MiFID II and the paper conundrum

By Lisa Roitman and Nadia Humphreys, Bloomberg's Entity Exchange

Published: 13 April 2017

If you think MiFID II doesn’t apply to you, think again. The new rules, which span topics as varied as best execution, transparency and trade reporting, research and record keeping, all have one thing in common… paper, and lots of it.

Firms who must comply with MIFID II will need to repaper their client agreements, whether these are covered by the regulation or not. The sell-side is mobilizing large operational teams to prepare for this expected increase in client outreach, and for the need to identify the information they are going to collect from clients. As for the buy-side, it will have to either accept or negotiate new terms of business with the sell-side, and may need to change fund disclosure material, internal policies and procedures, and investor subscriptions.

Exchanging and negotiating all this new documentation is going to take time, which is in short supply as the regulation comes into effect in January 2018.

According to a Bloomberg poll of ten top tier sell-side firms in London, an estimated 2.5 million documents will need to be exchanged in 2017 across their client base in order for them to become MiFID II compliant. This represents a significant burden on the buy-side, who rarely has the operational or legal resources available to receive and process these requests.

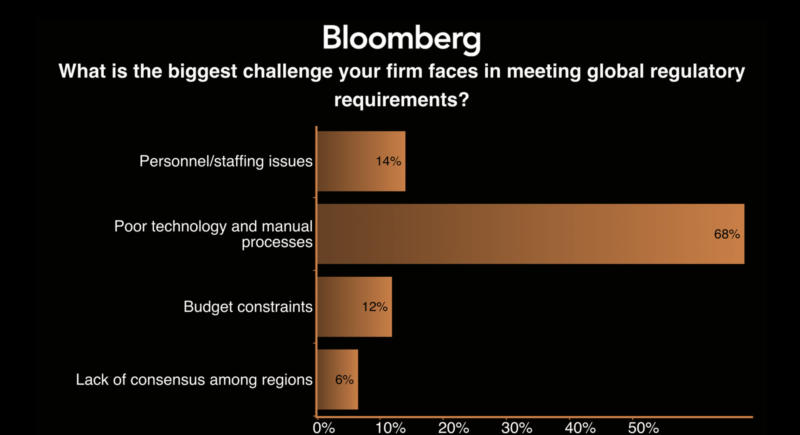

Perhaps even more important is determining exactly how firms will collect and respond to all this information. Traditional methods of exchanging contracts by email or post may fall short both in terms of operational strain and security. “Firms will need to think about how they can best leverage technology to assist with the challenges that this raises – manual processing is simply too time consuming,” confirmed John Ahern, Partner at Jones Day.

Implementing technology to assist with the process can help with workflow management and provide audit trails of the exchanges. Using solutions to encrypt these communications, data and document exchanges provides security for sensitive client information. Seeking technology-driven ways to conduct client outreach, collect, organize and store information will be key to handling the repapering crush.

What are the requirements?

While most see MiFID II implementation as a sell-side problem, there is no need for the buy-side to sit back and wait for the paper deluge. “Firms on the buy-side are sufficiently conversant with the MiFID II requirements and should consider taking the initiative to produce the relevant information for their sell-side counterparties with a view to speeding up the process and avoiding disruption post January 2018,” says John Ahern.

These are some of the key things that both sides will need to consider:

- Revising terms of business and updating execution policies

- Changes to research provisions

- Onboarding to new venues

- Obtaining and disclosing Legal Entity Identifiers (LEI)

- Delivery of Systematic Internaliser (SI) information to clients

- Due diligence in order to determine the correct Client Classification

- Due diligence regarding Algorithmic trading platforms

- Periodic report on suitability

- Changes to costs and charges

- Declaration of conflicts of interest and inducements

5 things buy-side firms should do right now to prepare for MiFID II

- Obtain a Legal Entity Identifier (LEI) across their universe of entities

- Determine the appropriate registration process for their business and notify their counterparts and third-party distributors

- Determine and be prepared to communicate their classification under MiFID II

- Plan for how their firm will handle and/or negotiate the document types to be delivered under MiFID II

- Look at technology solutions to ease the operational burden and increase the security of their communication

Fundamentally, there are many ways to engineer a solution to the paper conundrum, but firms shouldn’t wait. Do the analysis now, identify technology that can provide efficient solutions to the repapering exercise and take the pain out of MiFID II compliance.

To contact the authors:

Nadia Humphreys, Bloomberg LP: [email protected]

Lisa Roitman, Bloomberg LP: [email protected]

Lisa Roitman and Nadia Humphreys oversee business strategy and regulatory product development for Bloomberg's Entity Exchange, a centralized and secure platform where trading counterparties can exchange and documents for KYC processes.