How US private fund managers may avoid running afoul of proposed UK legislation criminalizing the facilitation of tax evasion

By Will Smith, Partner, Sidley Austin LLP

Published: 13 April 2017

In its latest effort to identify and punish those involved in tax evasion, the UK has proposed legislation making it a criminal offence for companies and partnerships to fail to prevent their agents from facilitating tax evasion. The proposed regulations – known as the “failure to prevent the facilitation of tax evasion” rules (UKFP rules) – are broad in nature and will affect a range of businesses, including private fund managers and other financial services firms.

This article, the second in a two-part series, provides an in-depth discussion of how the UKFP rules may apply to private fund managers, including US-based investment managers that have a link to the UK. The first article provided an overview of the UKFP rules and discussed the two new criminal offences prescribed therein.

How the UKFP Rules .to a Common Hedge Fund Structure

The proposed UKFP rules are broadly drafted and will have significant extra-territorial scope. Accordingly, the rules will need to be considered carefully by many enterprises with links to the U.K., including hedge fund managers and their related fund arrangements.

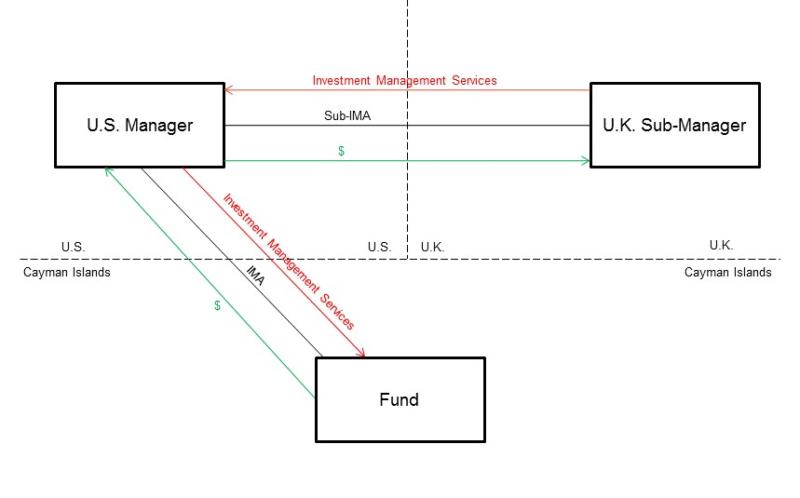

For purposes of this article, a standard hedge fund structure is considered to include the following:

- a master fund vehicle, established as an exempted company incorporated and resident in the Cayman Islands (Fund);

- an investment manager located in the US (US manager), to which the management of the fund has been delegated by way of an investment management agreement (IMA); and

- an affiliate of the US manager located in the UK (UK sub-manager), to which certain aspects of the management services under the IMA have been sub-delegated by the US manager by way of a sub-investment management agreement (Sub-IMA).

The services provided to the fund by the US manager and the UK sub-manager broadly consist of portfolio, and risk-management services; investment-advisory services; services relating to the arrangement of deals in investments and safeguarding or administering assets; dealing in investments as agent for the Fund; managing investments; making arrangements with a view to transactions in investments; marketing the fund; and managing investor relations.

Below is a basic structure showing this arrangement.

Applying the UKFP Rules to the Fund, the US manager and the UK sub-manager

The UKFP rules provide for two new criminal offences:

- The first offence applies to a company or partnership (Relevant Body) that fails to prevent the criminal facilitation of a tax evasion offence under UK domestic law (UK Offence).

- The second offence applies to a Relevant Body that fails to prevent the criminal facilitation of a tax evasion offence under the laws of a jurisdiction outside the UK (Foreign Offence).

Provided that neither the Fund nor the US Manager is incorporated in the UK or carrying on business in the UK through a permanent establishment, it would not have the requisite 'UK nexus' to fall within the scope of the Foreign Offence under the first two elements of that rule. Accordingly, exposure in respect of the Foreign Offence would arise only to the extent that criminal tax facilitation activity takes place in the UK. As a result, in practice, consideration of the application of the Foreign Offence may generally be more relevant to the activities of a person associated with the UK Sub-Manager.

