G20 derivatives regulation – equivalence or divergence?

By Sinead Walley, Senior Associate, aosphere LLP (an affiliate of Allen & Overy LLP)

Published: 23 April 2018

Since 2009, G20-initiated regulatory reforms have fundamentally altered the over-the-counter (OTC) derivatives market. Trading standardised derivative transactions on specified venues and/or clearing them through a central counterparty (CCP) is fast becoming the norm. Transparency and risk mitigation are key, with minutiae now being reported to trade repositories and margin requirements often applying to uncleared transactions.

These reforms have proven to be a major new area of focus for asset managers as they assess, firstly, whether they (or the funds they manage) are in-scope of the requirements and, secondly, the extent of any such legal obligations. This is a challenging task. The global nature of the derivatives market and the extraterritorial reach of some of these rules means that multiple, complex regulatory regimes (the terms of which may vary considerably) may apply.

This is a far cry from what the G20 leaders had envisaged, which was consistent global standards reforming the derivatives market, ensuring a level playing field and avoiding fragmentation of markets, protectionism, and regulatory arbitrage. Whilst this may seem a long way off, thankfully, there is a glimmer of light at the end of the regulatory tunnel in the form of cross-border recognition, the much sought after ‘regulatory equivalence’ (otherwise referred to in jurisdictions such as Canada, Japan and the US as ‘substituted compliance’).

G20 Regulatory Background – Does it matter to me?

- The G20 regulatory requirements focus on strengthening regulatory oversight of the OTC derivatives markets following the 2008 financial crisis and may, in some jurisdictions, apply to buy and sell side market participants.

-

The global nature of the market means that market participants have to grapple with a range of applicable foreign requirements as well as their own domestic obligations. Further complexities can arise in scoping out applicable regulations when managers and their funds are located in different jurisdictions.

-

Benefitting from equivalence decisions can significantly reduce the regulatory burden on market participants as regulators deem compliance with equivalent foreign rules as compliance with their own rules. This avoids the need to comply with duplicative or conflicting rules and, in the context of margin, avoids double collateral posting obligations.

In this article, we explore regulatory equivalence in some key G20 nations, including its take-up and the differing frameworks. We identify some important equivalence decisions (referred to in the US as ‘comparability determinations’). We assess whether regulatory regimes are working in harmony or are diverging across G20 nations and consider the possible impact of Brexit.

Regulatory Equivalence Frameworks

The Process

By incorporating a regulatory equivalence framework into its regulatory regime, a jurisdiction’s regulators recognise and can give due regard to comparable regulatory regimes. There are some divergences in the processes used in different jurisdictions to achieve this but similarities are emerging.

In the EU, the European Commission assesses the equivalence of rules in foreign jurisdictions to those applied in the EU and checks that those rules, amongst other things, have the same substantive outcome as the corresponding EU rules in respect of the regulatory objectives they seek to achieve.

In the US, traditionally, the United States Commodity Futures Trading Commission (CFTC) has adopted a rules based approach to comparability determinations. Each rule was assessed for comparability resulting in the CFTC approving only portions of foreign regulatory regimes. However, we have seen recent margin comparability determinations which indicate that the CFTC seems to be moving to a more favourable outcomes-based approach. Technically, substituted compliance is available when a comparability determination has been made.

In Canada, an unusual framework exists for substituted compliance in respect of collateralisation. Comparability is determined on a case-by-case basis through a consultation process between the in-scope entity and the Office of the Superintendent of Financial Institutions Canada (OSFI).[1] At the time of writing, we are not aware of any such determinations having been made.

Recognition of overseas trading venues or CCPs should be distinguished from regulatory equivalence/substituted compliance. Where available, market participants established in a particular jurisdiction can comply with the trading or clearing obligation in that jurisdiction if they trade on a third-country venue or clear through a third-country CCP, which has been recognised (EU) or exempt from registration (US).

The Beneficiaries

The entity who benefits from the equivalence decision or comparability determination varies from jurisdiction to jurisdiction. In some cases, it is particular counterparties who benefit (e.g. in the US it is certain eligible counterparties and, for the Australian reporting rules, it is the foreign reporting entity) and in others, it is both parties who benefit (e.g. in Japan), in each case provided that all relevant conditions are met (such as the in-scope transaction being subject to the relevant rules in both jurisdictions and that the competent overseas authorities conduct 'appropriate' supervision over the relevant entity).

