Investment firms should prepare now for big changes under the FCA’s new prudential regime

By Michael Chambers, Wheelhouse Advisors

Published: 20 September 2021

Executive summary

Prudential regulation for firms with one or more MiFID permission (investment firms) is set to undergo major changes with the introduction of the new prudential regime (IFPR in the UK, and IFR/IFD in the EU). The UK’s implementation date is 1 January 2022, while a near-equivalent regime commenced on 26 June in the EU.

There are clear similarities between the two regimes; in fact, they share much of their DNA.

This article explores how the practical work undertaken by Wheelhouse Advisors to prepare firms for the new regimes can assist firms when trying to understand the impact on their own businesses.

What is it and how might you be included?

The new regime was designed for investment firms, after it was agreed by regulators and the industry that the extant regime, designed originally for banks, does not adequately or proportionately address the risks faced or posed by such investment firms. The objective of the new regime is to simplify and create a more relevant and proportionate framework for the Markets in Financial Instruments Directive (MiFID) investment firms.

Initially an EU-driven initiative, the FCA is exercising its post-Brexit independence to consult on a UK-specific version of the regime, effective from 1 January 2022. So, whether you’re an adviser/arranger, investment manager, broker, dealer, fund manager or anything in-between – or in prudential category terms: Exempt-CAD, BIPRU, IFPRU and collective portfolio management investment (CPMI) firms all need to pay attention – changes in the prudential rules are afoot and you will need to take action to be ready.

The Investment Firm Prudential Regime (IFPR), proposed by the FCA covers a number of core areas:

| CATEGORISATION |

CAPITAL |

| LIQUIDITY |

REPORTING |

|

CONSOLIDATION |

GOVERNANCE |

|

RISK |

REMUNERATION |

| ICARA | PUBLIC DISCLOSURE |

Categorisation

The first challenge for investment firms is to identify where they fit into the new framework. ‘Exempt-CAD’ and ‘BIPRU’ categories will cease to exist and the ‘IFPRU’ category will only apply to those investment firms deemed systemically important or sufficiently bank-like to remain under the existing CRD/CRR framework. The CPMI category will endure, but the way the MiFID rules apply will be tweaked.

Under the new framework, firms will see themselves included under new categories: ‘small and non-interconnected investment firms’ (SNI) and ‘non-SNI’ for those who do not fall under the below parameters or are credit institutions.

Criteria to determine SNI/non-SNI status (relevant to AIFMs) are:

- Assets Under Management < £1.2 billion

- Client Orders Handled < £100 million/day cash or £1 billion/day derivatives

- Balance sheet assets < £100 million

- Revenue < £30 million

- No client money or assets held

- No dealing on own account or underwriting transactions

SNI is a good news story for most firms; requirements are less strict. Failing any one of the criteria does, however, mean that you are categorised as a non-SNI firm.

Wheelhouse Advisors’ extensive impact assessment work has shown that the effort required for data gathering should not be underestimated (for AuM and COH in particular). Mapping business activities to regulatory permissions is particularly complex for AIFMs conducting a mix of AIFM and MiFID business, as the new regime applies only to the MiFID aspects.

Capital requirements

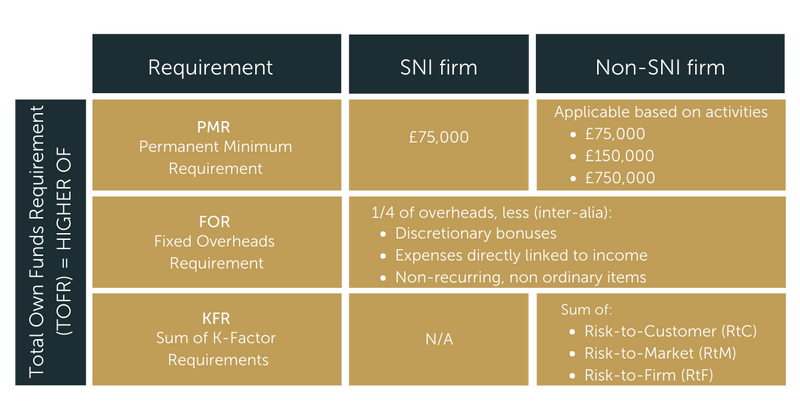

The table below illustrates how capital requirements will apply under the new regime:

Base requirements have nominal, non-problematic increases (the base requirement for AIFMD is already higher in any case). The fixed overheads requirement (FOR) is likely to be the biting point for most investment firms. For many, including advisers/arrangers, it is new and is the cause of large capital requirement increases.

For non-SNI firms, the entirely new requirements will come from the K-Factor requirements (KFR). When considering K-factors, it is highly likely that only RtC would be relevant to AIFMs (although it is still imperative to check this assumption) on the basis that AIFMD precludes firms from undertaking the MiFID activities which trigger the RtM and RtF requirements.

