Investing in real estate

By Ramesh Kashyap; Piyush Arora; Michael Kam, Ninepoint Partners

Published: 19 June 2023

The oldest asset class dominating modern wealth allocations

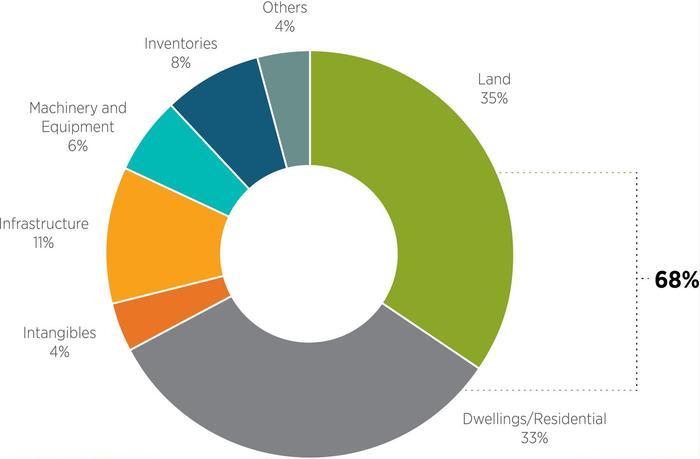

Real estate is one of the oldest asset classes in the world with the first records of transactions in the US dating back centuries. What is more interesting is that it continues to remain the largest portfolio allocation amongst real assets accounting for ~68%1 of the total global net worth.

Figure 1. Distribution of real asset, 2020 (%)

