Dreams of white picket fences: the investment potential of US single-family real estate

By Petteri Barman, Co-Head of Real Assets at Man GPM and a member of the Man Group Executive Committee

Published: 12 July 2017

As returns across asset classes become ever more elusive, we believe it’s increasingly important for investors to consider a wider range of opportunities. Real estate investment is an established part of many investors’ alternative portfolios, but single-family residences (SFR) have received limited attention since the Global Financial Crisis (GFC). Whilst US commercial property has risen 157% since its crisis nadir – putting it 23% above its previous cycle peak – US SFR is still 7% below its 2006 highs[1]. Currently, the ratio of house prices against average income within the US market are in line with historical averages, in contrast to the UK (where they are 30% higher versus long-term averages), Canada (+46%), Australia (+50%) and Hong Kong (+50%).[2]

Moreover, the US has one of the biggest and most liquid residential property markets in the world, with more than 5.4 million transactions every year[3]. As a core tenet of ‘the American dream’, we believe that the persistent trends of home ownership may be a compelling investment story, and that single-family residences could offer interesting opportunities.

SFR supply and demand dynamics look attractive

America is a relatively youthful nation. Its 15-34 age bracket represents 27% of the total population. This is high compared to other developed markets such as France (where it makes up 24%), Germany (23%), Italy and Japan (both 21%). For obvious reasons, this segment drives a nation’s rate of household formation. Even when accounting for the fact that headship rates are declining, this demographic structure is forecast to drive a rate of family unit formation 30% above the long term average[4]. The potential increase in demand for family homes that this could entail may potentially provide a long-term structural tailwind for SFR.

There are also shorter term catalysts for demand. Mortgage availability in the US fell 91% between June 2006 and February 2009, as credit underwriting horror stories filled the column inches. Although access has become less constrained since then, it remains over 80% below the previous peak[5]. Although we do not see a return to the ‘Wild West’ days of 2006 – where some lenders were evidently irresponsible – we do think that the next move may be skewed to the upside, especially if Trump makes good on his promises to reduce regulatory oversight. We believe the average US household is also in an increasingly better position to borrow: unemployment has fallen from the 10% peak it hit in December 2010 to little over 4.5% today, which has helped reduce household-debt-to-disposable-income ratios back to the levels of the early 2000s[6]. In short, the pockets of the prospective US homebuyer are potentially deepening.

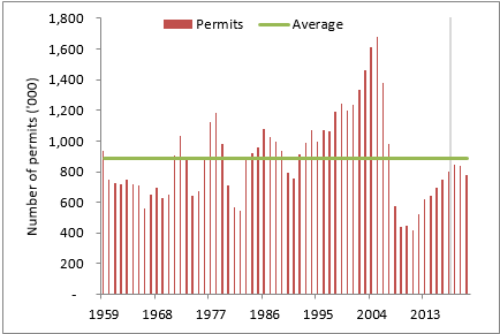

If this potential demand comes to fruition it may meet restricted supply. This is shown in Figure 1, which shows the number of single-family building permits since 1959, and forecast up to 2020 (indicated by the grey line). As can be seen, activity collapsed after the GFC and does not appear set to return to its long run average this decade, in our view. So, whilst supply is running below its long run average, demand may be structurally higher due to demographics, with the possibility of short term catalysts. For us, this represents an attractive fundamental configuration.

Figure 1: US SFR permits[7]

Institutional investors have previously opted for multi-family over single-family residences

Since the GFC, multi-family apartment (MF) accommodation has been far more popular with institutional investors than SFR, and the segment is currently 244% above the post-crisis low, and 53% above the previous cycle high. Doubtless, investors have felt that what they perceived as superior liquidity and homogeneity made the space more attractive than SFR. Looking forward from today, however, given recent price appreciation and significant new supply we do not see the same relative upside for MF.

