Planning ahead for the Senior Managers and Certification Regime: What should you be doing now?

By David Cummings, Senior Associate, Employment, Robbie Sinclair, Senior Associate, Employment, and Sarah Hitchins, Associate, Regulatory, Allen & Overy

Published: 14 October 2016

The Senior Managers and Certification Regime (SMCR) is due to apply to asset and fund managers from 2018. However, to date, the Financial Conduct Authority (FCA) has remained tight-lipped as to what the SMCR will look like for asset and fund managers.

In this article, we explore what the SMCR is likely to look like for asset and fund managers, as well as what firms can be doing now to prepare themselves for the forthcoming FCA consultation process and implementation programmes.

What is the SMCR going to look like for asset and fund managers?

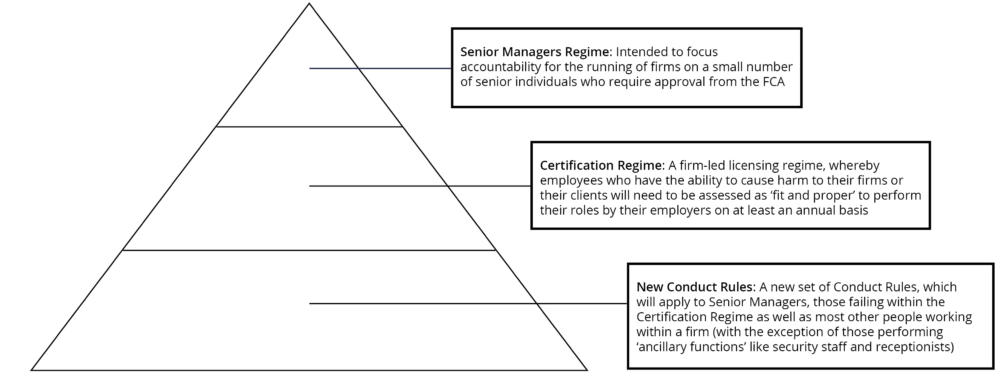

The FCA) has not publicly commented about what the SMCR will look like for asset and fund managers. However, it is very likely that the basic structure of the SMCR will mirror what has already been put in place for banks and building societies, namely:

There may be some differences between the SMCR that applies to banks and building societies and the SMCR that applies to asset and fund managers – for example, the categories of people who will fall within each of the three layers of the new regime set out above.

Avoid starting with a blank piece of paper

Some asset and fund managers might feel that the prospect of implementing the SMCR is a daunting one, even before the FCA’s consultation process starts. However, based on our experience of advising banks and building societies in relation to the implementation of the SMCR, this process need not be so daunting. Instead of scrapping current arrangements and starting from scratch, firms may be able to enhance, adapt and supplement their existing arrangements in order to meet the requirements of the SMCR. This approach may make for a smoother (as well as more time and cost effective) transition to the SMCR. With this in mind, even before the FCA starts to consult on the SMCR for asset and fund managers, firms may wish to undertake a ‘health check’ of their existing arrangements in areas such as governance, record keeping, policies and procedures and remuneration. This will help firms to be in the best position possible prior to any FCA consultations.

Governance

One of the key objectives of the SMCR is to clarify precisely who is responsible for what within a firm. When identifying who needs to be designated as a Senior Manager or a Certified Person, asset and fund managers will need to have a clear idea about who is responsible for what within their organisations. One way to get a head start on this process is for firms to ensure that employees have up-to-date job descriptions which accurately reflect their roles and responsibilities.

Now would also be a good time for asset and fund managers to ensure that reporting lines and delegation arrangements are clear and work effectively in practice. To the extent they do not already exist, up-to-date organisational charts should also be drawn up, so that responsibilities, reporting lines and delegations are accurately mapped out, especially at the most senior levels within firms.

New hires

A number of the banks and building societies we have assisted with implementing the SMCR have taken the opportunity to update their employment contracts for Senior Managers and Certified Persons. This is important because contracts drafted with a view to compliance with the old approved persons regime do not necessarily reflect the requirements of the new regulatory landscape in which staff subject to the SMCR are working.

