Bitcoin: A compelling alternative asset class

By Jack Tatar, Advisor, 3iQ

Published: 21 January 2018

It seems as though everyone is talking about bitcoin these days.

As I write this, the price of bitcoin has just risen above $15,000, and it’s now a daily topic of discussion on 24-hour finance channels and nightly news. It’s only a matter of time before it’s listed on the bottom of TV screens alongside the current equity market averages and commodity prices.

To put its current price in perspective, back in January of 2017, it was trading at $1,000 a bitcoin. Clearly, anyone who put money into it back then would now have huge profits. But the question for many investors and investment managers is - is it an investment? Perhaps the first question should be - what the heck is bitcoin?

What is Bitcoin?

The creation of Bitcoin grew out of the financial crisis of 2008. It was created by an anonymous entity known as Satoshi Nakamoto. Six and a half weeks after mid-September, 2008 when Lehman Brothers declared bankruptcy and Merrill Lynch was sold to Bank of America to save it, Satoshi released the Bitcoin white paper. This document outlined a new method for electronic transactions and is the genesis for every single blockchain implementation deployed. Satoshi wrote, “We have proposed a system for electronic transactions without relying on trust.”

Although Satoshi released the white paper first to outline the creation, the coding of the bitcoin software had been completed. Soon the software was loaded onto computers and Bitcoin’s blockchain was implemented. Bitcoin’s blockchain can be thought of as a digital ledger that keeps track of user balances via debits and credits. On each computer running the Bitcoin software around the world sits the entire record of all transactions conducted on the Bitcoin blockchain as a distributed, immutable and permanent record.

Bitcoin is the reward for the verification of transactions, which is a “competitive” exercise utilizing a “proof of work” protocol (consistently working computer power is required to compete). This is an overly simple explanation for the process but the key to recognize is that the public eco-system of the bitcoin blockchain is maintained by this process and its open nature allows for anyone (with computing power) to join the blockchain.

The process of gaining bitcoin through the public blockchain is known as “mining,” and there will be a total of 21 million bitcoin by the year 2024 created through this mining process. There are currently over 16 million bitcoin in circulation. This “set” total of bitcoin creates a “disinflationary” asset, as compared to gold, which has a rising supply and no end amount in sight (thus, an “inflationary” asset). I bring up gold in this comparison because it’s often compared to bitcoin in discussions extolling bitcoin as an asset and even an investment. So, should we consider bitcoin an asset and even an investment?

Bitcoin as an asset

Bitcoin is currently traded on numerous exchanges throughout the world on a 24-hour basis. Anyone can trade fiat currency for bitcoin through exchanges such as Coinbase (NYSE is an investor). At any time, traders can recognize a price for bitcoin and many other cryptoassets, including ether (ethereum) and litecoin. Currently there are over 800 cryptoassets trading on exchanges around the world. Along with bitcoin, many of these assets exhibit volatility and significant returns for those brave enough to invest in them.

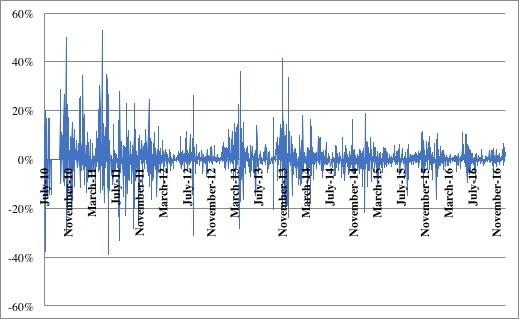

Over the past few months, bitcoin has been on a wild price ride, but let’s take a look at its volatility historically and even compare it to current assets that make up holdings in investor’s portfolios. Below is a chart from the book, ‘Cryptoassets” that shows that bitcoin’s volatility has been significantly decreasing since the collapse of Mt. Gox (the initial bitcoin exchange that was opened in 2010 and subsequently hacked in 2013 with many bitcoins lost).

Chart 1

Although there’s been a decrease in volatility over time, it’s true that bitcoin exhibits a significant level of volatility. However, the same can be said for some of the most widely held stocks by investors – the FANG stocks. So how does the volatility of bitcoin stack up against the volatility of those stocks?

