Taking a data-driven approach to optimizing target operating models

By Palak Patel, Global Business Manager, Bloomberg AIM

Published: 13 July 2018

As the global asset management industry evolves, firms may find that legacy operating models and technologies are no longer sufficient to address current challenges and take advantage of new opportunities. In this article, two such firms provide insight into their data-driven processes of optimizing target operating models (TOM) and underlying technology to sustain competitive growth.

Starting on the path to optimization

Today’s asset management firms are facing myriad and fast-changing pressures: investors are seeking higher yields, return, and income at a lower cost. Regulators, clients and internal stakeholders are issuing mandates of increased transparency and efficiency. An explosion of new market and “alternative” data may unlock (or surface) insights that drive performance, but requires rigour in management and application to deliver real value.

In this environment, it’s hardly surprising that many asset managers are reconsidering their operating models, as well as their investment in technologies to support modernised operations. While priorities vary based on each firms’ goals for growth, one thing has become clear: consistent and timely access to dependable data is central to both the TOM and the technology strategy.

In recent client discussions, we’ve learned that firms who have taken the lead in implementing data-driven operating models are achieving measurable results. The front office can more quickly discover and act on investment opportunities. IT departments can more easily scale for growth and complexity. Executives can set realistic goals for firm growth launching new funds, raising new assets, complying with the latest regulations and clearly identify what’s required for success.

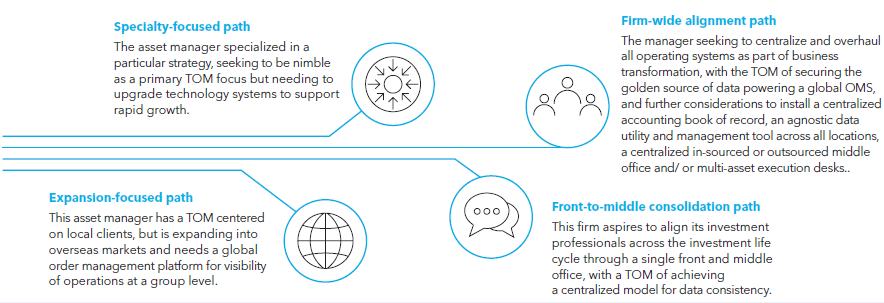

As we tailor our support for our clients’ goals, Bloomberg has identified four paths asset managers are taking on their journey to optimise their TOMs: specialty-focused, expansion-focused, front-to-middle consolidation or firm-wide alignment.

These paths and how to get started are more fully explored in a whitepaper available for download at https://www.bloomberg.com/professional/the-journey-tomorows-buy-side-operating-model

The specialty-focused path: a boutique streamlines systems and grows AUM

In 2014, the founders of Jamieson Coote Bonds (JCB) saw an opportunity in their home market of Australia. With their combined several decades of fixed income experience, Charles Jamieson and Angus Coote believed that domestic investors--serving an ageing population of superannuation participants--would embrace an offering to increase exposure to the high-rating, high-yield Australian government debt favoured by international investors.

Operating a relatively young fund management firm, the team was aware that attracting investment from the institutional market would require that they demonstrate best practices in operations, compliance and systems. They determined that concentrating their information and technology spend with a single provider was the most cost-efficient and fastest way to achieve that goal, and thereby meet asset owners’ due diligence requirements.

Jamieson explains, “We realized that we needed to keep our operating environment as simple and contained as possible, to minimize op risk concerns. At the same time, we needed a streamlined investment and trading workflow, with dependable connectivity to the markets and consistent data throughout the process.”

JCB chose a scalable system that is also in use by a number of their domestic asset owners, which helped gain validation from that community. They credit this instant confidence in their systems with helping them close in on their goal of becoming a multi-billion AUM manger in just a few years.

The firm-wide alignment path: a global “golden source” becomes reality

Italy’s largest independent asset management firm has grown internationally through acquisitions and partnerships, resulting in a presence that spans 17 countries. For Azimut Group’s Francesco DeMatteis, Head of Risk Management, this global expansion presented a unique challenge: how to capture all portfolio activities across the globe, fully integrated within a risk management framework that adheres to corporate mandates while accommodating local differences in operations.

A key aspect of firm-wide alignment is the importance of data consistency in establishing transparency across multiple offices for global oversight. Says DeMatteis, “When you don’t have intelligent systems, it’s a problem, as looking at different figures results in different assumptions and different models. When you use one model for everything, you can get right to discussing what is going on with the portfolio, and not waste time reconciling figures.”

For example, Azimut’s risk team designed a NAV interface with a custom calculation, which they rolled out to every manager. Now, when something goes wrong in the market, everyone is looking at the same information, facilitating faster decision-making across the global business.

In addition, Azimut is finding efficiencies in operations through a unified order management system with middle office capabilities. For example, when one office approves a broker, all the other locations can use the same broker based on that one completion of due diligence, without having to repeat the process for every single location. Similarly, regulatory inquiries can be handled quickly and with confidence, due to a universal, transparent view of positions.

Embracing a data-driven TOM has also presented new opportunities for growth. DeMatteis explains, “We wanted to use funds with a higher level of complexity, and we had some portfolio managers that were doing strong activity in derivatives. Having a common platform allowed us to supervise and manage these more sophisticated funds so that other managers within Azimut could use them too.”

In conclusion, asset managers burdened with fragmented technology and disparate data cannot achieve an optimized target operating model. As these examples illustrate, forward-thinking firms are realizing their goals by creating TOMs that place data and analytics at the center of their technology strategy.

For further information, please contact: [email protected]