Portable alpha for all: Return stacked strategies for diversification without sacrifice

By Adam Butler, ReSolve Asset Management Global

Published: 18 March 2024

Diversification is the cornerstone of investing. This principle, fundamentally understood as not concentrating all resources into a single investment, inherently seeks to minimise risk while potentially smoothing out returns over the long term.

By spreading investments across uncorrelated assets, investors may more reliably cushion against sector-specific downturns and geopolitical risks. Moreover, diversification serves not only as a defensive mechanism against losses, but also as a proactive strategy to capitalise on opportunities across a broad

spectrum of investments. Thus, embracing diversification unequivocally enhances the resilience and performance potential of investment portfolios.

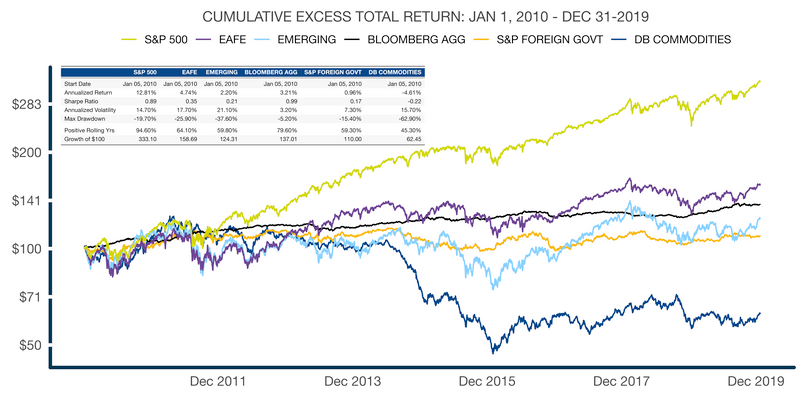

The 2010s mocked attempts at diversification as returns were highly concentrated in US large-cap equities. Driven by the pursuit of higher returns, investors increasingly allocated capital towards US equities, neglecting other asset classes. This trend not only underscored the challenges in achieving genuine portfolio diversification but also reflected a broader skepticism towards non-equity investments.

Despite a dearth of rewards to diversification, the 2010s saw a marked acceleration in the proliferation of liquid and accessible alternative mutual funds and ETFs. These funds significantly democratised access to previously exclusive market segments and strategies, allowing even small-scale investors to partake in the benefits of a diversified investment strategy.

The return experience of the 2010s is unlikely to repeat in the 2020s. For one, valuations may exert substantial headwinds. The preceding decade’s significant equity valuation increases may necessitate a recalibration of investor expectations. By one reliable metric,1 US cap-weighted equities are poised to deliver total returns at a rate of 0.7% below inflation over the next decade.2 This phenomenon, reminiscent of other historical ‘Lost Decades,’ underscores the cyclical nature of financial markets.

Calendar 2022, characterised by a global inflation spike driven by a confluence of demand and supply shocks, may be more representative of what investors might expect in the 2020s. Broader themes of higher and more volatile inflation dynamics and large fiscal deficits are likely to persist. Historical precedents indicate that once inflation thresholds are breached, a new normative baseline often emerges, suggesting a protracted period of elevated rates of appreciation in global prices.3

There are several reasons why inflation might gain an entrenched foothold. Aside from the long-term supply-chain effects of “onshoring” policies in the wake of critical supply gaps during the COVID pandemic, and commensurate deglobalisation efforts, supply is also likely to be pressured by an escalation in geopolitical conflict analogous to the last sustained inflation supply shock in the 1970s. Conversely, while unprecedented deficits due to COVID have moderated, the fiscal outlook for the United States includes large and rising deficits and debt levels for most of the coming decade.4 US Congressional Budget Office projections indicate a rising federal debt-to-GDP ratio, expected to reach 110 by 2032.5

