Demystifying the SEC’s upcoming Treasury Clearing Mandate and its implications for market participants

By Kevin MacNeill; Jordan Cobb, State Street

Published: 23 September 2024

The upcoming Treasury Clearing Mandate will have significant impact on the methods by which the hedge fund and alternative investment community – as well as the broader buy-side – access and create incremental value from the Treasury repo market.

The United States Securities and Exchange Commission’s (SEC) Treasury Clearing Mandate – announced on December 13, 2023 – will require a significantly larger portion of US Treasury cash and repo activity (both bilateral and triparty) to be centrally cleared through an SEC-regulated covered clearing agency.

The Fixed Income Clearing Corporation (FICC) currently serves as the only central counterparty (CCP) for US Treasuries. Therefore, Treasury repo activity cleared by FICC is expected to increase significantly. Eligible trades are any secondary market US Treasury cash or repo transaction where at least one counterparty is a FICC Netting Member (direct member). While the final rule won’t be enforced until December 31, 2025, and June 30, 2026, for eligible cash and repo transactions, respectively, migration to cleared activity will ramp up quickly as market participants move to become compliant. The cash mandate beginning in 2025 will exclude the hedge fund and alternatives community, whereas the 2026 repo mandate will expand the scope of eligibility – from the broader buy-side to the inter-dealer community. Both mandates include key exceptions for transactions with certain affiliates and sovereign entities. Firms can become FICC direct members to submit their eligible trades; however, eligibility terms are strict and not all buy-side firms may qualify or be willing to support the associated expenses. Alternatively, firms can have their access to the FICC facilitated by a direct member via several indirect access models.

To promote compliance, the FICC reviewed its various methods for access and is in the process of proposing rulebook changes. As the deadline approaches, the alternative investment and broader buy-side community will need to evaluate how these changes will affect market sizing, methods for access, economics and concentration.

Market sizing

Over the past few years, the hedge fund and alternatives community has become increasingly involved in the FICC cleared repo market. Repo cleared by the FICC serves as a liquid outlet for firms to borrow cash against US Treasuries at flexible terms in order to finance broader strategies. Firms can be sponsored as indirect members by existing direct members – which allows them to access cleared repo without needing to satisfy all the requirements of becoming a direct member. Sponsoring direct members submit trades to the FICC, guarantee performance of their client’s trade, and generally contribute margin and clearing fund requirements to the FICC on behalf of indirect member clients. Moreover, direct members can offer additional value-adds (e.g., haircut reduction) when recognising synergies through support of other cleared products (e.g., exchange-traded derivatives) on behalf of the sponsored client.

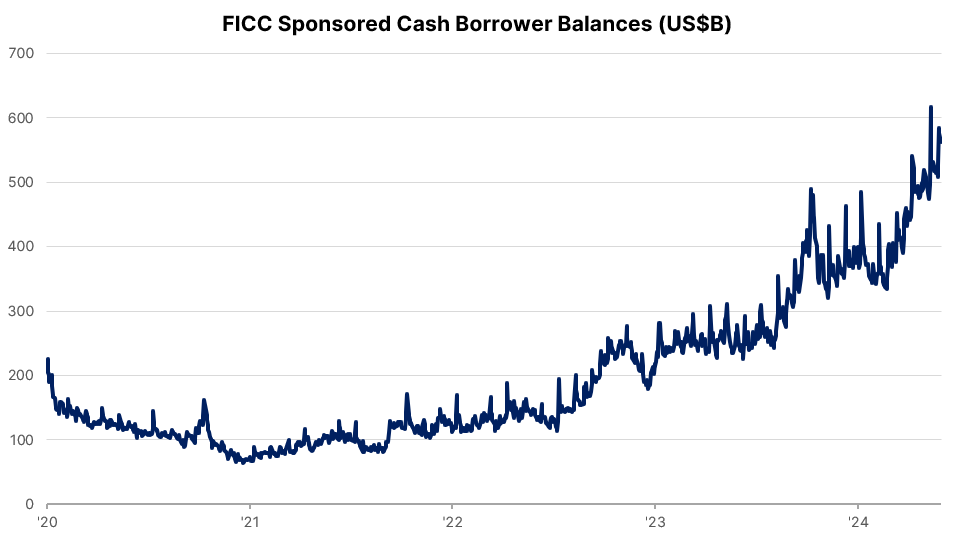

The alternatives community can also participate on the other side of the trade, investing cash via reverse repo for incremental return. In the second quarter of 2024, FICC sponsored repo cash borrower balances – dominated by the hedge fund and alternatives community – averaged around US$390 billion (see Figure 1, below), up significantly from about US$80 billion in the first quarter of 2021, exhibiting a 70% compound annual growth rate. It is clear that demand for access to the economic, risk and operational benefits of cleared liquidity while retaining potential for cross-product synergies has driven increased adoption of FICC sponsored repo. The mandate is expected to exacerbate this trend and further expand FICC balances. FICC’s 2024 survey of market participants suggested that overall volumes (cash, repo, and reverse repo) could increase by more than US$4 trillion. As the market becomes increasingly crowded, firms will need to consider all accessible options.

