Foreword

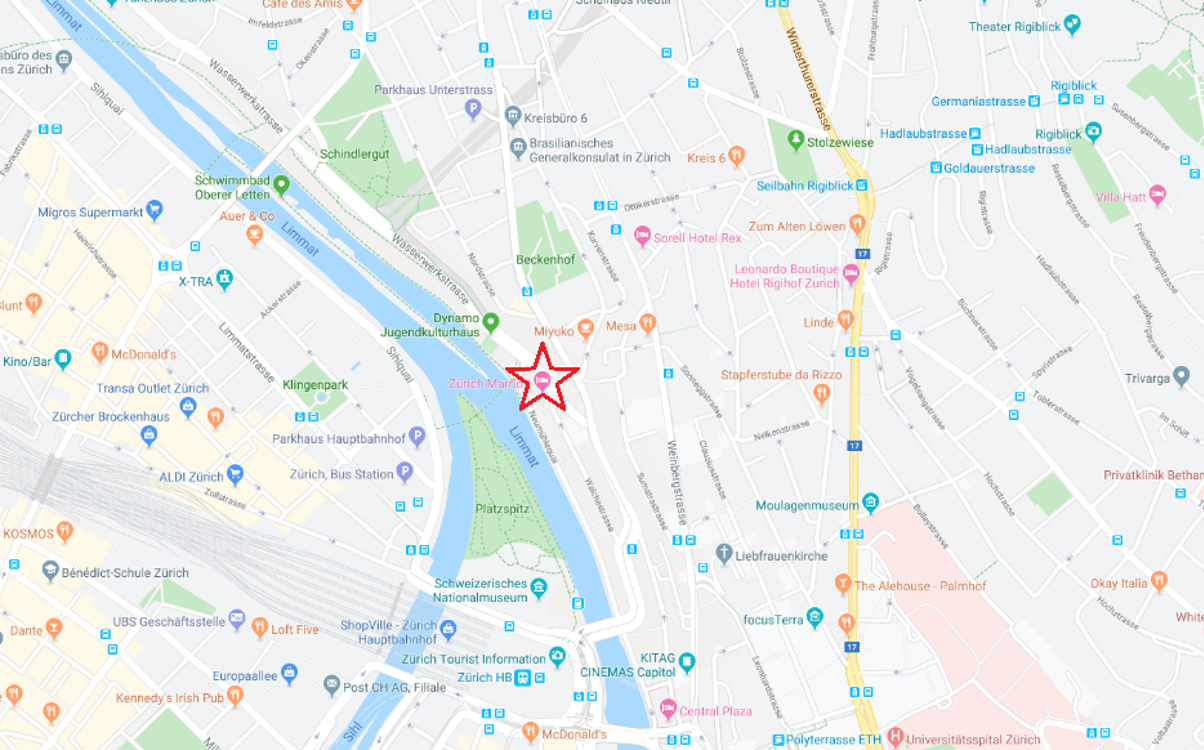

AIMA and the Alternative Investment Council “AIC” of the Swiss Funds & Asset Management Association are delighted to invite you to the Swiss Investing Forum, held in Zurich on the 25 February 2020.

This half-day investor-event featuring a host of industry leaders explores the nuts and bolts around allocating to alternative investments, including new industry insights and latest trends.

The programme includes a panel discussion asking where the smart money is being allocated, as well as a presentation on the latest trends in alternative investments, and a keynote speaker from a lead investor in the region.

Attendees can take advantage of the opportunity for peer-to-peer education as well as widen their networks with lasting industry connections.

This event is off the record.

