(Re)discovering alternatives: APPG on alternative investment management launches

By Jiri Krol

Published: 28 November 2016

By Jiri Krol, Deputy CEO, AIMA

The creation of an All-Party Parliamentary Group on Alternative Investment Management presents a significant opportunity for both government and the alternative investment industry to work together on understanding how the industry could be tapped as unique national resource when it comes to pensions and savings, investments in the real economy and better corporate governance.

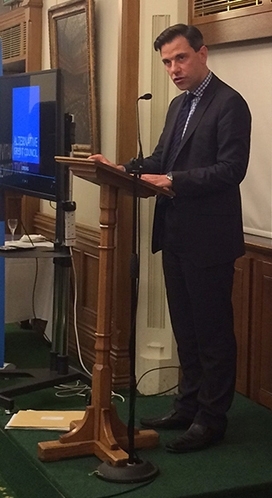

We welcome this new group. Led by Chris Evans MP, it will allow politicians to have a better understanding of the value the alternative investment industry contributes to the real economy. As Chris told the media, the group will be, above all, an educational space where MPs can learn about topics such as closing the pension’s gap, hedge fund value for capital market development, alternative lending, financing social housing and what Brexit will mean for the industry.

Even though the sector has grown substantially since the depth of the financial crisis, and is an important and influential segment of the asset management industry, it still remains largely misunderstood in policymaking circles in Westminster and beyond. This perception gap matters because it influences the regulatory and tax discourse and may even have an impact on investor allocations.

We are an industry which has been transformed profoundly by the crisis, the increasing institutional nature of our clients and the diversification of investment strategies. Today, we are heavily regulated, fully transparent to authorities and serve a much broader constituency of stakeholders and investors.

Around a quarter of the industry’s capital originates from pension funds. A further 18% comes from foundations – which fund scientific research, provide health services and fund religious and charitable endeavours – and 12% from university endowment funds. Other large investors include sovereign wealth funds and insurers. In addition, the UK the sector supports 40,000 jobs and brings in £4 billion in tax receipts to the Exchequer.

Since the 2008 financial crisis, many alternative investment managers have also stepped in to fill the financing void left by banks. Organisations such as Game, Caffe Nero and Heathrow Airport have all benefited from loans from alternative investment funds. Our members increasingly lend to small business owners and have been key to helping real estate projects get off the ground, whether that’s commercial real estate, social housing or student accommodation.

So in addition to our more traditional role of providing liquidity in the markets in search of alpha, we’ve been moving into strategy spaces which aren’t usually associated with the industry. We can and want to do more. That is why this APPG focused on alternative investments will be key to getting this message out.

Ahead of Brexit, there’s never been a more opportune moment for the two sides to work together and achieve genuine results.