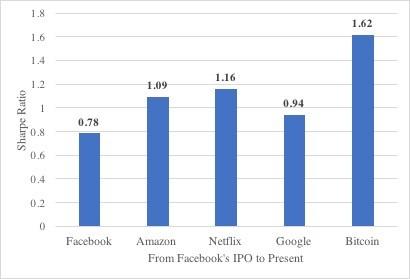

In the time-period from Facebook’s IPO to January 3, 2017, the volatility levels were: Facebook 2.5%; Amazon 1.9%; Netflix 3.4%, Google 1.5%, and bitcoin was 4.6%. Although bitcoin exhibited higher volatility than each of the FANG stocks, it’s not as drastic as one may think. All five of these assets have seen significant absolute returns over the last few years, and although returns and volatility are important, those of us who study assets recognize that putting the two together provides us with the Sharpe ratio, which helps to calibrate the returns for the risk taken. The higher the Sharpe ratio, the more the asset is compensating investors for the risk.

Evaluating the Sharpe ratio for bitcoin and these assets over this same time-period show that not only did bitcoin exhibit the highest volatility and highest returns over this time, but it also had the highest Sharpe ratio of these assets by a significant level. Bitcoin compensated investors twice as well for the risk they took with Facebook, and 40 percent better than Netflix.

Chart 2

As investors and investment managers, there’s always need to implement effective risk/reward holdings into our portfolios. Utilizing the Sharpe ratio helps to identify those assets that can provide significant returns while balancing the risk profiles of our funds and investors. The significant returns exhibited by bitcoin over the last couple of years are “nudging” investors of all levels to explore bitcoin and other cryptoassets as assets within their investment portfolios. As responsible investment professionals, it becomes vital for us to consider how these assets should be appropriately recommended and positioned for investors.

Bitcoin as an alternative asset

In 2013 as a columnist writing on retirement for Marketwatch.com, I began a series of articles (https://www.bitcoinandbeyond.com/single-post/2017/12/04/Whats-the-Deal-with-Investing-in-Bitcoin-for-Retirement) about my interest in pursuing bitcoin as a holding for my investment portfolio, specifically into the alternative asset allocation of my portfolio. After the financial crisis of 2008, we saw financial service firms incorporate alternative assets into their asset allocation for clients.

Morgan Stanley and Merrill Lynch soon produced asset allocation models for both high net worth and traditional investors that provided recommendations for around 20% of a portfolio to be positioned into alternative assets. The primary reason was to address the correlation between assets in a portfolio to protect investors from down markets significantly impacting multiple assets, as happened in 2008 when both equities and fixed income both had drastic drops. Since that time, the growth of the ETF model and the inclusion of gold, energy resources, and real estate into these holdings provided an easy way for all investors to gain access to alternatives in their portfolio.

So, could bitcoin fit the model of being an alternative asset? One of the major functions of an alternative asset is to provide a level of non-correlation to other assets, which would then provide a lower level of risk in a portfolio.

Looking at the period-of-time from January 2011 to January 2017, we find that bitcoin’s average 30-day rolling correlation with other assets was -.04 for the S&P 500, .02 for gold, -0.2 with oil and zero correlation with U.S real estate and U.S. bonds. According to Burton Malkiel in his classic book, “A Random Walk Down Wall Street,” the closer an asset is zero correlated to other asset results in “considerable risk reduction” for a portfolio.

Having an open mind towards Bitcoin

Bitcoin has moved from being something that’s discussed between geeks to front page material for financial publications and the mass media. As it permeates the public discourse, clients are bringing it up to their advisors, and investment managers are frantically searching for knowledge on the topic. We’re now seeing people with knowledge of the topic being given a chance to report to the public on it. They extol the opportunities that exist for bitcoin and other cryptoassets to not only disrupt current financial systems, but also make money for those investors who are willing to do their due diligence and recognize how it may fit into their asset allocation models.

Dismissing bitcoin and ignoring the entire cryptoassets space is something that an investor and investment manager does at their own peril. For every Jamie Dimon who seeks to protect the financial status quo with uneducated remarks and dismissals of bitcoin as a fraud, there are those visionaries in the investment space like Fidelity, who now include bitcoin balances as part of a client’s net worth.

Since I began my bitcoin journey in 2013, I’ve heard the same old tired calls from banks, investment firms and advisors dismissing it as a fraud and a fad, and it’s not fair to investors. I believe that it fits an alternative asset sleeve for investors and for the investment manager who’s willing to come to bitcoin with an open mind, do your due diligence, and understand the risks involved, you may come to the same conclusion.

To contact the author:

Jack Tatar, advisor at 3iQ: [email protected]