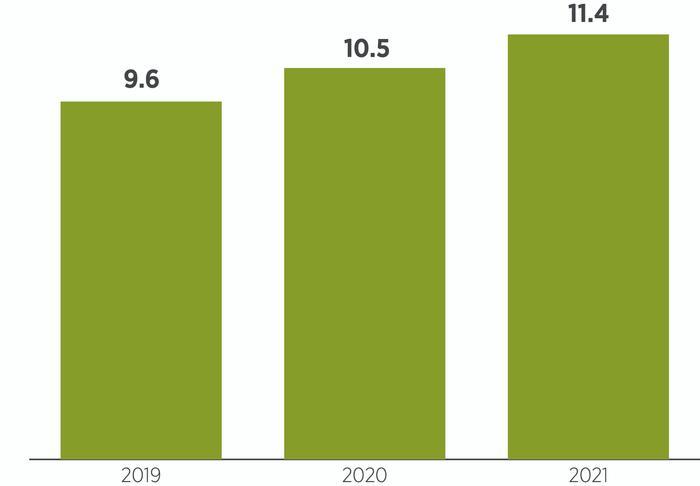

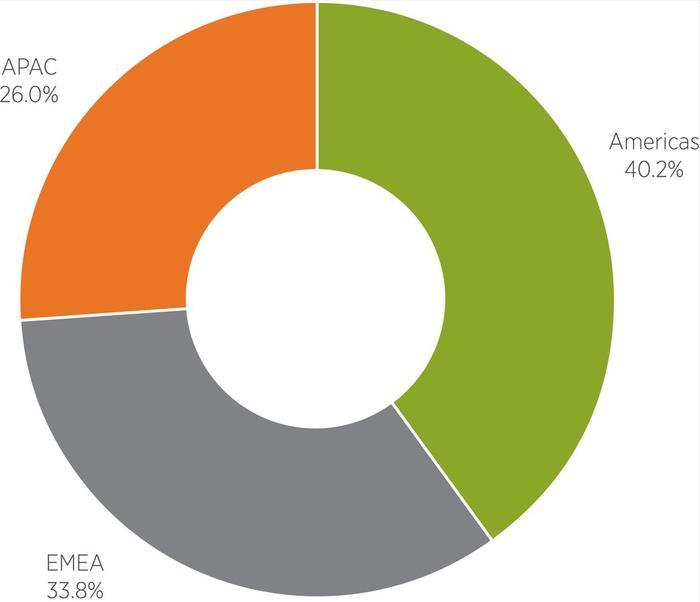

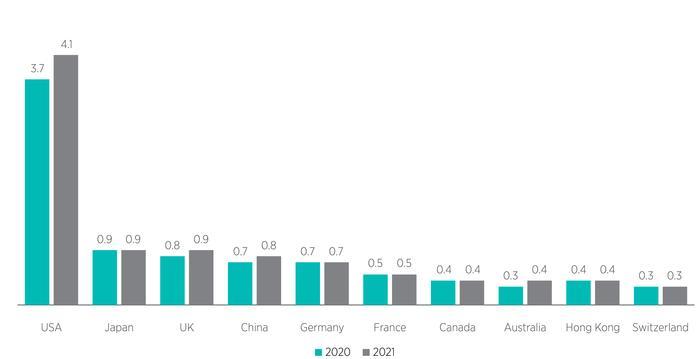

The global real estate market (public and private) has grown from US$9.6tn in 2019 to US$11.4tn in 2021. Geographically, the Americas lead the pack accounting for 40.2% of the market or US$4.6tn.2 The US alone contributes US$4.1tn to the US$4.6tn total Americas market. The Americas is also the fastest growing region with 12.9% growth in 2021. The US market grew by 13.1% in the same period.3

Figure 2. Market size (US$tn)

Figure 3. Market share, 2021 (%)

Figure 4. 10 largest real estate markets in US$tn (2021 vs 2020)

The US has long remained the most attractive market due to a variety of factors including economic size, (relative) housing affordability, growing population, and government regulation/stability. These factors make it the most ideal candidate to chart a V-shaped recovery once yields stabilise post the recent correction driven primarily by higher interest rates.

Current trends in real estate

Industrial: Strong fundamentals attracting investor interest

The year 2021 saw the rapid expansion of light industrial facilities including warehousing, fulfilment centres, and cold storage. These segments grew in response to shifting customer behaviour from offline to online. We have not seen a large portion of those sales return to offline retailers once they re-opened in 2022. This structural shift in the way consumers shop has given a new impetus to the light industrial sector.

Despite economic headwinds, industrial real estate absorption remains high in 2022 and is expected to cross pre-pandemic levels. This spread offers embedded net operating income growth for the foreseeable future.

According to research from MSCI Real Assets of surveyed US industrial managers, in-place rents were 22% below spot market rents.

The imbalance of supply and demand has not only pushed leasing rates on existing properties higher but new developments as well. Combined with all-time lows in vacancy, the industrial space is poised to benefit from numerous tailwinds.

Housing: Demographics, affordability and customer preferences supporting long term demand

A four-generation surge of household formation and housing preferences could buoy fundamental apartment demand through and beyond 2030. With 1.3 million new US households projected each year through 2035, apartment industry trade groups—the National Multifamily Housing Council (NMHC) and the National Apartment Association—calculate that the United States needs 4.3 million newly built apartments between now and then. That level of new development would work out to 331,000 new multifamily rental units annually. This would expand the existing apartment rental stock in the United States by more than 20% in just over a decade.

Another factor to consider is the increasing unaffordability trend in developed nations where property values are rapidly outpacing household income. In Canada, the Housing Affordability Index, which measures the share of income needed to cover housing related expenses, has recently peaked at 0.48. This is even higher than housing affordability preceding the Great Financial Crisis. A similar situation is growing in the US, where there is a far larger market. As a result of growing unaffordability, there is growing acceptance to rent amongst the middle-income, middle-age demographic. For investors, this could represent an attractive tailwind for residential opportunities.

The emergence of rent-by-choice segment (discretionary rental households who can afford buying a home) has increased the demand for multifamily housing. According to Harvard’s Joint Centre for Housing Studies (JCHS), the number of renters making at least US$75,000 jumped by 48% over the decade ending just before the pandemic, to 11.3 million in the US. With this increase, the share of renter households in this income group rose from 20% to 26%.4 The supply side of the equation has not caught up to the high demand leading to higher rentals across markets.

Retail: Flight to high-quality grade-A assets

Given the outsized challenges that retail has faced in recent years and with economic uncertainty on the horizon, the outlook for the retail sector in the immediate future differs significantly for different segments and property types.

Grocery in the US remains white-hot, with growth bolstered by aggressive expansion plans from newer market entrants like Aldi and Lidl. Athleisure and new digital- native apparel brands have ramped up brick-and-mortar growth even as department stores and many legacy players are still facing challenges. Perhaps most surprising of all is the massive surge in restaurant growth. Fuelled by QSRs and new fast-casual concepts, major chains were poised to add as many as 7,000 units through midyear 2023.5 Retail banking continues to deal with digital disruption, driving less need for overall branches and smaller footprints. Drugstore chains are reducing store counts, though online pharmacy has yet to emerge as a major disrupter. Department stores, particularly outside of the luxury sphere, still largely need to downsize and evolve their models to remain relevant.

