A shifting landscape: Recent trends shaping the European hedge fund industry

By Gerard Duffy; Dermot O’Connell, KPMG in Ireland

Published: 18 September 2023

Europe is the second-largest region for hedge fund activity across the globe, with European located managers and funds accounting for ~15% of global assets under management1. Despite this it has been a challenging time for the industry, with changes in the external environment impacting returns. In our view, though, the industry remains resilient with certain players capitalising on market stress conditions.

Keep reading for five key trends shaping the industry.

1. Macroeconomic environment moves the goalposts

A web of macroeconomic and geopolitical factors over the past number of years has resulted in a significant shift in the economic climate, with a bear market emerging following the prolonged period of growth in the aftermath of the 2007/2008 global financial crisis. In particular, persistently high inflation has led to a rising interest rate environment that has significantly impacted the alternatives landscape, with hedge funds being no exception.

Against this background, there have been winners and losers across all hedge fund investment strategies. For example, macro strategies tended to outperform other approaches such as multi-strategy and relative value strategy approaches.

2. Capital flows and liquidations highlight challenges

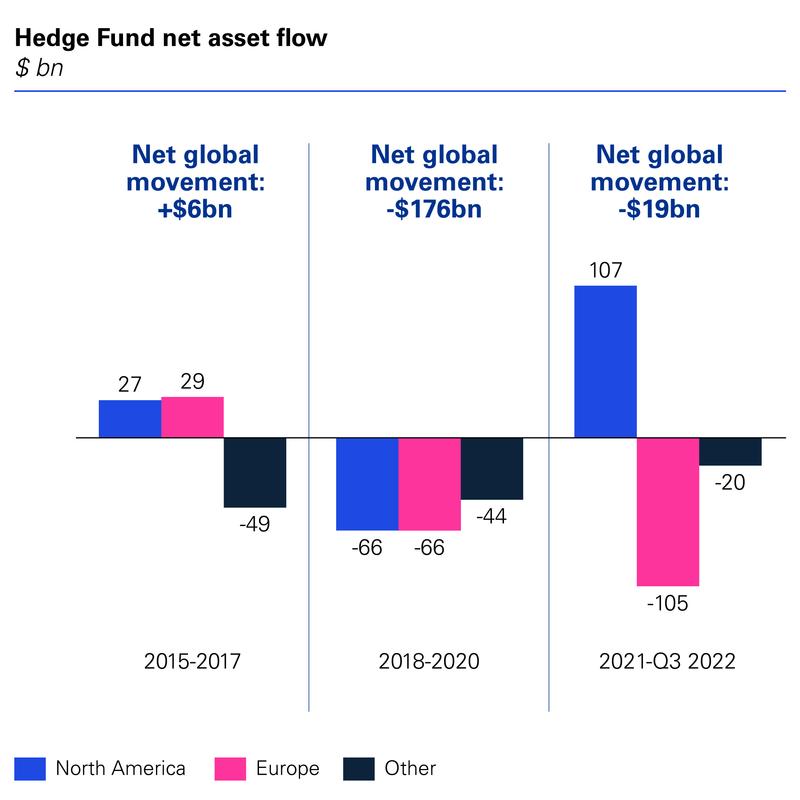

Between 2015 and 2017, positive net inflows of capital into European hedge funds totalled US$29 billion. However, since 2017, there have been net outflows of US$171 billion (US$66 billion between 2018 and 2020 and US$105 billion between 2021 and Q3 2023) in response to market volatility and the rise in popularity of other asset classes such as private equity.

Figure 1

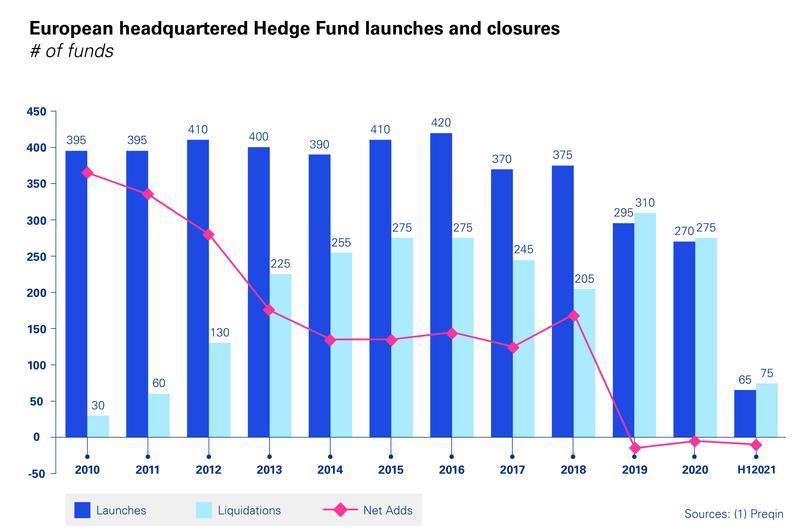

Other indicators of the challenges hedge funds are facing can be observed by the changes in the patterns of hedge fund launches and closures.

Between 2019 and H1 2021, liquidations of European domiciled hedge funds have outpaced fund launches, leading to an overall net decrease in the number of hedge funds. In contrast, during the long bull market run between 2010 and 2018, the number of hedge fund launches (>3,500) far outnumbered the number of liquidations (<1,750).

Figure 2

3. Investor profiles evolving

In the context of the above challenges, the profile of those investing into European-headquartered hedge funds has altered slightly in recent years, with banks now making up a larger proportion of the total investor pool in hedge funds than was previously the case.2,3 Taking a strategy specific view, banks account for nearly one-third of the capital invested into relative value strategy funds). By comparison, pension funds and insurance companies account for 27% and 24% respectivley. In particular, multi-strategy funds have proven popular with banks, where they account for around 50% of the total investor base in these funds.

4. Use of leverage (including repo) declining

One of the hedge fund industry’s defining characteristics is the use of leverage compared to traditional or long-only players. However, there has also been a change in the industry in this regard. Based on latest available data at the industry level, European funds’ use of leverage has decreased from 430% of Net Asset Value in 2018 to 315% in 2020, as funds showed greater caution considering broader economic challenges.,

In contrast, the equivalent figures grew from 11% in 2018 to 130% in 2020 for the alternatives market as a whole.2,3 There has been an associated knock-on impact on hedge funds using repurchase agreements (repo) as a financing tool.

5. Regulatory evolution, not revolution

Since 2013, hedge funds domiciled in Europe have been subject to Directive 2011/61/EU of Alternative Investment Fund Managers (AIFMD). In 2021, the European Commission published proposed changes that will form the basis of AIFMD II across delegation, marketing, reporting, liquidity, and loan origination. The text is currently still subject to debate and amendment, with changes not expected to take place in the short term.

2023 to date has been challenging for the hedge funds industry, and signs point to much of the same for the beginning of 2024. But its resilience and generally positive investor sentiment bodes well for the industry overall.

This document has been drafted using material downloaded from ESMA’s website ESMA does not endorse this publication and in no way is liable for copyright or other intellectual property rights infringements nor for any damages caused to third parties through this publication.