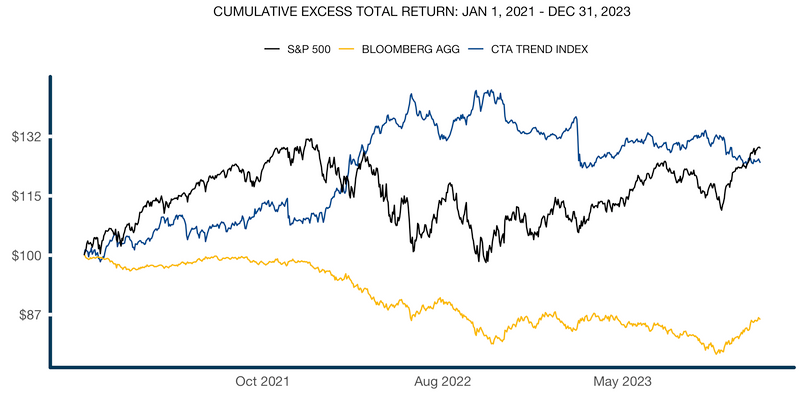

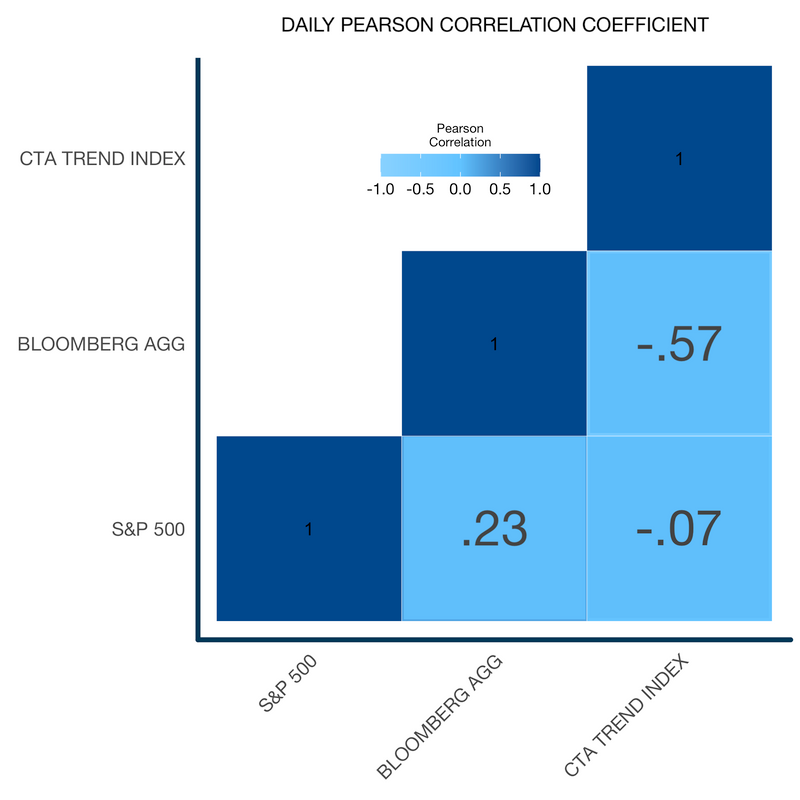

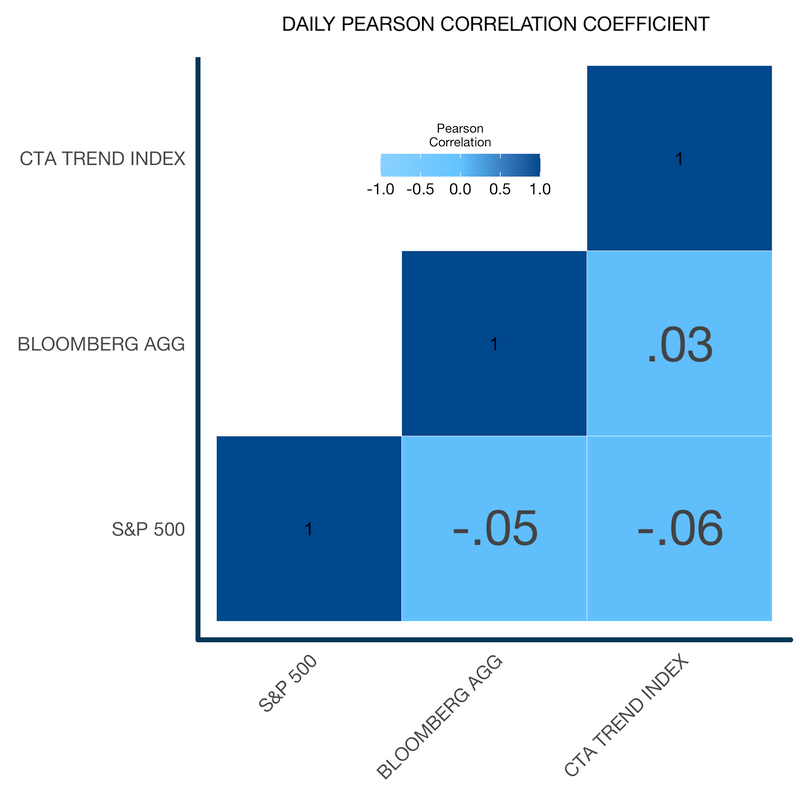

Investors have many choices for diversifiers across inflationary regimes, including commodities, inflation protected securities, and active strategies. In the active category, managed futures trend following experienced a renaissance in 2022.6 Despite attention-grabbing performance in the 2008 Global Financial Crisis, managed futures endured a lackluster 2010s amidst a general lack of macroeconomic dispersion.7 Strong performance in the post-COVID inflationary shock highlighted the strategy’s potential capacity to navigate the volatility and inflationary pressures that have become more pronounced in the wake of the pandemic. This is consistent with the category’s low historical correlations with equities and bonds.

