Credit outlook pulse check

By Craig W. Packer, Blue Owl Capital

Published: 20 November 2023

The first half of 2023 was a conflicting storyline of optimism and uncertainty as investors navigated a global picture in transition on several fronts.

Indeed, we were cautious about the outlook for the US economy as we entered the year but have been pleasantly surprised by its resilience. Company fundamentals are strong, as consumer and industrial demand have held up despite higher interest rates and slowing growth. As inflation moderates, many businesses are exhibiting improved profitability and margin profiles. Risk assets have generated attractive investment returns and direct lending portfolios generally continue to perform well. For direct lenders, elevated rates have widely continued to benefit earnings profiles, evidenced by significantly higher loan asset yields and increasing dividend rates. Though a ‘higher-for-longer’ rate regime still poses a threat to the macro backdrop, we believe upper middle market borrowers are well-positioned even if the economy were to modestly weaken in 2024.

In this piece, we revisit some of the themes shared in our 2023 Direct Lending Outlook published earlier this year. Rather than offering entirely new perspectives, we have provided updates on the topics continuing to define our market.

Navigating the macroeconomic conditions that lay ahead

So far this year, direct lending portfolio returns across the asset class have been buoyed by stable credit quality, as well as rising spreads and benchmark rates. We have not observed any signs of broad-based erosion in credit fundamentals or a material uptick in defaults or non-accruals in our portfolios. We have been particularly focused on the impact of higher rates on interest coverage ratios, which, as we expected, have come down moderately in recent quarters in line with the higher rate environment. Our current expectation is that interest coverage will reach its lowest point in 1H24, albeit at an acceptable level for the vast majority of borrowers, and then increase thereafter as benchmark rates are currently expected to normalise in the back half of next year.

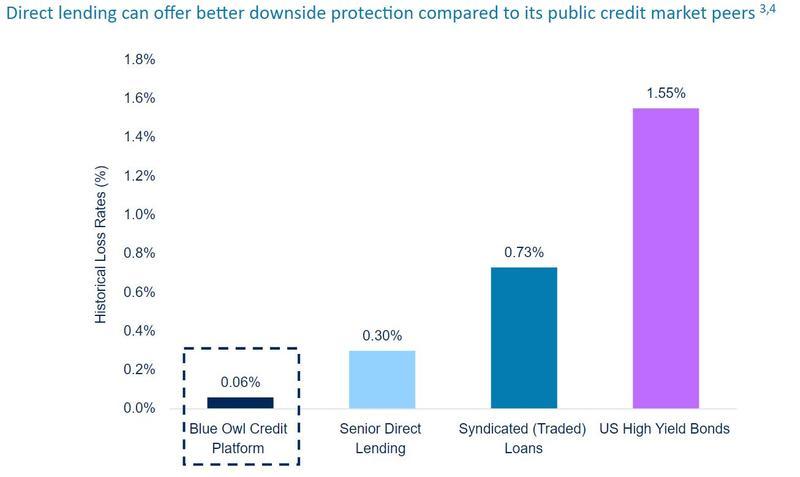

Our borrowers continue to see positive, though moderating, revenue and earnings before interest, taxes, depreciation and amortisation (EBITDA) growth and maintain reasonable liquidity to service debt. Businesses across many industries are proactively cutting costs to ensure sufficient cash cushions in this higher rate environment. In the select instances in which borrowers anticipate tight liquidity, sponsors have demonstrated a strong willingness and ability to provide additional equity capital when needed. We remain vigilant on portfolio monitoring and believe any potential credit losses will be manageable and more than offset by the earnings increases from higher benchmark rates. We also believe private credit will continue to deliver lower default and loss rates relative to public markets. This reflects our enhanced diligence and underwriting process, ability to negotiate more comprehensive covenant packages, on-going dialogue with borrowers and sponsors, and in-house portfolio management and workout teams to support downside mitigation and capital preservation.