Second, in the context of the Fund, the most likely person who could criminally evade tax (Tax Evader) is likely to be an investor in the Fund. However, given the fact that Cayman Islands funds are subject to the full range of automatic exchange of information regimes and should operate extensive 'know your client' and 'anti-money laundering' on-boarding processes, the risk that an investor would be approaching an investment in the Fund with the intention of criminally evading tax should be reduced. See “CIMA Enumerates Best Practices for Hedge Fund Manager AML Programs” (Mar. 17, 2016); and “Understanding the Intricacies for Private Funds of Becoming and Remaining FATCA-Compliant” (Sep. 12, 2013).

The Fund

The Fund will:

- likely have no employees;

- solicit and receive investments from a range of investors;

- retain the US Manager under the IMA; and

- retain certain other third-party service providers, which may include an administrator, custodian, prime broker and, potentially, placement agent.

Accordingly, the principal risk areas for a Fund are likely to focus on the relationships with the US manager, the UK Sub-Manager and other third-party service providers. When it comes to appointing these entities, the terms upon which they will be retained are likely to be fairly prescriptive and will set out the specific roles and services which the Fund is expecting to receive. In many cases, these services will be operational and administrative in nature and are required by the Fund to conduct its business. For example, in the context of the US manager, the principal supply of services will likely be portfolio management. Portfolio management is, by its very nature, not a service that should be considered to give rise to a meaningful risk of criminal facilitation being undertaken.

On the other hand, however, services provided to the Fund by a placement agent could be seen as posing a higher risk. The Fund will have retained the placement agent to solicit investments from third parties. In providing this service, it is theoretically possible that the agent could criminally facilitate an investor in criminally avoiding tax.

The US Manager and UK Sub-Manager

Both the US Manager and UK Sub-Manager:

- are likely to employ or retain a range of investment professionals; and

- may directly retain a placement agent to assist with marketing the Fund.

Unlike the Fund, both the US manager and the UK sub-manager may have employees and may retain third-party service providers. As such, there is greater potential for risk under the UKFP rules. However, the same observations made with respect to the Fund should apply when considering functions such as portfolio management.

There is also one other circumstance that is important to note with respect to the operation of the US manager and UK sub-manager. Where the Fund is making international investments through the US manager or UK sub-manager, this raises the possibility of the Fund being the Tax Evader, with the relevant manager deemed the facilitator of the tax evasion (Facilitator) under the UKFP rules. Whilst, at first blush, this may appear somewhat unlikely, it is nonetheless important when the US manager and UK sub-manager are analysing their potential risk profiles under the UKFP rules.

Establishing a Defence: Creating Reasonable Prevention Procedures

No liability will arise to a Relevant Body under the UKFP rules where it can be shown that the Relevant Body has “reasonable” prevention procedures in place, designed to prevent the commission of an offence of facilitating tax evasion.

Reasonable procedures are those that are, broadly, proportionate to the risk faced by the Relevant Body of having persons associated with it committing tax evasion facilitation offences. UK revenue guidance, in addition to the proposed legislation, states that, in some limited circumstances, it may be considered reasonable for the Relevant Body not to have any prevention measures in place (for example, where the Relevant Body has fully assessed the risks, and the costs involved in any implementation are disproportionate to the risks). UK revenue does state, however, that “it will rarely be reasonable to have not even conducted a risk assessment.”

It is important to note that having prevention procedures in place is not necessarily a guarantee that there will be no prosecution. It is always possible that the UK prosecuting authority may take a different view to the relevant body as to the reasonableness of the prevention procedures and decide to prosecute anyway. In such a case, the ability of the relevant body to rely successfully on this defence would be determined by the courts.