Agenda

10:30 Registration

11:00 Welcome - Jack Inglis, Chief Executive Officer, AIMA

11:05 Opening remarks - Régis Martin, Chairman of the Alternative Investment Council, SFAMA

11:10 Overview of Alternative Assets Today and Outlook for 2020 - Amy Bensted, Head of Hedge Fund Products, Preqin

11:25 Keynote: Alternative investments in a Swiss pension fund - Georg Wessling, PhD, Senior Portfolio Manager Alternative Investments, Roche Pension Fund

11:45 Research presentation: A quantitative approach to Private Equity Fund selection - Natalia Sigrist, Partner, Private Equity, Unigestion

12:05 Alternative Data and its impact on Derivatives markets - Stewart Jardine, Director, Head of Market Technology & Data Services, EMEA & APAC, CME Group

12:25 Panel discussion: Where is the smart money going and why?

Alternative investment managers and Institutional investors discuss the latest allocation trends across public and private markets, from alternative risk premia to private debt and private equity

Speakers include:

- John Argi, Co-head, Alternative Investment Solutions, UBP

- Patrick Bronger, Senior Portfolio Manager, APG Asset Management

- Théodore Economou, Chief Investment Officer, Multi-Asset, Lombard Odier

- Robert Lustenberger, Managing Director, Client Solutions Europe, Partners Group

13:10 Closing remarks - Markus Fuchs, Chief Executive Officer, SFAMA

Speakers

|

John Argi, Co-head, Alternative Investment Solutions, UBP John Argi is co-head of Alternative Investment Solutions at Union Bancaire Privée. He was previously Senior Advisor for Alternative investments in Geneva, focusing on business development for both the institutional alternative business and UBP’s Wealth Management clients. From 2012 to 2015, Mr. Argi was based in New York as a Portfolio Manager for UBP’s alternative products and mandates. Before that, he spent more than three years with the UBP Alternative Investments Global Advisory team in Geneva focused on investments for European and Middle Eastern institutional clients. Prior to joining UBP in 2008, Mr. Argi was an Equity Analyst at Everest Capital covering Initial Public Offerings and European Equities in Miami. Mr. Argi received a BA in Finance and Economics from HEC in Lausanne, Switzerland in 2007. |

|

Amy Bensted, Head of Hedge Fund Products, Preqin Amy Bensted joined Preqin in 2006. Today she heads Preqin’s data products team, guiding Preqin’s strategy and delivery of data services. As Preqin’s hedge fund expert, Amy is a regular contributor of articles and features in the financial press and her research has featured in the Financial Times and the Wall Street Journal as well as in specialist hedge fund media. Amy is also a key-note speaker at several key industry conferences and events each year. Amy graduated from Imperial College London in 2003 after gaining a BSc. in Biology and a MSc. in Applied Biological Sciences. |

|

Patrick Bronger, Senior Portfolio Manager, APG Asset Management Over 20 years experience in the financial industry, including roles as Senior Portfolio Manager Hedge Funds & Alternative Alpha/Sector Head of Macro Mandates at APG Asset Management, Chief Investment Officer and Member of the Executive Board at Conservatrix NV, Head of Investment Strategy at ASR Nederland, Senior Portfolio Manager GTAA & Hedge Funds at Mn Services, Robeco and Hoogovens Pension Plan. Market maker at Eurex. Over 20 years experience as a senior lecturer and researcher at the Rotterdam School of Management and the School of Business and Economics, Vrije Universiteit Amsterda. Over 10 years experience as a Non-Executive Board Member in the healthcare and cultural sector. Experience as a member of several examination committees of the Dutch Securities Institute (DSI). Master of Financial Analysis, Vrije Universiteit Amsterdam (2004); Chartered European Financial Analyst degree (2004); Eurex Exchange Trader Program (1999); Master of Arts in Philosophy, Erasmus University Rotterdam (1994) |

