New research quantifies benefits of outsourcing

By Elaine Chim, Apex group

Published: 20 September 2022

As private equity continues to attract institutional capital, funds are outsourcing to their trusted partners to overcome resource and technology pain points.

According to Preqin’s Global Alternatives Report 2022, assets under management by private markets funds are set to climb to over US$23 trillion by the end of 2026 - with private equity (PE) and venture capital accounting for almost half of that sum.

Accordingly, many PE firms are looking for growth opportunities through diversification of their investment strategies and/or expansion into international markets. But this comes with an additional set of operational pressures.

Here we explore the biggest growth challenges facing PE firms in 2022 and reveal new research which quantifies the costs and resource benefits of using an outsourced third-party partner to alleviate these resource constraints and achieve greater efficiency.

Filling talent gaps

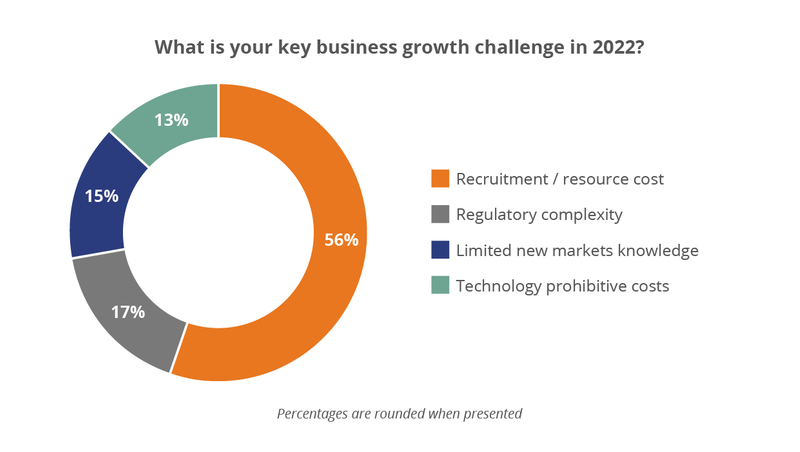

A recent LinkedIn poll by Apex Group revealed that the biggest growth challenge for PE firms in 2022 was recruitment and resource cost (56%). This was followed by managing regulatory complexity (17%), then having limited new markets knowledge (15%) and lastly, technology prohibitive costs (13%).

Trying to maintain and build a fixed headcount in-house with the right skillset can be challenging and costly in the current environment. This is particularly pertinent given that finding and retaining talent is one of the key success factors to scaling.

Drawing on a third-party service provider that has a global footprint can act as an extension of the fund team, sourcing talent via their global footprint to achieve greater flexibility and efficiency. By outsourcing the heavy lifting of often repetitive or administrative tasks, the funds’ employees are freed up to focus on high value projects and core investment objectives.

In addition, seeking growth through expansion into new markets can be a minefield of challenges for firms that don’t have the knowledge in place to deal with local regulations and processes. A global partner, with people on the ground, can ensure firms respond quickly to any regulatory requirements and are compliant wherever the next opportunities lie.

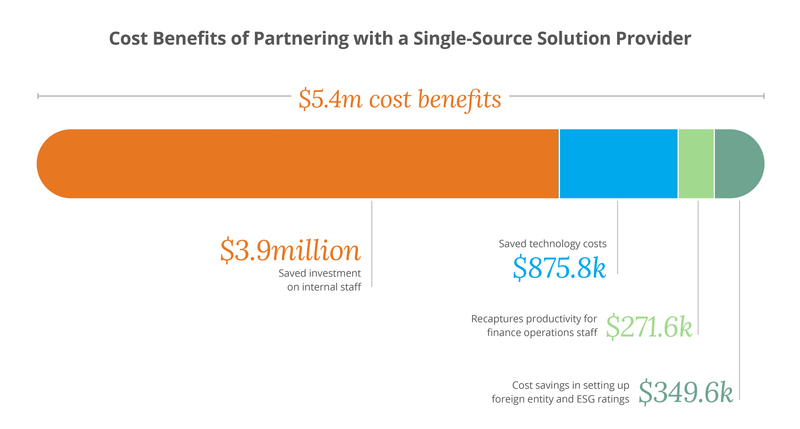

Those PE firms that took part in Forrester Consulting’s Total Economic ImpactTM study saved on average US$3.9 million on internal staff costs over a three-year period by drawing on a service provider’s single source solution. This equated to an estimated average saving of four to five full-time staff per fund by working with an independent service provider.

Technology stacks up

When it comes to unlocking value, it is no surprise that PE firms are turning to data solutions, technology providers and third-party experts to leverage the benefits of cutting-edge tools.

As in-house expectations of what can be accomplished with data increase, so too do the expectations of investors. Increasingly, they are calling for full transparency, especially on factors such as risk management and contextual market data. Coinciding with this has been the rise of ESG, further contributing to the complexity of the metrics investors are demanding transparency on.

Technology is becoming central to successful operations, bringing benefits across a range of functional areas, with PE firms finding that poorly integrated legacy technology stacks simply cannot perform many of the functions that their investors are calling for.

The right partner can provide access to the latest industry leading technologies that can be tailored and integrated to specific needs. A recent Apex Group poll of asset managers found 62% view having access to leading technologies as being the most immediate benefit of seeking third-party support.

By leveraging integrated technology, a single-source provider can deliver the tools and expertise to help achieve success. Forrester Consulting found that over three years, the PE firms interviewed were able to make savings of around US$876,000 by leveraging on technology. This efficiency not only came through reduced expenses on license fees, but from the implementation and ongoing management of the technology stack as well.

The benefits of partnering with a single-source solution provider

Many private markets managers are now following what hedge fund managers have done for a while by turning to trusted partners for additional business support and guidance, not only for back-office functions, but for front office too.

Whether firms are looking to scale up or down, using a service provider delivers the flexibility of being able to access leading technology, manage resource levels and add necessary skillsets quickly and easily.

The Total Economic ImpactTM report by Forrester Consulting has shown that PE firms that have partnered with a single source solution provider can achieve an average return on investment of 105% and total cost benefits of US$5.4m, with a net present value of US$2.75m over a three-year period.

This shows that there are clear and quantifiable benefits of drawing on a dedicated, external financial or operational resource. The right partner can help improve efficiencies, control costs – particularly human capital and technology expenditure – and ease the burden of managing increased regulatory and investor reporting requirements.