For that reason (amongst others) it is important to pay attention to UK revenue guidance in respect of prevention procedures. The guidance states that the prevention procedures should be formulated around six guiding principles:

- Risk assessment: The relevant body should assess the nature and extent of its exposure to the risk that those who act for it or on its behalf could engage in the facilitation of tax evasion offences. The guidance comments that the relevant body should 'sit at the desk' of those providing services on its behalf and ask whether those service providers have the motive, opportunity and means to facilitate tax evasion offences;

- Proportionality of risk-based prevention procedures: Prevention procedures should be proportionate to the risk a relevant body faces of a Facilitator committing a tax facilitation offence. Excessively burdensome procedures tailored to every conceivable risk are not required; procedures need only be reasonable given the risks posed in the circumstances but must do more than pay lip service to prevention;

- Top-Level Management Commitment: The guidance states that the most senior levels of the organisation are best placed to foster a culture where facilitation of tax evasion offences are considered unacceptable. Senior management are encouraged to be involved in the creation and implementation of preventative procedures and the assessment of risk;

- Due diligence: The organisation should apply due diligence procedures in respect of persons who perform services for or on behalf of the Relevant Body. The reasonableness of any prevention procedures should take account of the level of control and supervision the Relevant Body is able to exercise over a particular person acting on its behalf, as well as its proximity to that person. Increased scrutiny may be appropriate for persons working in higher risk areas;

- Communication (including training): Prevention policies are to be 'communicated, embedded and understood' throughout the organisation (not just at senior levels) through internal and external communication. This could potentially include tax evasion-specific training not just for employees but also for agents and other service providers; and

- Monitoring and review: There is an obligation to monitor the procedures and make improvements or other amendments from time to time as applicable.

The manner in which these six guiding principles are applied and operated by each of the fund, the US manager and the UK sub-manager will, to an extent, depend on the functions being undertaken by or on behalf of each entity.

Practical Observations

The UK revenue guidance makes it clear that prevention procedures should be tailored in a bespoke way to address the particular circumstances and risks of a relevant body. In the context of each of the fund, the US manager and the UK sub-manager, it would seem prudent to undertake a risk assessment (see above). The conclusions reached in that risk assessment should be documented.

As a next step, consideration should be given to what (if any) prevention procedures are required. Set out below are a number of prevention procedures that could be implemented by the Fund, the US manager or the UK sub-manager (as the case may be) in the event that, based on the relevant body’s risk assessment, it is determined that some prevention procedures should be implemented.

- Each of the fund, the US manager and the UK sub-manager could include appropriate contractual protections in their contracts with persons acting on their behalf that require the agent or service provider to: (1) represent that it will not be engaged in any activity that could give rise to the criminal facilitation of tax evasion; and (2) warrant and undertake that it has considered, has implemented, will keep under review and will amend (as applicable) from time to time reasonable preventative procedures in respect of its organisation.

- Each of the Fund, the US manager and the UK sub-manager should perform due diligence on persons whom it directly or indirectly engages to act on its behalf.

- The US manager and UK sub-manager should develop policies with the active involvement of senior management that outline appropriate conduct of the employees; explain how to report suspicious activities and what constitutes tax evasion; and summarize the penalties that could be imposed where a person facilitates tax evasion. Such policies should then be clearly communicated to their employees and agents (whether orally or in a document).

From an investor-relations perspective, it may also be helpful for the Fund to prepare a copy of its internal policy and procedures relating to the UKFP rules. This is in light of the growing interest investors are taking with funds’ compliance procedures.

Conclusion

Whilst the application of the UKFP rules to particular fund structures will be determined by specific facts and circumstances, in general it should be possible for persons operating in the hedge fund industry to manage – and therefore mitigate – the risk of incurring liability under the new UKFP rules, provided that risk assessment is carried out and reasonable preventative procedures implemented.

It should also be noted that final legislation and official guidance on what constitutes reasonable prevention procedures has not been published as of the date of this article and may be subject to further amendment as the Criminal Finances Bill 2016 makes its way through the final stages of Parliament.

Will Smith is a partner in the London office of Sidley Austin LLP. His practice focuses on the direct and indirect aspects of a range of international and UK tax matters. Whilst having a particular emphasis on representing investment funds and investment advisers, Will has extensive experience in the tax aspects of cross-border investment and structuring, corporate transactions and reorganizations and executive incentivization and relocation.

This article was first published in The Hedge Fund Law Report

To contact the author:

Will Smith, Partner, Sidley Austin: [email protected]