Achieving T+1 multi-party reconciliation through automation of the reconciliation process

By J-P Lee, Metaframe Technology Solutions

Published: 18 September 2023

The process

The necessary task of hedge fund reconciliation has become more demanding in recent years. Trade volume hit a record high in the first quarter of 2023 following an upward trend. Increasingly stringent regulations, like the upcoming SEC T+1 settlement rule, puts more pressure on operations teams leaving less room for error. Regulations are matched by heightened demand by investors for transparency in an increasingly competitive hedge fund market. Probably the most challenging aspect of the reconciliation process is the expanded use of exotic instruments. It is estimated that the derivatives market already exceeds a quadrillion dollar. These elements of the hedge fund landscape are problematic for the reconciliation process by themselves, but funds don’t act alone. A hedge fund isn’t navigating the reconciliation landscape solo but joined by its partners, prime brokers, and administrators.

While a hedge fund, custodian, and fund administrator are each independent with different teams and systems, they share, process, and report data among themselves. The multi-party reconciliation required among multiple parties can be resource-intensive, time-consuming, and error-prone. With settlement cycles shrinking and increased trade volume, the task of reconciliation by itself, let alone with multiple parties, becomes more and more onerous.

A hedge fund reports its trades to a prime broker and a fund administrator. Each of the three parties builds a separate portfolio based on the trades reported. The prime broker and the administrator reconcile between themselves and the prime broker and the administrator each provide their portfolios to the hedge fund. For the prime broker, fund reconciliation occurs daily. For the administrator, reconciliation matters most at the end of the month when they close their books in terms of performance and compile and transmit reports for investors.

To summarise:

- Hedge funds send trades to both prime broker and administrator.

- All parties build a portfolio based on the trades received.

- The prime broker and administrator reconcile between themselves.

- The prime broker provides their portfolio to the hedge fund.

- The administrator provides their portfolio to the hedge fund.

- The hedge fund reconciles the portfolio with the prime broker’s and again with the administrator’s.

Operational efficiency

A reconciliation process is tedious but can be vital to a hedge fund’s reputation. The approach the COO chooses to tackle reconciliation depends on a number of factors: the complexity of the fund’s structures, reporting obligations to counterparties, the cadence of the reporting to each counterparty, resources available to the hedge fund operations team, and available manpower. In most cases, the reporting cadence is the major deciding factor on how often reconciliation takes place. On the prime broker side, trades are settled on a daily basis, leading to the trade reports being generated daily. On the administrator side, performance reports are issued monthly or quarterly, yielding a monthly reconciliation cadence. If the fund is working with multiple prime brokers, multiple trade reports are issued on a daily basis. When it’s time to generate monthly reports, the operational team must look at 30+ days of transactions and data, poring over reports in search of discrepancies and resolutions to any errors. These month-end reports become an operational focus on top of the daily trading reports. The additional efforts become an operational stressor to the normal day-to-day workflow for the team.

One way to alleviate this pain and speed up reconciliation for all counterparties is to set up a multi-party reconciliation process. Multi-party reconciliation involves matching the cadence for all data sources ensuring trades and positions are in sync. Initially, performing reconciliation on the prime broker and the administrator seems like an overuse of operational resources, but daily reconciliations catch discrepancies as soon as they happen. The operations team can address issues immediately if needed. For firms not wishing to add additional daily tasks to the operations team, daily break reports can still be beneficial. When it is time to prepare and verify the monthly or quarterly reports, the team can pinpoint the sources of breaks quickly by reviewing the daily break reports rather than combing through the entire time span of transactions and data.

