Foreword

When you strip away the lively discourse around the outsized returns that some alternative investment fund managers can generate, the proactive efforts to align their interests with their investors are arguably the most attractive aspect of their offering.

The entwining of the personal prospects of principals and those that entrust their capital to them is baked into the DNA of alternative investment fund structures, and the most successful managers are those that are most in sync with their clients’ demands.

The core of this ethos is demonstrated by the increasingly large amount that these fund managers have in their own firm’s success. Not only principals but other key staff are also expected to have their capital in the fund as a way of demonstrating to their firm and underlying investors that they are committed to the mission.

Every aspect of the GP/LP offering from the fee model and performance incentives to the products offered includes characteristics designed to ensure that when the fund manager does well, the investor does well, and the fund manager only does well when the investor does well.

Of course, what an optimal model of alignment looks like is a moving target and competition among fund managers and the changing mandates of investors are drivers of change. This evolution has been tracked by AIMA for almost a decade and this third iteration of market research seeks to identify how the key trends are changing.

We would like to thank AIMA’s research committee and its Global Investor Board for their valuable input and for taking the time to discuss these findings. We would also like to thank the various managers who provided the number of testimonials included throughout this paper. Finally, we thank you for your time in reading this paper.

We hope you enjoy it.

-

Tom Kehoe

Managing Director, Global Head of Research and Communications

-

Jonathan Waterman

National Asset Management Leader, RSM US

Executive Summary

Part I. Aligning interests: The fundamentals

For managers, having significant personal capital invested in their fund remains central to reassuring their investors that their interests are aligned. This strong foundation to the relationship is now being built upon the application of greater transparency around the portfolio to facilitate more granular attribution analysis by investors, as well as more flexibility around fees and expenses and other aspects of the business.

Part II. The modern fee model

After years of downward pressure on fees, many investors and fund managers have settled on a new fee model that emphasises rewarding fund managers that can consistently deliver strong performance, albeit with more stringent hurdles to clear. In turn, managers have had to innovate how they charge fees and manage expenses through the use of new product structures and share classes that reward longer lock-up periods in exchange for fee discounts. While management fees remain below the historic 2% level, rising operational costs are being supplemented by more fees being charged to the fund pass-through to investors.

Part III. Innovating to maintain alignment

Fund managers are innovating their offering to win and retain investors with new fund structures and the launch of new products. Specifically, the increasing popularity of co-investment products in the hedge fund space may be providing the ideal vehicle for aligning interests. Relationships are being further deepened through strategic knowledge sharing and sophisticated conversations around complex issues incorporating ESG and responsible investment to the investment experience to ensure investors and their managers are aligned.

Part IV. ESG: adapting to the changing landscape

Responsible investment has entered a new phase. The macroeconomic headwinds of the moment are demanding a more nuanced ESG strategy that transcends binary exclusion lists and is only applied where relevant.

Methodology

This paper represents the latest research by AIMA to shed light on the relationship between GPs (fund managers) and LPs (investors), with the aim of identifying where the needs of investors are being met and the extent to which the priorities of both parties align.

We previously focused on this topic in 2019 in the report In Harmony and this paper offers a time series analysis of how trends have changed since then.

Where we have included previous analysis, these are referenced by the symbol of an hourglass.

