Price Take/Price Maker: 3Q21 Inflation Playbook

By Winnie Cisar, CreditSights

Published: 30 November 2021

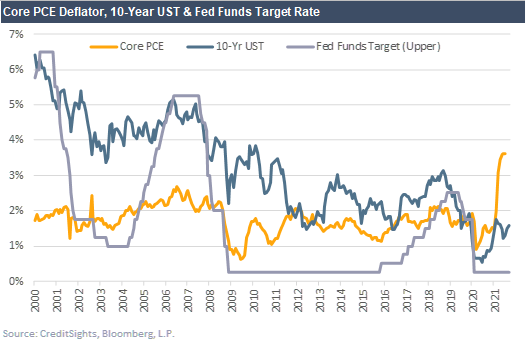

Most market participants view the Federal Reserve as 'in play' to make a taper announcement at its early November meeting, and the 29 October release of September’s personal consumption expenditures (PCE) deflator data may prove a key focus for investors leading into the meeting. The Fed uses core PCE as its preferred measure in its policy of 'average inflation targeting' and, in the April 2021 reading, core PCE jumped to 3.1% (year-over-year (YoY) % change). In the subsequent months, core PCE has climbed above 3.5% and consensus estimates point to another heady gain of 3.7% (YoY) for the September data. Looking further out, many, including the Fed, believe inflation will moderate as core PCE is expected to end 2021 at 3.2% before declining further in 2022 and 2023 (to 2.8% and 2.2%, respectively). With other central banks implementing rate hikes and inflation proving stickier than expected, market participants have pulled forward expectations of one (or more) Fed funds rate hike(s) into late 2022. The Fed funds futures market currently shows a 40% chance of a hike at the September 2022 Federal Open Market Committee (FOMC) meeting and an almost 60% chance of a December rate hike, a significant change in expectations from just a few months ago. At the end of June, the futures market was pricing in a 24% chance of a September 2022 hike and 32% of a December hike.

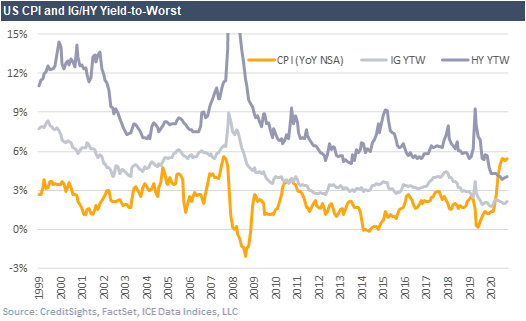

In the two rate hiking cycles since 2000, the Fed started to raise the Fed funds target prior to, or in tandem with core PCE hitting the 2% target level. For many investors, the recent extended period of Fed accommodation, both in the form of quantitative easing and zero interest rate policy (ZIRP), is a point of concern given the risk of a policy error as the Fed navigates its exit strategy. These fears recently came to a head as the jump in core PCE has proven persistent and has generally been met with patience from the Fed, keeping a lid on rates. For corporate credit investors, the pace of changes in the monetary policy and rates landscapes have the potential to drive significant total return losses across both investment grade (IG) and high yield (HY), which trade at the low end of the historic range in yields.

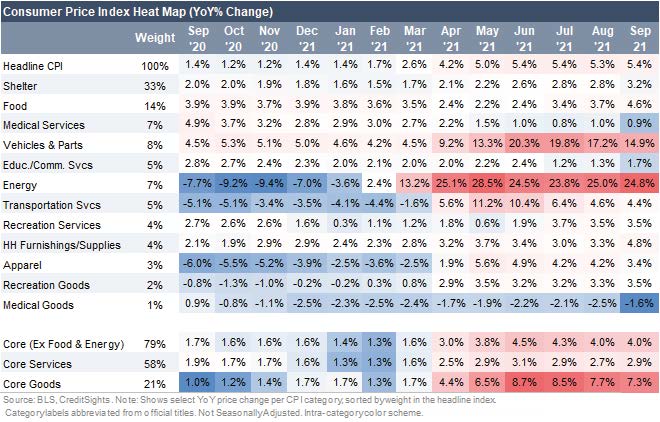

The September readings for consumer price index (CPI) and producer price index (PPI) added more pressure to the Fed and rates. Both metrics hit lofty levels and showed persistently acute pressure in autos, energy, and overall core goods. Increases in housing prices added to investor concerns as the shelter category of the CPI data jumped 3.2% YoY. Taken together, these factors leave the US consumer on somewhat less stable ground as housing and energy prices account for a significant portion of household budgets. We also note that recent data show glimmers that inflationary pressures may abate over the next 12 months, as some categories have demonstrated modest price stabilisation (medical services and apparel).

