ETFs: Guidelines for distribution in Switzerland

By Luis Pedro, CEO, Oligo Swiss Fund Services

Published: 23 April 2018

ETFs (Exchange Traded Funds) have been available in Europe since 1999 and over the last years they have become one of the most successful financial products.

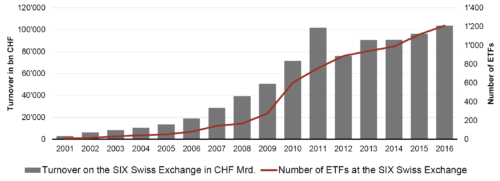

Compared to traditional investment funds, they offer lower transaction and management costs, can be traded throughout the day on regulated exchanges at or close to the NAV and are available for investing in a wide range of assets (stocks, bonds, commodities, etc.). From less than 100 ETFs in 2012, their number has grown to 1600 as of November 2017 just in Europe, with assets increasing from less than $80bn in 2002 to $750bn in November 2017, according to ETFGI.

Switzerland, an attractive market for ETFs

Switzerland is a politically neutral and stable country. Two-thirds of Swiss adults have assets of at least USD 100,000. At the end of last year, Switzerland was home to about 600,000 millionaires and an estimated 4,000 ultra-high-net-worth individuals (assets over USD 50m)1. It is then not a surprise that the Swiss fund market is the fifth-largest in Europe, with assets totaling CHF1,073bn (October 2017), up 17% for the year2.

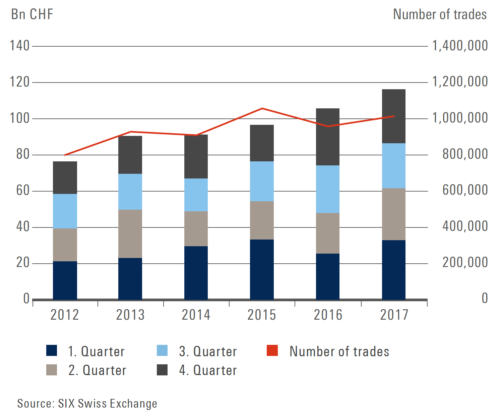

Figure 1: ETF turnover development

These facts make the Swiss market an attractive location for selling investment funds, including ETFs, and at the end of 2017 more than 1,200 ETFs were listed on the Swiss stock exchanges, with total AUM of CHF116.4bn, up 11% year over year. During 2017, the number of transactions on the Swiss exchanges was up by 6%, to just over 1 million, while 114 new ETFs were listed, bringing the total to 1,278 products from 22 issuers: a record3 as shown on the charts.

Figure 2: ETF trading turnover and the number of listed ETFs on the SIX

Distribution of ETFs to retail (“non-qualified”) investors

The Swiss Collective Investment Schemes Act (“CISA”) groups the country’s investors into “qualified” and “non-qualified” investors, this latter term being used to describe retail investors. Regular investment funds can be sold to non-qualified investors after the appointment by the fund or its promoter of a Swiss representative and a Swiss paying agent plus the authorization of the fund by the Swiss regulator FINMA, a process that is handled by the Swiss representative. For ETFs, there is the additional requirement of a listing on a Swiss stock exchange (“SIX”), and the Swiss regulator requires the listing of all share classes of an ETF.

Obtaining approval for retail distribution involves providing FINMA with a set of documents, some of which in one of the country’s official languages (German, French or Italian).

The Swiss representative, possibly with the support of Swiss legal counsel, guides the ETF provider through this process, in order to ensure compliance with all requirements. The approval process usually takes up to four weeks.

The prospectus of the ETF as approved by FINMA will be used as the listing prospectus, with FINMA requiring the ETF prospectus to include specific information about the type of ETF, the replication method applied and the product’s liquidity (market making).

The listing application must be submitted to SIX at least 20 days before the intended listing date by a recognized issuer representative. It must - inter alia - include a short product description and mention the first day of trading. In the case of a new collective investment scheme/issuer one should allow an additional five exchange days for the SIX for their respective approval of the new collective investment scheme/issuer.

The SIX listing application and FINMA request can be filed in parallel ensuring that FINMA give its approval in advance of the intended first trading day.

Distribution of ETFs to institutional (“qualified”) investors

According to the CISA, institutional investors fall into one of two groups:

- regulated qualified investors, which include banks, insurance companies and other regulated companies as listed on the FINMA website;

- non-regulated qualified investors such as high-net worth-individuals, pension funds, independent asset/wealth managers and family offices.