|

Théodore Economou, Chief Investment Officer Multi-Asset, Lombard Odier Investment Managers Théodore is CIO, Multi-Asset for Lombard Odier Investment Managers, and chairs the investment committee of the Lombard Odier pension fund. He has experience in both asset management and as an asset owner in the US and Europe. Prior to Lombard Odier, he was CEO and CIO of the CERN Pension Fund, where he initiated a risk-based approach that became known the CERN model. Previously he managed capital markets activities and investments for ITT Corporation, a New-York conglomerate, where his initial responsibilities were in mergers & acquisitions. He started his career at Accenture. In 2013, he received HFR’s award for “Outstanding contribution to the alternative investment industry by an institutional investor”. He holds an MBA from Northwestern and an MSc from the Swiss Federal Institute of Technology, and is a CFA Charterholder. |

|

Markus Fuchs, Chief Executive Officer, SFAMA Markus Fuchs has been working in the fund and asset management industry since 1992. He built up and headed the Products & Fund Services team at Bank Hoffman, a subsidiary of Credit Suisse in the nineties. From 2000 until 2004 he headed the fund product management team of Swiss Life as CEO of Swiss Life Funds AG. He then joined UBS AG as a Managing Director (Global Wealth Management & Swiss Bank / Products & Services) where he had the overall responsibility for proprietary hedge fund products. In November 2010 he joined the Swiss Funds Association SFA as a Senior Counsel, namely in charge of the areas asset management and alternative investments. In July 2013 he became the Managing Director of SFA, which since then operated under the name Swiss Funds & Asset Management Association SFAMA. He obtained a degree in Economics from the University of Zurich and an Executive MBA from the IMD International Management Development in Lausanne. Markus Fuchs is a Member of the Board of Directors of the European Fund and Asset Management Association (EFAMA) in Brussels and Vice-President of the Swiss Fund Data AG. He is also member of various Working Groups of the International Investment Funds Association IIFA In Toronto. |

|

Jack Inglis, Chief Executive Officer, AIMA Jack Inglis is the Chief Executive Officer of the Alternative Investment Management Association (AIMA*). He has been in the financial services industry and closely involved with hedge funds for over 30 years. He has held senior management positions at both Morgan Stanley, where he served for 16 years, and Barclays, where he was prior to joining AIMA. From 2007 to 2010 he was CEO of London based hedge fund manager, Ferox Capital Management. Jack served as a non-executive director of London Capital Group plc from 2007 to 2010 and currently sits on the board of the Chartered Alternative Investment Analyst Association (CAIA). He began his career in 1983 at UK stockbrokers James Capel (which was subsequently acquired by HSBC) and has extensive experience in origination, distribution, financing and trading across the fixed income and equity capital markets. Jack holds a Master of Arts in Economics from Cambridge University. |

|

Stewart Jardine, Director, Head of Market Tecnology & Data Services, EMEA & APAC, CME Group Stewart Jardine joined CME Group in June 2015 and serves as Director, Head of Market Technology & Data Services, EMEA & APAC. Stewart is responsible for sales and business development efforts for the company’s portfolio of data and technology products across all customer segments within the EMEA and APAC regions. He is also CME Group’s FinTech lead for EMEA, with responsibility for driving commercial engagements across Artificial Intelligence, Alternative Data, Cloud, Blockchain and other emerging technologies. Prior to joining CME Group in 2015, Stewart was Global Head of Business Development for TradeNet, a wholly owned subsidiary of TradingScreen. During his time at TradeNet he helped to launch the world’s first fully-automated financial extranet. Before TradingScreen, Stewart worked with BT Global Services where he held various roles including Head of UK Sales for BT Radianz. Stewart holds a First Class Bachelor of Science Degree in Computing & Management Sciences from the University of Warwick. |

|

Robert Lustenberger, Managing Director and Head of Client Solutions Europe, Partners Group Robert Lustenberger is part of the European Client Solutions business unit, based in Zug. He has been with Partners Group since 2004 and has 32 years of industry experience. Prior to joining Partners Group, he worked at Julius Baer Asset Management AG, Vontobel Asset Management AG and Luzerner Kantonal bank, where he led the team for institutional clients in Switzerland. He holds a master's degree in economics from the University of St. Gallen (HSG), Switzerland. |