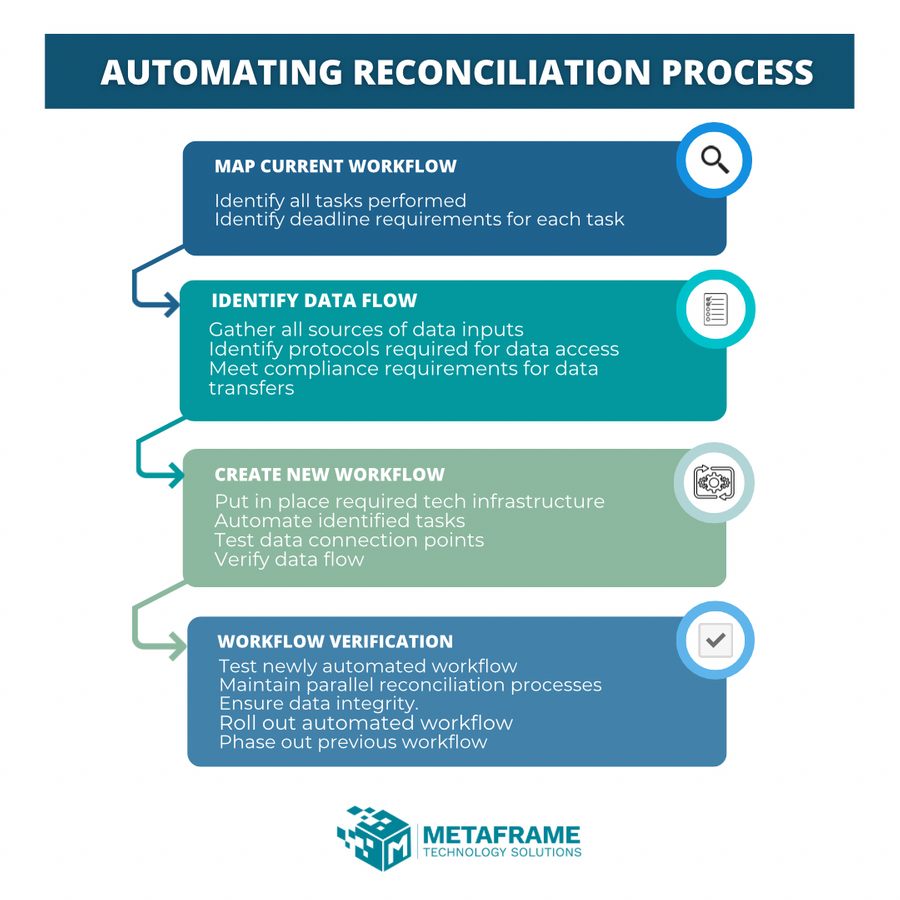

For this to work optimally, reconciliation must be automated. The process of automating the reconciliation is outlined in Figure 1 below.

Figure 1

Without automating the multi-party reconciliation process, the hedge fund operations team is importing and exporting data, combing through files, spreadsheets, and reports for breaks and discrepancies, and creating reports from this muddle of sources. Once automated, data is gathered automatically, sorted, and matched automatically, with reports generated automatically. The intelligent software identifies, and highlights breaks and discrepancies.

The benefits of automated reconciliation

- Automation saves time. Clients report a reduction of end-of-month reconciliation time from weeks to days. Automating tasks and repetitive steps streamlines the reconciliation processes creating a multiplier effect that improves operations elsewhere.

- Staying ahead of reporting requirements. Looking ahead to new regulations on the horizon, such as the T+1 settlement requirement, or the halving of the Section 13 D reporting timeline, saving time and effort now will pay dividends later.

- Intelligent automation reduces the possibility of error. Human manipulation of spreadsheets creates errors. With three parties using different symbology, the application of artificial intelligence to symbology reconciliation is a powerful automation tool.

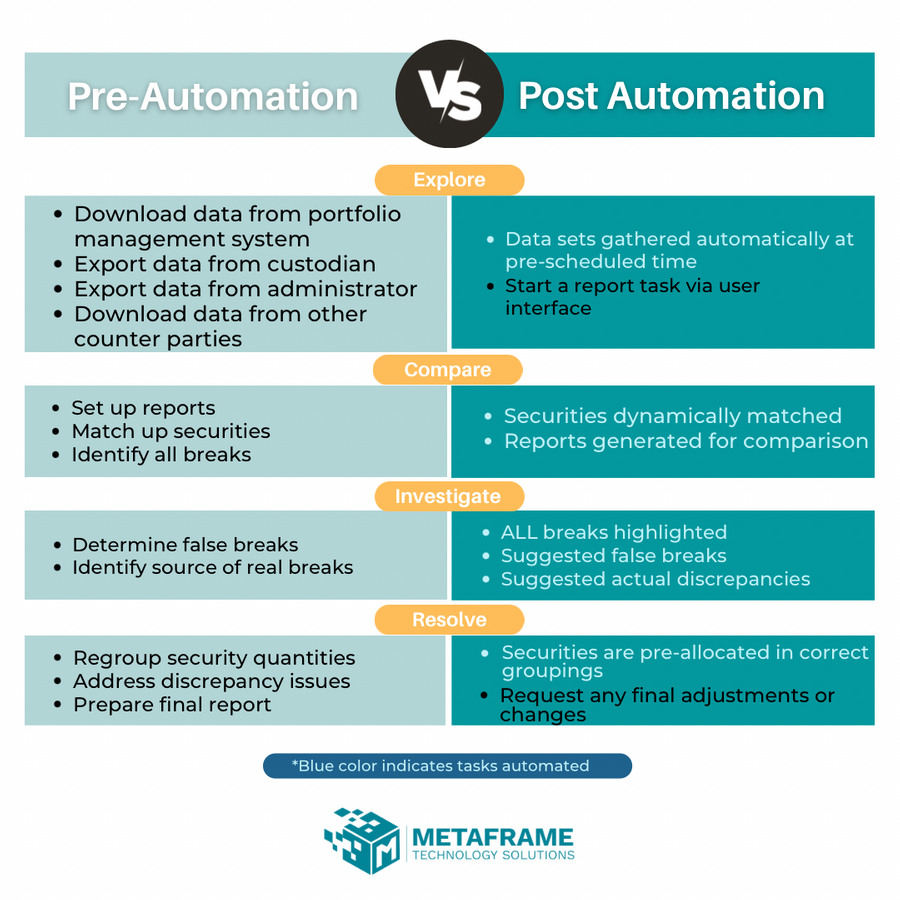

Figure 2

COOs acknowledge automation is the answer, but they also admit there’s a high bar in adopting new technologies. There is a balance to strike between minimising operating costs, maximising staff performance, and staying ahead of regulatory requirements. With the right balance, automating reconciliation is a worthy endeavor for COOs to undertake. Spending the upfront effort to set up a process like multi-party reconciliation will reduce costs over time, improve the operation team’s performance, and be ready to easily meet additional reporting requirements.