The next big thing after Bitcoin

By George Salapa, Bardicredit

Published: 27 September 2019

The most successful application of blockchain, so far, has been Bitcoin. This is what blockchain excels at - recording transactions and tracking who owns what without the involvement of a middlemen.

It is this attribute of blockchain that will have far-reaching consequences for the socio-economic order that we live in. Our mistrust in other people (and our fallibility) begs for costly layers of intermediation and the necessity for authorities 'for the authorities' sake'.

Security Token Offering (STO) is the issuance of tokens on blockchain which represent real assets, equity, debt or future profit rights. Unlike traditional ownership rights like stocks or bonds, they are intelligent because they have inbuilt rules and actions that are performed automatically. Imagine a stock with automated dividends. Sounds like a true improvement, right?

Well, despite this, STOs suffer from being compared to ICOs - the now infamous fundraising campaigns that operated through the creation of new crypto-coins. STOs are often confused with ICOs, or - even worse - seen as the last-ditch effort by companies that missed the ICO bubble to raise some dough.

This is wrong. Right after the digital payments, STOs could be the next best application for blockchain. STOs are about using blockchain to represent and transact ownership rights. Present day securities are non-intelligent pieces of paper that are at best converted to an electronic copy. They cannot perform any actions independently. Someone has to do all the sending, receiving, storing and clearing around transactions of conventional securities.

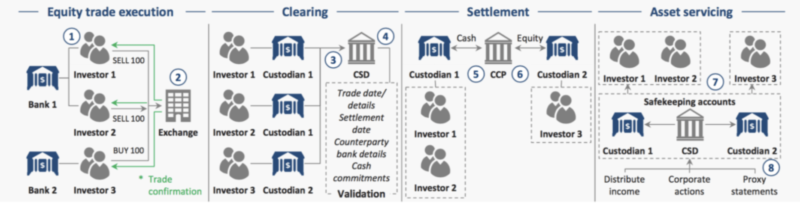

To buy or sell a stock, people need a system to keep track of who owns what. At present, financial markets accomplish this through a complex net of brokers, exchanges, central security depositories, clearing houses, and custodians. Add a layer of complexity on top, in that stocks are represented in electronic format.

When someone buys or sells a stock, that order is executed through a whole bunch of middlemen and third parties. Each step of the stock transaction, from trade (sending order to the exchange), through clearing (moving stock from one custodian to another) and settlement (cash transfer) to stock servicing (safekeeping, dividends, voting) involves multiple parties, each of which has to communicate with another in a complex network. Each party maintains its own version of truth in its own ledger.

So, what's the problem? After all, there is nothing wrong with complexity as long as it works, right?

Well, that's the thing - it sort of doesn't. The mechanism described above somehow evolved from the old system of paper ownership, which was later enriched by the element of electronic trading. Not only is it inefficient, but also prone to errors, which can lead to (nearly) unsolvable problems.

The case of Dole Food Co. illustrates this rather well. Matt Levine brilliantly explains how it is possible that the company had at one point some 12M extra shares. For one, when a company is undergoing larger transaction (like a merger), DTC stops tracking trades in the company's stock because it would be too hard. DTC 'places a chill on the stock'. The stocks are still being traded, of course, but DTC doesn't want to know about it. It is the responsibility of the brokers, custodians and other DTC participants to maintain some order.

Things got even worse thanks to short selling. Short selling involves selling a 'borrowed share'. The present day financial markets account for this by recording two positive shares (the original owner whose broker lends their share and the buyer who buys the borrowed share) and one negative share (the short seller). To make this work, the short seller has to pay dividends (and other payments) to the holder of the 'extra' stock.

Errors of this convoluted system (otherwise called financial markets) have become apparent when several years after the merger had taken place, court ordered that the acquirer should pay extra consideration to original shareholders who held the stock at the time of the merger. And as it turned up, there were suddenly too many shares. It was up to the brokers to figure out who owns what 'really' and how to split the extra consideration. In many cases this was impossible.

Many short sellers yelled in protest, or they were simply no longer there to pay up the missing money to those who held the 'extra stock'.

A distributed common ledger to keep track of who owns what in the real time would make a lot of this much easier. Aside from the fact that it would eliminate the inefficiency - the necessity to go back and do the forensic work to identify the rightful owners - blockchain is ‘humanless’ and that can be a good thing. Sure, the brokers would still have to call up the short sellers from years back, but they would have little grounds to object because blockchain doesn't make mistakes.

Security tokens bring the promise that many of the functions laboriously performed by multiple middlemen can be automated away. They are a more intelligent version of ownership rights - digital programs in place of paper. They have inbuilt rules and actions, which they perform automatically.

But there is more. STOs can do to private investments what P2P lending platforms did to private debt markets after 2008. People loved the idea of being able to lend directly to a small shop or just to another person to finance his/her business idea. It felt good to be completely in control of your own capital.

Thanks to the automation described above, STOs can become a new way to facilitate flow of capital. Investments like a premium building in Manhattan have historically been available only to a few super-rich. Now, STOs have the potential to transform investing in private assets into a 'one-click' experience from anyone's desktop. Investor and territory restrictions can be 'encoded' in the token with smart contracts, as can be the asset servicing functions like dividends.

Ownership of premium assets like buildings, yachts, cars, or even just private unlisted companies can be divided across much larger audience of investors with much less paperwork and virtually no involvement of the costly middlemen.

The potential is large, but the market is still very nascent. STOs are like building a highway on top of another one. On more than several occasions, security tokens replace the existing infrastructure of the present day financial markets, yet people are understandably trying to fit them into the current legal and regulatory frameworks.

Undertaking an STO can be a costly endeavor. Often, companies that are planning to do an STO end up hiring an armada of lawyers and sink into a lengthy correspondence with regulator to learn (create) the process. Fortunately, first 'proto' advisory shops are emerging to advise entrepreneurs and companies on how to do STOs properly.

It will be many years before security tokens can replace the volume and liquidity of traditional securities, but even in their present form, STOs (when done properly and legally) can be an innovative, paperless and seamless way of connecting investors to premium, alternative projects, which have historically been only accessible to a few super-rich.