Nowhere is the bifurcation in performance greater than in the mall world. Class A and trophy malls account for roughly one-third of the inventory, but 80% of the sales. Those properties have benefited from the flight to quality and have been the focus of nearly all the growth from new clicks-to-bricks (digital-native brands opening physical stores) and experiential concepts, as well as a substantial influx of food and beverage concepts.6

Office: Medical offices and life sciences facilities opening new growth avenues

The traditional office sector is struggling with pandemic-induced behavioural changes with complete work from home and hybrid arrangements still being the norm across corporates. The high-quality properties within the traditional office space continue to retain high occupancy and command rentals as corporates continue to renew.

While the traditional office demand outlook remained uncertain due to lagging return-to-office momentum, the pandemic accelerated the growth of a few segments within the overall office sector including medical offices and life sciences laboratories. These sectors proved to be non-cyclically correlated as they grew at a higher pace during the pandemic and continue to exhibit high growth.

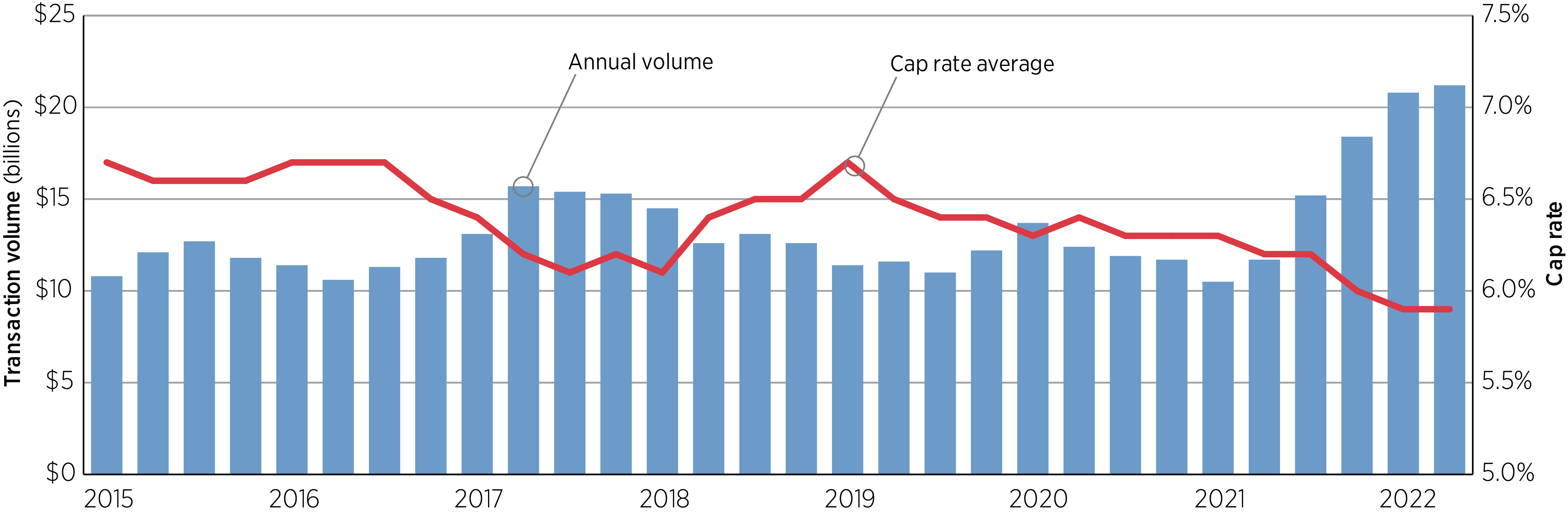

Figure 5. Medical office transaction volume and cap rates, 1Q 2015-2Q 2022

Tenants of medical office buildings tend to sign much longer lease terms than tenants of other types of commercial real estate—sometimes up to 15 or 20 years—and are much more likely to renew since moving too far away would jeopardise their local patient market share. Transaction activity over the last year has grown to an average annual run rate exceeding US$20 billion, with institutional private equity accounting for most of the activity. Looking ahead, medical office transaction activity will face the same headwinds— rising interest rates, inflation, and a potential recession—as other real estate sectors. However, with so many entities interested in investing and solid sector fundamentals, future activity will likely remain strong.

