MiFID2: The journey began on January 3rd

By Mark Croxon, Head of Regulatory and Market Structure Strategy, EMEA, Bloomberg LP

Published: 21 January 2018

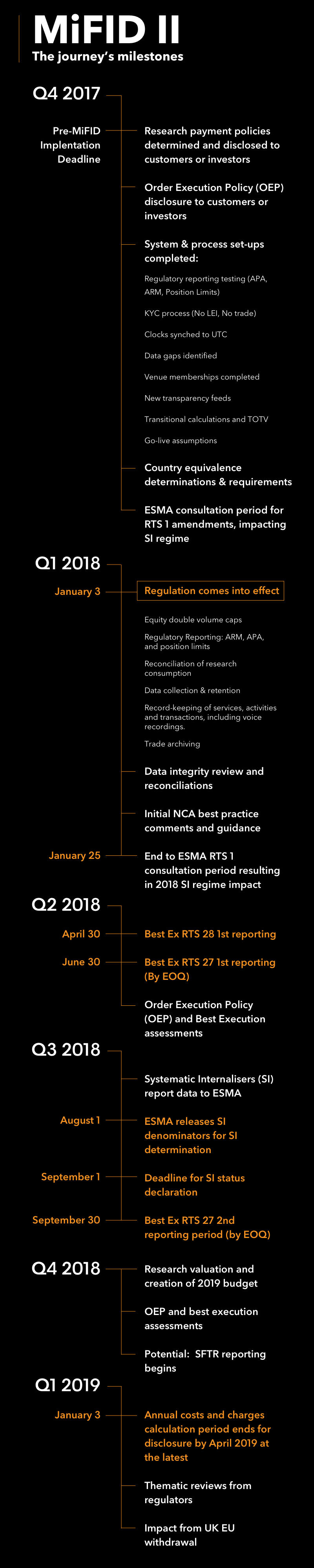

By the time this article will be published, MiFID2 will have gone into effect. While most EU and non-EU firms were naturally focused on getting ready to go live, some realized they needed to look beyond 3 January 2018 as well. MiFID2 doesn’t occur all at once - regulatory reporting and compliance dates are layered throughout the year.

It is going to be a (long) journey with a lot of twists and turns, new guidance, evolving standards and realizations that people, process and technology may need to be rethought, and perhaps revamped to ensure robustness and data integrity. As Steven Maijoor expressed in Bloomberg Markets magazine: "Once MiFID2 starts, we'll monitor how it is implemented. On a daily basis we'll get Q&As from stakeholders and from national regulators, and on that basis we'll adjust guidelines - as we already are."

To help firms visualize what a MiFID2 calendar may look like for the coming months and year, we have created a chart. This highlights moments at which key information may be provided by the regulators, such as third country equivalence determinations and requirements, expected initial best practice comments or guidance from the National Competent Authorities (NCAs) in Q1, and the release of data for SI determination in August 2018.

In addition, we've noted the checkpoints firms will need to respect with regards to the best execution reporting requirements in RTS 27 and 28, and the research budgeting and valuation obligations for firms who chose to remunerate research providers through RPAs. Some of these "events", such as transaction-trade reporting reconciliations, are not hard-wired into the rules but more a question of interpretation. Firms should consider them as potential best practice suggestions.

Best practices

For example, we believe firms should consider performing data integrity exercises during Q1. The main focus in January will be on the three regulatory reporting mandates. In order for national competent authorities to fulfil their statutory investor protection and market abuse prevention obligations, they need accurate information from the transparency reporting (APA), transaction reporting (ARM) and commodity position limit reports. At a basic level this may mean looking at the different data through the post-trade workflows. Broadly speaking, the data used in trade reporting should be the same as the one contained in the transaction reports, used in best execution analysis and stored in immutable format. Is there integrity in the process when a trade is corrected?

From the outset, firms may seek to confirm that transaction reports (and other records) are stored in immutable format. They may choose to reconcile investment generation and execution workflows to their transaction reports and NCA acknowledgement status, to identify potential instances of under and inaccurate reporting. They may also want to consider using their ARM reports to identify instances where they should have submitted a corresponding real-time APA trade report. And, they should verify they are accurately recording time stamps and order and trade execution information for RTS 28 best execution reports that have to be produced in April (and quarterly thereafter).

Speeches from regulators including comments on how systems and the industry are performing, as well as observations of good practice typically accompany regulatory milestones. We should expect these type of "soft guidance" events to be sprinkled throughout January.

Milestones in 2018

For best execution requirements, the UK regulator has indicated that under the MiFID2 regime, an order execution policy (OEP) and a feedback loop are required in order to continually improve execution practices. Due to the wide-ranging market structure changes for equities, bonds and derivatives, firms may want to look at their order and execution data in February to preliminarily determine if recalibration of trading protocols, strategies, and, if applicable, execution algorithms, is needed.

However, firms may wish to wait until April, when venues and systematic internalisers release their first RTS 27 best execution reports (quarterly thereafter), or June to conduct a more robust analysis. There may simply not be enough statistically significant data to identify trends and make data-driven changes to the order execution process until then.

In early Q2, but potentially near the end of Q1, ESMA is expected to post the first recalibration of bonds and continue to do so quarterly thereon. ESMA will also start to collect trade and volume data from venues in order to create the "official set" of denominators for systematic internaliser determination. In August, ESMA is expected to release their official set of denominators so that firms can determine their status by September.

In Q4, firms will most likely begin business planning for 2019. Although it is mandatory for those who chose to remunerate research providers through RPAs, firms that pay for research out of their P&L will most likely evaluate and set budgets for research to make sure that the value to the fund was commensurate with the cost. Also in Q4, potentially in November but possibly sooner, firms remunerating research through RPAs may start to provide notice for approval from their investors.

December 2018 may also be a busy month. In addition to RTS 27 and 28 best execution reports and evaluation of the best execution data to determine if adjustments need to be made to order execution policies for the coming year, the next leg of transaction (ARM) reporting - securities financing trade reporting (SFTR) - is set to begin.

And, of course, during 2018, we might also have to contend with potential differing member state approaches, the ebb-and-flow of the UK withdrawal from the EU, and a possible application of MiFID2 to collective portfolio management.

For further information, please contact: [email protected]