Why start-up managers should consider an alternative route to launching

By Teun Johnston; Carol Ward, Man Group

Published: 28 November 2022

Using third-party infrastructure that is both proven and scalable can be a powerful boost when starting a new fund business.

Introduction

There is very little in a portfolio manager’s career that can compare to the excitement of starting a new hedge fund business. Indeed, the process of striking out on one’s own is the culmination of many years of hard work and good performance. But since hedge funds became established vehicles in the 1990s, the difficulties of raising capital, managing compliance responsibilities, and investing assets successfully, have risen. At the same time, fund businesses must provide a competitive fee structure which offers clients value for money, meaning that the challenges of running a hedge fund business, small or large, have never been higher.

What then, should fledgling fund managers do? In our opinion, the answer is not to duck the opportunity to run their own fund. Instead, managers should look to avoid the burden of administration and increase their prospects of success by considering an established asset manager. In particular, asset managers that offer a multi-boutique model can often deliver the entrepreneurial freedom of a start-up model, with the institutional benefits of a scaled business. By joining an established asset manager which provides product development capabilities, full trading, and research infrastructure, as well as sales, administration and compliance support, managers can avoid the pitfalls of striking out their own, while still giving themselves the chance to shine as investors and focus on what they do best: delivering alpha for clients.

The headache and the cure: economies of scale in asset management

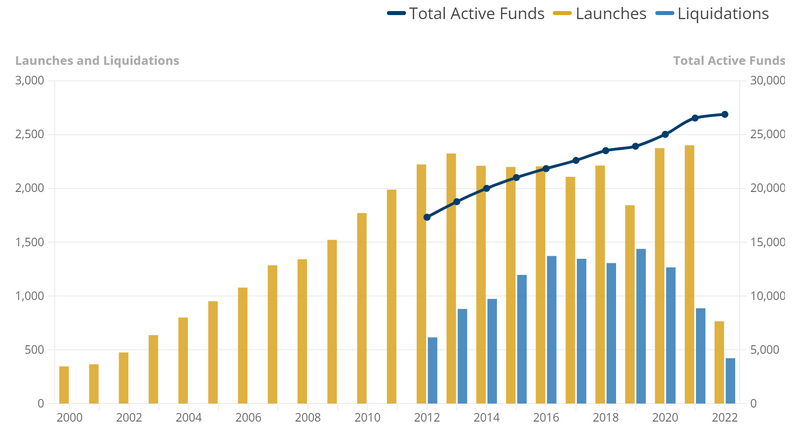

Setting up an independent fund means that portfolio managers are also setting up a small business. Like all small businesses, hedge funds have a high failure rate. Over 11,000 hedge funds have liquidated over the last decade. For every two funds that launched one fund entered liquidation (Figure 1). While this refers to funds rather than management firms, it is indicative of the challenge that managers face. As seen in 2022, periods of significant market volatility add to the challenge as many managers have struggled to deliver performance, which may trigger additional liquidations.

Put simply, the skills required to run a fund management business go well beyond the skills required to manage money.

Figure 1: Hedge fund launches and liquidations

Source: Preqin; as of October 2022

This point is reinforced by the contraction in hedge fund fees over the past decades. In a world where 2 and 20 is no longer the norm, it is harder for smaller funds to consistently compete, with lower revenues sparking a negative cycle of lower reinvestment in the business.

While difficulties for new fund businesses have never been greater, there are many economies of scale to be had within asset management. While generating alpha will always remain a test of an investor’s skill, new managers may well be able to mitigate some of the costs of running a fund. We see the major challenges that new funds contend with as being focussed around three core areas:

Challenge 1: sales and distribution recruitment

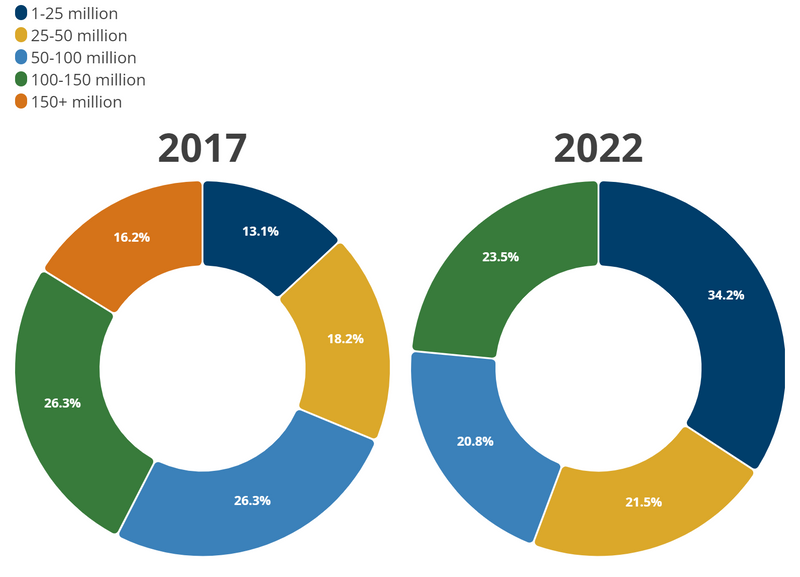

The first challenge is the need to recruit a sales and distribution operation, which will then require time to bed in and develop relationships with investors. Finding salespeople is no easy task: relationships with institutional investors take time to build, and not every new hire will be able to easily transfer their network to their new role. This in turn increases the amount of dead time in between starting a fund and beginning to trade, as the time needed to gather assets is increased. A recent study by AIMA[1] indicated that start-up hedges funds are taking longer to scale to US$100 million AUM (widely seen as a key threshold for funds looking to attract a wider variety of capital investment). The study found that 50% of funds that are five years or older are below US$100 million AUM, versus 38.9% in 2017.