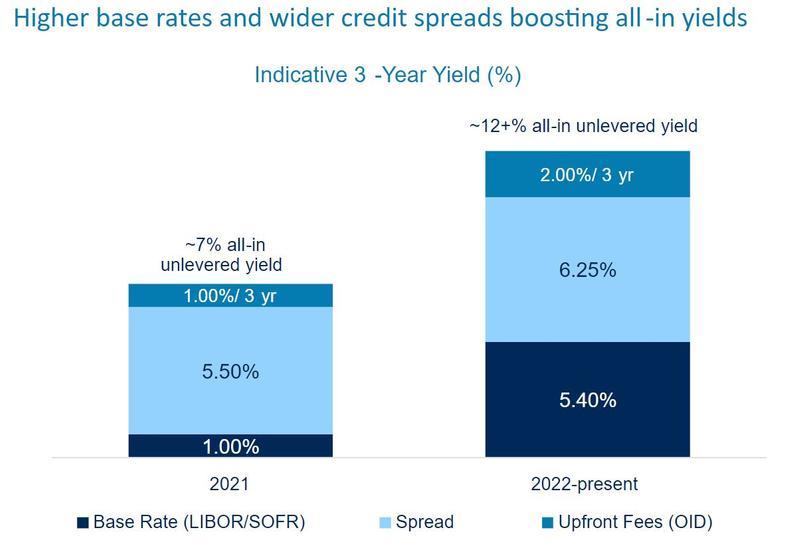

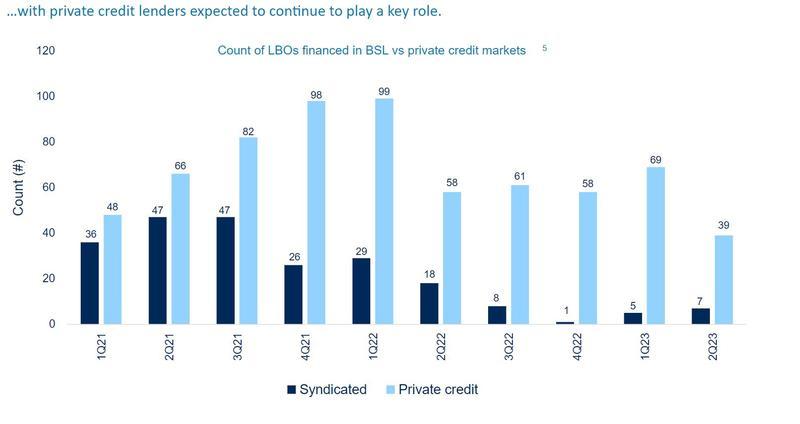

One of the best investing environments for direct lenders

The investing environment is still very attractive for direct lenders, and particularly scaled managers. While the syndicated market has reopened somewhat this year, leveraged loan volumes are still light as direct lending comprises roughly 90% of leveraged buyout (LBO) financings so far this year. As noted in our 2023 outlook, we continue to secure compelling economics and ‘lender-friendly’ terms on deals. Direct lenders are still pricing newly originated unitranches at over 12% all-in unlevered yields, as a result of rising benchmark rates and credit spreads in the last year.

While spreads have moderated in recent months as markets re-open and capital constraints within direct lending taper off, they remain at attractive levels and overall yields are well above historical levels.

Borrower credit quality also remains very attractive. The borrowers seeking capital in our market continue to skew very high quality. Also, these deals are frequently closing at lower leverage and loan-to-values as sponsor valuations remain high and lenders factor in elevated debt service costs in the financing packages they provide.

Private equity deal activity is slower than last year, but picking up

Deal activity in the direct lending space has picked up over the last quarter after a slow start to the year. We are seeing a diverse mix of deal flow across a range of transaction types and company sizes. The most noteworthy change since the beginning of the year is the recent pick-up in traditional sponsor LBO activity. This is the ‘bread-and-butter’ of the leveraged finance markets but was largely dormant in the first quarter of this year and fourth quarter of 2022.

