Navigating change: How the European ABS market proves to be resilient through challenging times

By Marco Masotto; Gabriele Guidoni; Emanuele Zocchi , CARDO AI

Published: 20 November 2023

The European securitisation market has been navigating a very volatile year, largely due to persistent geopolitical tensions, inflationary pressures, and increasing interest rates. This turbulence has had a negative impact on the issuance and placement rate of Asset-Backed Securities (ABS).

However, the second quarter of 2023 witnessed a period of diminished volatility, even if it was still accompanied by some uncertainty. The total issuance surged to €95.4 billion, marking an impressive escalation of 166% compared to the preceding quarter (€35.9 billion in Q1 2023) and a significant leap of 177% from the second quarter of the previous year (€34.5 billion in Q2 2022).

Shifting our attention to the Year-to-Date (YTD) volumes, the first half of 2023 witnessed a significant increase of 31.1% when compared to the latter half of 2022 (H2 2022), resulting in a total of €131.3 billion.

Notably, this exponential upswing can be largely attributed to the BPMHL programme, a massive €49.5 billion transaction focused on residential mortgage-backed securities, which was entirely retained. It’s important to highlight that this substantial deal had a negative impact on the overall placed amounts in Q2 2023, constituting only 21.3% of the overall issuance volume.

Amidst these market dynamics and the complexities of securitisation products, it becomes evident that data plays a crucial role in deepening our understanding of this ever-changing landscape.

Securitisations are often complex products, making standardisation in terms of disclosure and performance analysis challenging due to their inherent complexity and the differences between transactions.

As a result, investors must commit substantial effort to conduct due diligence on potential securitisation investments and regularly monitor various factors that influence the performance of their holdings.

It is obvious that missing data stemming from the lack of transparency, as well as low quality or lack of standardisation, hinders a proper overall assessment.

To navigate these challenges, leveraging the right tools is paramount. For this reason, Cardo AI has designed a market intelligence tool to empower investors with the data needed to make informed decisions. Users can access powerful metrics, including delinquency rate, default rate, prepayment rate, collateral analysis, and risk metrics such as transition matrix, that provide deep insights with over 10 years of historical data. This invaluable resource equips investors with the means to confidently assess and harness new investment opportunities while effectively managing risks in the securitisation market.

The current state of the SME ABS market

The SME ABS segment constitutes approximately 13% of the total market outstanding volume and has experienced significant growth over the years. The total outstanding volume has risen from €86 billion in Q1 2017 to its current level of €100 billion.

By analysing the evolution of the SME ABS market’s composition over time, four key elements emerge:

- The SME ABS market has grown from €85 billion in 2015 to €110 billion at the end of Q2-2023. con Moreover, it has seen roughly 4 million new loans issued from 2020 through June 2023. This segment is, therefore, comprised of relatively young loans, on which the changes in macroeconomic conditions are yet to be fully reflected.

- When looking at the three largest countries by lending amount, Italy has the largest manufacturing sector as ranked by the NACE code, Spain’s largest sector is agriculture, and Belgium’s is financial, professional, and administrative services.

- The percentage of non-performing loans (i.e., delinquent, and defaulted loans combined) has steadily decreased over the last decade, from the heights reached after the great financial crisis (peaking at 12%) down to the current level of 5%.

- Defaulted loans and late-stage arrears have made up a relatively larger proportion of non-performing loans over time, particularly before 2017.

Stable inflation levels and low-interest rates have provided a solid foundation for the market. Despite the current low levels of non-performing loans, key risk indicators reveal that in countries where moratoriums and other amortising techniques have been used, there is now a noticeable response to the surge in inflation and interest rates.

Figure 1

In Italy, for instance, a substantially stable trend is observed from COVID-19 to January 2023. This stability can be attributed to various measures put in place to mitigate the effects of inflation and the pandemic. However, when we examine the data for Q2 2023, we notice that the mitigating effect is diminishing, with delinquency increasing by about 1%, and there is a potential for further increases.

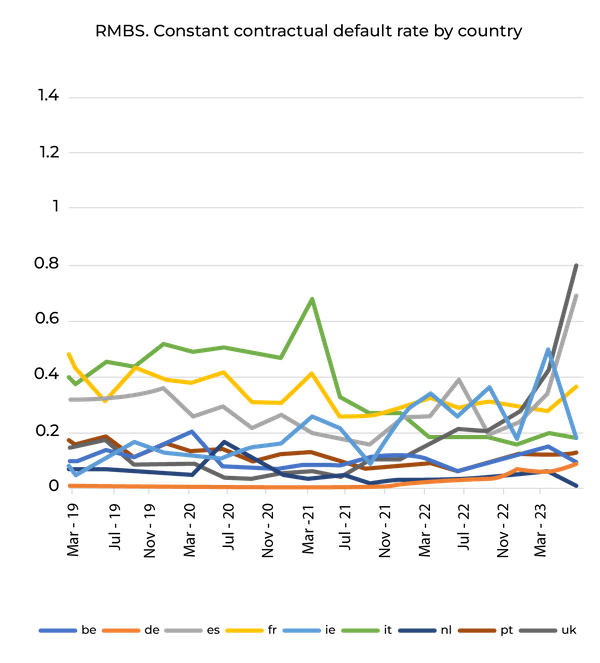

Following the Constant Default Rate (CDR) analysis, when comparing the two charts below, the second of which reclassifies as default those loans that have been repurchased (assuming this as a strategy to avoid impairing statistics and triggers), it is possible to assert that some countries have implemented a proactive repurchase strategy to control the growth rate of CDR.

