From niche to norm: Impact investing in agriculture continues to rise as investors recognise the opportunities associated with funding the future of food

By Giulia Schuck, INOKS Capital SA

Published: 19 June 2023

Over the past two decades, impact investing as a whole has gained traction, driven by the recognition of pressing global challenges and the potential for positive social and environmental impact alongside financial returns. The Global Impact Investing Network (GIIN) defines impact investments as those made with the intention to generate measurable social and environmental impact.1

As with other sectors, impact investing in agriculture should deliver much more than financial returns. It should aim to tackle any of the multifaceted challenges in order to contribute to building a sustainable food system capable of feeding the world’s growing population while improving food security and nutrition; and reducing the carbon and water footprint. Capital flowing into food and agriculture value chains in emerging markets plays a crucial role in driving private sector economic growth in regions that need it the most.2

However, the need for sustainable agricultural practices is not limited to emerging markets. Developed markets within Europe also face considerable sustainability challenges, despite significant funding through programmes like the Common Agricultural Policy (CAP). Following reform, the EU’s new farm deal was implemented from January 2023, worth €386.6 billion, reflecting the ongoing commitment to the sector, but highlighting the need for greater alignment and sustainability focus.3

Additionally, it is well-known that the agricultural sector, in its current form, is a major contributor to climate change and impact investments should contribute to adapt and mitigate its effects. With approximately one-third of human-caused greenhouse gas emissions linked to food production, there is a pressing need to rethink and transform food production methods. This transition requires substantial investment in sustainable practices, technologies, and infrastructure.

The evolution of impact investing in agriculture has been remarkable, and the sector is expected to continue expanding.4 More institutional investors are expressing interest in the sector, recognising the potential for financial returns alongside the opportunity to create positive social and environmental outcomes.

Market overview: impact investing and the agricultural sector

According to the Global Impact Investing Network (GIIN), the market counts over 3,349 organisations managing US$1.164 trillion in impact investments as of 2021.5

Furthermore, the impact investing market research report from The Business Research Company highlights the market’s impressive growth, with a compound annual growth rate (CAGR) of 17.8% between 2022 and 2023.6

Within the global market estimated by the GIIN, Swiss impact investing specialist Tameo estimates that US$84 billion is invested in private asset impact funds focusing on emerging and frontier markets. Its 2022 Private Asset Impact Fund (PAIF) report identified 672 funds run by 346 fund managers. The impact sector of food and agriculture represents merely 8% of funds’ portfolios, where about 50% is dedicated to microfinance and 24% to SME development.7 The sector’s investor composition is dominated by institutional investors (59%), followed by almost 30% public funders and about 15% retail and HNWIs.

The number of investment funds specialised in the sector keeps rising. In 2022, there were 730 investment funds specialised in food and agriculture, compared to fewer than 50 in 2005.8 It remains surprising though, given the size of the market, that the number of fund managers in this space is not increasing even more rapidly.

The agricultural sector holds immense potential for impact investors to drive positive change on various fronts. With nearly 900 million people employed in the sector worldwide,9 investing in agriculture can have significant social, economic, and environmental impacts.

The sector’s contribution to the economy is substantial. For example, in the United States, food and related industries make a significant contribution to the country’s gross domestic product (GDP), amounting to approximately US$1.264 trillion in 2021.10 This highlights the economic value generated by the sector and underscores the opportunity for impact investors to support and enhance its sustainable growth.

Similarly, in Europe, the farm sector’s value goes beyond agricultural production. With a multiplier effect, each euro spent in the sector generates an additional €0.76, contributing to the gross value added of over €178.4 billion for the EU economy.11

This demonstrates the interconnections between agriculture and the broader economy, emphasising the potential for impact investments to foster economic development, job creation, and regional prosperity.

Challenges and opportunities

The challenges and opportunities within the agricultural sector for impact investors encompass a range of factors such as climate change, access to capital, education, and food security. By addressing these challenges, investors have the opportunity to achieve both financial returns and positive social and environmental impact.

Coffee, being one of the world’s most widely consumed beverages, provides a compelling example to highlight the challenges and opportunities within the agricultural sector for impact investors. It is one of the most valuable and widely traded tropical agricultural products with 80% of its production attributed to smallholder farmers. The livelihoods of approximately 125 million people worldwide rely on it.12

Climate change

Climate change poses a significant challenge for the sector and beyond. However, it also presents an opportunity for sustainable and regenerative practices to mitigate negative effects. The food system contributes to approximately 30% of the global energy consumption, with a significant portion still relying on fossil fuels that produce greenhouse gas emissions. Impact investors can support and invest in climate-smart agricultural practices and technologies that improve resilience, conserve natural resources, and reduce greenhouse gas emissions.13 Examples include agroforestry, precision farming, sustainable irrigation systems, and climate-resilient crop varieties.

