State Street data opportunity study: The growing importance of human capital in data operations

By Cleyde Hazell, State Street

Published: 20 November 2023

Generative artificial intelligence (AI) across the industrial sectors including financial services is at the center of a long-running debate about the ability of emerging technology that automates several processes that were traditionally performed by individuals with specialised skills.

In this article, we focus on how generative AI is transforming the way asset managers in the alternatives space function and the impact it has on their clients.

Over the last two decades, technological developments have allowed institutions to store, process and analyse vast amounts of data electronically, enabling them to harness the power of data to make informed decisions across investment functions such as asset allocation and securities analysis, risk management, regulatory compliance, and product distribution.

The relationship between technology systems and humans, in terms of data management, has seen significant change. The global data quest is fast evolving and there are now high-performing technology tools available in the market with no shortage of new solutions.

However, institutions still face the challenge of having the right people and processes in place to maximise their investment in new technology and automation tools to deliver better outcomes for the clients they serve.

We see the ‘human vs machine’ paradigm shift taking place where certain tasks are moving to automation and leading to the introduction of new tasks and expanded roles. We have seen this happen in the past with the motor car - when blacksmiths became mechanics. However, the fear with AI goes beyond automation of existing jobs to include the jobs its expansive potential may create.

However, this is not a pressing concern for today’s institutional investors and alternatives managers, according to State Street’s latest research. Respondents to the State Street Data Opportunity Survey are highly focused on acquiring data literate talent and have indeed created a highly competitive job market in this area that looks set to continue for several years.

Unsurprisingly, institutions were focused on a combination of workforce and technology (as well as partnerships with third party organisations offering them access to both), but more than a quarter (27%) of asset owners said talent was the area they were most focussed on to build their data capabilities. Among alternatives managers this figure rises to 29%.

This is in alignment with institutional investors’ ongoing approach to data and technology. They like to have capability in house, and to have highly sophisticated teams to manage their alternatives assets. Instead of growing these teams in headcount, investors are focused on leveraging technology to support their existing expertise to expand their investment strategies.

With the right balance of technology and skilled workforce, they can outsource operations externally, enabling the internal teams to manage oversight functions, thus prioritising upskilling, cybersecurity, and governance.

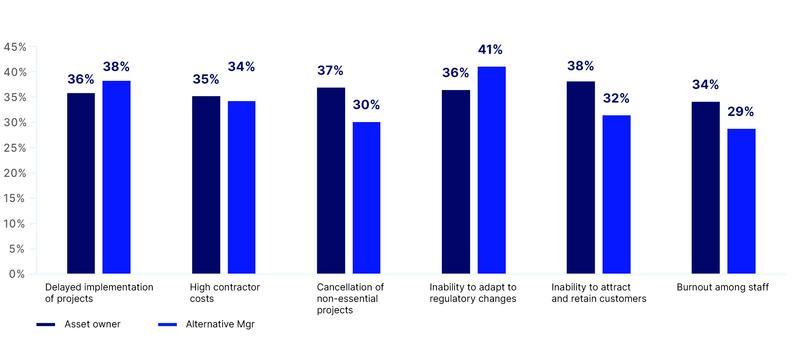

Significant proportions of both respondent types highlighted a large number of ways that a shortage of data literate talent in the job market was negatively impacting their organisations.

Among alternatives managers, it was primarily making it harder for them to adapt to new regulations and pushing back strategic project implementation. Asset owners found customer retention and their ability to focus on projects beyond the day-to-day essential functions of their organisations were the main areas that were impacted.

Figure 1. Is a lack of talent negatively impacting your organisation in any of the following ways?

Our research also suggests, technology that facilitates greater speed and efficiency in data management through automation will continue to benefit workforces.

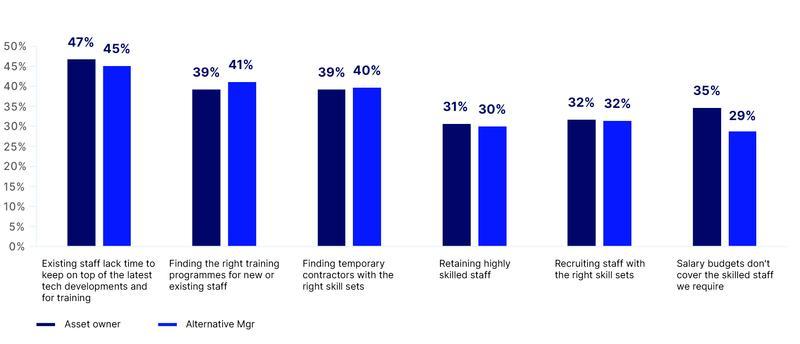

Nearly half of both asset owners and alternatives managers (47% and 45% respectively) said their biggest impediment in trying to address the shortage of adequately skilled staff was finding time for upskilling existing employees.

Institutions foresee a virtuous circle of automation and technology freeing up time to enable workforces to make better use of automation technology.

Figure 2. What are the greatest challenges your organisation faces when developing data-literate talent who can unlock the potential of data?

According to our research, 29% of asset owners prioritise talent and skilled workforce to meet their data management goals as the most important area to invest in currently. When asked to consider the same list of priorities between two to five years from now, talent dropped out of the top three priorities (although it remained a top choice for 17% of asset owners).

Alternatives managers do not consider investing in human capital as a top three priority among their current areas of investment in data management. However, in two to five years, nearly a third of alternatives manager respondents said they anticipated it to be their top priority (second only to AI).

As technology continues to drive innovation in investment management, firms will need to look further into how their human capital working in tandem with innovative new tools will enable them to be dynamic and excel in a competitive market environment.

As times goes by, we tend to get a binary view of what the solution for today’s data problems will be, with a common perception that automation is the only pathway to success. In reality, there are many things in parallel that the industry is doing well, through data collaborations, knowledge sharing and in-house investment in talent that will help all of us with our quest for holistic data integration.

Disclaimer

The material presented herein is for informational purposes only. The views expressed herein are subject to change based on the market and other conditions and factors. The opinions expressed herein reflect general perspectives and information and are not tailored to specific requirements, circumstances and / or investment philosophies. The information presented herein does not take into account any particular investment objectives, strategies, tax status or investment horizon. It does not constitute investment research or investment, legal, or tax advice and it should not be relied on as such. It should not be considered an offer or solicitation to buy or sell any product, service, investment, security or financial instrument or to pursue any trading or investment strategy. It does not constitute any binding contractual arrangement or commitment of any kind. State Street is not, by virtue of providing the material presented herein or otherwise, undertaking to manage money or act as your fiduciary.

To learn how State Street looks after your personal data, visit: https://www.statestreet.com/utility/privacy-notice.html. Our Privacy Statement provides important information about how we manage personal information.

No permission is granted to reprint, sell, copy, distribute, or modify any material herein, in any form or by any means without the prior written consent of State Street.