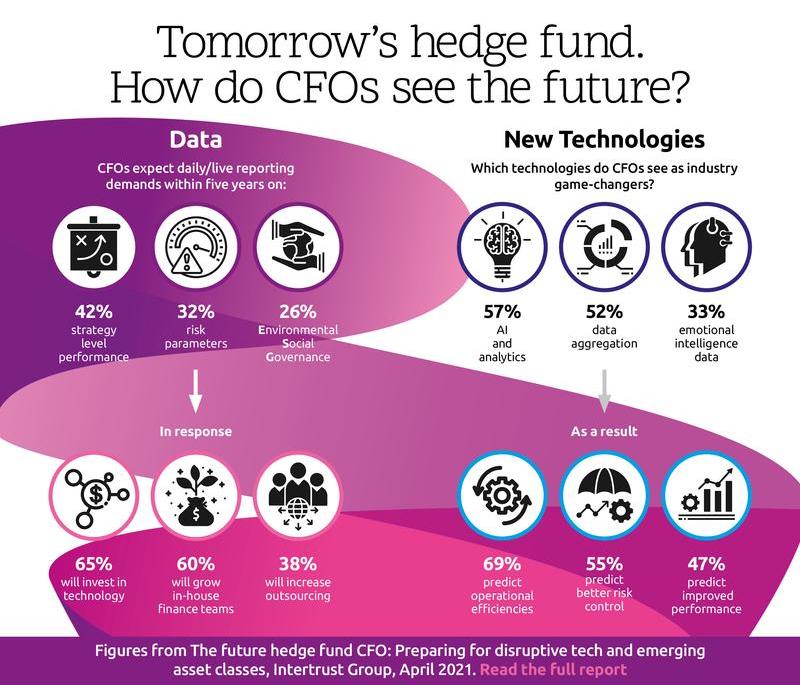

Over the next five years, hedge fund chief financial officers (CFOs) expect investors to demand an increased volume and frequency of reporting in areas ranging from trading and performance data to risk parameters and ESG.

While compiling our recent report, The Future Hedge Fund CFO: Preparing for Disruptive Tech and Emerging Asset Classes, we found investors hungry for frequent updates.

Our survey found 33% of respondents seeing demands for daily reporting on strategy-level performance, with an extra 9% seeing demands for live reporting in this area. The second-highest demand for daily reporting was over risk parameters at 26%, with an additional 6% demanding live reporting.

Reporting frequency is increasing because of technological advances, which in turn drive expectations. The average manager reports data to many stakeholders within and outside their organisation, from the front and back offices to management and C-level executives and fund investors. Each wants the data in a different format.

Delivering data in a timely fashion

To meet these demands, hedge funds must be able to access data in a timely fashion, both to report to investors and for front-office efficiencies in the all-important trading realm.

Hedge fund managers require reliable information on reconciliations, profit and loss, cash, positions and other metrics before markets open. If the front office is still receiving reports at 10am, the firm is at a disadvantage.

Having service-level agreements in place; maintaining solid relationships with prime brokers, banks and other parties; and standardising data presentation and analysis formats enable service providers to do their jobs effectively and deliver clean, useful data to clients.

Technology is important for engendering efficiency, but at least equally important are human connections between firms and process expertise developed over years.

This is where service providers excel. For example, if a client is adding a new prime broker, Intertrust Group probably already has a connection with that broker and understands their technical requirements.

Receiving data that is not in the correct format for validation and output highlights another challenge to delivering on timeliness – how data is digested.

Digesting data in a meaningful way

A key obstacle to meeting heightened reporting frequency demands is the mixture of separate internal systems that often exist within a manager firm.

Company operations departments face the challenge of sending this data over different systems to help the front office best position itself at the start of the trading day.

Providing standardised data helps firms bridge situations where, for instance, back and front offices use different systems. In this context, being technology-agnostic enables services to be provided as flexibly and in as customisable a way as possible.

Firm size, complexity, broker relationships and the amount of trades involved can all affect the efficiency of data digestion – the more data there is to digest, the more potential for something to break.

Service providers must be experts at ingesting data in multiple formats and outputting it with a unified structure to make it more meaningful, providing what Intertrust Group calls actionable insights. This requires investment in robust technological infrastructure.

The extent to which a firm will outsource to nullify problems related to the timeliness and digestibility of data is, we believe, intimately related to where it is in its growth. Larger firms often decide to build systems in-house, while smaller ones may not have the budget for outsourcing or appreciate its cost-effectiveness.

We also find that as small to medium-sized firms grow, they need more operational due diligence and greater efficiency. This prompts them to investigate outsourcing.

Discerning meaningful patterns in data

Gathering ‘meaningful information’ is not simply about successfully ingesting data. Instead, it means discerning patterns that can be fundamental to providing actionable insights.

For example, managers might want to understand patterns on issues occurring on a more frequent basis and the root causes for such issues. They might use these insights to advise the third party in question. With this approach, a service provider becomes a partner helping hedge funds to eliminate breaks in process, rather than simply fixing recurring breaks.

Although a firm might be able to glean these insights on its own, it is unlikely to be able to match an outsourcer’s economies of scale. Perhaps the greatest challenge in providing data to facilitate front-office trading and accurate reporting to investors is managing third-party relationships between various data producers. Outsourcing providers can navigate these relationships continuously in a way that is increasingly in demand in a digital-first world.

The Future Hedge Fund CFO report canvassed the views of 100 senior-level respondents, evenly split between continental Europe, the UK, North America and Asia. Read the full report here.