Preparing to disrupt and grow: Optimistic asset managers see challenges on the path to success

By Alfred Fichera, Global Head, Alternative Investments, KPMG

Published: 23 January 2018

The casual observer could describe the past few years in terms of unprecedented economic, political, social and technological change, and the alternative investment industry globally has had no safe harbor from this tumult.

Asset managers are navigating profound changes regarding their customers and markets, operations and systems, and their regulatory landscape, driving widespread agreement that they need to be agile – to anticipate and react quickly and well to change – and so must disrupt themselves in order to succeed.

These themes resonated in KPMG’s 2017 Global CEO Outlook, which surveyed CEOs from the world’s most significant businesses. And for this discussion, we focus on the responses of 85 CEOs of asset management firms, to identify their priorities over the next three years. From these data – and insights gleaned from ongoing conversations with industry executives – it’s clear fund managers face common challenges to extract opportunities from these unfolding developments.

Optimism amidst disruption

Looking first at the big picture industry view, we see a high level of optimism, since 71 percent of the asset management CEOs say they expect moderate growth for their company in the next three years and 67 percent feel positive regarding the global economy.

This attitude was pervasive across the gamut of asset management firms. Those surveyed represented firms across the range of asset classes and products, with revenues up to over $10 billion, and included managers based in 10 markets, including Australia, China, Europe, the UK and the US. Conversations with emerging and mid-market managers reinforce that they have similar sentiments and strategic imperatives while their anticipated execution tactics rightly vary for firms’ unique situations.

Alert to shifting risks

Although most asset management CEOs exhibit bullishness for the near future, they also voice prudent caution and planning for potential uncertainty over the next 36 months. For instance, 71 percent are now spending more time on scenario planning due to an uncertain geopolitical climate.

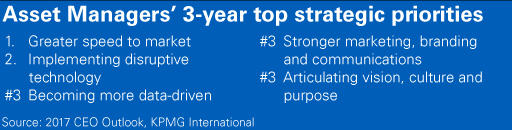

As a result, among fund operators surveyed by KPMG, the top industry risks are strategic, regulatory and operational. And in response, they are prioritizing client-related initiatives to improve their speed to market, technology (including disruptive technologies and data-driven capabilities), branding and marketing and strengthening their internal culture.

These findings align with recurring comments from our clients who describe their concerns about meeting evolving customer demands, navigating product polarization, and accelerating regulatory change. Managers are conveying the pressure they feel to attract and retain customers by identifying the critical moments in the customer experience, improving the returns they deliver and creating distinct value for their clients.

This theme is especially relevant to alternative investment managers who see global investors’ rising appetite for non-traditional strategies that can deliver enhanced, risk-adjusted returns. The challenge for alternative asset managers is to differentiate themselves with robust operating processes, and greater customization and innovation of product offerings in a way that minimizes costs and enables scale.

In addition, these fund managers describe their unease with the growing regulatory complexity they face, weighing heavily upon their business models, costs and growth plans. Indeed, while regulatory liberalization is unearthing new opportunities for some, many jurisdictions are intensifying their scrutiny of firm conduct, including internal culture, pricing and client disclosure, in addition to governance and risk management practices.

Investing for long-term growth

In light of these risks and related priorities, the CEOs articulated a longer-term mindset, with a focus on investing today for growth and transformation. Seventy-five percent of the CEOs say their organizations have successfully balanced long-term growth plans with short-term financial goals. Interestingly, the same percentage indicate they place greater importance on trust, values and culture in order to sustain their long-term growth.

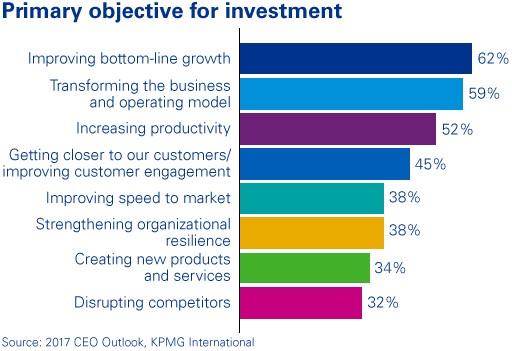

Executives listed their top four investment priorities as improving bottom-line growth, business transformation, increasing productivity, and improving customer engagement.

We see these themes playing out in various forms with our clients who typically are heavily focused on reducing costs and improving efficiency due to rising compliance expenses from new regulations, increased expense to recruit and retain necessary talent, and the significant outlays required to replace legacy systems with next generation technology.

Focus on customer-oriented transformation

It’s important to highlight that asset managers are not solely concentrated on cost reduction and risk mitigation. Fifty-two percent of the responding fund managers say they are pursuing customer-focused transformation as a route to growth, and two-thirds say they have a growing responsibility to represent the best interests of their customers. Our industry is under pressure to attract and retain customers, with firms trying to find some bit of competitive advantage by being able to identify the critical moments that matter to the customer. The funds that get this customer experience right will have great success.

Embracing disruption, but unclear path

With such optimism among asset managers, it’s no surprise that the CEOs say they are embracing disruption. In fact, 71 percent say that rather than waiting to be disrupted by competitors, they are actively disrupting their sector. And, 65 percent boldly affirm that they see technological disruption as more of an opportunity than a threat.

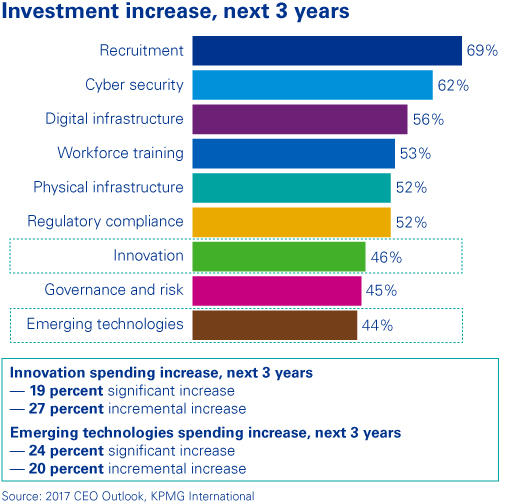

That said, the KPMG study found a clear disconnect between stated ambitions and action among asset managers. While 46 percent say they will increase their investment in innovation over the next three years, only 19 percent expect that investment to be significant. Similarly, while 44 percent plan to invest in emerging technology, just 24 percent define that spending as significant. The survey data also showed that actual investments in the past 12 months lagged behind the CEOs’ stated investment goals.

Even in the acknowledged, high-risk realm of cyber security, planned investment levels may not be sufficient to address evolving challenges over the next 3 years, since 4 in 10 firms will be making no new investment in this critical area.

This reticence among CEOs to make tangible new investment may be linked to a variety of factors. When asked what is the single biggest barrier to implementing new technologies, 24 percent state lack of internal skills or knowledge, 22 percent say complexity of implementation, 14 percent cite risk and security concerns, and 13 percent blame legacy systems.

A roadmap to disrupt and grow

It’s evident that while asset managers are attuned to the wall of new customer-, technology- and regulatory-related hurdles on the horizon, they feel ready to confront the challenges and take bold steps to disrupt themselves, so they can both lead the pack and achieve sustainable growth.

To do so, alternative investment managers may need to strengthen their brand positioning and internal cultures to focus crisply on value delivery for customers, and develop concrete plans to apply innovation and emerging technologies to tame the mounting customer demands, regulatory expectations and operating costs.

To contact the author:

Alfred Fichera, Global Head, Alternative Investments, KPMG (US): [email protected]