Access to finance, education and technology

Smallholder coffee farmers often face difficulties in accessing capital, limiting their ability to invest in modern farming techniques, infrastructure, and technology that could enhance sustainability. Similarly, lack of education can impede the adoption of sustainable farming practices, limiting productivity and efficiency across the entire value chain. Impact investors can play a vital role by providing financial and non-financial additionality, investing in initiatives that provide financial services and promote education and training, empowering farmers to adopt sustainable practices and improve productivity.

Food security and nutrition

Investing in sustainable food production and agricultural productivity contributes to building a future-fit food system, addressing global food security challenges. Impact investments in infrastructure, technology, and logistics can strengthen supply chains, improve efficiency, and reduce post-harvest losses, ensuring access to nutritious food.

Risk mitigation

Impact investing in agriculture can help mitigate risks associated with climate change and resource scarcity on one hand. On the other hand, risk management and mitigation are key to protecting investments. Investors can employ financial due diligence, diversification, technical assistance and capacity building which can help mitigate risks related to knowledge gaps and lack of skills, collateral control, insurance and risk-sharing mechanisms, partnerships with local stakeholders, regular monitoring and impact assessment and legal due diligence to manage risks effectively.

Portfolio diversification and further benefits

Impact investments in agriculture have the potential to deliver competitive financial returns. According to the GIIN’s 2020 Annual Impact Investor Survey,14 the majority of impact investors opt for market-competitive and market-beating returns, while a small percentage intentionally pursue below-market-rate returns matching their strategic goals.

Agriculture impact investing provides an opportunity to diversify investment portfolios. Historically, agriculture has shown low correlation with other asset classes such as stocks or bonds, which can help reduce overall portfolio risk and increase potential returns.15 Investors can benefit from capital appreciation, dividend payments, and other financial incentives.