Correlation of Daily Returns: Jan 1, 2021 – Dec 31, 2023

INDEX is proxied by the Société Générale CTA Trend Index. All data from Bloomberg. Returns are total

returns in excess of US 3-month Treasury bills. Past performance is not indicative of future results.

Correlation of Daily Returns: Jan 1, 2000 – Dec 31, 2023

INDEX is proxied by the Société Générale CTA Trend Index. All data from Bloomberg. Returns are total

returns in excess of US 3-month Treasury bills. Past performance is not indicative of future results.

Seasoned professional investors may endorse the view that complex markets motivate portfolios diversified against a wider array of risks, but less experienced investors may be loathe to reduce exposure to core equities and bonds to make room for diversifiers. For many, the incredible mega-capitalisation focused rebound in 2023, primarily in US technology stocks riding a wave of AI enthusiasm,8 feels like vindication. The fear of missing out on traditional market gains often outweighs the theoretical benefits of diversification. Consequently, portfolios remain skewed towards higher-risk and concentrated investments.9

This prompts a question: how can asset managers nudge investors into more diversified portfolios without requiring them to sell coveted core products to make room for alternatives? As institutions have understood for decades, futures can be easily layered on top of cash equities or bonds to maximise capital efficiency . Futures are also well understood by regulators, and regulations accommodate leverage derived from futures much more flexibly than the leverage drawn by cash equity market-neutral or long-short strategies.10

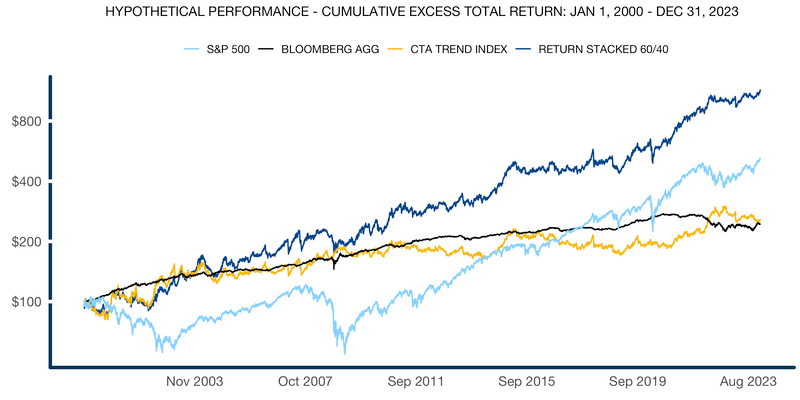

Return Stacked strategies have emerged as a streamlined and approachable mechanism to offer investors of all sizes access to “portable alpha” strategies previously only available to sophisticated institutions.11 By collateralising an active futures strategy with passive equities or bonds, Return Stacked strategies allow investors big and small to maintain full exposure to core positions while stacking reliable diversifiers on top.

Managed futures stand out as an especially complementary tool for Return Stacking on top of cash backed equities and bonds. But astute readers will have identified a potential complication.

Specifically, traditional managed futures benchmarks like the Société Generale CTA Index are not directly investable. Rather, they are constituted from a universe of large, mostly private performance funds. Large institutions may invest in a large cross section of constituent funds to minimise tracking error, or search for above-average managers.

Source: Employed ETF Proxies for investable returns: S&P 500 (SPY), BLOOMBERG AGG (AGG). CTA TREND INDEX is proxied by the Société Générale CTA Trend Index. RETURN STACKED 60/40 represents a monthly rebalanced portfolio of 60% S&P 500 (SPY), 40% BLOOMBERG AGG (AGG), and 100% Societe Generale CTA Trend Index less the 3-month US Treasury bill rate and an additional 0.4% annualised assumed excess funding rate. The portfolio is rebalanced back to target weights at the end of each month. All data from Bloomberg.

The above chart presents HYPOTHETICAL PERFORMANCE results that do not reflect actual trading and are not indicative of future results. They are designed to demonstrate what performance might have looked like if certain strategies had been employed. Returns are total returns. Past performance is not indicative of future results.