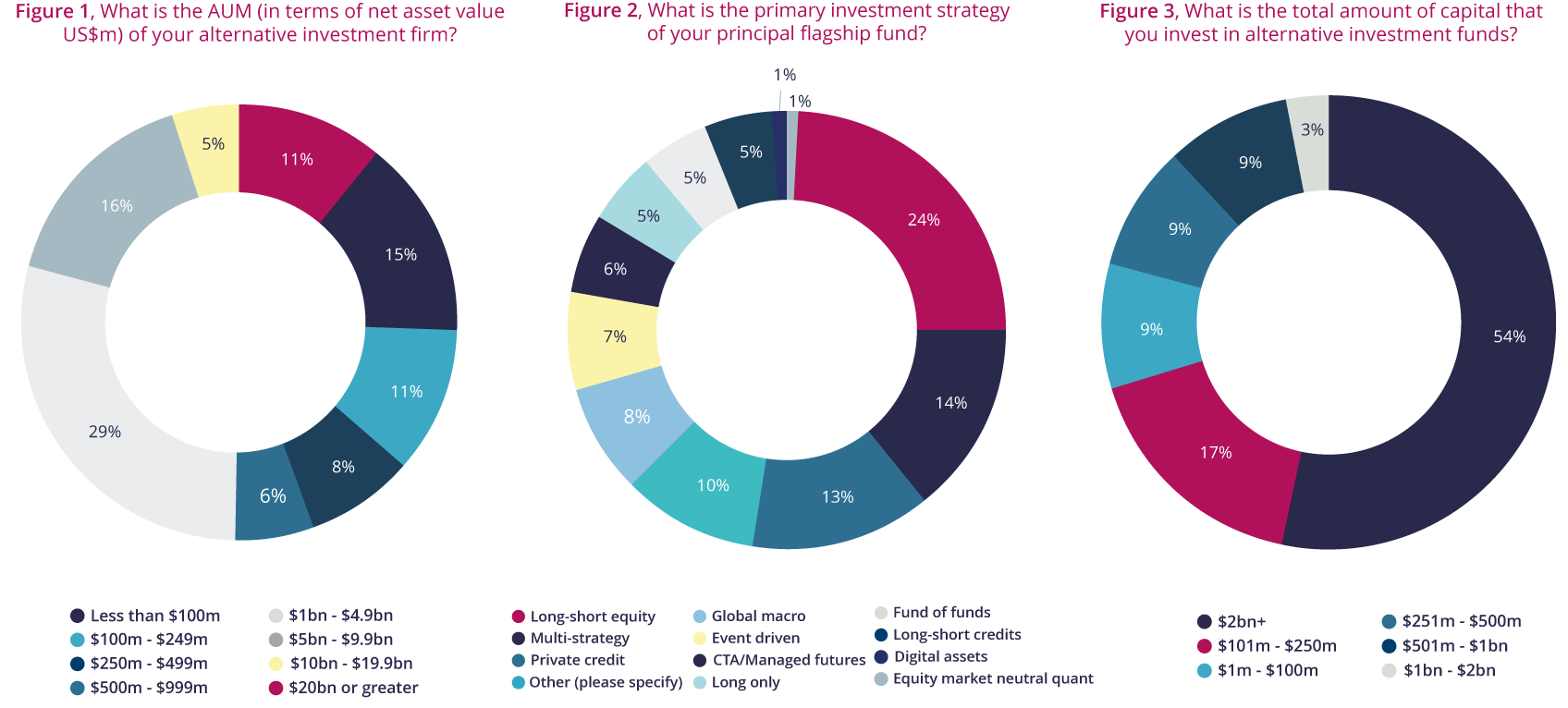

The paper is built upon the findings of a survey of 138 alternative investment fund managers with an estimated aggregate of $707 billion in assets under management.1 The average AUM of fund managers surveyed is $5 billion, up from $3.7 billion in 2019, (see figure 1).

Broken down by strategy, a quarter of all fund managers surveyed are long-short equity managers, with 14% multi-strategy managers and 13% are private credit managers, (see figure 2).

Respondents are divided by size (see figure 3). Where we refer to larger managers, these include managers with more than $1billion AUM and those with AUM of less than $1billion are referred to as smaller managers. The fund manager survey is complemented by a separate survey of 35 institutional investors that allocate to alternative investment funds to get their perspectives on key opportunities for alignment of interests. More than half of these investors allocate more than $2 billion to alternative investment funds, while the average is $1.3 billion.

The conclusions drawn in this report are primarily based on the data from these surveys and enhanced by trend analysis by managers and investors who were interviewed after the survey closed.

1 The surveys took place during H2 2022

The Long-Short Podcast

The Long-Short is a podcast by the Alternative Investment Management Association, focusing on the very latest insights on the alternative investment industry.

Each episode will examine topical areas of interest from across the alternative investment universe with news, views and analysis delivered by AIMA’s global team, as well as a host of industry experts.

AIMA in partnership with RSM recently published a new report loaded with compelling data points into the fascinating world of fund manager and investor alignment.

This week, Scott Mackey, Partner at RSM, joins us to decode the report's findings and explore the ever-evolving landscape of how hedge funds achieve alignment with investors to foster long-term strategic partnerships.

Listen to this episode and subscribe on Spotify

Listen to this episode and subscribe on Apple Podcasts

Listen to this episode and subscribe on Google Podcasts

Listen to this episode and subscribe on Amazon Music

The trascript is available here.

Disclaimer

This podcast is the sole property of the Alternative Investment Management Association (AIMA). This audio production and content are intended as indicative guidance only and are not to be taken or treated as a substitute for specific advice, whether legal advice or otherwise. AIMA permits use or sharing of the content in media or as an educational resource, provided always that proper attribution is made. The rights in the content and production, including copyright and database rights, belong to AIMA.

Download the report

Members with a log-in should log-in here to be provided with a download link to the Report

Availability for non-members

Most of the guides AIMA produces are available solely to AIMA members. This report, by contrast, is available for download by both members and non-members.

This report is representative of the types of reports and guidance AIMA produces for the benefit of members. We hope readers will find the information in the report to be helpful.

For more information about the report please contact Tom Kehoe, Managing Director, Global Head of Research and Communications.