Although the detail of the SMCR that will apply to asset and fund managers has not yet been fleshed out, now would be a good time to start thinking about how existing contract templates can be tweaked and strengthened before the new regime is implemented. With careful drafting, contracts can be appropriately updated even before the detail of the regime is set in stone and some of the key changes to consider are as follows:

- Update any references to the existing approved persons regime to include equivalent regulatory provisions and requirements (i.e. SMCR).

- Make employment conditional on holding any regulatory status that is required for the employee to perform their role under the regulatory regime in force at the appropriate time, whether it be by approval by the regulators or through certification by the firm (as will be required under SMCR).

- Require new hires to warrant that they are fit and proper to perform their roles – this will be a key requirement for both Certified Persons and Senior Managers.

- Consider expanding any existing duties clause to reflect the new duties to which employees will become subject when the SMCR applies to them.

- Require new hires to complete a full handover of their responsibilities on termination of their employment (likely to be a key regulatory requirement for Senior Managers) or to assist with any such handover (an important role for Certified Persons to whom a departing Senior Manager has delegated responsibilities).

- Extend any existing grounds for summary dismissal to include non-compliance with any regulatory framework, e.g. under SMCR, ceasing to be approved by the regulators or failing to be certified by the firm as fit and proper.

Significant Influence Function holders

Some individuals who currently perform Significant Influence Functions (SIFs) will be designated as Senior Managers under the SMCR. As Senior Managers, their actions and inactions are likely to be subjected to a higher degree of scrutiny by the FCA, especially given the FCA’s continued focus on individual accountability. Under the SMCR, Senior Managers are required to take reasonable steps to prevent a breach of regulatory requirements from occurring or continuing in their area(s) of responsibility. If the FCA can prove that a Senior Manager failed to do so, it may take enforcement action against that Senior Manager personally. This is similar to what the FCA may do in relation to SIFs under the current approved persons regime. As a result, asset and fund managers may wish to review or ‘stress test’ their current SIF arrangements, in order to assess in advance of the SMCR whether they would stand up to regulatory scrutiny.

Record keeping

Since the implementation of the SMCR in March 2016, a number of banks and building societies have been reviewing their record keeping procedures in light of the SMCR. Key areas of focus have included:

- How long email records and back-up tapes are retained for.

- Whether a central electronic storage space should be set up to store core documents relating to the SMCR.

- To what extent should notes be taken of informal discussions and meetings attended by Senior Managers.

- How should hard copy records (for example, day books) be retained.

- What access should Senior Managers be allowed to have to firm records after they have left the firm.

Most asset and fund managers are already likely to have policies and procedures in place to manage how these kinds of documents should be stored and retained. However, it would be advisable for these policies and procedures to be checked, in order to ensure that they remain fit for purpose – both now and also under the SMCR.

Policies and procedures

The new requirements of and terminology associated with the SMCR are likely to mean that a number of existing policies and procedures will require amendment. Some of these policies and procedures will only require light amendments, whereas others may require more substantial editing in light of the SMCR. In addition, it is likely that asset and fund managers will need to introduce new policies and procedures to take account of the SMCR. For example, a policy setting out how a firm undertakes its obligations under the Certification Regime to assess the fitness and propriety of certain employees. A number of banks and building societies also opted to introduce new policies which, although not strictly required under the SMCR, set out for employees what the SMCR meant for them.

In the lead up to the SMCR applying to asset and fund managers, now would be a good time for firms to ensure that their current suite of policies and procedures are up-to-date, and meet current requirements. This approach will help to simplify the process of updating and amending these policies and procedures to take account of the SMCR, when this time comes.

Training

A point that the FCA has been keen to emphasise for banks and building societies is that it is key that employees understand how the new Conduct Rules apply to them and their specific responsibilities. The FCA has already tried to emphasise this point to the industry through recent enforcement action it has taken against firms that featured training provided to employees. However, under the SMCR, ‘one-size-fits-all’ training programmes really are likely to become a thing of the past.

Given that the vast majority of a firm’s employees are likely to be subject to the new Conduct Rules (i.e. not just Senior Managers and those falling within the Certification Regime), this type of more bespoke training will need to be prepared for and rolled out to a much broader population of employees. Firms will also need to take steps to ensure that accurate records of training completion are maintained, and that those who fail to complete mandatory training (whether on the Conduct Rules or other topics) are dealt with appropriately.