While distribution to regulated qualified investors is not subject to any restrictions, the CISA requires the appointment of a Swiss representative and a Swiss paying agent before fund promoters are allowed to market their fund products to non-regulated qualified investors. This also applies to investment funds structured as ETFs and/or with the ETF designation in the product name.

Choosing a Swiss representative

There are currently about 15 independent firms offering representation services for foreign funds in Switzerland. They fall into two groups:

- firms that are licensed to represent funds distributed to qualified investors only;

- firms that are licensed to represent funds distributed to all types of investors, including retail investors and ETFs authorized by FINMA and listed at SIX.

A manager wishing to distribute ETFs in Switzerland should carefully consider which investor segments to address and choose a Swiss representative with the appropriate license.

Representatives that are licensed to represent funds for distribution to retail investors will have a deep knowledge and experience about how to proceed in the best possible way, including providing resources such as professional translation services and direct communication channels with FINMA, SIX and with big distribution platforms.

The Swiss representative, a long-term partner for ETFs distribution

The role of the Swiss representative is to ensure that the fund’s distribution complies with the Swiss regulations.

While it is a legal obligation to appoint a Swiss representative for distribution in Switzerland, some Swiss representatives guide and support the fund promoter’s marketing efforts in Switzerland. In addition to the legal and procedural expertise, they can provide guidance and help with the fund’s distribution in Switzerland.

Today, Swiss representatives can:

- help build relations between fund promoters and Swiss investors and distributors;

- organize capital introduction events and conferences to introduce fund promoters and their products to investors;

- administer and pay retrocessions, if these are part of the distribution process. This can include the calculations of fees on behalf of Swiss distributors such as wealth managers and family offices. This support function is sometimes called “global distribution”;

- assist the fund/promoter with managing and organizing cross-border registrations in European countries and other geographies;

- publish fund information and documents on electronic platforms dedicated to Swiss investors;

- facilitate communication between the involved parties and act as a point of contact between potential investors and the fund/promoter.

This makes the Swiss representative an ongoing point of reference, source of business and long-term partner for a fund’s distribution in Switzerland.

Involvement of legal counsel

The application for the listing of an ETF on the SIX must be submitted in writing by a recognized issuer representative. This function is usually assumed by an experienced local legal counsel who is an officially recognized legal representative for the listing of ETFs on the SIX. The Swiss representative can propose a suitable local legal counsel and manage the process.

The appointed local counsel acts closely with the Swiss representative whereas both parties provide best-in-class services based on their core qualification and expertise in a well-established and reliable setup. ETF providers benefit of a well-coordinated cooperation between the Swiss representative and the Swiss legal counsel.

In summary

Switzerland is a large and attractive market for foreign investment funds with very specific, yet easy to fulfil, requirements for distribution. The main points to retain are:

- addressing a Swiss institutional investor for distribution of an ETF requires appointing a Swiss representative and a Swiss paying agent;

- addressing a Swiss retail investor for distribution of an ETF requires, in addition, the listing on a Swiss exchange and FINMA approval.

- there is a large market for retail distribution;

- foreign collective investment schemes (exchange-traded funds, exchange-traded structured funds, investment and real-estate funds) domiciled in one of 17 FINMA-agreed countries4 are eligible to apply for retail distribution;

- the Swiss representative plays a key role and is the gate keeper for authorization by the Swiss regulator as well as the distributors and investors in Switzerland, as defined in the Swiss Collective Investment Schemes Act;

- the relation between the ETF provider and the Swiss representative is an active one, with an ongoing exchange of useful contacts and information.

For any question concerning funds representation and distribution in Switzerland, please feel free to contact Oligo Swiss Fund Services (a regulated Swiss representative for funds addressed to both qualified and retail Swiss investors) at [email protected].

To contact the author:

Luis Pedro, CEO at Oligo Swiss Fund Services: [email protected]

Footnotes:

[1] Credit Suisse Research Institute, Global Wealth Report 2016

[2] Swiss Fund Data – Swiss Fund Market Statistics, 31 October 2017

[3] SIX Swiss Exchange – ETF Q4 2017 report

[4] https://www.finma.ch/en/finma/international-activities/supervisory-cooperation/agreements/