For example, Italy shows a difference of about 5% between the first and second charts, suggesting a significant level of repurchases during that time. This strategy has been predominantly employed in countries like Italy, Spain, and Belgium. During the last quarter, Belgium and Italy extensively utilised this approach to counteract the impact of inflation.

Figure 2

The current state of the RMBS market

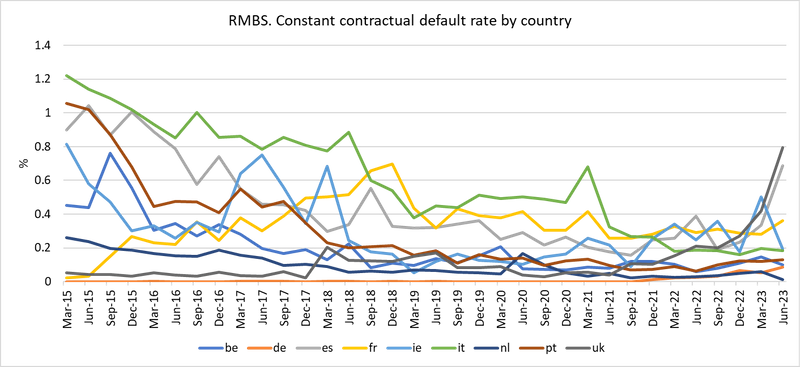

Starting from 2015, with nearly 800 transactions and a total outstanding amount of €460 billion as of Q2-23, our dataset enables us to comprehensively analyse the main trends and features of the European Residential Mortgage-Backed Securities (RMBS) market, including the UK. An added value to our dataset is the opportunity to perform highly detailed, loan-by-loan level analyses on the most significant metrics. Furthermore, the dataset are constantly updated, including the latest data, enabling timely analyses on key market trends.

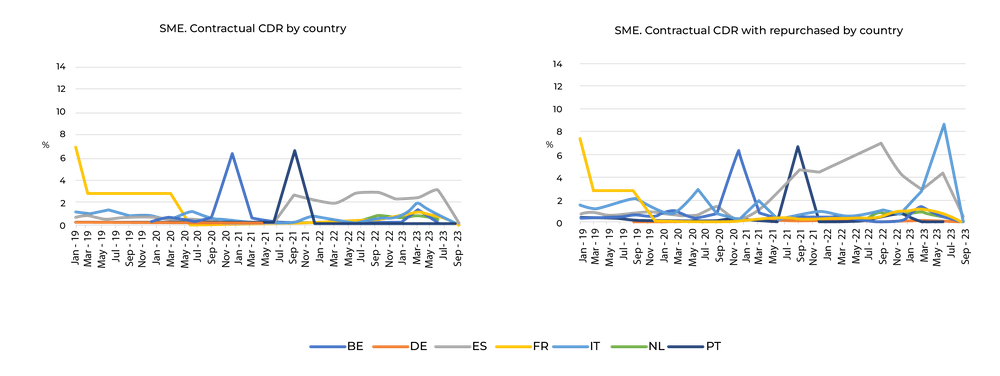

To better understand the impact of inflation, we have used the CDR as the primary metric for evaluating this asset class.

Figure 3 below displays the CDR per country from the beginning of 2019 to June 2023, according to the contractual definition. It provides insights into how the default growth rate has behaved over this period.

When examining the data from Q2 2023, it becomes evident that both Spain and the UK exhibited the most pronounced reactions to inflation. Both countries witnessed an increase of approximately +0.5% in June 2023, effectively returning to the levels observed before the COVID-19 pandemic.

On the other hand, countries such as Italy, the Netherlands, and Portugal continue to show a stable trend.

Figure 3

Q2 2023 and future outlook

DBRS Morningstar has revised its securitisation issuance forecast upwards. In January 2023, the forecast ranged from €185-195 billion. However, by June 2023, this projection was further adjusted to €195-200 billion. The adjustment can be primarily attributed to a significant surge in the issuance of RMBS in both France and the UK.

With the impending maturity of substantial amounts of central bank funding, specifically Targeted Longer-Term Refinancing Operations (TLTRO), securitisation is poised to assume a pivotal role in the funding strategies of European banks. This potential stems from its ability to counterbalance the anticipated reduction in central bank funding and enhance the diversification of funding sources, considering that 75% of European bank funding is derived from deposits.

However, a contrasting observation emerges from the Funding Plan report issued by the European Banking Authority (EBA). This report encompasses the funding plans of 159 banks that have submitted forecasts spanning from 2023 to 2025. While securitisations have the potential to play a substantial role in banks’ funding strategies, they do not appear to feature prominently among the main funding sources that respondents intend to prioritise in 2023. This might also be explained by an increasing preference among market participants for private transactions, which allows for a more tailored approach to investor needs while providing a shield from market volatility.