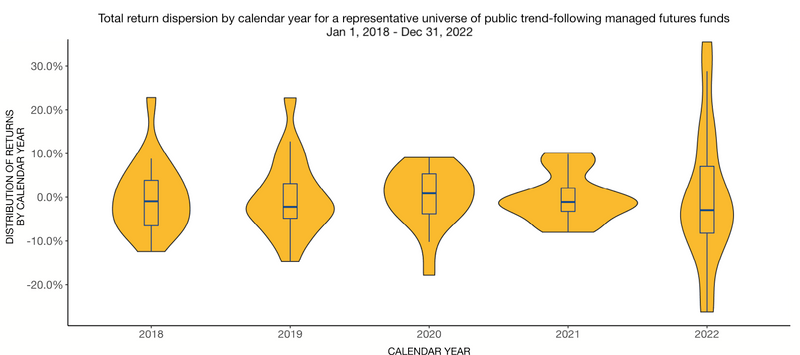

Smaller investors may choose to allocate to just one fund or perhaps a small sample of funds. This may be problematic for those seeking category-like returns most years. That’s because there is a great deal of variation in how managed futures funds operate. Managers may choose different universes of markets to trade, utilise different trend lengths and definitions, apply various weighting schemes, use diverse risk management techniques and stop-losses, or include exposures to other systematic factors like carry. As a result, the returns to trend-following managed futures funds can exhibit large dispersion from year-to-year.

Over the five years from 2018 through 2022 the returns to individual trend-following managed futures funds13 deviated from the average of all funds by 9 percentage points about half the time. The 95% range of dispersion was almost 27 percentage points. This dispersion motivates a search for methods to gain exposure to the underlying theme of trend-following with minimal tracking error.

Rather than choosing one or two funds to represent the index, investors may be better served by trying to replicate a popular benchmark index quantitatively. The task is challenged by limited disclosure from constituent fund managers regarding their current positions and strategies. Replication strategies, therefore, must infer the weighted average holdings of the benchmark’s constituent managers.

This deduction is based on a thorough understanding of the common markets traded by managed futures funds, the typical strategies they employ, and the reported returns of the index, ensuring a methodical approach to closely emulate the desired return trajectory.14

In conclusion, the evolving landscape of global financial markets underscores the enduring importance of diversification and the strategic implementation of alternative investment strategies. The 2020s present a complex array of challenges and opportunities, necessitating a recalibration of investor expectations and strategies. Managed futures and trend-following strategies, in particular, may offer a viable pathway for navigating market volatility and inflationary pressures, providing a complementary hedge to traditional asset classes. The advent of Return Stacked strategies and the pursuit of methods to minimise tracking error in managed futures investments further democratise access to sophisticated diversification tactics. Investors, therefore, must remain vigilant and adaptable, leveraging these innovations to enhance portfolio resilience in an increasingly uncertain macroeconomic and geopolitical environment.

Disclaimer: https://investresolve.com/disclaimers/

1 https://www.philosophicaleconomics.com/2013/12/the-single-greatest-predictor-of-future-stock-market-returns/

2 https://www.morningstar.com/news/marketwatch/20240122131/the-latest-from-the-single-greatest-predictor-of-future-stock-market-returns

3 https://haymaker.substack.com/p/making-hay-monday-november-6th-2023

4 https://www.cbo.gov/publication/58946

5 https://www.pgpf.org/expert-views/inflation-interest-and-the-national-debt/five-fundamental-changes-for-us-fiscal-policy

6 https://www.etftrends.com/managed-futures-channel/2022-the-year-of-managed-futures/

7 https://thehedgefundjournal.com/managed-futures-d1/

8 https://www.statista.com/chart/30318/sector-contributions-to-sp500-return/

9 https://en.wikipedia.org/wiki/Portable_alpha

10 https://www.jdsupra.com/legalnews/sec-adopts-new-regulatory-framework-for-50828/

11 https://investresolve.com/inc/uploads/pdf/return-stacking-strategies-for-overcoming-a-low-return-environment.pdf

12 https://wholesale.banking.societegenerale.com/fileadmin/indices_feeds/SG_CTA_Index_Methodology.pdf

13 Funds included in the analysis include ABYIX, ACXIX, AHLIX, AMFNX, AQMIX, CSAIX, EQCHX, EVOIX, GMSSX, LCSIX, LFMIX, LOTIX, MFTNX, PQTIX, QMHIX, RYIFX, SUPIX, WAVIX.

14 Source: Peering Around Corners: How to Replicate Managed Futures Strategies