Reshaping the industry: Digitize or jeopardize

By Anthony Cowell, Partner and Claire Griffin, Director, Asset Management, KPMG in the Cayman Islands

Published: 23 April 2018

Digital technologies are radically reshaping the alternative investment industry. But a large majority of hedge funds firms appear to be too slow to respond. This is the key finding of a new report, Alternative investments 3.0 – digitize or jeopardize, based on a global survey conducted by KPMG International and CREATE-Research.

Alternatives face disruption

Like most other activities in finance, alternative investing is information intensive. Data is its lifeblood. Digitization is thus emerging as its new ‘heartland’ technology, with the potential to penetrate every activity in its value chain — core and non-core alike.

Previous waves of information technology mainly automated routine manual processes to reduce costs and enhance accuracy.

The current wave, on the other hand, seeks to deliver end-to-end solutions within more joined-up businesses via speed, connectivity, insights, transparency, personalization and disintermediation.

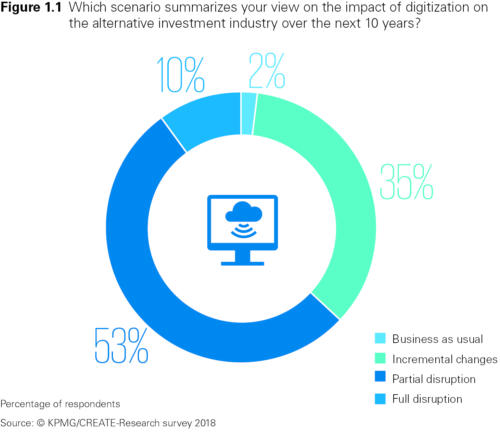

Unsurprisingly, on a 10-year view, the current business models will most likely face disruption. While 98 percent of respondents say ‘business as usual’ is not an option, at least three out of five respondents said they are still at the early stage of ‘awareness raising’ with respect to revolutionary technologies that could potentially transform their businesses.

Alternative Investment 3.0

Digitization may well be driving the alternative investment industry into the third phase of its evolution.

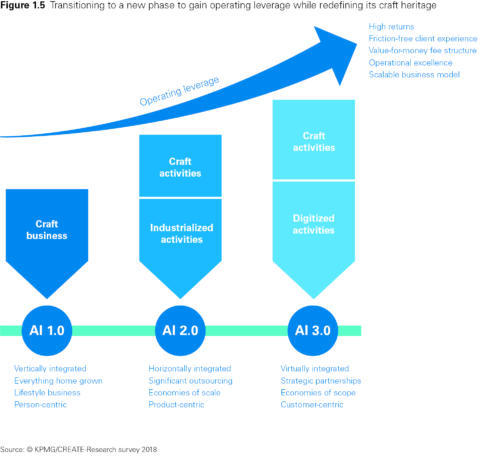

Prior to the 2000s, autonomous lifestyle businesses run along craft lines dominated the alternative landscape.

In the last decade, the search for uncorrelated absolute returns intensified, following the success of iconic investors such as the Harvard and Yale Foundations. The new wall of money from institutional investors ushered the industry into its second phase, where economies of scale and robust operations became fresh imperatives (AI 2.0).

The front office retained its craft nature but routine activities elsewhere in the business were increasingly automated

or outsourced via a new horizontal integration. The aim was to enjoy economies of scale: unit costs fell as AuM rose.

Now the industry is transitioning to its third phase to create joined-up businesses via digital innovations that can deliver operating leverage, within strategic partnerships with the best-of breed external service providers and FinTechs (AI 3.0).

The latest phase redefines its heritage via a new human–machine interface that combines the best of both. It also seeks to create new opportunity sets by widening the scope of the business. Above all, it reflects the transition from being a supply-led industry to being a demand-led industry.

Drivers of digitization

Whereas our respondents accept that digitization of their industry is inevitable, their own approach will be marked by small steps rather than giant leaps.

Less than a third of respondents said they are at the implementation stage for key innovations, while advanced technologies such as blockchain and robo advisors have been implemented by three percent or fewer.

Factors accelerating the pace of innovation

Indeed, when asked which factors will accelerate the pace of digital innovation in their business over the rest of the decade, respondents cited market-driven factors, including growing cost pressures (58 percent), changing investor needs (51 percent) and fees and charges, becoming a major differentiator (30 percent). They also cited client-driven factors such as growing social acceptance of digitization, and end-investors becoming more demanding (37 percent) and more financially and digitally savvy (36 percent).

Factors moderating the pace of innovation

Holding back the pace of digitization are a number of technology and business-related factors. On the technology side, they include cyber security (58 percent), legacy IT systems (43 percent), and the high cost of digital innovations (42 percent). On the business side, they include senior executives being too focused on day-to-day matters (40 percent), regulatory issues (39 percent) and low risk appetite in the corporate culture (31 percent).

The survey identified activities that are especially ripe for disruption in the front, middle and back offices. They include portfolio risk management, research and securities selection, alpha generation, deal flows, risk & compliance and fund accounting.

Sources of disruption

That disruption is inevitable is not in doubt. But opinions differ on its potential source.

- 34 percent expect internal disruption, as alternative investment managers themselves get on the front foot and digitize their businesses in order to pre-empt competitive threats — from both inside and outside their industry. This group included many large managers in our survey.

- 44 percent expect joint disruption, as incumbents collaborate with potential external rivals. This group includes many medium and small sized managers who want to stay in the driving seat.

- 22 percent expect external disruption, as current internet titans and FinTech start-ups venture into alternative investments, especially into areas where they have a dominant digital advantage and brand presence. This group included many medium sized managers.

Digital leaders make the difference

Business transformation is as much about leadership as about technology — if not more so. It requires digital leaders who can navigate the transition alternative investment managers have to realign their businesses to meet the emerging needs.

This is all the more necessary, since our survey respondents envisage three outcomes as digitization progresses over time in their industry. The outcomes are as follows.

- Client context: a better investment proposition — based on fees, returns, engagement and experience — will mark the shift from a product-centric to a client centric business.

- Industry context: competition will intensify and profitability will erode. Those able to deliver the required proposition will do well, in what may well turn out to be a ‘winner takes all’ world.

- Corporate context: improvements are expected in process efficiency, time to market, investment capabilities, client base and skill sets.

Concluding remarks

Our research suggests that the Alternative Investments Industry is already in the midst of a tectonic shift, with significant consequences over the next decade.

History shows that at the dawn of each major IT innovation, ex ante predictions about its adoption and impact have invariably been proven wrong. They overestimated the adoption pace and underestimated the magnitude of the impact. The pace turned out to be slower but its eventual impact much larger.

By any measure, the industry has been highly profitable. But its members now face a stark choice: digitize or jeopardize.

To contact KPMG:

Anthony Cowell, Partner, Asset Management, KPMG in the Cayman Islands: [email protected]

Claire Griffin, Director, Asset Management, KPMG in the Cayman Islands: [email protected]

The full report can be found at kpmg.com/ai3.0