ACC-sponsored Oliver Wyman Study on ABS Residuals

Published: 11 March 2024

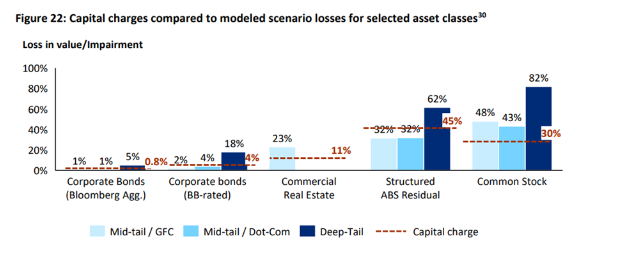

The Alternative Credit Council ("ACC") sponsored Oliver Wyman to provide an independent, fact-based assessment of the risk profile of residual tranches of asset-backed securities (ABS). The goal of the study was to enable an objective comparison to other commonly held assets with an NAIC capital charge to determine if the NAIC’s ABS residual tranche 45% capital charge adequately reflects the actual risk. A key guiding principle of the study’s analysis was to utilize the NAIC’s accounting principles and normal, fact-based method of analysis to determine the appropriate C1 factor for each asset class. Representative samples were selected from the Intex database for the most common ABS asset classes: middle market CLOs, broadly syndicated loan CLOs, prime auto loan ABS, subprime auto loans and student loans. These asset classes represent more than 60% of ABS total outstanding volume.

Oliver Wyman then developed a forward-looking stress model for these most common classes of ABS using a 95th percentile value-at-risk (VaR) and a separate 99th percentile VaR calibration level. The two Mid-Tail stress scenarios were the 2001 Dot Com market crash and the 2008 Great Financial crisis. While 95th percentile is aligned with what the NAIC has used historically to establish capital charge levels, the ACC asked Oliver Wyman to also include a more strenuous test, which is why they added the Deep-Tail 99th percentile Great Depression stress scenario.

As demonstrated in Figure 22 below, the study showed that under all three stress scenarios, on a portfolio basis, ABS residuals perform better than common equity under all modeled stress scenarios.

The common stock losses are 30% higher than ABS residuals in the Deep-Tail stress scenario and 35%-50% higher than ABS residuals in the Mid-Tail stress scenarios. The ACC believes this study persuasively highlights that the 45% interim risk-based capital charge does not reflect actual risk when compared to the capital charges and losses of other assets. This study provides ample evidence that more diligence should be done before imposing any interim capital charge, and the ACC suggests an implementation delay allowing further consideration of any data put forth by interested parties. A letter summarizing the findings of the study was sent to Philip Barlow of the NAIC and can be accessed here. For additional information, please reach out to Joe Engelhard, Head of Private Credit & Asset Management Policy, Americas, at [email protected].