Regulatory environment drives jurisdictional choice among crypto firms

Published: 12 June 2023

- 9 out of 10 respondents say the regulatory environment is the most important factor when choosing a jurisdiction.

- A third of respondents are currently only operating in the US but are considering expansion or redomiciling elsewhere.

- Half of the respondents that are not currently operating in the UK said they are considering entering the market in the next five years. Those that are either headquartered or have a presence in the UK are all considering expanding their presence over the same period.

- The UAE and Singapore are attracting the greatest interest as a jurisdiction among those currently in the US and/or the UK.

The UK, the United Arab Emirates (UAE) and Singapore are among the leading jurisdictions in line to grow their market share of the digital assets sector, according to a snap poll of AIMA’s US-based digital asset members and other market participants.

Given recent reports of firms operating in the US digital asset sector looking to expand into other markets, AIMA’s Digital Assets Working Group (DAWG) asked its members which jurisdictions they are most interested in expanding to and what characteristics they most value in a domicile.

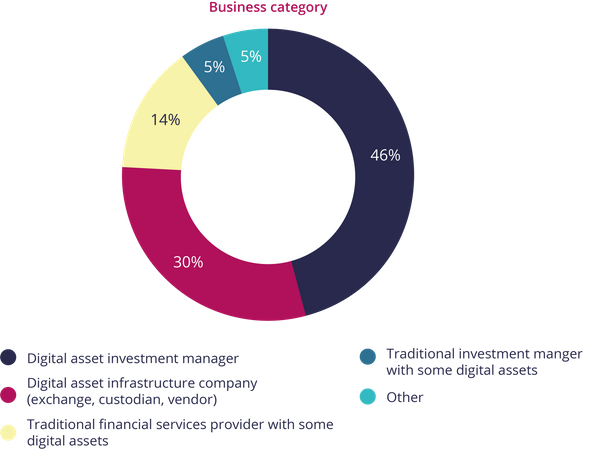

All 37 respondents are either based exclusively in the US or have a presence there. Just under half (46%) are digital asset investment managers, while a further third are digital asset service providers. The remainder are either traditional fund managers or service providers.

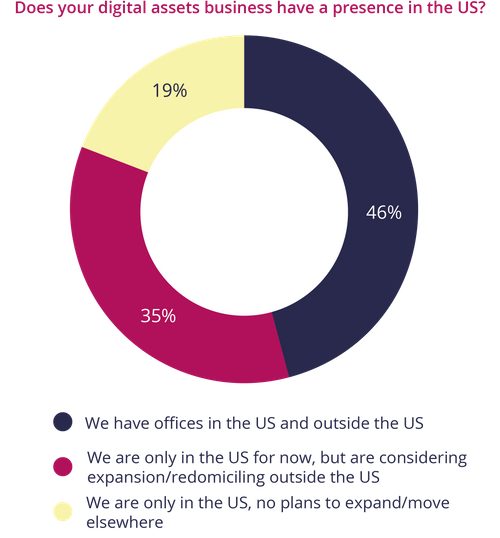

Just over a third (35%) are currently only operating in the US but are considering expansion or redomiciling elsewhere, while two in 10 plan to remain a US-only business.

What digital asset firms want when choosing their jurisdiction.

When asked what factors are most important in the choice of jurisdiction, respondents were nearly unanimous in highlighting the regulatory environment, with 90% describing it as very important and the remainder saying it is somewhat important.

The service provider ecosystem was the next most valued factor, with 84% citing it as either very or somewhat important. Meanwhile, availability of local talent and lifestyle were seen as more nice-to-haves. The former is only somewhat important according to seven in 10 respondents and the latter by six out of 10 respondents.

| Options | Very important | Somewhat important | Not important |

|---|---|---|---|

| Regulatory environment | 90% | 10% | 0% |

| Service provider ecosystem | 42% | 42% | 16% |

| Cost of doing business | 41% | 50% | 9% |

| Lifestyle | 13% | 60% | 27% |

| Availability of local talent | 12% | 72% | 16% |

The UK

The UK government has committed to introducing a new regulatory regime for crypto assets, with a consultation setting out proposals for this future regime closing last month. This consultation with industry is an example of the UK attempting to position itself as a crypto-friendly jurisdiction, in line with UK Prime Minister Rishi Sunak’s goal to make the UK “the jurisdiction of choice for crypto and blockchain technology”.

Of the jurisdictions listed, the UK was the jurisdiction respondents were most likely to already be present in, just edging out Singapore. Half of the respondents that are not currently operating in the UK said they are considering entering the market in the next five years. Those that are either headquartered or have a presence in the UK are all considering expanding their presence over the same period.

The UAE

The UAE, and Dubai specifically, is widely considered to be among the most crypto-friendly jurisdictions today. Although the Middle Eastern hub recorded the strongest percentage of those saying they had a strong interest in the jurisdiction, it also had one of the lowest percentage of respondents already operating there. This suggests the flow of business into the region is at an earlier stage than the other frontrunners (The UK and Singapore). Roughly seven in 10 respondents expressed either some or a strong interest in the jurisdiction, while 10% said they were already present there.

Singapore

Two in 10 respondents are already active in Singapore, which is seeking to solidify its position as the digital asset jurisdiction of choice for Asia Pacific, while also constructing a robust regulatory framework to support the industry.

A further 55% of respondents have either some or a strong interest in gaining a presence in Singapore.

| Poll question: Are you considering setting up in any other jurisdictions outside the US/UK? | ||||

|---|---|---|---|---|

| Jurisdiction | No interest | Some interest | Strong interest | Already here |

| UAE | 23% | 29% | 39% | 10% |

| Singapore | 20% | 33% | 23% | 23% |

| Caribbean | 36% | 32% | 18% | 14% |

| Bermuda | 50% | 31% | 12% | 8% |

| Hong Kong | 44% | 37% | 11% | 7% |

| Canada | 74% | 9% | 0% | 17% |