Overview of Equivalence Decisions and Comparability Determinations

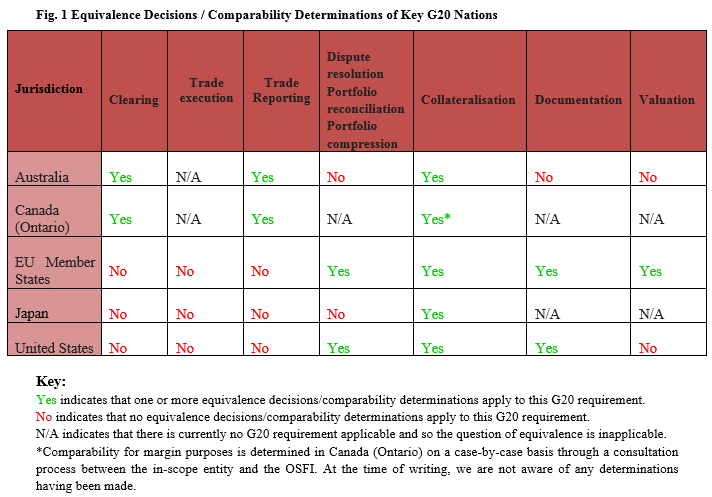

Fig. 1 identifies the equivalence decisions and comparability determinations made by key G20 nations who have taken the lead in regulatory change for their OTC derivatives markets.

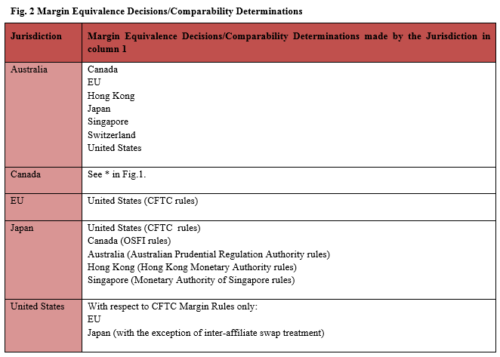

Fig. 2 takes a closer look at those decisions for uncleared margin. It identifies some milestones that have been reached including the mutual recognition of certain margin regimes.

It is clear from the tables below that the number of regulatory equivalence decisions and comparability determinations is currently low. This is expected to rise as regulatory regimes continue to develop in lin with the international standards agreed by the G20 nations.

Brexit

There are a multitude of EU laws and regulations that assist in the smooth functioning of the derivatives and collateral markets. Following Brexit, consideration must be given to the effect of these regulations in the UK. Certainty will only come following negotiation of the post-Brexit derivatives regulatory regime and the market hopes that agreement can be reached in respect of how existing UK laws will be treated after the UK has left the EU. In light of the fact that so much work has been undertaken in the UK in developing these regulatory requirements, we believe it is unlikely that the UK would want to disapply these requirements after Brexit.

With respect to regulatory equivalence decisions and comparability determinations, following Brexit, UK counterparties may no longer be able to benefit from the European regime being recognised as ‘equivalent’ by third-country regimes. As part of its negotiations, the UK would need to negotiate whether it could continue to benefit under the existing EU regime or whether it needs to start on its own cross-border recognition framework by having equivalence discussions with the EU and other third-country jurisdictions (including the US).

Conclusion

The derivatives market is global in nature and, for its smooth functioning, relies heavily on cross-border recognition of regulatory requirements. Regulators in jurisdictions with the biggest financial centres appreciate this and have embodied regulatory equivalence frameworks into their derivatives regulatory regimes to ensure an avoidance of duplicative and conflicting cross-jurisdictional rules.

Regulatory equivalence is a complex topic. Equivalence decisions and comparability determinations have been slow to emerge, but thankfully, some milestones have been achieved.

Footnotes:

[1] Guideline E-22 Margin Requirements for Non-Centrally Cleared Derivatives as published by the OSFI in February 2016 (updated in June 2017).

To contact the author:

Sinead Walley, Senior Associate at aosphere LLP (an affiliate of Allen & Overy LLP): [email protected]

Disclaimer:

Nothing in this article is intended to provide legal or other professional advice and Allen & Overy LLP, aosphere LLP and its affiliates do not accept any responsibility for any loss which may arise from reliance on the information contained in this article.