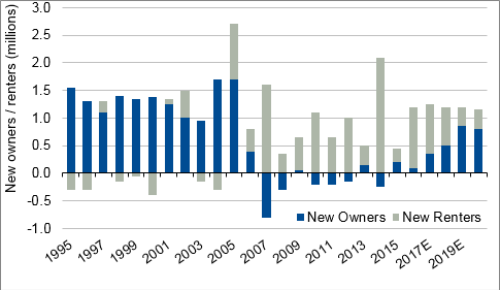

Instead, we believe US SFR may experience a rental yield compression until it is more in line with other residential property markets globally. Why? Simply put, we believe that the US is not historically a renting nation, and a core strand of the American dream is the home-owning dream. We can see evidence of this in Figure 2, which shows that between 1995 and the GFC, owners were in the ascendency. As the crisis forced a more hand-to-mouth existence, this pattern was reversed, but we believe a return to a more historical norm may have begun. We estimate that 9% of MF units are occupied by families with children, whilst for SFR this figure rises to over 80%[8]. As the number of US households increase, and if their finances improve over the short term – as we have discussed – the outperformance of MF over SFR could potentially be reversed.

Figure 2: US new owners and renters[9]

Active managers can help provide efficient access to SFR

We believe one of the things that has kept institutional investors away from the SFR space is the perception of its operational difficulties: the challenges posed by idiosyncratic assets subject to significant geographic dispersion. Today, however, the industry norm is for gross/net yield ratios of 60%, with 94-96% occupancy rates, figures which are comparable to US MF[10]. As investors consider their allocations to alternatives, we believe that this may be an asset class worthy of attention – but the choice between ways to access these assets will be an important one for investors.

Footnotes

[1] Source: Morgan Stanley, RCA, Moody’s.

[2] Source: The Economist, March 2017. http://www.economist.com/blogs/graphicdetail/2017/03/daily-chart-6

[3] Source: Census data, National Association of Realtors.

[4] Source: Morgan Stanley.

[5] Source: Mortgage Bankers Association.

[6] Source: Bloomberg, OECD.

[7] Source: John Burns Consulting, Census data.

[8] Source: Man GPM research.

[9] Source: Green Street Advisors, 06 June 2016.

[10] Source: Man GPM research.

Important Information

This material has been prepared by the material is prepared by Aalto Invest US Inc. and is distributed by Man Investments Inc. (“Man Investments”), each of which is a member of Man Group. “Man Group” refers to the group of entities affiliated with Man Group plc. Man Investments is registered as a broker-dealer with the US Securities and Exchange Commission (“SEC”) and is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Aalto Invest US Inc. is registered with the SEC as an investment adviser. The registrations and memberships above in no way imply a certain level of skill or that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein.

The information in this material is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private funds or pools, or any other investment product, managed account or other investment vehicle (each, an “Investment Product”) advised by Aalto Invest US Inc. or any of its affiliates. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The strategies discussed in this document may not be suitable for all investors. Some of the views expressed herein may contain certain forward-looking statements. We believe these forward-looking statements to be reasonable, although they are forecasts and actual results may be meaningfully different. The opinions stated are subject to change without notice and the Investment Manager does not undertake any responsibility or obligation to revise or update such Statements. Statements expressed herein may not necessarily be shared by all personnel of an Investment Manager or the Man Group. This material represents an assessment of market conditions at a particular time and is not a guarantee of future results. This information should not be relied upon by the reader as research or investment advice.

No representation is made of Aalto Invest US Inc. or any Investment Product. This material represents an assessment of market and political conditions at a particular time and is not a guarantee of future results, or that any underlying investment will make any profit or will not sustain losses. This information should not be relied upon by the reader as research or investment advice. An investment in an Investment Product utilizing the Strategy involves risk, as disclosed in the Investment Documents. Aalto Invest US Inc. may engage in investment practices or trading strategies that may increase the risk of investment loss and a loss of principal may occur. Risk management is an effort to minimize risk, but does not imply no risk. The risk management techniques which may be utilized by Aalto Invest US Inc. cannot provide any assurance that an Investment Product will not be exposed to risks of significant trading losses.

All investments involve risks including the potential for loss of principal. Property is specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Past performance does not guarantee similar future results.

This material is proprietary information and may not be reproduced or otherwise disseminated in whole or in part without prior written consent. Any data services and information available from public sources used in the creation of this material are believed to be reliable. However accuracy is not warranted or guaranteed. © Man 2017