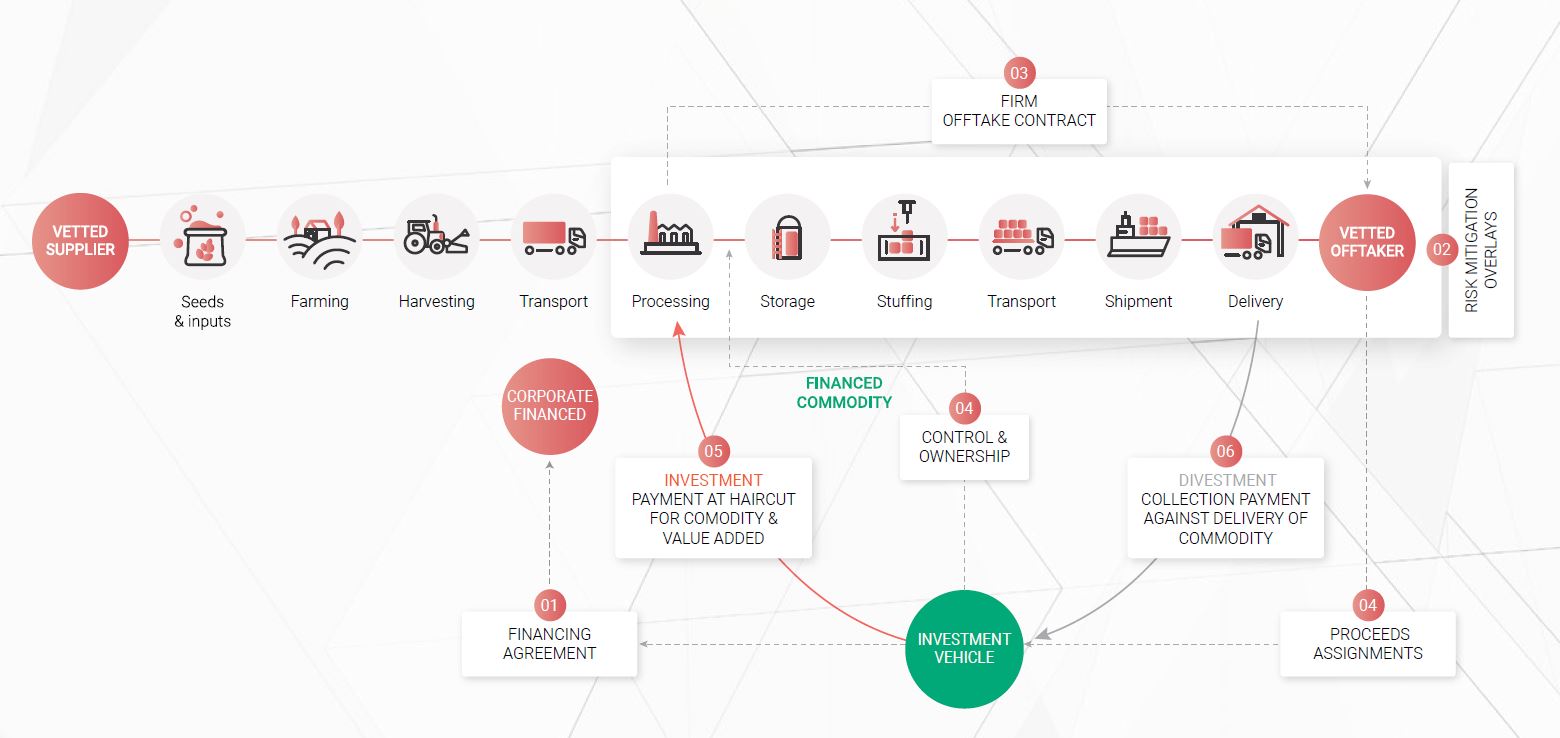

Figure1. Example of a transparent investment structure and sequence (post-harvest).

A promising outlook

To conclude, it is essential for agriculture impact investors to navigate these challenges effectively, leverage the opportunities, and adopt a long-term perspective to achieve sustainable and impactful outcomes.

Asset managers should take note of the growing investor interest in alternative investments and the escalating demand for sustainable investing, as these trends will shape the industry’s trajectory.16 Surpassing the US$1 trillion milestone in impact investing reflects remarkable growth,17 establishing impact investing as a significant component of sustainable finance, with potential for further integration into mainstream capital markets. The broader sustainable finance landscape, valued at US$35 trillion, emphasises the growing importance of impact investing and ESG integration strategies.18

Although institutional investors’ allocation remains limited, there is potential for further progression as investors recognise the value of combining financial returns with positive social and environmental impact. The institutionalisation of the agriculture impact investing asset class is expected to accelerate with the increasing challenges around food production, driving the expansion of green finance vehicles.

The growth of this asset class and the developing interest from institutional investors point to a promising future for impact investments in agriculture, enabling investors to address global challenges, promote sustainability, and combat climate change. By actively engaging in this sector, stakeholders can contribute to building a more sustainable and efficient food production system while achieving their financial goals.

1 GIIN. What you need to know about impact investing, available at: https://thegiin.org/impact-investing/need-to-know/

2 Harry Trick. Michel Mores. 2023. Impact investing in agriculture.

3 Kate Abnett. REUTERS. 2021. EU strikes deal on huge farm subsidies, ending three years of negotiations, available at: https://www.reuters.com/world/europe/late-night-breakthrough-brings-eu-closer-deal-farm-subsidies-2021-06-25/

4 Roberto Vitón. Le Déméter. 2022. Chapter: Investment Funds in the Food and Agriculture Sector: A Fertile Ground for Investors.

5 Global Impact Investing Network (GIIN). 2022. Sizing the Impact Investing Market 2022.

6 The Business Research Company. Impact Investing Global Market Report 2023, available at: https://www.thebusinessresearchcompany.com/report/impact-investing-global-market-report

7 Tameo. 2022 PAIF Report.

8 Roberto Vitón. Le Déméter. 2022. Chapter: Investment Funds in the Food and Agriculture Sector: A Fertile Ground for Investors.

9 World Bank. 2020. Employment in agriculture, available at: https://www.stepstonegroup.com/wp-content/uploads/2022/11/Agriculture_-Ripe-for-Institutional-Investment.pdf

10 USDA. What is agriculture’s share of the overall U.S. economy?, available at: https://www.ers.usda.gov/data-products/ag-and-food-statistics-charting-the-essentials/ag-and-food-sectors-and-the-economy/

11 News European Parliament. 2021. EU agriculture statistics: subsidies, jobs, production (infographic), available at: https://www.europarl.europa.eu/news/en/headlines/priorities/agriculture-and-food/20211118STO17609/eu-agriculture-statistics-subsidies-jobs-production-infographic

12 Food and Agriculture Organisation of the United Nations (FAO). Markets and Trades. Commodities. Coffee. Available at: https://www.fao.org/markets-and-trade/commodities/coffee/en/

13 United Nations. The Science. Climate Action Fast Facts. 2022. On climate, food and agriculture, available at: https://www.un.org/sites/un2.un.org/files/fastfacts-food-and-agriculture-february-2022.pdf

14 GIIN. 2020. Annual Impact Investor Survey.

15 Stepstone. 2020. Agriculture: Ripe for Institutional Investment, available at: https://www.stepstonegroup.com/news-insights/agriculture-ripe-for-institutional-investment/

16 Boston Consulting Group. 2022. Global Asset Management 2022: From Tailwinds to Turbulence.

17 Tameo. 2022 PAIF Report.

18 Global Sustainable Investment Alliance. 2021. The Global Sustainable Investment Review 2020.