Assessing opportunities in Asia's evolving funds landscape

By Connall McGuckian, COO, Alternative Investment Solutions, Asia Pacific, State Street

Published: 28 June 2021

Fund onshoring has become an increasingly prominent trend in Asia as international tax and regulatory requirements have evolved. At a recent roundtable discussion, we explored the fund landscape in Singapore and Hong Kong and discussed some of the structural differences between Hong Kong’s Limited Partnership Fund (LPF) and Singapore’s Variable Capital Company (VCC), two fund structures that were enacted in 2020 to attract global fund managers to set-up shop in Asia.

Speakers included Armin Choksey, partner at PwC in Singapore, and key author of a white paper on VCCs and instrumental in the legislation; Michael Atkinson, partner at PwC in Hong Kong and a financial services specialist; along with State Street’s Cora Tang, managing director of the Alternatives segment in Hong Kong.

Hong Kong’s LPF was passed into law on 31 August 2020, replacing the Limited Partnership Ordinance (LPO), which had lacked the flexibility demanded by modern asset managers.

The LPF was the missing link to provide for private equity and venture capital funds that are usually closed-ended. Fund managers are already showing willingness to sign up, with 211 LPFs registered with the Company Registry as of 30 April.

Meanwhile, Singapore enacted its VCC on 15 January 2020, aimed at providing investment funds with greater flexibility in the treatment and movement of capital. Around 250 managers have used the structure to date.

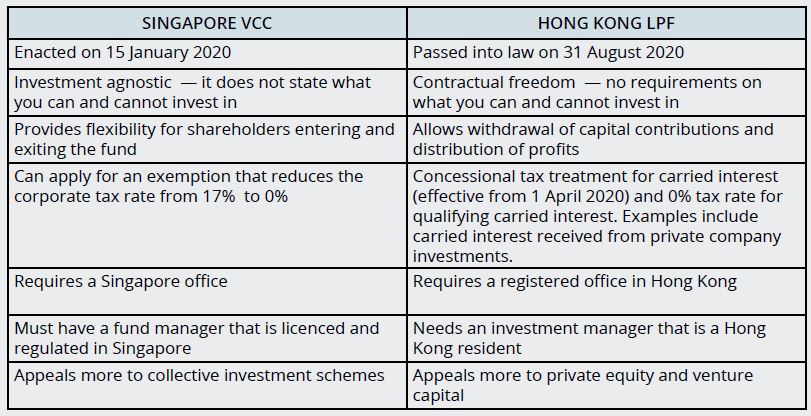

The two vehicles have many similarities, as both were created with the goal of simplifying regulations to entice investors to domicile their funds onshore.

Table: Similarities between Singapore’s VCC and Hong Kong’s LPF

Advantages of LPFs and VCCs that are appealing to fund managers

Which attributes of the new fund legislation are resonating most with asset managers?

Cora Tang: LPF has the whole industry very excited. It’s the right direction to enhance Hong Kong’s competitiveness in the asset management space, but the majority of clients are taking a wait-andsee approach. They still lean toward what investors are familiar with, which is Cayman or the British Virgin Islands and are eagerly waiting for the carried interest bill to pass*.

Armin Choksey: Singapore sits on a network of 90-plus double-taxation treaties. Therefore, it enables the VCC fund structure to be tax efficient if it is domiciled in Singapore and has a legal entity status. A unit trust and a limited partnership do not get a legal entity status.

The VCC’s distinction is its umbrella-like feature. You can break it into pieces and run it as an umbrella structure with various sub funds, where each sub-fund’s assets are legally segregated — the assets of one sub-fund can never be utilised to extinguish the liabilities of another.

Michael Atkinson: There are quite a lot of advantages to LPFs. The definition of the fund in the legislation is fairly broad and similar to the VCC. It's very commercial.

Similar to the Cayman’s Exempted Limited Partnership structure, to which LPF is frequently compared, an LPF allows different types of investment strategies. The LPF is currently most attractive to the private equity and venture capital industry, who were instrumental in getting LPF created.

The LPF brings an equivalent structure to Hong Kong to those that were typically being set up overseas. Now, fund managers will have the option to only have to deal with considerations, laws and regulations of Hong Kong. Not having to deal with different jurisdictions obviously has some advantages. It's also very cost effective to set up.

Early demand from Chinese and global fund managers

How strong has the industry’s appetite for LPF and VCC been so far?

Armin Choksey: It is driven by need and the cost differential plays a part too. From a business perspective, both Singapore and Hong Kong are very open as a place to do business, and there are only marginal differences in the licensing, registration and time to market. Ultimately, it’s the institution’s organisational structure or preference. If they want proximity to China then it makes sense to be in Hong Kong.

We have a separate North Asian task force because of language, as well as the number of queries coming in. There is growing interest among Chinese high-net-worth investors as well as Chinese managers to set up their operations outside, and they’re looking at Singapore a lot more.

But these are enquiries. We are yet to see that translating into actual domiciliation and launches. That is mainly because these enquiries only started at the end of last year and nobody can make a decision that quickly.

Cora Tang: For Chinese asset managers it really depends on what type of limited partnership (LP) they are targetting. If managers are capturing funding from the United States or Europe, they will probably be inclined to use the Cayman Islands and Singapore.

If managers are aiming for offshore capital from Hong Kong and China then the LPF would be their preference. This trend might change when international LPs become more familiar with Hong Kong’s LPF structure.

Quite a few global asset management clients have already set up a VCC structure. The VCC has definitely been the front runner.

Michael Atkinson: In Hong Kong there’s interest from local managers and family offices, and China’s asset managers. Asian investors often look more towards the general partner to set the appropriate structure, so they have more freedom to launch an LPF.

We see quite a few well-established private equity players who have established one, or in some cases, multiple LPs. We are also seeing boutique or niche firm’s register an LPF. I would say that the interest is often governed by who those fund managers are targetting as investors.

Near-term developments to monitor

Can fund managers expect more positive news – on VCC 2.0 and carried interest rules – in the near future?

Armin Choksey: Will there be an uplift to VCC? Yes, there is a plan. It has has been coined VCC 2.0, and that’s the market term for it now. Hopefully, this will allow the VCC to be expanded to the single-family office sector as wealth management is very big in Singapore.

There is also a hope to allow the real estate sector – currently exempted — to utilise the VCC. There could be some news about it in 2022, so a wish list has been created and shared with the Monetary Authority of Singapore. Obviously, there are policy decisions to be made and research of demand, at which point a framework would be developed for legislation.

Michael Atkinson: Hong Kong’s carried interest tax concession is something that has been very long in the making. The industry has been lobbying for this for quite some time.

There was always that level of uncertainty in Hong Kong as to how the local tax authority would view carried interest. Would the authority view carried interest as income from services being provided, or would the authority view carried interest as the industry always hoped it would — as a capital gain?

In the Hong Kong tax regime, capital gains are exempt from tax, but you pay corporate tax on service and fee income. So, it will be a very big difference for Hong Kong managers if carried interest was considered income rather than capital. What the tax concession basically brings in is a 0% tax rate on eligible carried interest for a corporation.

It also allows employees who receive eligible carried interest from having to declare that amount as employment income. So, it creates an exemption from salaries tax as well. That bill came out at the end of January and although it still needs to be passed*, it was very well received by the industry, because it helps to eradicate that uncertainty that previously was there.

*After this roundtable discussion took place, the bill was gazetted and formally became law on Friday 7th May 2021.