Financial services industry outlook: Secondary funds will become a bigger feature of private capital funds

By Kennedy Chinyamutangira, RSM US LLP

Published: 20 September 2021

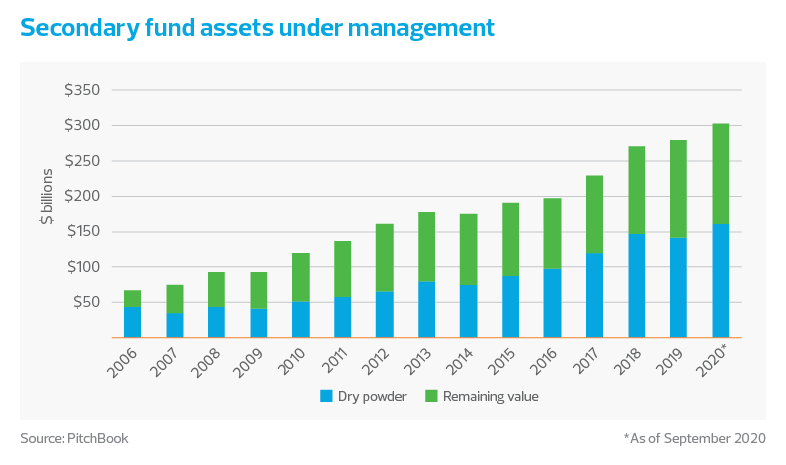

Private equity is generally recognised as an illiquid investment strategy best left to those with investment horizons distant enough to tolerate the lock-up period. Secondary funds (known as 'secondaries') that acquire private equity interests from limited partners in private equity funds who wish to exit their investment before the end of a fund’s term have long been a feature of private equity investments. As assets in private equity have grown, secondaries have also gained popularity, but they have continued to be a small segment of private capital assets. This is expected to change going forward as the evolving landscape of private equity makes secondaries a more prominent feature of private capital markets.

Capital flowing into private capital funds should continue to increase given its track record of outperforming public markets and the current low interest rate environment. On a transient basis, however, the recent concern is about inflation. As more investors seek exposure to private capital funds, the growth in assets will be accompanied by an increasingly diverse profile of investors which can only spur a greater need for more liquidity in the asset class. Secondary funds meet this need by providing liquidity to investors in primary funds. An established secondary market in private equity should be the culmination of a maturing marketplace as private capital markets continue to grow and evolve.

Secondary funds also cater to investors with different needs for the timing of cash flows because relative to primary funds, they generate cash sooner. By investing in primary funds that are in the later stages of their life cycle, secondary funds acquire interests that are typically in the harvest stage and are already returning cash to underlying investors. This alters the risk-return, duration, and cash-flow profile of exposure to private equity, which can be attractive to a different universe of investors.

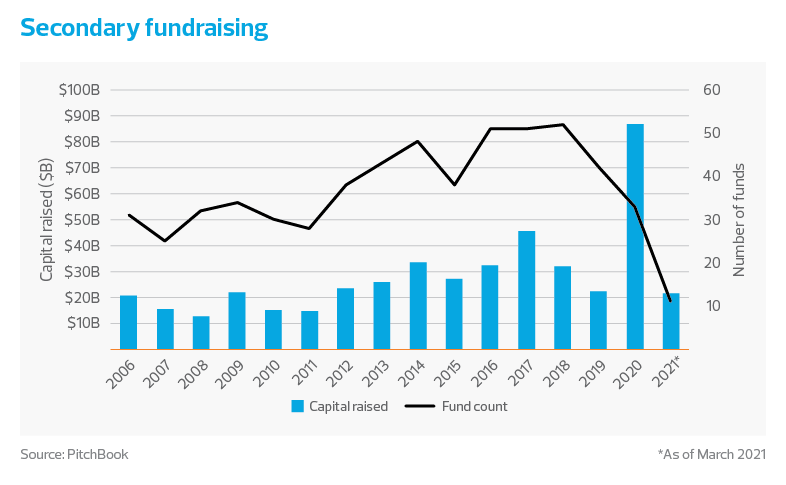

Secondaries had a record fundraising year in 2020. COVID-19 may have had some part to play in this. Given that secondary funds can provide liquidity to investors who may be forced to sell in a distressed environment, the aftermath of the pandemic may have attracted investors to this type of strategy. The large publicly traded private equity asset managers have increased their focus on secondaries in recent years and drove much of the fundraising success in 2020 with several mega-fund launches, resulting in the growth in capital raised while the fund count dropped.

The quick economic recovery has meant that the opportunities that secondary funds may have been expected to cash in on might not have materialised as expected. However, the increasing popularity of secondaries should endure as focus shifts to secondary funds that are led by GPs of private funds (GP-led secondaries) instead of secondary funds created by independent fund managers to buy interests from limited partners wishing to liquidate their holdings in existing private funds (LP-led secondaries).

GP-led secondary funds have gained in popularity, primarily through the creation of continuation funds by GPs seeking to achieve two goals. The first is to give liquidity to existing limited partners that cannot go beyond the fund’s term in a maturing fund and need to cash out their investment. The second goal is to allow investors that can endure a longer holding period to renew their commitment to a portfolio of companies that would benefit from staying in the general partner’s portfolio for a while longer.

GPs with high-performing or high-potential assets in their portfolio that have room to appreciate further may find themselves forced to sell these assets prematurely if the fund is nearing the end of its life. Continuation funds and GP-led secondary processes have gained in popularity as they solve this problem by allowing the general partner more runway to capture this additional value for themselves and their limited partner base. For example, companies that have strong long-term prospects but were severely impacted during the pandemic and are expected to rebound as the economy recovers would be prime candidates for a GP-led secondary process via a continuation fund.

Secondaries bring liquidity to private equity investment, an alternative way of gaining exposure to private equity and faster access to some prized private equity assets. These features make this strategy an important supporting feature of a growing asset class and a compelling investment proposition for investors with a certain profile. As a result, growth in secondary funds is expected to persist.

While currently dominated by larger asset managers, this trend is also expected to take hold among midsize asset managers driven by the increasing flow of capital into private equity across the size spectrum and as the type of investors seeking exposure to private equity as an asset class continues to expand and diversify.