Federal Reserve may shrink its balance sheet gradually

By Blu Putnam, Chief Economist, CME Group

Published: 12 July 2017

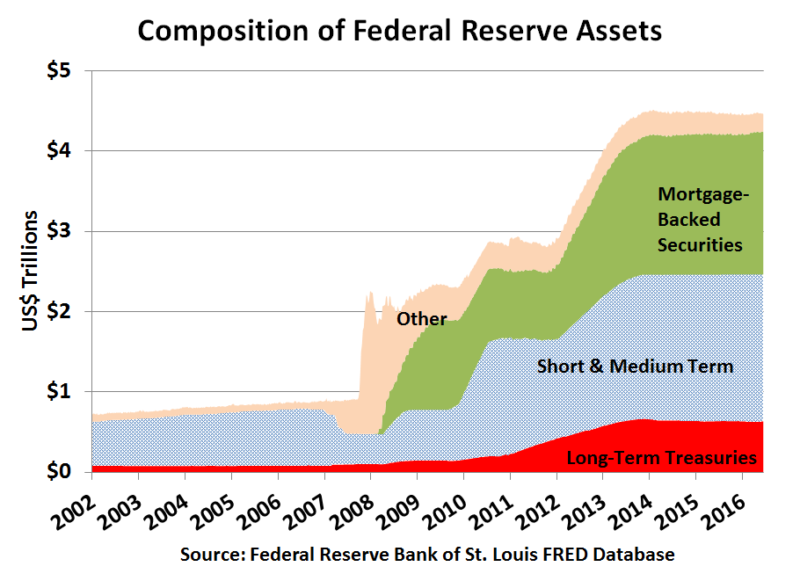

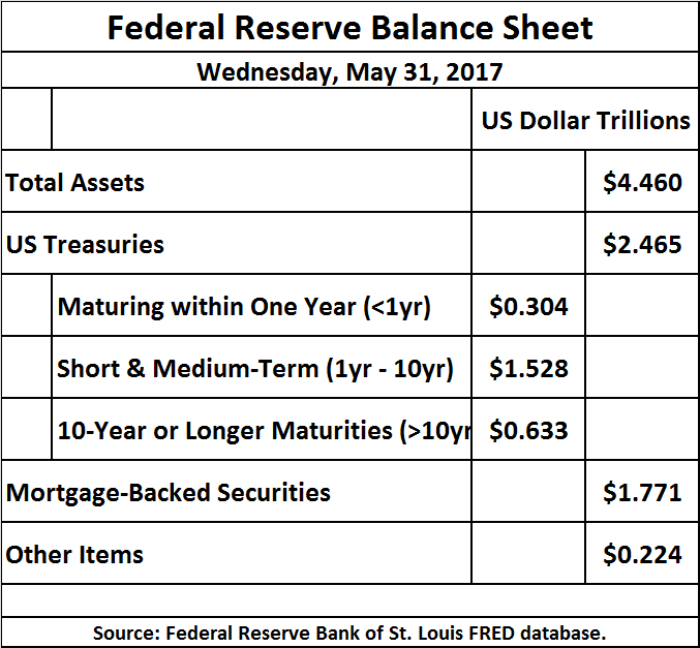

With U.S. unemployment at 4.3%, the Federal Reserve (Fed) remains on track for more rate increases in 2017 despite sluggish labor force expansion and wage growth barely staying ahead of inflation. And, the Fed now appears ready to start a long and drawn out process to reduce the size of its massive balance sheet. A bloated balance sheet is inconsistent with raising rates, but fears of possible market impacts have made the Fed very cautious. The Fed’s total assets are now $4.5 trillion, including portfolio holdings of $2.5 trillion of U.S. Treasury securities and $1.8 trillion in mortgage-backed securities (MBS). The reinvestment activity implies the Fed is currently a buyer of about $1 of every $2 of new Treasury debt, and remains a huge player in the mortgage market. We anticipate that the Fed will stop reinvesting 100% of the principal received from maturing investments and switch to a staged policy of putting a cap on reinvestment activity. The cap would be adjusted periodically over the next few years until the balance sheet had been reduced to roughly 12%-15% of GDP from about 25% currently.

Because the Fed anchors the short end of the yield curve with its target federal funds rate policy and the interest it pays on excess reserves, the market impact of maturing Treasury securities not being reinvested will probably be very small, although it does imply less buying by the Fed at Treasury auctions. If the Fed also steps back from reinvesting in the MBS market, the impact might be a little larger, in the range of 0.25% to 0.50% in terms of possible mortgage rate increases along the maturity curve, especially centered on the 15-year and 30-year mortgages that the Fed buys.

I. Inconsistency of Rising Rates and a Massive Balance Sheet

The asset purchase programs (aka Quantitative Easing or QE) were instituted during a period of near zero short-term rates while the Fed was targeting the federal funds rate at between 0.00% and 0.25%. Before the financial panic of 2008 and the institution of QE, the Fed’s balance sheet was about $800 billion, or 6% of GDP. Moreover, the mix of reserves held at the Fed was roughly 80% required reserves and 20% excess reserves. The massive asset purchases created a huge overhang of excess reserves – those deposits held by banks at the Fed and not needed to meet reserve requirements. Total bank reserves are now $2.2 trillion (end-May 2017), of which 5% is required reserves and 95% excess reserves.