|

Régis Martin, Chairman of the Alternative Investment Council, SFAMA Régis Martin is the Group Deputy Chief Executive of Unigestion and the Chief Executive Officer of Unigestion (UK) Ltd. He is a member of Unigestion (US) Ltd. Unigestion (UK) Ltd. Unigestion Asia PTE Ltd. Unigestion Asset Management (France) SA and Unigestion Asset Management (Canada) Inc. boards of Directors. He joined Unigestion in 1994. He has also served as Group Chief Financial Officer since 1999. Régis supervises the teams included in Unigestion’s Service Platform (IT & Logistics, Finance, Legal, Compliance, Risk Management, Operations, Human Resources). Régis previously worked as a corporate auditor at KPMG for three years. Régis holds a Masters in Science from the University of Lausanne, Switzerland and has also completed a number of executive education programs at the London Business School and in leadership (High Performance Leadership) at the IMD Business School in Lausanne. He also holds a certificate from the Swiss Board School (Swiss Board Institute). He is the chairman of the Alternative Investment Council (AIC), an Expert Committee of the Swiss Fund & Asset Management Association (SFAMA). |

|

Natalia Sigrist, Partner, Private Equity, Unigestion Natalia Sigrist, Partner Private Equity, leads the “digitalization” of Unigestions’ business, with projects across investment activities. Natalia is a member of the advisory board of several private equity funds. She joined Unigestion in 2017 with the integration of Akina into Unigestion’s private equity unit. Natalia began her career in 1998 at PricewaterhouseCoopers in Russia as a tax associate where she was advising mainly global IT and telecommunications businesses on their domestic and international tax optimization. Furthermore, she was involved in a number of M&A transactions and operational restructurings of major international corporations post the Russian crisis of 1998. In 2004, Natalia assumed a Project Manager role at Banca del Gottardo (today absorbed by EFG through a series of M&A) in Switzerland to develop the international expansion strategy in the CEE region and contribute to the internal restructuring process of the bank. Natalia’s professional experience also includes quantitative research and modelling for FX trading, starting and running a business in the education sector, strategy consulting for start-up firms and non-profit organisations. Natalia holds an MBA from The Ohio State University’s Fisher College of Business in Columbus (OH), USA and an MSc in Economics from the International University in Moscow, Russia

|

|

Georg Wessling, PhD, Senior Portfolio Manager Alternative Investments, Roche Pension Fund Georg Wessling, PhD, is a Senior Portfolio Manager Alternative Investments and a member of the Pension Asset Management team at F. Hoffmann-La Roche Ltd. (Roche). He is responsible for investments in foreign real estate, private equity, hedge funds and insurance-linked securities on behalf of Roche’s Swiss pension funds. Before joining Roche in 2017 he has been for 12 years with Vontobel Asset Management’s hedge fund division (former Harcourt Investment Consulting) in various roles managing and advising hedge fund portfolios. Between 1995 and 2004 Georg was an Investment Consultant with Zurich-based Ecofin Investment Consulting. In 2004 he received a PhD from Zurich University with a thesis on solvency insurance and investment policy of pension funds. |

Registration

This event is complimentary however an invite code is required for all bookings.

If you are interested in attending the forum and you are not an AIMA or SFAMA member, please contact us at [email protected].

Restrictions may apply.

Sponsor

CME GROUP and CME GROUP GLOBE are trademarks of Chicago Mercantile Exchange Inc. and have been licensed by AIMA for use in connection with the AIMA & SFAMA Swiss Investing Forum. Any services offered by AIMA are not sponsored, endorsed, sold or promoted by Chicago Mercantile Exchange Inc. or its affiliates and none of them makes any representation regarding any such goods or services.

Event Partner

In collaboration with the Alternative Investment Council “AIC”

The Alternative Investments Council was initiated in 2006 by its founding members and became an expert committee of the SFAMA in 2007. Its members are amongst the business leaders in the alternative investments in Switzerland.