Aside from the recovery in sponsor-to-sponsor LBOs, we have primarily witnessed a continuation of trends from earlier this year. Add-on acquisitions for existing portfolio companies remain active. We view these transactions as particularly attractive because we have an in-place relationship with the sponsor and management team and thus have a keen understanding of the company’s historical financial and operating performance. We can be very efficient in diligence, leveraging the competitive advantages of our incumbency and often securing above-market pricing given our unique positioning. We are also still seeing activity across corporate carveouts and divestitures as large conglomerates focus on streamlining operations and selling off non-core assets.

While ‘take-private’ transactions remain a source of deal flow, activity has been slightly less prominent versus late last year as public equity markets have rebounded. We continue to lead the vast majority of these deals in which we participate, typically driving negotiations and speaking for large size.

Of note, the average size of these take-privates has come down relative to the ‘mega-tranche’ deals of 2022, as rising debt service costs inform smaller purchase prices and debt financing packages.

Finally, we believe there is significant pent-up demand from sponsors to sell mature assets and to deploy dry powder across the industry. This will likely lead to a welcome pick-up in financing activity as the rate outlook stabilises.

In conclusion

We believe market dynamics will continue to favour the direct lending asset class. There is no denying that direct lenders have been uniquely situated to finance transactions and gain share from the investment banks amidst the volatile backdrop of the last few months, but we believe the opportunity set will continue to expand even after public markets reopen to normal levels.

This is part of an ongoing secular shift, rather than a cyclical one. Indeed, more sponsors today are familiar with direct lending and have seen first-hand the strong value proposition that a private solution can offer. Scale, certainty of execution and flexibility all provide borrowers and financial sponsors with a compelling alternative to the syndicated and high yield markets. As a result, direct lending is poised to gain further share from the public credit universe. After all, the asset class represents only 20% of the leveraged finance market today, and we believe has potential for further growth, representing up to 30% of the total market in the coming years. So, the opportunity set is expanding dramatically even as more capital enters the direct lending asset class and as public market activity normalises.

Looking ahead, we maintain a decidedly positive outlook for direct lending. We are able to be highly selective on the deals that we do and the terms at which we transact. Solid earnings potential, a manageable credit environment, and growing demand for our capital all point to a compelling opportunity set and risk-return profile to come.

1. Sources: Bloomberg, Cliffwater as of March 31, 2023. Federal Funds Effective Rate (ticker: FEDL01 Index). Direct lending yield represented by Cliffwater Direct Lending Index 3-year takeout.

2. Sources: Bloomberg, Cliffwater for the period January 1, 2022 to June 30, 2023. Global Agg represented by the Bloomberg Barclays Global Aggregate Index, Global IG represented by the Bloomberg Barclays Global IG Corporate Index, US High Yield represented by the ICE BofA US High Yield Index, US Direct Lending represented by the Cliffwater Direct Lending Index.

3. Average annual loss rate based on total annual net realised losses across Direct Lending strategies divided by the average aggregate quarterly cost of investments. The loss rate is based on the average loss rates in each year since inception from 2016 to 2Q23.

4. Source: SP LCD, Cliffwater, JP Morgan. Market loss rates calculated as average loss rates and defined as: for loans, based on SP LCD default rates for all loan $ defaults as percentage of total outstanding and calculated as default*(1 – average historical Recovery Rate) from 2016 to 2Q23; Direct Lending based on Cliffwater Direct Lending Index realised gains/losses from 2Q16 to 1Q23; High Yield Bonds based on JP Morgan Default Monitor annual defaults and calculated as default* (1 – average historical Recovery Rate) from 2016 to 2Q23; Recovery rates for loans of range from 48-63% by year and 22-55% for bonds and are based on JP Morgan Default Monitor, July 5, 2023

5. Sources: Pitchbook, LCD. As of June 30, 2023. Private Credit & Middle Market Report 2Q23.

Disclaimer

Please review the important disclosure information for this article at the following link: https://www.blueowl.com/disclosure-information