To provide a return to banks, the Fed instituted a policy of paying interest on reserves, set at the top end of the target federal funds rate range. As the Fed raises its target federal funds rate range, it also raises the interest rate it pays on reserves, and this means the interest expense bill rises by $5.6 billion annually for each 25-basis-point rise in the target federal funds rate range, eating into the Fed’s annual portfolio earnings. To be clear, raising rates means raising the costs of funding the Fed’s massive balance sheet and creates an incentive for the Fed to reduce the size of its balance sheet, in part to protect its portfolio earnings that are running close to $100 billion annually over the last few years. [Note: After some accounting adjustments, the Fed contributes the bulk of its net portfolio earnings to the U.S. Treasury.]

There is another challenge created by the size of the Fed’s massive balance sheet – namely, the process by which the Fed controls the federal funds rate so it stays within its target range. Prior to the financial crisis and QE, with excess reserves representing about 20% of total reserves, and amounting to only $2 billion, the Fed was able to use security repurchase agreements (i.e., repo and reverse repo operations) to add or drain reserves on a temporary basis to keep the federal funds rate at its desired level. While the Fed still does some repo and reverse repo operations, with over $2 trillion of excess reserves, the size of potential reverse repo operations needed to keep the federal funds rate in its target range is overwhelming. Consequently, the Fed now has a dependency on paying interest on excess reserves at the top of the target rate range as the primary method of enforcing its desired federal funds rate range. This dependency on paying interest on reserves is likely to remain even as the Fed moves to shrink its balance sheet. Over the long term, though, reductions in the level of excess reserves will give repo activities a little more influence, although not remotely as much in the old, pre-QE days.

II. Gradual Pullback from Reinvesting Principal

The reinvestment of principal makes the Fed a very big player in the market for U.S. Treasury securities and for 15-year and 30-year mortgage-backed securities. We estimate that over the next 12 months the Fed will see about $300 billion of its U.S. Treasury securities mature. This represents about half the U.S. budget deficit, or put another way, about $1 of every $2 of net new debt the U.S. Treasury issues. MBS are self-amortizing, so principal is received every month, and some mortgages are paid off as homes are sold or refinanced. Given the $1.8 trillion of MBS the Fed holds, as much as $400 billion in principal might be received over the next 12 months; which compares to the overall outstanding mortgage debt of U.S. households and nonprofit organizations of about $10 billion. Estimating the size of the new issue mortgage market is complex, and not just about rates. People pay off mortgages for a variety of reasons. While refinancing is usually about rates, sales can be driven by divorce, transferring to a different location for a new job, desire to downsize by retirees, and death. The Fed’s appetite for 15-year and 30-year mortgages makes it the elephant in the room for the new issue market for home mortgages as well as the secondary market.

The Fed’s plan to shrink its balance sheet is going to occur in very drawn out stages, mainly because the Fed does not want to disturb the Treasury or MBS markets. The plan is to put a cap on reinvestment activity that initially makes only a small dent in the reinvestment activity. Over time, as economic conditions allow, the Fed would adjust the cap and reduce reinvestment activity. Our estimate is that the Fed would like to reduce its portfolio holdings of Treasuries and MBS from $4.2 trillion in mid-2017, to around $2.8-$3.0 trillion by the end of 2021, with a target to get the balance sheet in line with about 12% of nominal GDP. This estimated long-term objective for the size of the Fed’s balance sheet is about half of what it is now and about twice what it was before the financial crisis and when QE was instituted.

III. Market Impact

The market impact of the Fed slowly starting to reduce in reinvestment activity will affect the Treasury market differently from the MBS market.

The short end of the U.S. Treasury yield curve is anchored by the Fed’s target federal funds rate range. So, the maturing of Treasuries is unlikely to have any impact at all on short-term rates.

The impact on longer-term rates depends on how the Fed targets its asset allocation along the yield curve, especially for the 10-year plus maturities. Since the Fed’s maturity extension program was announce in 2011 and implemented in 2012, the Fed has been holding about 22%-25% of its Treasury portfolio in longer-dated securities. If this asset allocation percentage is held constant, then there may be some incremental upward impact of a few basis points on 10-year or longer yields, as the portfolio shrinks. The Fed could decide to increase its asset allocation to longer-dated securities to offset this small impact. We believe changing the asset allocation is unlikely, however, since other influences on longer-term Treasury yields are expected to swamp the tiny impact of the slow pace of balance sheet shrinkage. We particularly expect the U.S. federal budget deficit to rise over the next several years as interest expense rises with rising rates. And, if the Republican Administration is able to enact a tax cut as we expect it will eventually, deficits are likely to rise even further. And, another big influence over the trend in Treasury yields will be inflation, which is currently well anchored at around 2%. A rise in inflation expectation, should it occur, would tend to push yields higher.

The impact on the MBS market of shrinking the balance sheet is much more complex. When the Fed does decide to taper its buying of 15-year and 30-year MBS, we estimate that mortgage rates might rise about 0.25% to 0.50% relative to the Treasury yield curve. We note, though, that the Fed may decide to set a different time table for shrinking mortgages versus Treasuries, and may be particularly sensitive to its impact on mortgage rates.

On net, we are expecting that as the balance sheet shrinkage process is implemented, an incremental upward increase in long-term mortgage rates of up to 25 basis points seems likely, while the impact on Treasuries will be very hard to find. In addition, Fed Watchers will now have to think about the pace of balance sheet shrinkage as the Fed will periodically adjust its cap on reinvestment activity. Changes in the reinvestment cap may not be one-for-one aligned with rate increases, and may cause some confusion along the LIBOR yield curve while markets and analysts come to terms with the pace of balance sheet shrinkage.

To contact the author:

Bluford Putnam, Managing Director & Chief Economist at CME Group: [email protected]

Disclaimer:

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the authors and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.