Access models

The FICC’s sponsored model through its delivery versus payment and general collateral tri-party services is the current standard for indirect clearing access. In the sponsored model, the client contracts with the FICC as an indirect member, enabling them to clear trades through a direct member without the additional cost and considerations of becoming a direct member. Indirect client trades executed with their direct member novate to the FICC as the CCP (i.e., the FICC becomes the client’s ultimate counterparty), reducing overall market exposure for participants. Direct members typically contribute margin to the FICC on behalf of their clients, which is a set of payments determined by the FICC’s internal stress modelling to maintain their default fund and other risk management factors. The FICC is currently updating its rulebook to promote broader adoption of its other indirect access model, agent clearing (formerly correspondent/prime broker clearing), which has seen very limited utilisation.

Under the agented model, a direct member still submits trades to the FICC on the client’s behalf. However, the client has no legal relationship with the FICC and, therefore, the client’s exposure ultimately remains with their direct member rather than with the FICC. The direct member is liable to fulfil all obligations resulting from their client’s trade. Under both the sponsored and agented models, indirect members have the flexibility to use their direct member as an executing counterparty and clearing agent (done-with trading) or execute with another FICC member and leverage the direct member as the clearing agent only (done-away trading). Indirect members also have the option to contribute margin directly or have the indirect member contribute it on their behalf. It’s currently unclear how the buy-side will optimally leverage this expanded optionality to access the repo market, given that these changes are still being digested and interpreted by market participants.

Margin

A key consideration for firms deciding between FICC indirect access models will be their willingness or ability to contribute margin. When a client contributes margin into a segregated customer account, their contribution is excluded from any loss mutualisation derived from FICC member defaults and their direct member’s margin obligation to the FICC will be considered on a gross basis (not netted across all customer accounts). The FICC is jointly pursuing cross-product margin recognition with the Chicago Mercantile Exchange (CME) for indirect clients who have a common clearing intermediary for futures, Treasury cash and repo activity.

This segregated customer margin model will be a requirement for clients and their associated direct members to recognise potential cross-margin benefit. If a client does not contribute margin, the direct member will contribute into a non-segregated, omnibus margin account on behalf of its clients. Under this model for agented cleared trades, the direct member will have its margin requirements calculated across clients on a net basis, significantly reducing or eliminating requirements altogether. Direct members will not be able to realise the same benefit under the sponsored model, which will have margin calculated on a gross basis due to the legal relationship between the FICC and indirect members.

Rates/Spreads

Increased activity expanded access models and changing margin requirements all play into spreads and liquidity available in the market. Non-FICC member sell-side firms currently intermediating US Treasury transactions will need to become FICC direct members, which includes the associated cost of onboarding, as well as the ongoing cost of clearing and margin requirements. Sell-side firms intermediating FICC activity will need to consider which indirect access models to offer to clients and how to handle optionality within these structures (e.g., margin contribution, ‘done away’ activity). These considerations will play into the rates passed along to the buy-side. Under the sponsored model, direct members typically pass along the cost via a spread. Currently, it’s unclear how direct members will seek compensation under the agented model, particularly when supporting ‘done away’ trading. The opportunity for direct members to net down contribution requirements in the agented model may reduce costs. However, it’s uncertain how this will compare to sponsored pricing for buy-side firms. Cost considerations will also need to be weighed against non-economic factors that are crucial to client’s decision-making (e.g., exposure to direct member in agented model, rather than FICC).

It should also be noted that an omni-margin agented model that provides margin benefit potential to direct members would exclude the respective indirect member transactions from any future FICC-CME cross-margin benefits. Given the significant trade-offs under each model, it’s possible that direct member firms may choose to support several offerings under different models, depending on client needs. The buy-side will need to weigh these options pursuant to their ultimate goals and better understand how different sell-side providers will position themselves in a changing market.

Uncleared alternatives

In the midst of understanding methods for cleared Treasury repo compliance, buy-side firms may also consider uncleared repo alternatives that are not currently in scope for the mandate – like peer-to-peer (P2P) repo. P2P effectively removes intermediaries from the repo process. Buy-side firms negotiate terms directly and a third-party guarantor may provide its guaranty of the cash borrower’s performance. P2P models may also offer support for expanded collateral types beyond US Treasuries, from agency mortgage-backed securities to corporates. Under the current rule, P2P transactions between two non-FICC direct members are not in scope for the mandate.

While the June 2026 mandate date may seem distant, the buy-side’s comparative analysis of compliance options may prove to be intensive, with key considerations yet to be fully fleshed out. As the market becomes increasingly crowded, buy-side firms with an in-depth understanding of available options will be the most prepared.