There are a few ways around this problem. Investment banking capital introduction teams can play a key role in helping new managers to get off the ground and giving them a platform to showcase their edge to clients. The alternative is bypassing the issue entirely. By joining an established asset manager that offers a multi-boutique model, new funds immediately benefit from the relationships of an established sales team, making the process of gathering assets quicker and easier. Such firms typically have relationships with a vast number of clients globally thus ensuring the broadest possible distribution is available to new managers. Furthermore, an established firm will typically contribute seed capital, which allows managers to hit the ground running through the allocation of internal capital to begin establishing a track record – of huge importance over the life of a fund.

Challenge 2: building fund management infrastructure

The fledgling fund must also put in place the operations personnel and infrastructure required to begin trading. Good risk management is a core part of successful investing and cannot be neglected. This requires both experienced staff and good technology systems, neither of which come cheap.

Likewise, fund accounting and administration systems and staff must be put in place, and relationships with brokers and counterparties established. As with a salesforce, there are significant economies of scale to be had in this area. Thankfully a number of high-quality outsourcing solutions have emerged in recent years which significantly ease the cost for start-up managers. A strong COO type role is typically needed to oversee these functions to ensure that the running of the business doesn’t detract from alpha generation. Interestingly AIMA have found that the breakeven point for start-up managers in terms of AUM has reduced in recent years (Figure 2) driven by increased use of outsourcing and the ability to run with smaller internal teams. It also reported however that there is significant regional dispersion in the underlying analysis, with the breakeven AUM greater in the UK than in other regions globally (Figure 3).

Figure 2: breakeven point for start-up fund managers

Source: AIMA; as of 2022.

Source: AIMA; as of 2022

Established asset managers enjoy the benefits of economies of scale in non-investment functions such as compliance, legal, human resources, operations. In addition to allowing investment teams to focus on alpha generation this comes with the benefit of providing institutional clients with comfort around established operational due diligence criteria, an area that can be a challenge for start-up managers.

Economies of scale can be extended to administrative functions such as compliance, legal and human resources. The regulatory landscape is constantly evolving, and it is critical that investment firms respond well to regulatory change to fulfil their fiduciary for clients. Given the continuing evolution and complexity of the regulatory environment, this also can he a challenge for start-up managers.

Critically, established managers typically ensure full independence between portfolio management teams and investment risk. In addition to providing a ‘second pair of eyes’ and constructive challenge, well-formed risk teams play a proactive role in stress testing portfolios and scenario modelling ahead of key market events – all of which play a key role in protecting client returns. This can often be a challenge for start-up managers which lack funds to invest in innovative tooling and where the risk function lacks independence (as the portfolio manager is often the head of the business).

Challenge 3: alpha decay

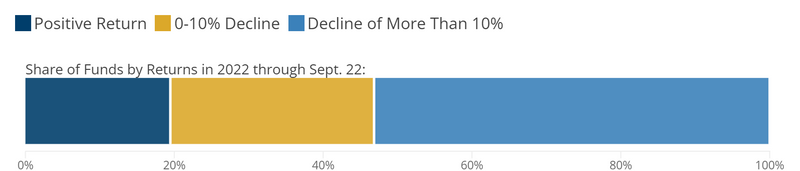

2022 has been a year that has demonstrated the challenges for many hedge funds in delivering consistent performance. While many hedge funds protected investors on the downside, there has been significant dispersion in the industry, and it has been a year where many of the hedge fund ‘darlings’ have slipped.

Figure 4: hedge funds by performance

Source: Bloomberg

In a world where quant managers are becoming increasingly sophisticated, the delivery of consistent alpha requires continual investment in all areas that drive and protect performance, such as data, research, analytical resource, risk management resources or behavioural analytics. This applies to both quant and discretionary investors. To maintain an edge, managers must continually enhance and review their investment process and prevent alpha decay.

Scaled asset managers can offer benefits of scale in terms of innovation and alpha generation. From incorporating quantitative support into discretionary investment processes, to ensuring that funds can benefit from the latest ESG research, to having access to the latest data sources. By pooling resources between portfolio managers, larger platforms are able to ensure their teams have access to the data, tools and research they need to generate alpha. Again, this requires capital investment: trading platforms to minimise slippage, global datasets, proprietary research and analyst support all cost money. This is not necessarily something which is easy to achieve in a smaller business where revenues may not be high enough to enable such spending. Furthermore, by working within a larger fund platform, managers have the opportunity to collaborate and share expertise with colleagues.

Conclusion

The last ten years has seen something of a winnowing of hedge funds. Lower fees, increased competition, increased regulation and more selective clients have all made it harder than ever to run a successful fund business – even if performance itself is not the issue.

Fortunately for the next generation of portfolio managers, alternatives exist. Multi-boutique asset managers offer economies of scale, sales and distribution, and middle and back-office operations and infrastructure. Most importantly however, they offer managers crucial support in areas directly relevant to generating alpha, investing in research and technology capabilities to keep portfolio managers ahead of the competition. Instead of focussing their energy on running their own business, managers should conserve their energies for what they do best – running money – and leave the operational headaches to someone else.