The RtC requirements should be considered and, if MiFID portfolios under management or advice are high enough, or client orders are handled in sufficient volume, the resulting capital requirements could exceed the AIFMD capital requirement. In any event, those metrics need to be monitored by appropriate, regular and timely processes.

Capital resources

The recognition and calculation of capital resources is closely aligned to the CRR/CRD framework, which is already borrowed by the AIFMD. So, CPMI firms may not see a change to the way their capital resources are calculated.

However, investment firms should note the deductions required from capital resources. Many of these are not new compared to existing regimes, but we have found, for investment firms that have managed their own prudential affairs, certain deductions that already applied have not been made.

Liquidity

Under the IFPR, firms’ liquidity requirement will be 1/3 of the FOR plus 1.6% of guarantees to clients. This is more lenient than the AIFMD liquidity requirement.

However, the definition of liquid assets has become stricter and means much of the requirement should be met with either cash or highly liquid assets.

Any receivables on the balance sheets are subject to certain haircuts and restrictions. Firms managing their liquidity on a centralised group basis (informally), need to formalise those arrangements to ensure that receivable meets the definition.

Consolidation

If the firm is in a banking group, then the IFPR consolidation rules need not be applied.

If the firm finds itself in an ‘investment firm only group’, then it could be subject to prudential consolidation. This results in consolidated capital adequacy, liquidity, reporting and potentially ICARA. Consequently, the regime provides a good opportunity to reassess the group structure with reference to the definitions of UK parents, as defined by the FCA.

Of particular interest is the inclusion of ‘connected undertakings’, which could result in two entities that share common management/ownership being supervised on a consolidated basis, even when not being part of a parent/subsidiary relationship.

A silver lining is the availability of the group capital test as a substitute for full prudential consolidation. This is available to investment firm groups that are sufficiently simple and where the FCA agrees that there is no significant risk that would otherwise require consolidated supervision.

Please note: it is not a substitute for appropriately capitalising parent companies; the test is that UK parents hold sufficient capital to cover the holdings in their subsidiaries.

Regulatory reporting

All reporting will be quarterly, with new reports to consider:

- FSA001 and FSA002 (balance sheet and income statement) will be replaced by FSA029 and FSA030 (now quarterly rather than semi-annually).

- FSA003 will be retired in favour of separate returns covering capital, liquidity, monitoring metrics, concentration risk (non-SNI firms only) and group capital test.

- FSA019 will be replaced by an ICARA questionnaire (MIF007)

- All firms will have to provide remuneration reporting (MIF008).

The FCA has remained silent on the topic of the reporting language for these reports. It remains to be seen whether extensible business reporting language (XBRL) or similar will be mandated.

Governance and Remuneration

Most governance changes only apply to larger non-SNI firms and the AIFMD remuneration rules will continue to apply unaffected. The existing non-AIFMD remuneration rules that are currently followed will be superseded with the IFPR remuneration.

At a high level:

- SNI firms will follow a ‘Basic RemCode’ which includes high-level standards on remuneration policy, governance, and oversight. It also includes principles on fixed and variable remuneration.

- Non-SNIs will follow the ‘Standard RemCode’. (Basic RemCode plus further standards on performance assessment, risk adjustments e.g. malus, clawback, etc. and setting of fixed vs variable ratio.)

- There will be even stricter requirements for larger non-SNI firms in the ‘Extended RemCode’.

ICARA

The FCA has provided further Internal Capital and Risk Assessment (ICARA)-related guidance in their second consultation paper (CP21/7), further to their previous publications in June 2020. This cements the direction of travel that the FCA expects investment firms to take regarding the assessment of the adequacy of their financial resources.

The ICARA document (as well as the thinking behind it) replaces the current ICAAP and will apply even to those who had no previous ICAAP requirement (e.g. exempt-CAD firms). Some key aspects are below:

Please note: the ICARA document itself is not the entirety of the activity and is not what the regulator will use to make its assessments.

Potential harm is associated with the propensity of a business to detrimentally affect its customer, the market and itself. These follow through to a potential need for additional capital and liquidity rather than following predetermined calculations. This is driven by the firm’s owned business model rather than being mapped unnaturally to a Basel framework designed for banks.

There will be stricter recovery and wind-down planning requirements; previously guidance, this has shifted towards a hard-and-fast rule. The ICARA process will, for most, require the greatest amount of time and input from senior stakeholders, management and those charged with governance.

Summary

Wheelhouse Advisors has been working with firms to address the issues above and to prepare firms to meet the obligations of the new regime. The impact can vary from firm to firm, with some seeing only minor changes in the way they will run their business, to others who will need to address significant increases in their capital, liquidity, governance, and reporting requirements.

An initial impact assessment helps identify areas where effort should be focused, where further work will be required, or to bring assurance that a firm’s arrangements need minimal changes. Planning and preparation will make all the difference.

Once appropriate changes to capital, liquidity and group structure are identified, senior management engagement and governance is paramount to implement the changes and support the development of a successful ICARA process.