Disciplinary

Any matter capable of amounting to a breach of the new Conduct Rules or which calls an individual’s fitness and propriety into question may well impact on that individual’s ability to continue in their role, and may also be reportable to the regulators. It is also likely to fall within the ambit of the firm’s HR disciplinary policy.

This overlap presents three key challenges for asset and fund managers to consider:

- How to ensure that adequate policies and procedures are in place to assess disciplinary matters, as well as potential breaches of the Conduct Rules and an individual’s fitness and propriety;

- How to ensure that the documentation governing these three issues dovetails; and

- How to ensure that the functions responsible for the relevant policies and procedures work together to ensure the appropriate, and consistent, outc individuals who are “material risk takers” for the purposes of the UK remuneration codes - and also prescribe how the remuneration of Senior Managers and Certified Persons should be structured.

Potential difficulties can be avoided if firms prepare early. Some new policies will certainly be needed – such as procedures to assess fitness and propriety and potential breaches of the new Conduct Rules. Asset and fund managers will also need to think carefully about who will own these policies (most likely compliance, with HR running the disciplinary side) and, most crucially, how relevant stakeholders operate these policies in practice. The most effective solution is likely to be some form of panel approach, with representatives of compliance, HR and other relevant functions convening to determine which procedures need to be followed and at what stage. In addition, we have found that this panel approach is extremely helpful in ensuring consistency of treatment. Record keeping (discussed above) will also be key throughout any disciplinary and compliance processes, both to ensure that the rationale for all decisions is adequately documented at every stage, and that outcomes affecting individual employees are adequately recorded and maintained on the system for the requisite regulatory period.

Remuneration

The SMCR and remuneration regulations are closely linked. Both focus on accountability and managing risk and reward. The remuneration codes (at least in part) inform the scope of the population of Certified Persons – i.e. those individuals who are “material risk takers” for the purposes of the UK remuneration codes - and also prescribe how the remuneration of Senior Managers and Certified Persons should be structured.

The precise scope of an asset and/or fund manager’s likely population Certified Persons is unclear at this stage. However based on the current SMCR in force across the banking sector, at a minimum, Certified Persons will be existing ‘material risk takers’ under the relevant remuneration codes, in addition to other individuals performing client-dealing functions which require qualifications and head material business units. The identification of Certified Persons has been a complex task in practice for banks and building societies under the SMCR, so asset and fund managers should take the time now, as a first step, to consider which individuals may fall within the scope of the Certification Regime based on its existing Remuneration Code population.

In view of the SMCR’s focus on individual accountability, asset and fund managers should also consider how remuneration plans and decisions can be adapted in practice to best reflect likely future requirements. For example, it may be appropriate to consider the appropriateness of any bad leaver, malus and/or clawback provisions that exist (or may not exist at this stage) in any discretionary variable incentive plans and/or to provide for the introduction of such ex-post/performance adjustment mechanism and/or additional triggers - for example - where it is determined that an individual is not fit and proper or has breached the new Conduct Rules, or fails to be approved by the regulators as a Senior Manager or to be certified by the firm.

Proportionality in respect of these issues are still likely to be relevant across the asset and fund management in the industry which may give firms some flexibility in this respect at least in the short term. However, the clear expectation of the regulators across the financial sector more widely is wide-spread use of performance adjustment mechanisms as inherent tools for firms to more effectively manage and balance risk and reward in respect of remuneration, combined with greater individual accountability under the SMCR. The same regulatory expectation will apply across the asset and fund management sector.

More generally, asset and fund managers will face a range of different - and at times intersecting - regulation when it comes structuring the remuneration of its Senior Managers and Certified Staff over the coming years at both sector and product level; including the Capital Requirement Directives, AIFFMD and UCITSV and MiFIDII, which will present challenges from a compliance perspective. Asset and fund managers should invest time now to understand this regulatory landscape, its impact on employees and its dovetailing with the added layer of regulatory compliance and expectations that will attend the implementation of the SMCR across the industry.

[email protected]

[email protected]

[email protected]

www.allenovery.com