Compared with historic levels, US IG and HY are trading at the very low end of the range for yields and spreads, leaving little room for spread compression to offset a move higher in interest rates and mitigate total return losses. In fact, for the first time since 1999, the recent acceleration in CPI pushed the annual rate of inflation well above IG and HY yields. In prior cycles, credit spreads have proven resilient amid inflationary pressures with both IG and HY generally tightening during periods when inflation runs around 2% (or slightly higher). This makes sense intuitively as recent inflationary periods have also coincided with strong economic growth, supporting risk appetite and credit fundamentals. However, investors are now navigating a coordinated global economic reopening that is complicated by pandemic related disruptions to the supply chain and labour markets all while waiting for the Fed to make its exit from the market.

These factors leave us less inclined to expect broad-based spread compression across IG, though a modest amount of spread tightening through year-end is possible in HY (US IG & HY Q4 2021 Outlook: Freshly Squeezed provides our forecasts through year-end for both asset classes). With these factors in mind, we view inflation and its specific impact across sectors and single names as a key catalyst for valuations.

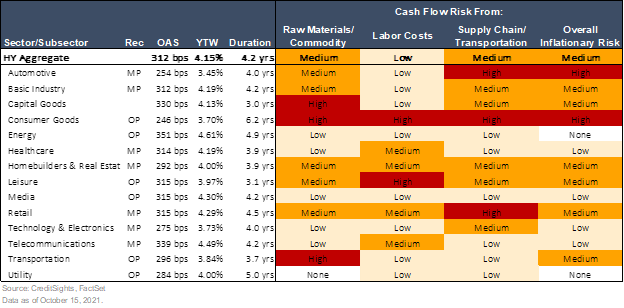

Price takers/price makers in US investment grade and high yield

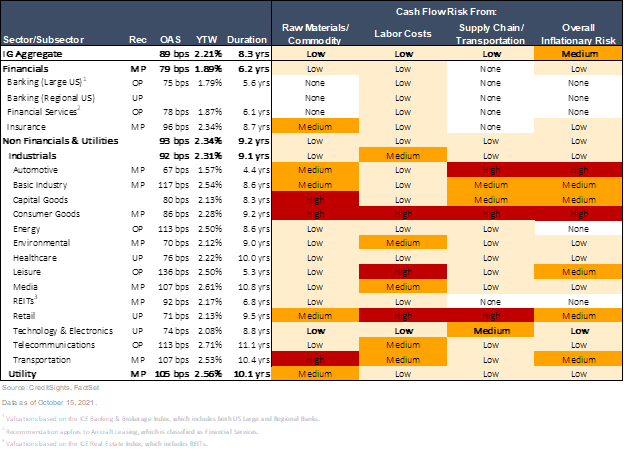

The CreditSights team of fundamental analysts identified three specific inflationary pressures: raw materials/commodity prices, labor costs and supply chain/transportation and assessed each sector's potential risk to cash flows from each of these categories. The analysts then provided an overall inflationary risk assessment for the sector. Overall market inflationary risk assessments for IG and HY are meant to reflect the aggregation of the sector recommendations on a fundamental, rather than technical, basis. For investors interested in sensitivity to interest rates at the sector level, see US Chart of the Day: Duration Adj Sector Yields.

US investment grade

Ultra-low yields have broadly benefited the IG universe, allowing issuers to lock in historically cheap, long-term debt financing and supporting fundamentals. As of now, inflation plays only a moderate threat to IG fundamentals, with the most risk to cash flows for autos and consumer goods. Sectors that require seasonal labor, including leisure and retail, both of which are already facing labor shortages, are also at risk of margin compression from higher labor costs. In general, IG financials and energy, two sectors where we have overweight recommendations, are well-positioned in an inflationary environment.

US high yield

In the US HY market, we expect inflationary pressures to play a moderate role in Q3 2021 earnings performance, and we have assigned the asset class a ‘medium’ rating for overall inflationary risk. The same two sectors are identified as inflation being a high risk to cash flows in the near-term: autos and consumer goods. Our analysts also identified pockets of potential challenges, specifically the effect of elevated raw materials/commodity prices on the capital goods sector, high labor costs for leisure issuers and continued supply chain/transportation-related pressures for retailers (especially heading into the holiday season). In the HY market, only energy is identified as having no risk to cash flow from inflationary pressures as commodity prices ultimately dictate what issuers in a range of other sectors must pay. Other HY sectors at overall low risk of an inflation-related hit to cash flows include healthcare, media, technology and telecom.