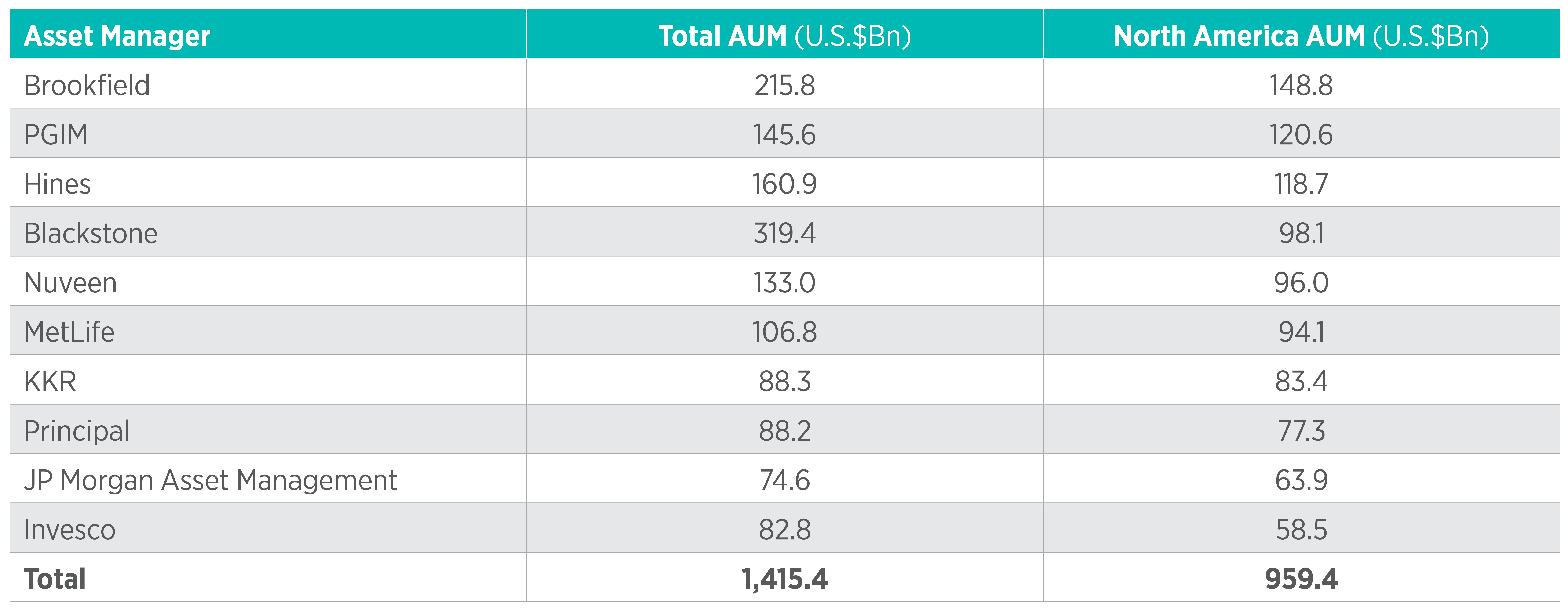

Top real estate asset managers in North America

Through both public and private vehicles, the top 10 real estate asset managers in North America manage an aggregate AUM of ~US$1.4tn with ~67% invested in North American markets. Six of these managers are in the top 10 global real estate managers list with all of them ranking in the top 20 among global real estate managers.

Figure 6

Outlook

We remain positive on the real estate sector overall and see most sectors reacting differently as we move through the high inflation-interest rate environment. Real estate is a core contributor to a diversified portfolio and may provide reliable income generation. Paired with its ability to function as an inflation hedging vehicle and low correlation to traditional securities, it is clear why real estate is a popular alternative asset among investors. Overall, we believe there is opportunity in the near to medium term to invest in quality Grade-A real estate assets in developed economies. Low valuations in an increasingly tightening liquidity environment coupled with stable income yield can help generate significant upside once cap rates compress as the economic cycle turns around.

1 McKinsey Global Institute: The rise and rise of the global balance sheet.

2 MSCI – Real Estate Market Size 2021-22.

3 MSCI – Real Estate Market Size 2021-22.

4 McKinsey Global Institute: The rise and rise of the global balance sheet.

5 Urban Land Institute & PwC – Emerging Trends in Real Estate 2023

6 Urban Land Institute & PwC – Emerging Trends in Real Estate 2023

Disclaimers

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP (“Ninepoint”) and are subject to change without notice. Ninepoint makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction. Materials may not be delivered or made available to individuals or entities that are not classified as (i) “Non-United States Persons” within the meaning of Section 4.7(a)(1)(iv) of the rules of the CFTC or (ii) permitted clients (as defined in section 1.1 of Canadian National Instrument 31-103). This document is for information purposes only and should not be relied upon as investment advice. We strongly recommend that you consult your investment professional for a comprehensive review of your personal financial situation before undertaking any investment strategy. Information herein is subject to change without notice and Ninepoint is not responsible for any inaccuracies or to update this information.

Ninepoint Partners LP: Toll Free: 1.888.362.7172.